Key Insights

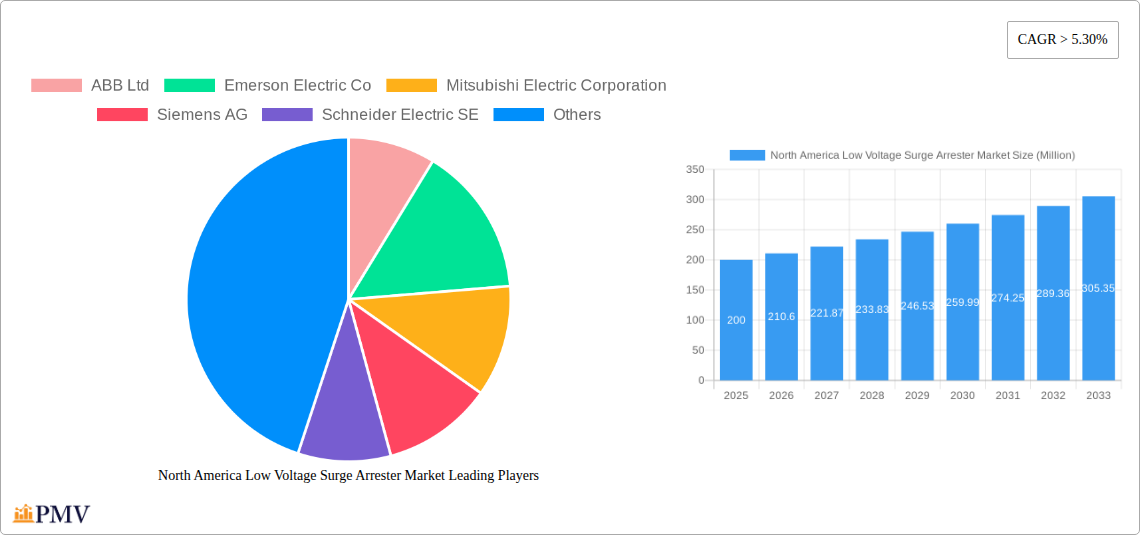

The North American low-voltage surge arrester market is experiencing robust growth, driven by increasing demand for reliable power protection across industrial, commercial, and residential sectors. The market's expansion is fueled by several key factors. The rising adoption of smart grids and renewable energy sources necessitates robust surge protection to mitigate the risks associated with voltage fluctuations and lightning strikes. Furthermore, stringent building codes and regulations mandating surge protection for sensitive electronic equipment are driving market expansion. The increasing prevalence of data centers and critical infrastructure further contributes to the demand for reliable surge protection solutions. While precise market sizing for the North American low-voltage segment is unavailable, a reasonable estimation can be made based on the overall market CAGR of >5.30% and the significant share expected from the low-voltage segment due to widespread applications. Assuming the overall market size in 2025 is approximately $500 million (a reasonable estimate given the stated value unit), and considering low voltage likely represents a considerable portion (say 40%), the 2025 North American low-voltage surge arrester market size could be estimated at around $200 million. This estimation is purely based on logical inference from available market trends.

North America Low Voltage Surge Arrester Market Market Size (In Million)

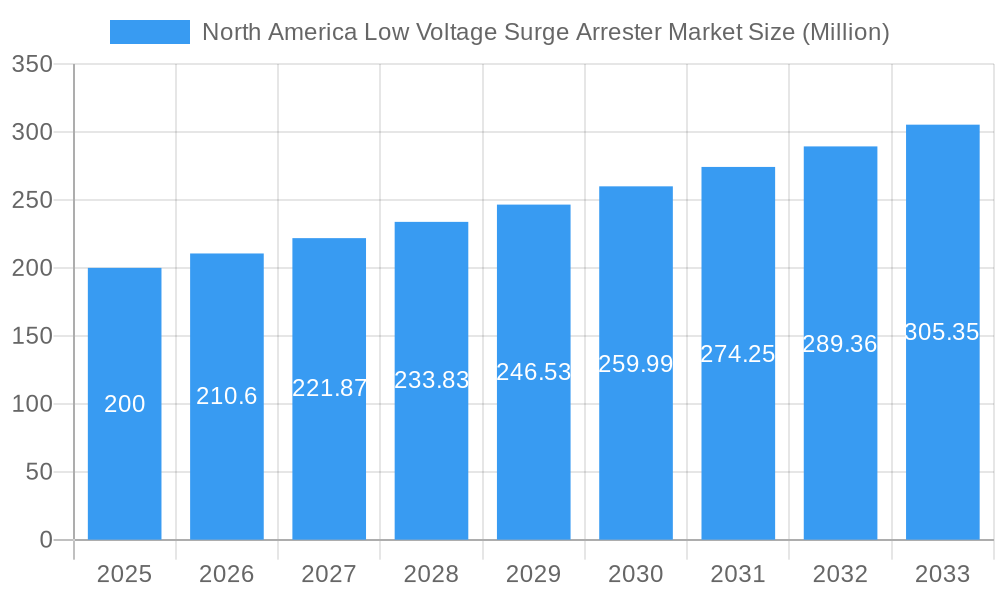

Looking ahead, the market is poised for continued growth throughout the forecast period (2025-2033). The integration of advanced technologies such as IoT-enabled surge arresters, which offer remote monitoring and diagnostics, will further propel market expansion. Moreover, the increasing focus on energy efficiency and the development of eco-friendly surge arrester solutions will create additional growth opportunities. However, factors like high initial investment costs and the availability of substitute technologies may pose challenges to market growth. Key players in this market, including ABB Ltd, Emerson Electric Co, and Siemens AG, are actively focusing on product innovation and strategic partnerships to maintain their competitive edge and capitalize on emerging market trends. The focus on providing customized solutions to meet diverse customer requirements will be pivotal for achieving sustained growth in this dynamic market.

North America Low Voltage Surge Arrester Market Company Market Share

North America Low Voltage Surge Arrester Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America low voltage surge arrester market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic sector. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive market research to forecast market trends from 2025 to 2033, building upon historical data from 2019 to 2024. Key players such as ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Raycap Inc, General Electric Company, and Hitachi Ltd are analyzed, though the list is not exhaustive.

North America Low Voltage Surge Arrester Market Market Structure & Competitive Dynamics

The North American low voltage surge arrester market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. The competitive landscape is characterized by intense innovation, driven by the need to enhance surge protection capabilities and meet evolving industry standards. Regulatory frameworks, particularly those related to safety and electrical code compliance, play a crucial role in shaping market dynamics. Product substitution, primarily from alternative surge protection technologies, presents a moderate challenge. End-user trends, such as increasing adoption of smart grids and renewable energy sources, are driving demand for advanced surge arresters. Mergers and acquisitions (M&A) activity in the sector has been moderate in recent years, with deal values averaging xx Million annually. Market share analysis reveals that the top five players collectively hold approximately xx% of the market, indicating a relatively consolidated landscape.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystem: High level of innovation focused on enhancing performance and meeting new standards.

- Regulatory Frameworks: Significant influence on product design and adoption.

- Product Substitutes: Moderate threat from alternative technologies.

- M&A Activity: Moderate activity, with average annual deal values of xx Million.

North America Low Voltage Surge Arrester Market Industry Trends & Insights

The North America low voltage surge arrester market is experiencing robust growth, driven primarily by increasing urbanization, industrialization, and the growing adoption of advanced electronic equipment. The market's CAGR from 2025 to 2033 is projected to be xx%, fueled by the rising demand for reliable power protection in residential, commercial, and industrial settings. Technological advancements, such as the development of more efficient and compact surge arresters, are further accelerating market growth. Consumer preferences are shifting toward high-performance, long-lasting, and environmentally friendly surge arresters. Competitive dynamics remain intense, with companies focusing on product differentiation and innovation to gain a competitive edge. Market penetration of low voltage surge arresters in residential applications is increasing steadily, driven by rising awareness of the risks of power surges and the growing adoption of sensitive electronics.

Dominant Markets & Segments in North America Low Voltage Surge Arrester Market

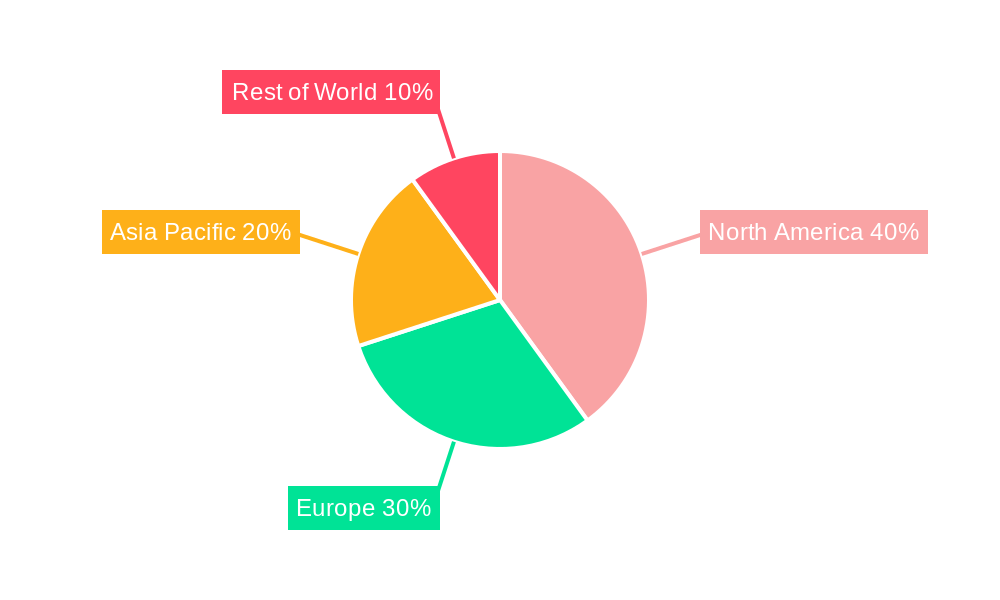

The United States dominates the North America low voltage surge arrester market, driven by its large and diversified economy, extensive infrastructure, and robust industrial sector. The industrial segment represents the largest application area, owing to the high concentration of industrial facilities and the critical need for reliable power protection in industrial processes.

- Key Drivers for US Dominance:

- Strong industrial base and manufacturing sector.

- High adoption of advanced technologies and electronics.

- Well-established infrastructure.

- Key Drivers for Industrial Segment Dominance:

- High reliance on sensitive electronic equipment.

- Need for reliable power protection to avoid production disruptions.

- Stringent safety regulations.

Analysis of Voltage Segments: Low voltage surge arresters constitute the largest segment, driven by the extensive use of low voltage power systems in residential, commercial, and industrial applications. Medium and high voltage segments show steady growth, spurred by expansion in transmission and distribution infrastructure.

Analysis of Application Segments: The industrial segment leads, followed by the commercial sector with residential showing increasing demand as electronic devices become ubiquitous in homes.

North America Low Voltage Surge Arrester Market Product Innovations

Recent product innovations focus on enhancing performance, improving efficiency, and reducing environmental impact. This includes the development of advanced materials, miniaturized designs, and integrated monitoring capabilities. These innovations cater to the growing need for reliable and cost-effective surge protection solutions in various applications, including smart grids and renewable energy systems. The market is witnessing a growing adoption of IoT-enabled surge arresters for remote monitoring and predictive maintenance. Key competitive advantages stem from superior performance, longer lifespan, advanced features, and cost-effectiveness.

Report Segmentation & Scope

Voltage: The report segments the market by voltage level into low voltage, medium voltage, and high voltage. Growth projections for each segment vary, with low voltage experiencing the highest growth rate. Market size for low voltage is estimated to be xx Million in 2025.

Application: The market is segmented by application into industrial, commercial, and residential. The industrial segment demonstrates significant market size and growth potential due to high equipment sensitivity.

Key Drivers of North America Low Voltage Surge Arrester Market Growth

The North American low voltage surge arrester market's growth is propelled by several key factors: increasing urbanization and industrialization leading to heightened demand for electrical power protection, stringent regulations on electrical safety, growing adoption of sophisticated electronic devices vulnerable to power surges, and technological advancements leading to the development of more effective and efficient surge arresters. Further, the transition towards renewable energy sources and smart grids necessitates robust surge protection infrastructure.

Challenges in the North America Low Voltage Surge Arrester Market Sector

Challenges include the fluctuating prices of raw materials impacting production costs, intense competition leading to price pressures, stringent regulatory compliance requirements increasing development and certification costs, and supply chain disruptions potentially causing delays in product delivery. These challenges collectively affect market growth and profitability, requiring proactive strategies for mitigation.

Leading Players in the North America Low Voltage Surge Arrester Market Market

Key Developments in North America Low Voltage Surge Arrester Market Sector

- September 2021: Toshiba Energy Systems & Solutions Corporation announced plans to triple its production capacity of polymer house surge arresters by April 2022. This expansion significantly increases supply and caters to rising market demand.

- May 2021: DEHN launched DIN-rail mounted surge protection devices certified with UL 1449 4th Edition, expanding product options for US and Canadian markets.

Strategic North America Low Voltage Surge Arrester Market Market Outlook

The North America low voltage surge arrester market presents significant growth opportunities driven by technological advancements, increasing demand for reliable power protection across various sectors, and the rising adoption of smart grids and renewable energy systems. Strategic focus areas for market participants include developing innovative, cost-effective solutions, enhancing supply chain resilience, and adapting to evolving regulatory landscapes. Expansion into niche markets and strategic partnerships will further enhance market penetration and profitability.

North America Low Voltage Surge Arrester Market Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium Voltage

- 1.3. High Voltage

-

2. Application

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Residential

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Low Voltage Surge Arrester Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Low Voltage Surge Arrester Market Regional Market Share

Geographic Coverage of North America Low Voltage Surge Arrester Market

North America Low Voltage Surge Arrester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand from the Commercial and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Industrial Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium Voltage

- 5.1.3. High Voltage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. United States North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. Low Voltage

- 6.1.2. Medium Voltage

- 6.1.3. High Voltage

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. Canada North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. Low Voltage

- 7.1.2. Medium Voltage

- 7.1.3. High Voltage

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Rest of North America North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. Low Voltage

- 8.1.2. Medium Voltage

- 8.1.3. High Voltage

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ABB Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Emerson Electric Co

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Mitsubishi Electric Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Siemens AG

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schneider Electric SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eaton Corporation PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Raycap Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 General Electric Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Hitachi Ltd*List Not Exhaustive 6 4 MARKET OPPORUNITIES AND FUTURE TREND

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 ABB Ltd

List of Figures

- Figure 1: North America Low Voltage Surge Arrester Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Low Voltage Surge Arrester Market Share (%) by Company 2025

List of Tables

- Table 1: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 2: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 6: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 10: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 14: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Low Voltage Surge Arrester Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the North America Low Voltage Surge Arrester Market?

Key companies in the market include ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Raycap Inc, General Electric Company, Hitachi Ltd*List Not Exhaustive 6 4 MARKET OPPORUNITIES AND FUTURE TREND.

3. What are the main segments of the North America Low Voltage Surge Arrester Market?

The market segments include Voltage, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand from the Commercial and Industrial Sectors.

6. What are the notable trends driving market growth?

Industrial Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

In September 2021, Toshiba Energy Systems & Solutions Corporation announced to triple its production capacity of polymer house surge arresters by April 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Low Voltage Surge Arrester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Low Voltage Surge Arrester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Low Voltage Surge Arrester Market?

To stay informed about further developments, trends, and reports in the North America Low Voltage Surge Arrester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence