Key Insights

The China vegan protein powder market is projected for substantial growth, fueled by rising health consciousness and an increasing vegan and flexitarian consumer base. With a projected market size of $5.65 billion in 2025, the industry anticipates a Compound Annual Growth Rate (CAGR) of 6.41% through 2033. This expansion is driven by heightened demand for plant-based ingredients in food, beverages, personal care, and particularly within the rapidly growing supplements sector, encompassing infant nutrition, sports nutrition, and medical nutrition. Leading protein sources such as pea, soy, and rice protein are central to this market, meeting diverse consumer preferences and nutritional requirements. Growing awareness of the environmental and ethical advantages of plant-based diets further accelerates this trend, positioning vegan protein powders as a key element in China's transforming food industry.

China Vegan Protein Powder Industry Market Size (In Billion)

Market expansion is further bolstered by consumer preferences for clean-label products and an increased focus on nutritional enhancement. While the market shows strong momentum, potential challenges include raw material price volatility and the necessity for continuous product innovation to sustain consumer engagement. Nevertheless, robust growth drivers, such as government initiatives promoting healthy lifestyles and a growing middle class with higher disposable incomes, are expected to overcome these obstacles. The competitive environment comprises established global brands and developing local manufacturers, all striving for market share through varied product offerings and strategic marketing targeted at health-aware and ethically-motivated consumers. The prevalence of plant-based proteins, especially pea and soy, highlights their broad acceptance and adaptability in numerous applications.

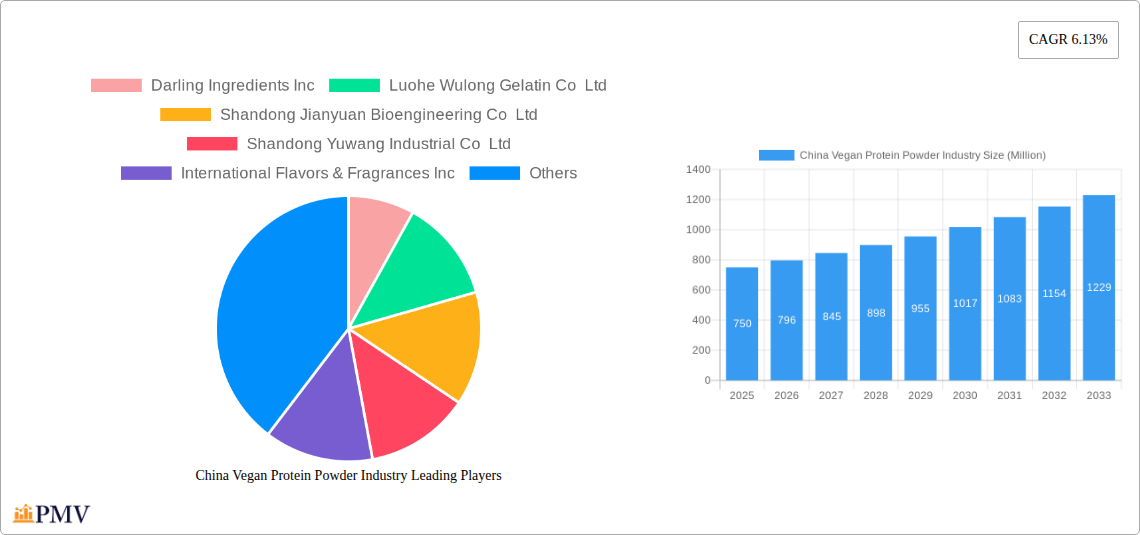

China Vegan Protein Powder Industry Company Market Share

China Vegan Protein Powder Industry: Market Analysis, Trends, and Forecast (2019–2033)

This comprehensive report provides an in-depth analysis of the China Vegan Protein Powder Industry, covering market dynamics, growth drivers, challenges, and future outlook. Leveraging historical data from 2019–2024 and forecasts up to 2033, with a base year of 2025, this report offers actionable insights for stakeholders. The market is segmented by protein source (Animal, Microbial, Plant) and end-user applications (Animal Feed, Food and Beverages, Personal Care and Cosmetics, Supplements).

China Vegan Protein Powder Industry Market Structure & Competitive Dynamics

The China Vegan Protein Powder Industry exhibits a moderately concentrated market structure, with key players vying for significant market share. The innovation ecosystem is robust, driven by increasing consumer demand for plant-based protein and advancements in protein extraction technology. Regulatory frameworks, while evolving, are becoming more conducive to product development and market expansion, particularly for vegan protein powder China. Substitutes for traditional animal-derived proteins are continuously emerging, fueling competition and driving product diversification. End-user trends highlight a strong shift towards vegan protein supplements, plant-based food and beverages, and animal feed applications. Mergers and Acquisitions (M&A) activities are a crucial element of market consolidation and strategic expansion, with recent deals demonstrating significant investment in food technology and sustainable protein sources. The estimated market share of leading companies in the vegan protein powder China market is constantly being reshaped by these dynamics. M&A deal values, while fluctuating, indicate strong investor confidence in the sector's future growth trajectory.

China Vegan Protein Powder Industry Industry Trends & Insights

The China Vegan Protein Powder Industry is poised for substantial growth, driven by a confluence of factors. A key market growth driver is the escalating health consciousness among Chinese consumers, coupled with a growing preference for sustainable protein sources and ethical dietary choices. This trend is significantly boosting the demand for plant-based protein powder, pea protein powder, and soy protein powder. Technological disruptions, including advancements in protein processing, flavor encapsulation, and texture enhancement, are enabling the development of more palatable and versatile vegan protein products. The growing adoption of alternative protein in everyday diets, from vegan protein bars to plant-based milk alternatives, further propels market expansion. Competitive dynamics are intensifying as both domestic and international players introduce innovative product formulations and expand their distribution networks. The CAGR of the China vegan protein powder market is projected to be robust, reflecting increasing market penetration of these products across various consumer segments. Insights suggest that brands emphasizing clean label, non-GMO, and allergen-free attributes will gain a competitive edge. The influence of social media and online health and wellness communities is also playing a pivotal role in shaping consumer preferences and driving demand for high-quality vegan protein. The integration of vegan protein into diverse food applications, beyond traditional protein shakes, is a significant emerging trend.

Dominant Markets & Segments in China Vegan Protein Powder Industry

Within the China Vegan Protein Powder Industry, the Plant protein segment is currently the most dominant, driven by widespread consumer acceptance and a diverse range of available sources. Pea protein and soy protein lead this sub-segment due to their established production infrastructure, affordability, and versatile applications.

Dominant Protein Source: Plant Protein

- Pea Protein: Its hypoallergenic nature, high amino acid profile, and sustainable sourcing make it a frontrunner. Key drivers include governmental support for agricultural diversification and increasing investment in plant-based protein research.

- Soy Protein: A long-standing staple, soy protein continues to hold significant market share due to its cost-effectiveness and widespread use in food and beverages. Economic policies supporting domestic agricultural production bolster its position.

- Other Plant Proteins: Hemp protein and rice protein are gaining traction due to their unique nutritional benefits and appeal to niche consumer groups seeking diverse vegan protein options.

Dominant End User: Food and Beverages

- Dairy and Dairy Alternative Products: The rapid growth of plant-based milk, yogurt, and cheese alternatives directly translates to increased demand for vegan protein as an ingredient. Consumer preferences for dairy-free protein are a major accelerator.

- Meat/Poultry/Seafood and Meat Alternative Products: The burgeoning market for vegan meat alternatives relies heavily on plant-based protein powders for texture, binding, and nutritional enhancement. Rising disposable incomes and a focus on healthier eating habits are key economic drivers.

- Snacks: The demand for convenient and healthy vegan protein snacks, such as protein bars and bites, is surging, driven by busy lifestyles and a desire for on-the-go nutrition.

Dominant Application: Supplements

- Sport/Performance Nutrition: This remains a cornerstone for vegan protein powder sales, with athletes and fitness enthusiasts actively seeking plant-based protein for muscle recovery and growth. The expansion of fitness centers and online fitness communities fuels this segment.

- Baby Food and Infant Formula: The increasing demand for hypoallergenic infant formula options is driving innovation and adoption of plant-based protein in this sensitive market. Regulatory support for safe and nutritious infant nutrition is crucial.

- Elderly Nutrition and Medical Nutrition: As China's population ages, there is a growing need for specialized nutritional products, including vegan protein supplements for seniors and individuals with specific dietary requirements or medical conditions. Advances in medical nutrition research are key drivers.

The China vegan protein powder market is characterized by strong growth in urban centers, driven by higher disposable incomes and greater exposure to global dietary trends. Infrastructure development supporting cold chain logistics for perishable vegan protein products also plays a vital role in market penetration.

China Vegan Protein Powder Industry Product Innovations

Product innovations in the China Vegan Protein Powder Industry are focused on enhancing taste, texture, and nutritional profiles to meet diverse consumer needs. Companies are developing novel plant-based protein blends that combine the strengths of different sources, such as pea and rice protein, for a complete amino acid profile. Microbial protein sources like algae protein and mycoprotein are emerging as sustainable and nutrient-rich alternatives, offering unique functional properties. Applications extend beyond traditional protein shakes to include vegan protein fortification in bakery items, confectionery, and ready-to-eat meals, expanding market reach and consumer convenience. Competitive advantages are derived from proprietary extraction technologies, allergen-free formulations, and the incorporation of functional ingredients that offer additional health benefits.

Report Segmentation & Scope

The China Vegan Protein Powder Industry is meticulously segmented to provide a granular view of market dynamics. The Source segmentation includes Animal Protein (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein), Microbial Protein (Algae Protein, Mycoprotein), and Plant Protein (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein). The End User segmentation encompasses Animal Feed, Food and Beverages (further categorized into Bakery, Breakfast Cereals, Condiments/Sauces, Confectionery, Dairy and Dairy Alternative Products, Meat/Poultry/Seafood and Meat Alternative Products, RTE/RTC Food Products, Snacks), Personal Care and Cosmetics, and Supplements (including Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, Sport/Performance Nutrition). Growth projections and market sizes are estimated for each segment, with a focus on competitive dynamics and evolving consumer preferences within each sub-category.

Key Drivers of China Vegan Protein Powder Industry Growth

The China Vegan Protein Powder Industry is propelled by several key drivers:

- Rising Health and Wellness Consciousness: A significant increase in consumer awareness regarding the health benefits of plant-based diets and clean label products.

- Growing Environmental Concerns: A greater emphasis on sustainability and the environmental impact of food production is driving demand for eco-friendly protein sources.

- Technological Advancements: Innovations in protein extraction, processing, and formulation are leading to more palatable and versatile vegan protein products.

- Governmental Support and Initiatives: Favorable policies promoting alternative proteins and plant-based food development contribute to market growth.

- Increasing Disposable Income: Higher purchasing power enables consumers to invest in premium vegan protein supplements and plant-based food options.

Challenges in the China Vegan Protein Powder Industry Sector

Despite robust growth, the China Vegan Protein Powder Industry faces certain challenges:

- Perception and Taste Preferences: Overcoming traditional taste preferences and ensuring the palatability of plant-based protein for a wider audience remains a hurdle.

- Supply Chain Volatility: Ensuring a consistent and high-quality supply of raw materials for plant-based and microbial protein sources can be subject to agricultural and environmental factors.

- Regulatory Hurdles: Navigating evolving regulatory landscapes for novel protein sources and product claims can impact market entry and product development timelines.

- Competition from Traditional Protein Sources: Despite growing demand, animal protein remains a dominant force, posing ongoing competitive pressure.

- Price Sensitivity: While premium products are gaining traction, a segment of the market remains price-sensitive, impacting the adoption of higher-cost vegan protein options.

Leading Players in the China Vegan Protein Powder Industry Market

- Darling Ingredients Inc

- Luohe Wulong Gelatin Co Ltd

- Shandong Jianyuan Bioengineering Co Ltd

- Shandong Yuwang Industrial Co Ltd

- International Flavors & Fragrances Inc

- Linxia Huaan Biological Products Co Ltd

- Wilmar International Lt

- Archer Daniels Midland Company

- Gansu Hua'an Biotechnology Group

- Fonterra Co-operative Group Limited

- Foodchem International Corporation

- FUJI OIL HOLDINGS INC

Key Developments in China Vegan Protein Powder Industry Sector

- July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.

- May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.

- March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

Strategic China Vegan Protein Powder Industry Market Outlook

The strategic outlook for the China Vegan Protein Powder Industry is exceptionally positive, driven by a sustained shift towards healthier and more sustainable dietary choices. Future market potential lies in further innovation across microbial protein and alternative plant protein sources, expanding the versatility of vegan protein powder applications in convenience foods and specialized nutrition. Strategic opportunities include capitalizing on the growing demand for hypoallergenic and allergen-free products, particularly in infant nutrition and for consumers with dietary sensitivities. Partnerships with food manufacturers and advancements in ingredient technology will be crucial for unlocking new market segments and reinforcing competitive advantages in this dynamic sector. The continued growth of the sports nutrition and elderly nutrition segments, coupled with increasing consumer acceptance of plant-based alternatives, paints a promising picture for long-term market expansion.

China Vegan Protein Powder Industry Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

China Vegan Protein Powder Industry Segmentation By Geography

- 1. China

China Vegan Protein Powder Industry Regional Market Share

Geographic Coverage of China Vegan Protein Powder Industry

China Vegan Protein Powder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Vegan Protein Powder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luohe Wulong Gelatin Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shandong Jianyuan Bioengineering Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Yuwang Industrial Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Flavors & Fragrances Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Linxia Huaan Biological Products Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wilmar International Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Archer Daniels Midland Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gansu Hua'an Biotechnology Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fonterra Co-operative Group Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Foodchem International Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FUJI OIL HOLDINGS INC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: China Vegan Protein Powder Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Vegan Protein Powder Industry Share (%) by Company 2025

List of Tables

- Table 1: China Vegan Protein Powder Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 2: China Vegan Protein Powder Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: China Vegan Protein Powder Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Vegan Protein Powder Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 5: China Vegan Protein Powder Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: China Vegan Protein Powder Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Vegan Protein Powder Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the China Vegan Protein Powder Industry?

Key companies in the market include Darling Ingredients Inc, Luohe Wulong Gelatin Co Ltd, Shandong Jianyuan Bioengineering Co Ltd, Shandong Yuwang Industrial Co Ltd, International Flavors & Fragrances Inc, Linxia Huaan Biological Products Co Ltd, Wilmar International Lt, Archer Daniels Midland Company, Gansu Hua'an Biotechnology Group, Fonterra Co-operative Group Limited, Foodchem International Corporation, FUJI OIL HOLDINGS INC.

3. What are the main segments of the China Vegan Protein Powder Industry?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, which is a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Vegan Protein Powder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Vegan Protein Powder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Vegan Protein Powder Industry?

To stay informed about further developments, trends, and reports in the China Vegan Protein Powder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence