Key Insights

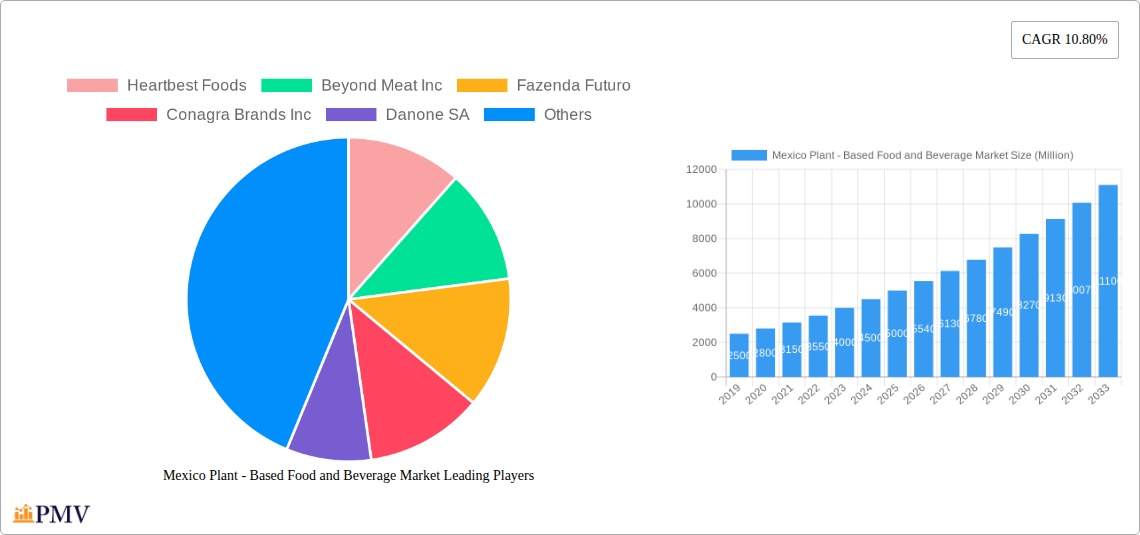

The Mexican plant-based food and beverage market is experiencing robust expansion, projected to reach an estimated XX million USD in 2025. This growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 10.80%, indicating a dynamic and evolving consumer landscape. Key drivers include increasing consumer awareness regarding health benefits associated with plant-based diets, a growing concern for environmental sustainability, and the rising prevalence of lactose intolerance and other dietary restrictions. The market's expansion is further propelled by a greater availability of diverse plant-based alternatives, ranging from meat substitutes and dairy alternatives like milk, yogurt, and ice cream, to non-dairy cheese and spreads. This enhanced product variety caters to a wider consumer base, including flexitarians, vegetarians, and vegans, making plant-based options more accessible and appealing than ever before.

Mexico Plant - Based Food and Beverage Market Market Size (In Billion)

The forecast period from 2025 to 2033 is expected to witness continued strong growth, driven by ongoing innovation in product development and an expanding distribution network. Supermarkets/hypermarkets and online retail stores are emerging as dominant distribution channels, leveraging their broad reach and convenience to capture a larger market share. Concurrently, convenience stores are adapting to consumer demand by stocking a wider array of plant-based options. The competitive landscape features both established global players like Nestle SA, Danone SA, and Unilever Plc, alongside agile local and regional innovators such as Heartbest Foods, Fazenda Futuro, and Heura. These companies are actively introducing new products and marketing campaigns to capitalize on emerging trends, including the demand for ethically sourced and cleaner label plant-based foods, further solidifying Mexico's position as a key market for plant-based innovation in North America.

Mexico Plant - Based Food and Beverage Market Company Market Share

Dive deep into the burgeoning Mexico plant-based food and beverage market with this in-depth report. Covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis provides critical insights into the market's structure, trends, dominant segments, product innovations, and competitive landscape. Essential for stakeholders seeking to understand and capitalize on the rapidly expanding vegan food Mexico and plant-based meat Mexico sectors.

Mexico Plant - Based Food and Beverage Market Market Structure & Competitive Dynamics

The Mexico plant-based food and beverage market is characterized by a dynamic and evolving competitive landscape, marked by increasing market concentration from established global players alongside emerging local innovators. Key companies like Heartbest Foods, Beyond Meat Inc., Conagra Brands Inc., Danone SA, Unilever Plc, Nestle SA, and NotCo are actively shaping market share through strategic product development and expansion. The innovation ecosystem thrives on technological advancements in food science, leading to improved taste, texture, and nutritional profiles of plant-based alternatives Mexico. Regulatory frameworks, while still developing, are increasingly supportive of health-conscious and sustainable food options, influencing product approvals and market entry strategies. The threat of product substitutes, both traditional animal-based products and other alternative protein sources, remains a consideration, driving companies to emphasize unique selling propositions such as health benefits, environmental sustainability, and ethical sourcing. End-user trends point towards a growing consumer preference for vegan products Mexico, driven by health awareness, environmental concerns, and ethical considerations. Mergers & Acquisitions (M&A) activities, though not always publicly disclosed in terms of deal value for all players, are crucial for market consolidation and expansion. For instance, the entry of JBS Foods' Planterra Foods signifies a consolidation trend, aiming to increase the market for plant-based products. Market share is continuously being redefined by companies effectively leveraging these dynamics to capture a significant portion of the growing dairy alternative Mexico and meat substitute Mexico segments.

Mexico Plant - Based Food and Beverage Market Industry Trends & Insights

The Mexico plant-based food and beverage market is experiencing a significant growth trajectory, fueled by a confluence of compelling industry trends and evolving consumer preferences. A key growth driver is the escalating consumer awareness surrounding the health benefits associated with plant-based diets, including reduced risks of chronic diseases and improved overall well-being. This health consciousness is directly translating into increased demand for dairy alternative beverages Mexico, non-dairy ice creams Mexico, and a broader range of plant-based snacks Mexico. Environmental sustainability is another potent catalyst; consumers are increasingly cognizant of the ecological footprint of animal agriculture and are actively seeking more sustainable food choices, boosting the demand for eco-friendly food Mexico. Technological disruptions are continuously enhancing the appeal of plant-based products. Innovations in ingredient sourcing, processing techniques, and flavor development are leading to plant-based foods Mexico that closely mimic the taste and texture of traditional animal products, thereby overcoming previous barriers to adoption. This is particularly evident in the meat substitute Mexico category, where products are becoming more sophisticated and appealing to a wider consumer base. Competitive dynamics are intensifying, with both multinational corporations and agile startups vying for market dominance. Strategic partnerships, such as the one between NotCo and Starbucks Mexico, and expanded distribution networks, exemplified by Heura's presence in major retail chains, are indicative of this fierce competition. The market penetration of plant-based options is steadily increasing across various sub-segments, from non-dairy cheese Mexico to other plant-based products Mexico, indicating a fundamental shift in consumer eating habits. The projected Compound Annual Growth Rate (CAGR) for this market is robust, driven by these interconnected trends.

Dominant Markets & Segments in Mexico Plant - Based Food and Beverage Market

Within the expansive Mexico plant-based food and beverage market, specific segments and distribution channels are demonstrating remarkable dominance, driven by evolving consumer demand and strategic market penetration. The Meat Substitute segment stands out as a primary growth engine, propelled by a growing desire among Mexican consumers to reduce meat consumption for health and environmental reasons. This includes a wide array of products such as plant-based burgers, sausages, and chicken alternatives, catering to both traditional palates and adventurous foodies seeking healthy food options Mexico. Following closely, Dairy Alternative Beverages represent another powerhouse, with almond, soy, and oat milk gaining widespread acceptance as substitutes for conventional dairy. The versatility and perceived health benefits of these beverages make them a staple in many Mexican households, driving significant market share.

The Distribution Channel landscape reveals the dominance of Supermarkets/Hypermarkets, which offer a broad selection and convenient shopping experience for consumers actively seeking vegan groceries Mexico. These large retail formats have been instrumental in increasing the accessibility of plant-based products across the country. Online Retail Stores are rapidly emerging as a formidable force, especially among younger demographics and urban populations, offering a wider variety of niche products and the convenience of home delivery for plant-based ingredients Mexico.

Key drivers underpinning the dominance of these segments include:

- Economic Policies: Government initiatives promoting healthier lifestyles and sustainable agriculture can indirectly support the plant-based sector.

- Infrastructure: The well-established retail infrastructure, particularly in urban centers, facilitates the widespread availability of plant-based products.

- Consumer Education: Increased awareness campaigns and readily available information about the benefits of plant-based diets are empowering consumers to make informed choices.

- Product Affordability and Accessibility: As production scales and competition increases, the price point of plant-based alternatives is becoming more competitive, making them accessible to a larger consumer base.

The Non-Dairy Ice Creams and Non-Dairy Yogurt segments are also witnessing substantial growth, driven by increasing demand for dairy-free dessert and breakfast options. While Non-Dairy Cheese and Non-Dairy Spreads are currently smaller segments, their growth potential is significant as product innovation continues to improve their appeal and functionality. The continued expansion of these dominant segments, supported by favorable economic conditions and shifting consumer preferences, solidifies their position as the vanguard of the Mexico plant-based food and beverage market.

Mexico Plant - Based Food and Beverage Market Product Innovations

Product innovations in the Mexico plant-based food and beverage market are primarily focused on enhancing sensory appeal, nutritional value, and convenience. Companies are investing heavily in research and development to create plant-based meat Mexico alternatives that closely replicate the taste, texture, and cooking experience of their animal-based counterparts, utilizing novel protein sources and advanced processing technologies. In the dairy alternative space, innovations are leading to dairy alternative beverages Mexico and non-dairy ice creams Mexico with improved creaminess and flavor profiles, catering to a wider range of consumer preferences. The development of plant-based cheese Mexico with better melting and shredding capabilities is also a significant area of focus, addressing a key unmet need. These advancements not only drive consumer adoption but also provide competitive advantages by offering superior product quality and fulfilling specific culinary applications.

Report Segmentation & Scope

This comprehensive report segments the Mexico plant-based food and beverage market to provide a granular understanding of its dynamics. The market is analyzed by Type, encompassing Meat Substitute, Dairy Alternative Beverages, Non Dairy Ice creams, Non Dairy Cheese, Non Dairy Yogurt, Non Dairy Spreads, and Other Plant-based Products. Each type is projected to exhibit varied growth rates, with Meat Substitute and Dairy Alternative Beverages leading the market in terms of size and expansion. Distribution channels are categorized into Supermarket/ Hypermarket, Convenience Stores, Online Retail Stores, and Other Distribution Channels, highlighting the growing importance of e-commerce alongside traditional retail. The analysis includes market sizes and growth projections for each segment from 2025 to 2033, offering a detailed outlook on competitive dynamics and emerging opportunities within each category.

Key Drivers of Mexico Plant - Based Food and Beverage Market Growth

The Mexico plant-based food and beverage market is propelled by several interconnected growth drivers. A primary factor is the rising health consciousness among Mexican consumers, leading to increased demand for healthy food options Mexico and plant-based diets for their perceived nutritional benefits. Furthermore, growing environmental awareness concerning the impact of animal agriculture is significantly influencing purchasing decisions, fostering demand for eco-friendly food Mexico. Technological advancements in food science are crucial, enabling the creation of more palatable and versatile plant-based alternatives Mexico, thereby overcoming previous taste and texture barriers. Supportive government initiatives, even if nascent, that promote sustainable food systems and healthier lifestyles indirectly fuel market expansion. The increasing availability and visibility of vegan products Mexico across various retail channels also play a vital role in driving consumption.

Challenges in the Mexico Plant - Based Food and Beverage Market Sector

Despite its robust growth, the Mexico plant-based food and beverage market faces several challenges. Price sensitivity remains a significant barrier, as many plant-based products are still priced higher than their conventional counterparts, limiting accessibility for a broader consumer base. Limited consumer awareness and education about the nutritional adequacy and versatility of plant-based foods can lead to skepticism and slower adoption rates. Supply chain complexities, including sourcing consistent quality ingredients and ensuring efficient distribution networks, can also pose challenges. Furthermore, competition from traditional food industries and the need for continuous product innovation to meet evolving consumer expectations require substantial investment. Addressing these challenges will be crucial for sustained market expansion and deeper penetration of plant-based foods Mexico.

Leading Players in the Mexico Plant - Based Food and Beverage Market Market

- Heartbest Foods

- Beyond Meat Inc.

- Fazenda Futuro

- Conagra Brands Inc.

- Danone SA

- Unilever Plc

- Nestle SA

- NotCo

- Heura

- JBS Foods- Planterra Foods

Key Developments in Mexico Plant - Based Food and Beverage Market Sector

- August 2022: NotCo and Starbucks Mexico announced a significant partnership, leading to the introduction of new plant-based menu options made with NotCo's plant-based products, enhancing the visibility and accessibility of vegan food Mexico.

- October 2021: Heura, a prominent producer of plant-based meat, strategically expanded its presence in Mexico. The company initiated sales across major retail chains including Walmart, City Market, Fresko, and La Comer, offering four distinct SKUs focused on healthier and more environmentally friendly alternatives within the plant-based meat Mexico category.

- June 2021: JBS Foods brand Planterra Foods announced its expansion into the Mexican market. The company secured a supply agreement with UNFI, with the objective of increasing the market reach for its plant-based burgers, ground meat alternatives, and Mexican Seasoned ground beef products through this strategic partnership.

Strategic Mexico Plant - Based Food and Beverage Market Market Outlook

The strategic Mexico plant-based food and beverage market outlook is highly promising, driven by sustained consumer demand for healthier, more sustainable, and ethically produced food options. Continued investment in product innovation to enhance taste, texture, and affordability will be a key growth accelerator. Expanding distribution channels, particularly the reach of online retail stores Mexico and the integration into mainstream supermarket offerings, will be crucial for broader market penetration. Partnerships between food manufacturers, retailers, and foodservice providers, such as the NotCo and Starbucks collaboration, will play a vital role in driving mainstream adoption of plant-based alternatives Mexico. Furthermore, educational initiatives aimed at increasing consumer awareness of the benefits of plant-based diets will further solidify market growth. The market is poised for significant expansion, offering substantial opportunities for both established players and new entrants in the vegan food Mexico and dairy alternative Mexico sectors.

Mexico Plant - Based Food and Beverage Market Segmentation

-

1. Type

- 1.1. Meat Substitute

- 1.2. Dairy Alternative Beverages

- 1.3. Non Dairy Ice creams

- 1.4. Non Dairy Cheese

- 1.5. Non Dairy Yogurt

- 1.6. Non Dairy Spreads

- 1.7. Other Plant-based Products

-

2. Distibution Channel

- 2.1. Supermarket/ Hypermarket

- 2.2. Convenience Stores

- 2.3. Online Retail stores

- 2.4. Other Distribution Channels

Mexico Plant - Based Food and Beverage Market Segmentation By Geography

- 1. Mexico

Mexico Plant - Based Food and Beverage Market Regional Market Share

Geographic Coverage of Mexico Plant - Based Food and Beverage Market

Mexico Plant - Based Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options

- 3.3. Market Restrains

- 3.3.1 Plant-based products can be more expensive than their animal-based counterparts

- 3.3.2 which may limit their appeal in price-sensitive segments of the market.

- 3.4. Market Trends

- 3.4.1. Rapid Expansion of Vegan Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Plant - Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meat Substitute

- 5.1.2. Dairy Alternative Beverages

- 5.1.3. Non Dairy Ice creams

- 5.1.4. Non Dairy Cheese

- 5.1.5. Non Dairy Yogurt

- 5.1.6. Non Dairy Spreads

- 5.1.7. Other Plant-based Products

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarket/ Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Heartbest Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beyond Meat Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fazenda Futuro

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conagra Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unilever Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NotCo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heura

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JBS Foods- Planterra Foods

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heartbest Foods

List of Figures

- Figure 1: Mexico Plant - Based Food and Beverage Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Plant - Based Food and Beverage Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Plant - Based Food and Beverage Market?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Mexico Plant - Based Food and Beverage Market?

Key companies in the market include Heartbest Foods, Beyond Meat Inc, Fazenda Futuro, Conagra Brands Inc, Danone SA, Unilever Plc, Nestle SA, NotCo, Heura, JBS Foods- Planterra Foods.

3. What are the main segments of the Mexico Plant - Based Food and Beverage Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options.

6. What are the notable trends driving market growth?

Rapid Expansion of Vegan Culture.

7. Are there any restraints impacting market growth?

Plant-based products can be more expensive than their animal-based counterparts. which may limit their appeal in price-sensitive segments of the market..

8. Can you provide examples of recent developments in the market?

In August 2022, NotCo and Starbucks Mexico announced the partnership. Starbucks Mexico Introduces New Plant-based Menu options Made with NotCo Plant-based Products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Plant - Based Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Plant - Based Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Plant - Based Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Mexico Plant - Based Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence