Key Insights

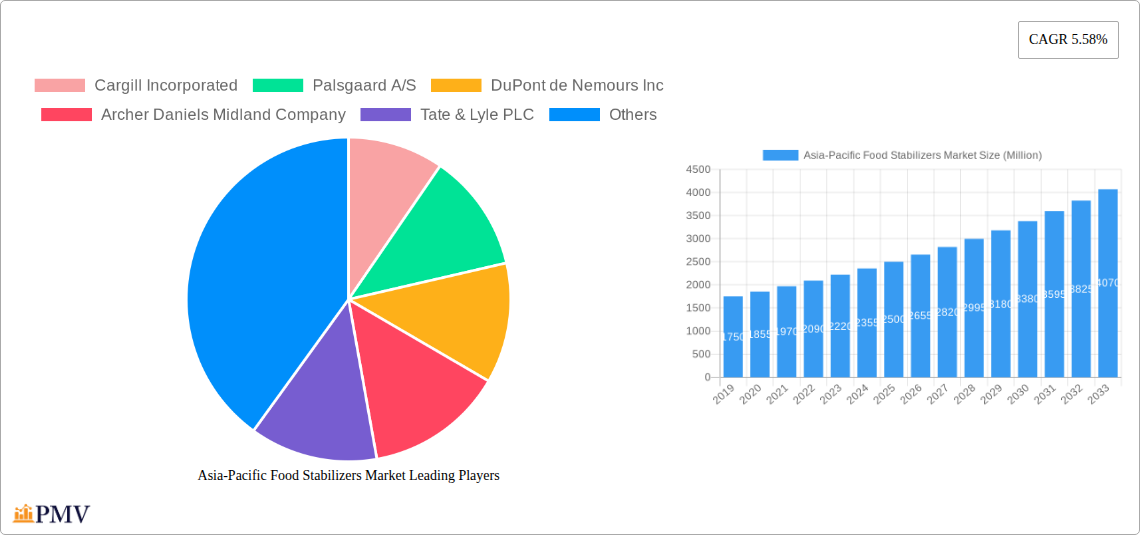

The Asia-Pacific Food Stabilizers Market is projected for substantial expansion, anticipated to reach $3.3 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 5.5% from the base year 2025. This growth is propelled by escalating demand for processed and convenience foods, a rising middle-class demographic with increased disposable income, and a growing consumer focus on product texture, shelf-life, and sensory attributes. The trend towards clean-label and natural ingredients is a significant factor, prompting manufacturers to favor plant-based and microbial stabilizers, particularly in bakery & confectionery, dairy, and beverage sectors. Enhanced food processing technologies and a stronger emphasis on regional food safety and quality standards further support this market trajectory.

Asia-Pacific Food Stabilizers Market Market Size (In Billion)

Key challenges include raw material price volatility, especially for natural sources, which can affect manufacturer profitability. Stringent regulatory frameworks for food additives in certain Asia-Pacific nations also present hurdles. Nevertheless, robust market potential, fueled by evolving consumer preferences and expanding applications, is expected to overcome these limitations. The competitive environment features established global players and emerging regional manufacturers focused on product innovation, strategic alliances, and adapting to diverse Asian culinary preferences and consumer behaviors.

Asia-Pacific Food Stabilizers Market Company Market Share

Asia-Pacific Food Stabilizers Market: Comprehensive Market Analysis and Growth Projections (2019–2033)

This in-depth report provides a meticulous analysis of the Asia-Pacific Food Stabilizers Market, offering critical insights for stakeholders seeking to navigate this dynamic sector. Spanning the Study Period: 2019–2033, with Base Year: 2025 and Estimated Year: 2025, the report details the Forecast Period: 2025–2033 based on thorough Historical Period: 2019–2024 data. We delve into market structure, key trends, dominant segments, product innovations, and future outlook, all while integrating high-ranking keywords for optimal search visibility. Our analysis covers Companies: Cargill Incorporated, Palsgaard A/S, DuPont de Nemours Inc, Archer Daniels Midland Company, Tate & Lyle PLC, Ingredion Incorporated, Ashland Global, and segments including Source: Natural (Plant, Microbial, Animal), Synthetic, and Application: Bakery & Confectionery, Dairy, Meat & Poultry, Beverages, Sauces & Dressings, Others, across Geography: China, Japan, India, Australia, Rest of Asia-Pacific.

Asia-Pacific Food Stabilizers Market Market Structure & Competitive Dynamics

The Asia-Pacific Food Stabilizers Market is characterized by a moderately consolidated structure, with a few key players holding significant market share, estimated to be around 60-70% of the total market value in 2025. Major companies like Cargill Incorporated and DuPont de Nemours Inc. are at the forefront, leveraging extensive R&D capabilities and robust distribution networks. The innovation ecosystem is vibrant, driven by increasing demand for clean-label ingredients and functional benefits, leading to a steady stream of new product developments. Regulatory frameworks, while generally supportive of food safety, vary across countries, necessitating careful navigation by market participants. Product substitutes, though present in some applications, often fall short in offering the precise textural and stability properties delivered by specialized food stabilizers. End-user trends are heavily influenced by growing health consciousness and demand for convenience foods, directly impacting stabilizer selection. Mergers and acquisitions (M&A) activities have been strategic, with estimated deal values in the range of tens to hundreds of millions of USD, aimed at expanding product portfolios and geographical reach. For instance, a key M&A in 2023 involving a prominent player in the dairy sector saw a deal value exceeding $50 million, reinforcing market consolidation.

Asia-Pacific Food Stabilizers Market Industry Trends & Insights

The Asia-Pacific Food Stabilizers Market is poised for robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5% during the forecast period. This expansion is primarily fueled by the burgeoning processed food industry across the region, driven by urbanization, increasing disposable incomes, and evolving consumer lifestyles. Technological disruptions, such as advancements in hydrocolloid extraction and modification, are enabling the development of more efficient and sustainable food stabilizers. Consumer preferences are increasingly leaning towards natural and plant-based ingredients, creating significant opportunities for natural food stabilizers derived from plant and microbial sources. The demand for improved texture, shelf-life extension, and enhanced sensory appeal in food products is a consistent growth driver. Competitive dynamics are intense, with both global giants and local players vying for market share. The penetration of specialized food stabilizers in emerging economies within the Asia-Pacific region is still relatively low, indicating substantial untapped potential. For example, the market penetration for advanced stabilizers in the sauces and dressings segment in India is projected to grow from an estimated 25% in 2025 to over 40% by 2033. Furthermore, the increasing adoption of stabilizers in functional foods and beverages, catering to health and wellness trends, is a key emerging trend.

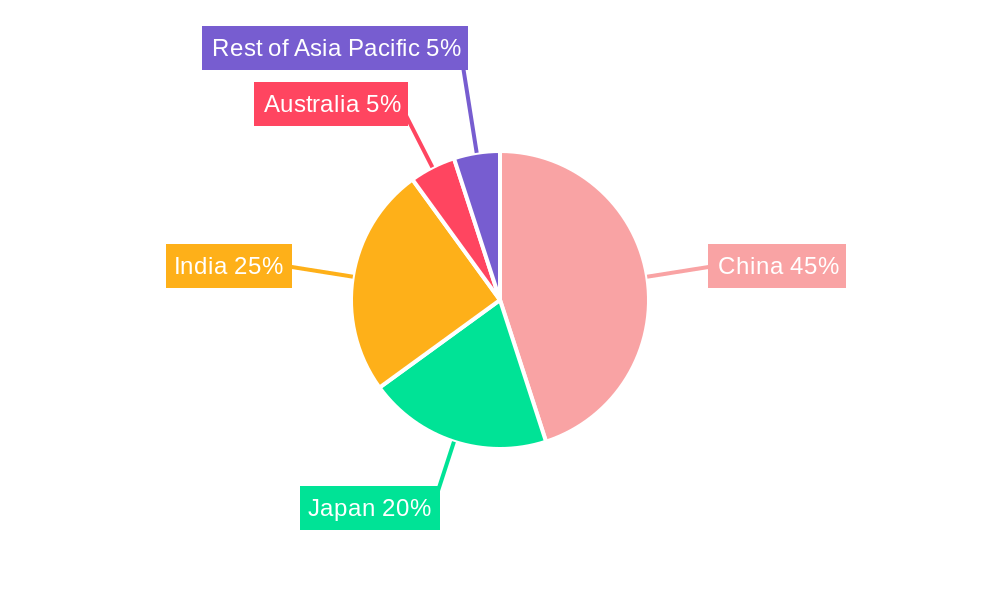

Dominant Markets & Segments in Asia-Pacific Food Stabilizers Market

China stands out as the dominant market within the Asia-Pacific Food Stabilizers Market, accounting for an estimated 35-40% of the regional market share in 2025. This dominance is attributable to its vast population, rapidly expanding food processing industry, and significant investments in food technology. India follows as another key market, showing a high growth trajectory due to its large consumer base and increasing demand for packaged and convenience foods.

- Dominant Segments by Source:

- Natural: Plant-based stabilizers, such as gums and starches, are gaining substantial traction due to the "clean label" trend and increasing consumer preference for natural ingredients. Microbial stabilizers are also witnessing steady growth, particularly for specialized applications in dairy and fermented products.

- Synthetic: While natural alternatives are on the rise, synthetic stabilizers continue to hold significant market share, especially in applications requiring high stability and specific functionalities at competitive costs.

- Dominant Segments by Application:

- Bakery & Confectionery: This segment consistently leads due to the widespread use of stabilizers for texture enhancement, shelf-life extension, and moisture control in a wide array of products. The market size for stabilizers in this segment is projected to reach over $3,000 million by 2033.

- Dairy: The dairy sector, encompassing ice cream, yogurt, and processed cheese, is another major consumer of food stabilizers, crucial for achieving desired textures and preventing syneresis.

- Meat & Poultry: Stabilizers play a vital role in processed meat and poultry products for binding, water retention, and texture improvement.

- Beverages: The growing demand for beverages with improved mouthfeel and stability drives stabilizer usage in this segment.

- Sauces & Dressings: These applications rely heavily on stabilizers for viscosity, emulsion stability, and texture, making it a significant growth area.

Asia-Pacific Food Stabilizers Market Product Innovations

Product innovation in the Asia-Pacific Food Stabilizers Market is largely driven by the pursuit of natural, sustainable, and high-performance solutions. Companies are focusing on developing novel plant-based hydrocolloids, optimizing fermentation processes for microbial stabilizers, and creating synergistic blends that offer enhanced functionality. For instance, advancements in modifying seaweed-derived polysaccharides and developing resilient starch-based stabilizers are addressing specific texture and stability challenges in confectionery and dairy applications. The competitive advantage lies in delivering cost-effective solutions with superior performance and appealing consumer profiles, aligning with market demand for healthier and cleaner food options.

Report Segmentation & Scope

This report meticulously segments the Asia-Pacific Food Stabilizers Market by Source, Application, and Geography. The Source segmentation includes Natural (Plant, Microbial, Animal) and Synthetic stabilizers, each offering distinct functionalities and market opportunities. The Application segmentation covers Bakery & Confectionery, Dairy, Meat & Poultry, Beverages, Sauces & Dressings, and Others, representing key end-use industries with varying stabilizer requirements. Geographically, the report focuses on China, Japan, India, Australia, and the Rest of Asia-Pacific, providing granular insights into regional dynamics. Growth projections for each segment are detailed, with the natural source segment exhibiting a CAGR of over 8%, driven by consumer demand. The bakery & confectionery application segment is expected to maintain its leading position, with an estimated market size of over $3,200 million in 2033.

Key Drivers of Asia-Pacific Food Stabilizers Market Growth

The Asia-Pacific Food Stabilizers Market growth is propelled by several key factors. The surging demand for processed and convenience foods, fueled by rapid urbanization and busy lifestyles, is a primary driver. Increasing disposable incomes across the region translate to higher consumption of a wider variety of food products, many of which require stabilizers for optimal texture and shelf-life. Technological advancements in stabilizer production, leading to more efficient and cost-effective solutions, are also contributing significantly. Furthermore, the growing consumer awareness regarding health and wellness, coupled with a preference for "clean label" ingredients, is fostering the adoption of natural food stabilizers. Regulatory support for food safety and quality standards also plays a crucial role in market expansion.

Challenges in the Asia-Pacific Food Stabilizers Market Sector

Despite the robust growth, the Asia-Pacific Food Stabilizers Market faces several challenges. Fluctuations in raw material prices, particularly for natural ingredients, can impact production costs and profit margins. Stringent and diverse regulatory landscapes across different countries can create complexities for market entry and product compliance. Intense competition among established players and emerging local manufacturers exerts downward pressure on pricing. Supply chain disruptions, exacerbated by geopolitical factors and logistics challenges, can affect the availability and timely delivery of key ingredients. Additionally, the continuous need for R&D investment to keep pace with evolving consumer preferences and technological advancements presents a financial hurdle for some companies.

Leading Players in the Asia-Pacific Food Stabilizers Market Market

- Cargill Incorporated

- Palsgaard A/S

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Ingredion Incorporated

- Ashland Global

Key Developments in Asia-Pacific Food Stabilizers Market Sector

- 2024/01: Launch of a new range of plant-based stabilizers by Ingredion Incorporated, targeting the growing demand for vegan-friendly bakery and dairy products.

- 2023/11: Cargill Incorporated acquired a significant stake in a regional hydrocolloid manufacturer, strengthening its presence in Southeast Asia.

- 2023/07: Palsgaard A/S introduced an innovative emulsifier system for plant-based dairy alternatives, addressing texture and stability concerns.

- 2022/09: DuPont de Nemours Inc. unveiled a new portfolio of clean-label starch-based stabilizers designed for reduced sugar and healthier food formulations.

- 2022/04: Archer Daniels Midland Company expanded its functional ingredient offerings with a focus on customized stabilizer solutions for the meat and poultry sector.

Strategic Asia-Pacific Food Stabilizers Market Market Outlook

The strategic outlook for the Asia-Pacific Food Stabilizers Market remains highly positive, characterized by sustained growth driven by favorable demographic shifts and evolving consumer demands. Future market potential lies in capitalizing on the increasing demand for plant-based and clean-label solutions, particularly in emerging economies like India and Vietnam. Strategic opportunities include expanding product portfolios to cater to niche applications, investing in R&D for sustainable and functional stabilizers, and forging strategic partnerships or M&A activities to enhance market penetration and technological capabilities. The growing focus on health and wellness trends will continue to fuel the demand for specialized stabilizers that offer functional benefits beyond basic texturization.

Asia-Pacific Food Stabilizers Market Segmentation

-

1. Source

-

1.1. Natural

- 1.1.1. Plant

- 1.1.2. Microbial

- 1.1.3. Animal

- 1.2. Synthetic

-

1.1. Natural

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Dairy

- 2.3. Meat & Poultry

- 2.4. Beverages

- 2.5. Sauces & Dressings

- 2.6. Others

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Food Stabilizers Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Food Stabilizers Market Regional Market Share

Geographic Coverage of Asia-Pacific Food Stabilizers Market

Asia-Pacific Food Stabilizers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products

- 3.3. Market Restrains

- 3.3.1. Stringent government regulations on food product claims

- 3.4. Market Trends

- 3.4.1. Significant Usage of Stabilizers in Beverage Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Natural

- 5.1.1.1. Plant

- 5.1.1.2. Microbial

- 5.1.1.3. Animal

- 5.1.2. Synthetic

- 5.1.1. Natural

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Dairy

- 5.2.3. Meat & Poultry

- 5.2.4. Beverages

- 5.2.5. Sauces & Dressings

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. China Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Natural

- 6.1.1.1. Plant

- 6.1.1.2. Microbial

- 6.1.1.3. Animal

- 6.1.2. Synthetic

- 6.1.1. Natural

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery & Confectionery

- 6.2.2. Dairy

- 6.2.3. Meat & Poultry

- 6.2.4. Beverages

- 6.2.5. Sauces & Dressings

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Japan Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Natural

- 7.1.1.1. Plant

- 7.1.1.2. Microbial

- 7.1.1.3. Animal

- 7.1.2. Synthetic

- 7.1.1. Natural

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery & Confectionery

- 7.2.2. Dairy

- 7.2.3. Meat & Poultry

- 7.2.4. Beverages

- 7.2.5. Sauces & Dressings

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. India Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Natural

- 8.1.1.1. Plant

- 8.1.1.2. Microbial

- 8.1.1.3. Animal

- 8.1.2. Synthetic

- 8.1.1. Natural

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery & Confectionery

- 8.2.2. Dairy

- 8.2.3. Meat & Poultry

- 8.2.4. Beverages

- 8.2.5. Sauces & Dressings

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Australia Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Natural

- 9.1.1.1. Plant

- 9.1.1.2. Microbial

- 9.1.1.3. Animal

- 9.1.2. Synthetic

- 9.1.1. Natural

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery & Confectionery

- 9.2.2. Dairy

- 9.2.3. Meat & Poultry

- 9.2.4. Beverages

- 9.2.5. Sauces & Dressings

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Rest of Asia Pacific Asia-Pacific Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Natural

- 10.1.1.1. Plant

- 10.1.1.2. Microbial

- 10.1.1.3. Animal

- 10.1.2. Synthetic

- 10.1.1. Natural

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery & Confectionery

- 10.2.2. Dairy

- 10.2.3. Meat & Poultry

- 10.2.4. Beverages

- 10.2.5. Sauces & Dressings

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Palsgaard A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont de Nemours Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tate & Lyle PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ingredion Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ashland Global

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Food Stabilizers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Food Stabilizers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 3: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 10: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 11: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 18: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 19: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 26: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 27: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 34: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 35: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 42: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 43: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Food Stabilizers Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Stabilizers Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Asia-Pacific Food Stabilizers Market?

Key companies in the market include Cargill Incorporated, Palsgaard A/S, DuPont de Nemours Inc, Archer Daniels Midland Company, Tate & Lyle PLC, Ingredion Incorporated, Ashland Global.

3. What are the main segments of the Asia-Pacific Food Stabilizers Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products.

6. What are the notable trends driving market growth?

Significant Usage of Stabilizers in Beverage Applications.

7. Are there any restraints impacting market growth?

Stringent government regulations on food product claims.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Stabilizers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Stabilizers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Stabilizers Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Stabilizers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence