Key Insights

The Canadian whey protein ingredients market is projected for significant expansion, driven by escalating demand for premium protein solutions across diverse industries. The market, valued at approximately $8.753 billion in the 2025 base year, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 12.1% through 2033. This robust growth is primarily attributed to heightened consumer awareness regarding the health advantages of whey protein, including muscle development, weight management, and overall wellness. The increasing popularity of fitness and sports nutrition supplements, alongside the broader integration of whey protein into functional foods and beverages, serves as key growth accelerators. Furthermore, the personal care and cosmetics sector's growing utilization of whey derivatives for their skin-conditioning and anti-aging benefits adds another dimension to market demand.

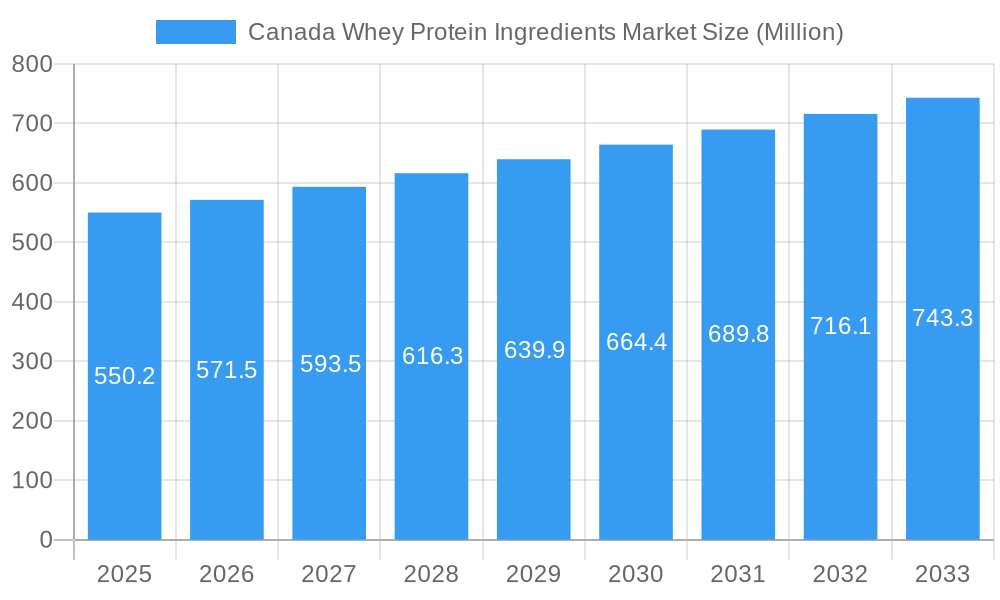

Canada Whey Protein Ingredients Market Market Size (In Billion)

Market segmentation highlights varied application areas. The "Food and Beverages" end-user segment is expected to command a substantial market share, with sub-segments such as bakery products, dairy and dairy alternatives, and snacks demonstrating strong performance. The "Supplements" category, encompassing sports nutrition and infant formula, is also a critical growth driver. Within the "Form" segment, hydrolyzed whey proteins are anticipated to experience accelerated adoption due to their superior digestibility and absorption. While the market outlook is largely positive, potential challenges may arise from volatile raw material prices (milk), stringent regulatory frameworks for new ingredients, and the availability of alternative protein sources. Nevertheless, the strong health consciousness of Canadian consumers and ongoing product innovation are expected to overcome these obstacles, ensuring a dynamic and growing market.

Canada Whey Protein Ingredients Market Company Market Share

Unlock comprehensive insights into the Canada Whey Protein Ingredients Market with this meticulously researched, SEO-optimized report. Analyze key market drivers, segmentation, competitive dynamics, and future trajectories to inform strategic decision-making. This report covers the Study Period: 2019–2033, with Base Year: 2025 and Forecast Period: 2025–2033, including Historical Data from 2019–2024.

Canada Whey Protein Ingredients Market Market Structure & Competitive Dynamics

The Canada whey protein ingredients market is characterized by moderate to high concentration, driven by a few dominant global dairy processors and specialized ingredient manufacturers. Innovation ecosystems are thriving, particularly around enhanced bioavailability, specialized functional properties, and sustainable sourcing of whey protein concentrates, whey protein isolates, and hydrolyzed whey protein. Regulatory frameworks, primarily governed by Health Canada and CFIA, ensure product safety and quality, influencing ingredient purity and labeling standards. Product substitutes, such as plant-based proteins and other animal-derived protein sources, pose a competitive challenge, though whey protein's superior nutritional profile and functional benefits often secure its market position. End-user trends are increasingly leaning towards high-protein formulations in food and beverages, supplements, and even animal feed, fueling demand. Mergers and acquisitions (M&A) activities, though not always widely publicized, play a significant role in consolidating market share and expanding product portfolios. Major players like Cooke Inc, Arla Foods, DMK Group, Milk Specialties Global, Glanbia PLC, Agropur Dairy Cooperative, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Saputo Inc, and Groupe Lactalis are actively involved in strategic partnerships and expansions to capture market opportunities. The market share distribution is influenced by production capacity, product innovation, and distribution networks. M&A deal values, while variable, often reflect strategic acquisitions aimed at bolstering market presence and technological capabilities.

Canada Whey Protein Ingredients Market Industry Trends & Insights

The Canadian whey protein ingredients market is poised for significant expansion, driven by a confluence of robust demand from the health and wellness sector, advancements in food technology, and evolving consumer preferences. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is robust, indicating substantial market penetration. Key growth drivers include the escalating consumer awareness regarding the health benefits associated with protein consumption, particularly for muscle building, weight management, and overall well-being. The increasing popularity of sports nutrition and performance enhancement products directly fuels the demand for high-quality whey protein isolates and concentrates. Furthermore, the versatility of whey protein ingredients in food and beverage applications, from dairy products and bakery items to nutritional bars and ready-to-eat meals, is a critical growth catalyst. Technological disruptions are playing a pivotal role, with manufacturers investing in advanced processing techniques to improve whey protein's digestibility, functionality, and sensory attributes. Innovations in microfiltration and ultrafiltration technologies are enabling the production of specialized whey ingredients tailored for specific applications. Consumer preferences are shifting towards clean-label products, driving demand for minimally processed and naturally derived whey protein ingredients. The rising disposable incomes in Canada also contribute to increased spending on premium health and nutritional products. The competitive dynamics are characterized by a strong emphasis on product quality, innovation, and strategic partnerships, with both domestic and international players vying for market share. The market penetration of whey protein ingredients across various end-use industries is expected to deepen as manufacturers develop novel applications and formulations. The growing acceptance of whey protein in everyday food items, beyond traditional supplements, signifies a maturing market and broader consumer acceptance.

Dominant Markets & Segments in Canada Whey Protein Ingredients Market

The Canada whey protein ingredients market is segmented by form and end-user, with specific segments exhibiting pronounced dominance.

Dominant Forms:

- Whey Protein Concentrates (WPC): These are currently the most dominant form due to their cost-effectiveness and versatility. WPC offers a good balance of protein content and functional properties, making it a preferred choice for a wide array of food and beverage applications, including dairy products, bakery, and general nutritional supplements. Economic policies supporting domestic dairy production and food processing infrastructure contribute to the widespread availability and adoption of WPC.

- Whey Protein Isolates (WPI): Gaining significant traction, WPI is a high-purity protein source with minimal fat and lactose, making it ideal for lactose-intolerant individuals and those seeking very high protein intake. Its dominance is driven by the growing demand in the sports nutrition and medical nutrition segments, where purity and digestibility are paramount. Technological advancements in isolation processes have made WPI more accessible.

- Hydrolyzed Whey Protein: While a niche segment, hydrolyzed whey protein is experiencing rapid growth. Its pre-digested nature offers enhanced digestibility and faster absorption, crucial for infant formula and specialized medical nutrition products. Its dominance in these specific sub-segments is driven by the need for specialized nutritional solutions and increasing R&D in infant and elderly care.

Dominant End-Users:

- Supplements: This segment, particularly Sport/Performance Nutrition, is a powerhouse in driving the Canada whey protein ingredients market. The strong culture of fitness and athletic pursuits in Canada, coupled with the increasing awareness of protein's role in recovery and muscle growth, fuels consistent demand. Economic factors like disposable income and participation in sporting activities directly correlate with this segment's dominance.

- Food and Beverages: Within this broad category, Dairy and Dairy Alternative Products represent a significant and growing dominant area. The incorporation of whey protein into yogurts, milk-based beverages, and plant-based alternatives to boost protein content is a key trend. The growing consumer preference for high-protein snacks and ready-to-drink (RTD) beverages also contributes to the dominance of this sub-segment. Manufacturers are increasingly leveraging whey protein's functional properties in bakery and breakfast cereals to enhance nutritional value and appeal.

- Animal Feed: This segment, while not as prominent as supplements or food and beverages, is a steady contributor to the market. The nutritional benefits of whey protein for young animals and its potential to improve feed efficiency make it a valuable ingredient, particularly in specialized animal nutrition formulations. Infrastructure supporting livestock farming and animal health research plays a role in its sustained demand.

Canada Whey Protein Ingredients Market Product Innovations

Product innovation in the Canada whey protein ingredients market is heavily focused on enhancing functional properties and expanding application versatility. Manufacturers are developing whey protein isolates with improved solubility and emulsification for smoother textures in beverages and dairy alternatives. Novel processing techniques are yielding hydrolyzed whey proteins with targeted peptide profiles for enhanced digestibility and specific health benefits, such as immune support and satiety. Advancements in micro-encapsulation are enabling the controlled release of active ingredients within whey protein formulations, catering to specialized supplement needs. These innovations offer competitive advantages by addressing niche market demands and providing superior performance in finished products, from nutrient-dense infant formulas to advanced sports nutrition solutions and fortified food items.

Report Segmentation & Scope

This comprehensive report meticulously segments the Canada whey protein ingredients market. The segmentation by Form includes Whey Protein Concentrates, Whey Protein Isolates, and Hydrolyzed Whey Protein, each analyzed for its market size, growth projections, and competitive dynamics. The End-User segmentation is equally detailed, encompassing Animal Feed, Personal Care and Cosmetics, Food and Beverages (further broken down into Bakery, Breakfast Cereals, Condiments/Sauces, Dairy and Dairy Alternative Products, RTE/RTC Food Products, and Snacks), and Supplements (including Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, and Sport/Performance Nutrition). Each of these sub-segments is examined for its current market share, anticipated growth trajectory, and the key factors influencing its performance within the Canadian market.

Key Drivers of Canada Whey Protein Ingredients Market Growth

Several interconnected factors are propelling the Canada whey protein ingredients market forward. The increasing consumer emphasis on health and wellness, driven by a desire for improved physical performance and disease prevention, is a primary driver. The robust growth of the sports nutrition sector, fueled by a health-conscious population and a thriving fitness culture, directly translates to higher demand for whey protein isolates and concentrates. Furthermore, the versatility of whey protein in a wide range of food and beverage applications, from enhancing the protein content of dairy products and bakery items to its use in ready-to-drink nutritional beverages, contributes significantly to market expansion. Technological advancements in protein extraction and processing are leading to the development of specialized whey ingredients with improved functionality, digestibility, and bioavailability, opening up new application avenues.

Challenges in the Canada Whey Protein Ingredients Market Sector

Despite the positive growth trajectory, the Canada whey protein ingredients market faces several challenges. Fluctuations in raw milk prices, the primary feedstock, can impact production costs and profit margins for whey ingredient manufacturers. Stringent regulatory requirements for food ingredients, including labeling standards and purity certifications, necessitate continuous compliance and investment in quality control. The increasing competition from plant-based protein alternatives, driven by veganism and sustainability concerns, presents a significant challenge, forcing whey producers to highlight their product's nutritional superiority and unique functional benefits. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of essential processing components and transportation, potentially impacting market stability.

Leading Players in the Canada Whey Protein Ingredients Market Market

- Cooke Inc

- Arla Foods

- DMK Group

- Milk Specialties Global

- Glanbia PLC

- Agropur Dairy Cooperative

- Farbest-Tallman Foods Corporation

- Fonterra Co-operative Group Limited

- Saputo Inc

- Groupe Lactalis

Key Developments in Canada Whey Protein Ingredients Market Sector

- April 2023: Arla Foods unveiled their latest whey protein offerings, harnessing cutting-edge micro articulation technology to deliver exceptional quality protein. These premium proteins find versatile applications in a range of products, from yogurt and desserts to dairy beverages.

- June 2022: Fonterra Co-operative's renowned brand, NZMP, introduced Pro-Optima, a top-tier functional whey protein concentrate. Pro-Optima caters to various culinary needs, enhancing spoonable yogurt, drinking yogurt, mousses, nutritional yogurt bars, and more.

- June 2021: Arla Foods Ingredients introduced Nutrilac FO-7875, a game-changing whey protein ingredient designed to meet the growing demand for high-protein yogurts. Nutrilac FO-7875 empowers manufacturers to create yogurts, both spoonable and drinkable, with elevated protein content.

Strategic Canada Whey Protein Ingredients Market Market Outlook

The strategic outlook for the Canada whey protein ingredients market remains exceptionally positive, driven by sustained consumer demand for protein-enriched products and ongoing innovation. The market is expected to witness significant growth accelerators through the development of specialized whey ingredients tailored for infant nutrition, medical foods, and performance supplements. Strategic partnerships between dairy processors, ingredient manufacturers, and food product developers will be crucial in unlocking new market opportunities and expanding the application landscape. Furthermore, the increasing focus on sustainable sourcing and production methods will offer a competitive edge. Investments in advanced processing technologies that enhance protein functionality and reduce environmental impact will shape the future market, ensuring continued growth and market penetration across diverse consumer segments.

Canada Whey Protein Ingredients Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Hydrolyzed

- 1.3. Isolates

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Canada Whey Protein Ingredients Market Segmentation By Geography

- 1. Canada

Canada Whey Protein Ingredients Market Regional Market Share

Geographic Coverage of Canada Whey Protein Ingredients Market

Canada Whey Protein Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Protein-Rich Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Whey Protein Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Hydrolyzed

- 5.1.3. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cooke Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arla Foods

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DMK Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Milk Specialties Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Glanbia PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agropur Dairy Cooperative

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Farbest-Tallman Foods Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fonterra Co-operative Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saputo Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Groupe Lactalis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cooke Inc

List of Figures

- Figure 1: Canada Whey Protein Ingredients Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Whey Protein Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Whey Protein Ingredients Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Canada Whey Protein Ingredients Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Canada Whey Protein Ingredients Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Whey Protein Ingredients Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: Canada Whey Protein Ingredients Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Canada Whey Protein Ingredients Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Whey Protein Ingredients Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Canada Whey Protein Ingredients Market?

Key companies in the market include Cooke Inc, Arla Foods, DMK Grou, Milk Specialties Global, Glanbia PLC, Agropur Dairy Cooperative, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Saputo Inc, Groupe Lactalis.

3. What are the main segments of the Canada Whey Protein Ingredients Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.753 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Demand for Protein-Rich Products.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Arla Foods unveiled their latest whey protein offerings, harnessing cutting-edge micro articulation technology to deliver exceptional quality protein. These premium proteins find versatile applications in a range of products, from yogurt and desserts to dairy beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Whey Protein Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Whey Protein Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Whey Protein Ingredients Market?

To stay informed about further developments, trends, and reports in the Canada Whey Protein Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence