Key Insights

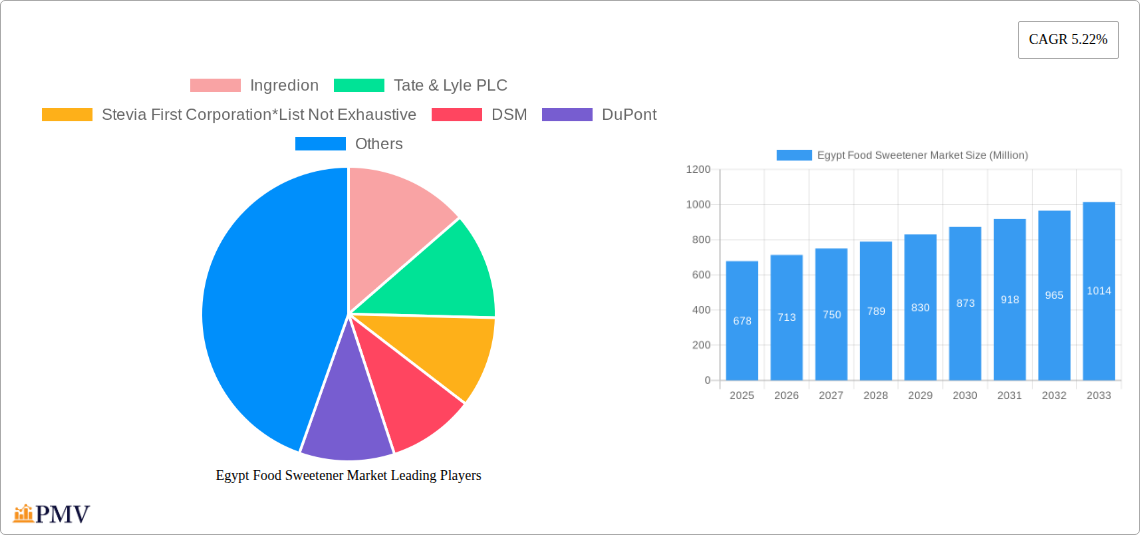

The Egyptian food sweetener market is poised for robust growth, projected to reach a substantial XX million by 2025 and expand further with a Compound Annual Growth Rate (CAGR) of 5.22% through 2033. This upward trajectory is significantly propelled by evolving consumer preferences towards healthier options and a burgeoning demand for sugar-free and low-calorie alternatives across various food and beverage applications. The growing health consciousness among Egyptian consumers, coupled with increasing prevalence of lifestyle diseases like diabetes, is a primary driver, fostering a greater acceptance and adoption of sugar substitutes. Furthermore, the expanding processed food industry in Egypt, driven by urbanization and changing dietary habits, creates a sustained demand for sweeteners. Key applications like beverages, confectionery, and bakery products are expected to lead this expansion, with manufacturers actively reformulating products to cater to the health-conscious segment. The market’s growth is also supported by government initiatives promoting healthier lifestyles and food fortification programs.

Egypt Food Sweetener Market Market Size (In Million)

The Egyptian food sweetener landscape is characterized by a dynamic segmentation, with High-Intensity Sweeteners (HIS) gaining significant traction due to their potent sweetness with minimal caloric impact, aligning perfectly with global health trends. Sucrose (common sugar) will continue to hold a considerable market share, especially in traditional food preparations, but its growth is anticipated to be slower compared to alternatives. Starch sweeteners and sugar alcohols are also witnessing steady demand, particularly in confectionery and dairy products, offering functional benefits alongside sweetness. Key industry players like Ingredion, Tate & Lyle PLC, and Cargill Inc. are actively investing in research and development to introduce innovative sweetener solutions and expand their market presence in Egypt. Restraints such as fluctuating raw material prices and stringent regulatory approvals for new ingredients are present, but the overarching consumer shift towards healthier eating habits is expected to outweigh these challenges, ensuring a promising future for the Egyptian food sweetener market.

Egypt Food Sweetener Market Company Market Share

Egypt Food Sweetener Market: Comprehensive Market Report & Analysis (2019-2033)

This in-depth report provides a detailed analysis of the Egypt Food Sweetener Market, offering critical insights into market dynamics, trends, opportunities, and challenges. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report is essential for stakeholders seeking to understand and capitalize on the evolving Egyptian sweetener landscape. We meticulously analyze key segments including product types and applications, alongside major industry developments and leading players.

Egypt Food Sweetener Market Market Structure & Competitive Dynamics

The Egypt Food Sweetener Market exhibits a moderate to high concentration, with established global players like Cargill Inc., Ingredion, and Tate & Lyle PLC holding significant market share. The acquisition of Stevia First Corporation by Ingredion in 2023 underscores the strategic M&A activities aimed at consolidating market position and expanding product portfolios, particularly in the high-growth high-intensity sweeteners (HIS) segment. Innovation ecosystems are driven by a demand for healthier and more functional food ingredients, fostering partnerships between ingredient manufacturers and food & beverage producers. Regulatory frameworks, while evolving, are generally supportive of food safety and quality standards, influencing product development and market entry strategies. Product substitutes, primarily from natural sources and emerging low-calorie alternatives, are increasingly challenging traditional sucrose dominance. End-user trends strongly favor reduced sugar content, driving demand for HIS and sugar alcohols across various applications like Beverages, Confectionery, and Dairy. M&A deal values, though not publicly disclosed in entirety, are projected to see increased investment in HIS and functional sweetener technologies. The market is dynamic, with continuous efforts to balance cost-effectiveness, taste profiles, and health benefits.

Egypt Food Sweetener Market Industry Trends & Insights

The Egypt Food Sweetener Market is poised for robust growth, driven by a confluence of factors that are reshaping consumer habits and food manufacturing practices. A key market growth driver is the escalating health consciousness among the Egyptian population, leading to a significant shift away from high-sugar products towards low-calorie and sugar-free alternatives. This trend is amplified by government initiatives promoting healthier lifestyles and tackling non-communicable diseases, which indirectly influence sweetener demand. The projected Compound Annual Growth Rate (CAGR) for the HIS segment is robust, estimated to be around 7.5% during the forecast period, reflecting its increasing penetration in mainstream food and beverage categories. Technological disruptions are playing a pivotal role, with advancements in extraction, purification, and formulation techniques enhancing the quality, cost-effectiveness, and versatility of various sweeteners. For instance, innovations in stevia processing have improved its taste profile, making it a more viable substitute for sugar in a wider array of products.

Consumer preferences are rapidly evolving. Beyond just calorie reduction, there's a growing demand for "natural" and "clean label" ingredients, favoring sweeteners derived from natural sources like stevia and erythritol. This is influencing product development strategies for major players like DSM and DuPont, who are investing in research and development to cater to this demand. The competitive dynamics are intensifying as both global giants and local manufacturers vie for market share. The expansion of Cargill's sweetener production facility in Alexandria in 2021 signifies a strategic move to bolster local supply chains and cater to the growing regional demand. Market penetration of HIS is steadily increasing, moving beyond niche segments to become integral components in mainstream Beverages, Bakery items, and Confectionery. The rising disposable incomes and a growing middle class further contribute to increased consumption of processed foods and beverages, indirectly boosting the overall sweetener market. The continuous launch of new products and strategic partnerships are indicative of a vibrant and competitive market environment where innovation and consumer-centricity are paramount. The market penetration of sugar alcohols, estimated to reach 20% in the Beverages segment by 2030, highlights the ongoing transition in consumer choices.

Dominant Markets & Segments in Egypt Food Sweetener Market

The Egypt Food Sweetener Market is characterized by significant dominance within specific product types and application segments, reflecting evolving consumer preferences and industry dynamics.

Dominant Product Type:

- Sucrose (Common Sugar): Despite the growing trend towards sugar reduction, sucrose remains the dominant product type in terms of volume and historical market share. Its widespread availability, low cost, and established functionality in numerous food applications, particularly in traditional Egyptian cuisine and widely consumed products like Beverages and Confectionery, ensure its continued prominence. Economic policies that support domestic sugar production and agricultural subsidies contribute to its competitive pricing. However, its market share is projected to see a gradual decline as healthier alternatives gain traction.

- High-intensity Sweeteners (HIS): This segment is witnessing the most substantial growth and is projected to emerge as a key dominant force in the coming years. The increasing consumer awareness regarding health and wellness, coupled with government initiatives to curb sugar consumption, are major drivers. HIS, including stevia, sucralose, and aspartame, offer significant sweetness with negligible calories, making them ideal for sugar-free and low-calorie product formulations. The acquisition of Stevia First Corporation by Ingredion highlights the strategic importance and future potential of this segment. The ease of use and cost-effectiveness per unit of sweetness also contribute to their growing adoption across various applications.

Dominant Application Segment:

- Beverages: The Beverages segment consistently holds the largest market share within the Egypt Food Sweetener Market. This dominance is fueled by the immense popularity of carbonated soft drinks, juices, and other sweetened beverages. The shift towards healthier beverage options, including diet and zero-calorie varieties, has significantly boosted the demand for HIS and sugar alcohols in this sector. Beverage manufacturers are actively reformulating their products to meet consumer demand for reduced sugar, making this a crucial application area for sweetener suppliers.

- Confectionery: The Confectionery sector, encompassing chocolates, candies, and baked goods, is another major application area. While traditional confectionery relies heavily on sucrose, there's a discernible trend towards developing healthier alternatives with reduced sugar content. This presents a significant opportunity for HIS and sugar alcohols to penetrate the market further. The growing market for sugar-free chocolates and candies is a testament to this evolving consumer preference.

- Dairy: The Dairy segment, including yogurts, flavored milk, and ice cream, also represents a significant application. Consumers are increasingly seeking healthier dairy options with lower sugar content. This trend is driving the adoption of sweeteners like stevia and sucralose to maintain palatability while reducing sugar. The versatility of sweeteners in masking off-flavors and enhancing texture further contributes to their use in dairy products.

Key drivers for dominance in these segments include:

- Economic Policies: Subsidies for sugar production and import duties on certain sweeteners can influence market dynamics.

- Infrastructure: Efficient supply chains and cold chain logistics are crucial for widespread adoption, especially in the Beverages and Dairy sectors.

- Consumer Awareness & Health Trends: The growing focus on health and wellness is a primary catalyst for the growth of HIS and sugar alcohols.

- Product Innovation: The ability of manufacturers to develop new formulations and product variants that cater to specific taste preferences and dietary needs is critical.

Egypt Food Sweetener Market Product Innovations

Product innovations in the Egypt Food Sweetener Market are primarily focused on delivering high-quality, cost-effective, and healthier sweetening solutions. Developments in High-intensity Sweeteners (HIS), such as improved stevia extracts with better taste profiles and reduced aftertaste, are a key trend. Companies are investing in advanced extraction and purification technologies to enhance the natural appeal and functionality of these sweeteners. Furthermore, the development of blended sweetener solutions, combining different types of sweeteners to achieve optimal taste and texture, is gaining traction. These innovations offer competitive advantages by catering to the growing demand for sugar-free, low-calorie, and naturally sourced ingredients across applications like Beverages, Bakery, and Confectionery.

Report Segmentation & Scope

This report meticulously segments the Egypt Food Sweetener Market to provide a granular understanding of its dynamics. The segmentation is based on:

Product Type:

- Sucrose (Common Sugar): This segment encompasses traditional granulated sugar, accounting for a substantial portion of the current market due to its widespread use and established functionality.

- Starch Sweeteners and Sugar Alcohols: This category includes ingredients like corn syrup, high-fructose corn syrup, sorbitol, xylitol, and erythritol, offering various sweetness levels and functional properties.

- High-intensity Sweeteners (HIS): This segment comprises non-nutritive sweeteners such as aspartame, sucralose, stevia, acesulfame potassium, and saccharin, providing intense sweetness with minimal caloric impact.

Application:

- Dairy: This includes yogurts, ice cream, flavored milk, and other dairy-based products.

- Bakery: This segment covers bread, cakes, pastries, cookies, and other baked goods.

- Soups, Sauces, and Dressings: This encompasses a range of savory products where sweeteners are used for flavor balancing.

- Confectionery: This includes chocolates, candies, chewing gum, and other sweet treats.

- Beverages: This is a broad category encompassing carbonated drinks, juices, teas, coffees, and functional beverages.

- Other Applications: This includes sweeteners used in pharmaceuticals, table-top sweeteners, and other niche food products.

Key Drivers of Egypt Food Sweetener Market Growth

The Egypt Food Sweetener Market growth is propelled by several interconnected factors. A primary driver is the escalating consumer demand for healthier food options, fueled by increasing health awareness and a growing prevalence of lifestyle diseases like diabetes and obesity. This has led to a significant preference for low-calorie and sugar-free alternatives. Government initiatives aimed at promoting public health and reducing sugar consumption also play a crucial role in shaping market trends. Economically, rising disposable incomes and a growing middle class translate to increased spending on processed foods and beverages, thereby expanding the sweetener market. Technological advancements in sweetener production, particularly in the extraction and formulation of High-intensity Sweeteners (HIS) like stevia, are making these alternatives more cost-effective and palatable, encouraging wider adoption by food manufacturers. Furthermore, the "clean label" movement is driving demand for natural sweeteners.

Challenges in the Egypt Food Sweetener Market Sector

Despite robust growth prospects, the Egypt Food Sweetener Market faces several challenges. Price volatility of raw materials, especially for sucrose and certain plant-derived sweeteners, can impact profitability and competitiveness. Regulatory hurdles and complex approval processes for new sweetener ingredients can slow down market entry and innovation. The perception and taste concerns associated with some artificial sweeteners continue to be a barrier for wider consumer acceptance, necessitating ongoing product development to improve taste profiles. Supply chain disruptions, exacerbated by global economic factors and logistics challenges, can affect the availability and cost of key ingredients. Additionally, the strong entrenched position of sucrose in many traditional food formulations presents a significant competitive challenge for alternative sweeteners.

Leading Players in the Egypt Food Sweetener Market Market

- Ingredion

- Tate & Lyle PLC

- Stevia First Corporation

- DSM

- DuPont

- Cargill Inc

- JK Sucralose Inc

Key Developments in Egypt Food Sweetener Market Sector

- November 2023: Acquisition of Stevia First Corporation by Ingredion, significantly bolstering Ingredion's presence in the high-growth high-intensity sweetener market.

- Q3 2022: Launch of a new low-calorie sweetener by Tate & Lyle PLC, targeting the burgeoning demand for healthier beverage and food options.

- Q1 2021: Expansion of Cargill's sweetener production facility in Alexandria, Egypt, enhancing its manufacturing capacity and strengthening its supply chain within the region.

Strategic Egypt Food Sweetener Market Market Outlook

The strategic outlook for the Egypt Food Sweetener Market is highly positive, driven by sustained consumer demand for healthier alternatives and supportive government policies. Growth accelerators include the continuous innovation in High-intensity Sweeteners (HIS) and the increasing acceptance of natural sweeteners like stevia. The expansion of manufacturing capabilities by key players, exemplified by Cargill's facility upgrade, will further strengthen the domestic supply chain and cater to burgeoning regional demand. Strategic opportunities lie in developing novel sweetener blends that address specific taste and functional requirements for applications in Beverages, Bakery, and Confectionery. The market is expected to witness further consolidation through M&A activities as companies aim to enhance their product portfolios and market reach. The focus on "clean label" ingredients and the growing awareness of the health implications of sugar consumption will continue to shape product development and market strategies.

Egypt Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

- 1.2. Starch Sweeteners and Sugar Alcohols

- 1.3. High-intensity Sweeteners (HIS)

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces, and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Other Applications

Egypt Food Sweetener Market Segmentation By Geography

- 1. Egypt

Egypt Food Sweetener Market Regional Market Share

Geographic Coverage of Egypt Food Sweetener Market

Egypt Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High-intensity Sweeteners (HIS) in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.3. High-intensity Sweeteners (HIS)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces, and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingredion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tate & Lyle PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stevia First Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JK Sucralose Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Ingredion

List of Figures

- Figure 1: Egypt Food Sweetener Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Egypt Food Sweetener Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Egypt Food Sweetener Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Food Sweetener Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Egypt Food Sweetener Market?

Key companies in the market include Ingredion, Tate & Lyle PLC, Stevia First Corporation*List Not Exhaustive, DSM, DuPont, Cargill Inc, JK Sucralose Inc.

3. What are the main segments of the Egypt Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Increasing Demand for High-intensity Sweeteners (HIS) in the Country.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Stevia First Corporation by Ingredion in 2023 2. Launch of new low-calorie sweetener by Tate & Lyle in 2022 3. Expansion of Cargill's sweetener production facility in Alexandria in 2021

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Egypt Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence