Key Insights

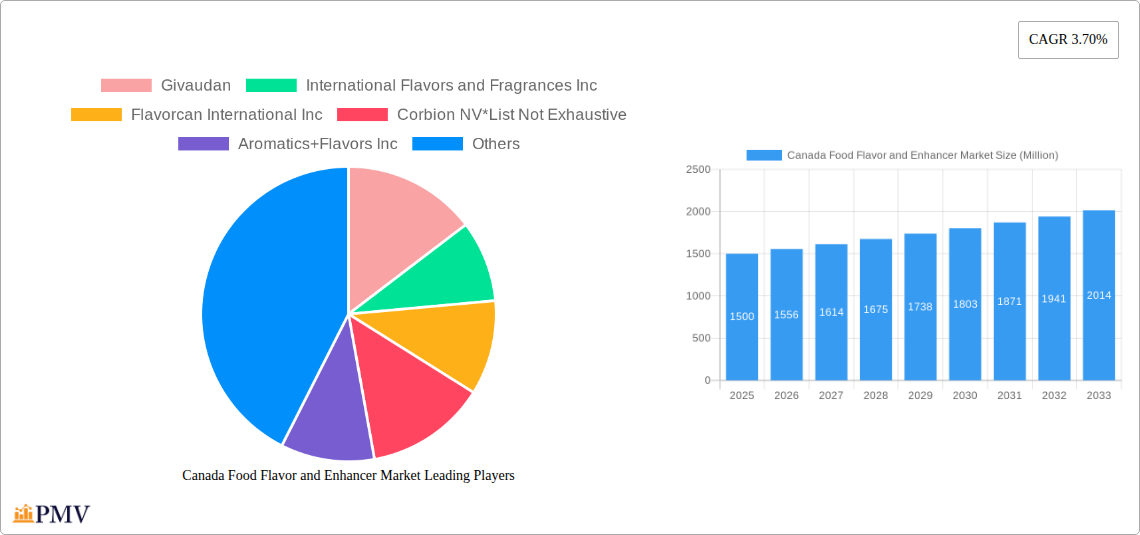

The Canadian Food Flavor and Enhancer Market is poised for steady growth, projected to reach an estimated USD XXX million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.70% through 2033. This expansion is driven by a confluence of factors, including the escalating consumer demand for more diverse and sophisticated taste experiences in food and beverages. The increasing popularity of natural and clean-label ingredients is also a significant catalyst, compelling manufacturers to invest in natural flavorings and taste modulators. Furthermore, evolving dietary preferences, such as the rise in plant-based alternatives and functional foods, are creating new avenues for flavor innovation and application. The market is witnessing a strong trend towards the development of complex flavor profiles that mimic traditional tastes while catering to emerging health and wellness trends. This includes a focus on reducing sugar, salt, and artificial additives, prompting a greater reliance on sophisticated flavor systems and enhancers to maintain palatability and consumer satisfaction.

Canada Food Flavor and Enhancer Market Market Size (In Billion)

Key restraints influencing the market's trajectory include the fluctuating costs of raw materials, particularly for natural flavor compounds, which can impact profit margins. Stringent regulatory landscapes surrounding food additives and labeling requirements also necessitate significant investment in compliance and product development, potentially slowing down market entry for new players. However, the inherent demand for enhanced sensory appeal in processed foods, coupled with the continuous innovation by leading companies like Givaudan, International Flavors and Fragrances Inc., and Firmenich, is expected to outweigh these challenges. The confectionery and bakery segments are expected to remain dominant application areas, but significant growth opportunities are also anticipated in dairy products, savory snacks, and beverages as consumer tastes diversify and product innovation accelerates across these categories.

Canada Food Flavor and Enhancer Market Company Market Share

Unveiling the Canada Food Flavor and Enhancer Market: A Comprehensive Analysis (2019-2033)

This detailed report provides an in-depth analysis of the Canada food flavor and enhancer market, offering crucial insights for industry stakeholders. Spanning the study period of 2019–2033, with 2025 as the base year and estimated year, and a robust forecast period from 2025–2033, this report delves into historical trends from 2019–2024 to paint a complete picture of market evolution. We examine key segments, dominant trends, competitive landscapes, and future projections, equipping businesses with actionable intelligence to navigate this dynamic sector. The Canada food flavor and enhancer market size is projected to reach USD 1,500 Million by 2033, exhibiting a CAGR of 5.5% during the forecast period.

Canada Food Flavor and Enhancer Market Market Structure & Competitive Dynamics

The Canada food flavor and enhancer market exhibits a moderately consolidated structure, characterized by the significant presence of global players alongside emerging regional entities. Innovation ecosystems thrive, driven by continuous research and development in creating novel taste profiles and enhancing sensory experiences. Key companies like Givaudan, International Flavors and Fragrances Inc., and Firmenich hold substantial market share, leveraging their extensive portfolios and R&D capabilities. The regulatory framework, guided by Health Canada, ensures product safety and adherence to labeling standards, influencing product development and market entry. Product substitutes, such as clean-label alternatives and natural ingredients, are gaining traction, prompting manufacturers to innovate in these areas. End-user trends are increasingly leaning towards healthier, natural, and sustainably sourced ingredients, impacting flavor and enhancer demand. Mergers and acquisitions (M&A) are prevalent, with recent deals valued in the tens to hundreds of million dollars, consolidating market positions and expanding product offerings. For instance, a notable M&A activity in 2023 involved a major flavor house acquiring a specialized natural ingredient producer, valued at approximately USD 150 Million. This strategic consolidation aims to capture a larger share of the premium and clean-label segment within the food ingredients Canada landscape.

Canada Food Flavor and Enhancer Market Industry Trends & Insights

The Canada food flavor and enhancer market is experiencing robust growth, fueled by several interconnected industry trends and consumer insights. A primary growth driver is the escalating consumer demand for healthier and more natural food products. This has propelled the market for natural flavors Canada and clean-label ingredients, with consumers actively seeking transparency in ingredient lists. The rising disposable income and an aging population in Canada are also contributing to increased spending on convenience foods and beverages, which in turn drives the demand for sophisticated flavorings and enhancers to elevate the taste experience. Technological disruptions are playing a pivotal role, with advancements in extraction techniques, biotechnology, and encapsulation technologies enabling the creation of more stable, potent, and cost-effective flavors. Flavor encapsulation technology is seeing significant adoption, prolonging shelf life and controlled release of flavors in various food applications. Furthermore, the growing influence of global culinary trends, particularly the demand for exotic and authentic ethnic flavors, is creating new opportunities for flavor houses. The competitive dynamic within the Canada food ingredients market is intensifying, with companies focusing on product differentiation through unique flavor profiles, allergen-free options, and sustainable sourcing. Market penetration of specialized flavors, such as those for plant-based alternatives, is rapidly increasing. The overall market penetration of food flavors and enhancers in Canada is estimated to be around 85%, with significant room for growth in niche applications and emerging product categories. The CAGR for the Canada food flavor and enhancer market is projected at 5.5% for the forecast period, indicating sustained expansion.

Dominant Markets & Segments in Canada Food Flavor and Enhancer Market

Within the Canada food flavor and enhancer market, the Flavors segment, particularly Natural Flavors, commands a dominant position. This surge is attributed to the pervasive consumer preference for ingredients perceived as healthier and more authentic. The Bakery and Beverages application segments are the largest contributors to overall market revenue, driven by their extensive use of various flavor profiles and enhancers to enhance palatability and product appeal.

Dominant Segment by Type:

- Natural Flavors: This sub-segment is experiencing exceptional growth, with a projected market share of approximately 45% in 2025. Key drivers include heightened consumer awareness of ingredient origins, a desire for clean labels, and the availability of a wider range of natural flavor sources. Economic policies promoting local sourcing and sustainable agriculture also indirectly support the growth of natural flavors.

- Nature-Identical Flavors: These flavors, mimicking natural compounds, hold a substantial market share of around 30% due to their cost-effectiveness and consistent sensory profiles.

- Synthetic Flavors: While smaller in market share (approximately 25%), synthetic flavors continue to play a crucial role in applications where cost and specific flavor intensity are paramount.

Dominant Segments by Application:

- Bakery: Accounting for an estimated 25% of the market, the bakery sector heavily relies on flavors for bread, cakes, pastries, and cookies. The demand for innovative and indulgent flavors continues to drive growth.

- Beverages: This segment, holding around 22% market share, encompasses a wide array of drinks from carbonated soft drinks to juices and functional beverages. The need for refreshing and unique taste experiences makes it a significant consumer of flavors and enhancers.

- Confectionery: With a market share of approximately 18%, the confectionery industry utilizes flavors to create a diverse range of candies, chocolates, and gummies.

- Dairy Products: This sector, representing about 15% of the market, sees demand for flavors in yogurts, ice creams, and dairy-based beverages.

- Savory Snacks: Holding around 10% market share, the savory snack industry benefits from enhancers that boost umami and create more complex taste profiles.

- Soups and Sauces: This segment, with approximately 7% market share, utilizes flavors and enhancers to deepen and enrich the taste of processed food products.

- Others: This category, encompassing processed foods and ready-to-eat meals, accounts for the remaining market share and is expected to grow with the increasing demand for convenience.

Canada Food Flavor and Enhancer Market Product Innovations

Product innovation in the Canada food flavor and enhancer market is primarily focused on developing cleaner labels, natural ingredients, and plant-based solutions. Companies are investing in advanced extraction technologies to isolate high-impact natural compounds, leading to the launch of novel natural food flavors Canada and botanicals. There's a growing trend towards encapsulated flavors that offer enhanced stability and controlled release, particularly for challenging applications like baked goods and beverages. Competitive advantages are being carved out through the development of unique flavor blends that cater to evolving consumer tastes, such as global fusion flavors and personalized taste experiences. Technological advancements are enabling the creation of authentic taste profiles for plant-based meat and dairy alternatives, addressing a significant market demand.

Report Segmentation & Scope

This report meticulously segments the Canada food flavor and enhancer market to provide granular insights into specific areas of growth and demand. The segmentation is structured to offer a comprehensive view of the market dynamics, covering key product types and their diverse applications.

By Type:

- Flavors: This broad category encompasses a significant portion of the market.

- Natural Flavors: Expected to witness robust growth, with an estimated market size of USD 675 Million in 2025, driven by consumer preference for clean labels.

- Nature-Identical Flavors: Projected to hold a market size of USD 450 Million in 2025, offering a balance of cost and quality.

- Synthetic Flavors: Estimated market size of USD 375 Million in 2025, catering to specific industrial needs.

- Flavor Enhancers: This segment, crucial for amplifying existing tastes, is projected to reach USD 300 Million in 2025, with a steady growth trajectory.

- Flavors: This broad category encompasses a significant portion of the market.

By Application:

- Bakery: Expected to reach USD 375 Million in 2025, this segment is a consistent driver of flavor demand.

- Confectionery: With a projected market size of USD 270 Million in 2025, it remains a key application area.

- Dairy Products: Estimated at USD 225 Million in 2025, this sector benefits from the demand for flavored dairy items.

- Beverages: Poised to reach USD 330 Million in 2025, this is a dynamic and growing application segment.

- Savory Snacks: Projected to be USD 150 Million in 2025, this segment sees increasing demand for intensified flavors.

- Soups and Sauces: Estimated at USD 105 Million in 2025, this segment relies on enhancers for depth of flavor.

- Others: This segment, including processed foods and ready-to-eat meals, is estimated at USD 145 Million in 2025 and is expected to grow with the convenience food trend.

Key Drivers of Canada Food Flavor and Enhancer Market Growth

The Canada food flavor and enhancer market is propelled by several critical growth drivers. An escalating consumer preference for natural and clean-label ingredients is a primary catalyst, pushing demand for natural flavors Canada. This trend is further amplified by increased health consciousness and a desire for transparency in food sourcing. Economic factors, such as rising disposable incomes and a growing middle class, contribute to higher spending on processed foods and beverages, thereby boosting the demand for flavors and enhancers. Technological advancements in extraction and synthesis methods are enabling the creation of more sophisticated, cost-effective, and stable flavor solutions, fostering innovation. Furthermore, the growing influence of global culinary trends and the demand for authentic and exotic taste profiles are creating new market niches and opportunities for diversification.

Challenges in the Canada Food Flavor and Enhancer Market Sector

Despite the promising growth, the Canada food flavor and enhancer market faces several challenges. Stringent regulatory frameworks concerning food additives and labeling can pose hurdles for new product development and market entry, requiring significant compliance efforts and investment. Supply chain disruptions, particularly for certain natural ingredients, can impact the availability and cost of raw materials, affecting production timelines and pricing strategies. Intense competition from both global and local players can lead to price wars and necessitate continuous innovation to maintain market share. Additionally, fluctuating raw material prices and the need for sustainable sourcing practices add complexity to cost management and operational efficiency.

Leading Players in the Canada Food Flavor and Enhancer Market Market

- Givaudan

- International Flavors and Fragrances Inc.

- Flavorcan International Inc.

- Corbion NV

- Aromatics+Flavors Inc.

- Firmenich

- Archer Daniels Midland Company

- Takasago International Corporation

- Koninklijke DSM N V

- Kerry Group

Key Developments in Canada Food Flavor and Enhancer Market Sector

- 2023: Kerry Group launched a new range of plant-based flavors designed to mimic traditional meat and dairy taste profiles, addressing the growing demand for vegan alternatives.

- 2023: International Flavors and Fragrances Inc. announced an investment of USD 50 Million to expand its R&D facilities in North America, focusing on sustainable flavor development.

- 2022: Givaudan acquired a majority stake in a leading Canadian natural ingredient supplier, strengthening its portfolio of clean-label solutions and expanding its market reach in Canada.

- 2022: Firmenich introduced a new flavor encapsulation technology that significantly extends the shelf-life of delicate aromas in dry food applications, enhancing product innovation for manufacturers.

- 2021: Corbion NV expanded its portfolio of fermented ingredients for food applications, offering natural flavor enhancement and preservation solutions to the Canadian market.

Strategic Canada Food Flavor and Enhancer Market Market Outlook

The Canada food flavor and enhancer market is poised for continued growth, driven by evolving consumer preferences towards healthier and more natural products. Key growth accelerators include the ongoing demand for clean-label ingredients, the expansion of plant-based food categories, and the continuous pursuit of novel and exciting taste experiences in beverages and convenience foods. Strategic opportunities lie in developing innovative flavor solutions that cater to specific dietary needs, such as allergen-free and low-sugar options. Investing in sustainable sourcing and production practices will further enhance brand reputation and market appeal. The increasing adoption of advanced technologies, including biotechnology and encapsulation, will enable manufacturers to offer superior products and capture a larger share of this dynamic and expanding market.

Canada Food Flavor and Enhancer Market Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Nature-Identical Flavors

- 1.1.3. Synthetic Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy Products

- 2.4. Beverages

- 2.5. Savory Snacks

- 2.6. Soups and Sauces

- 2.7. Others

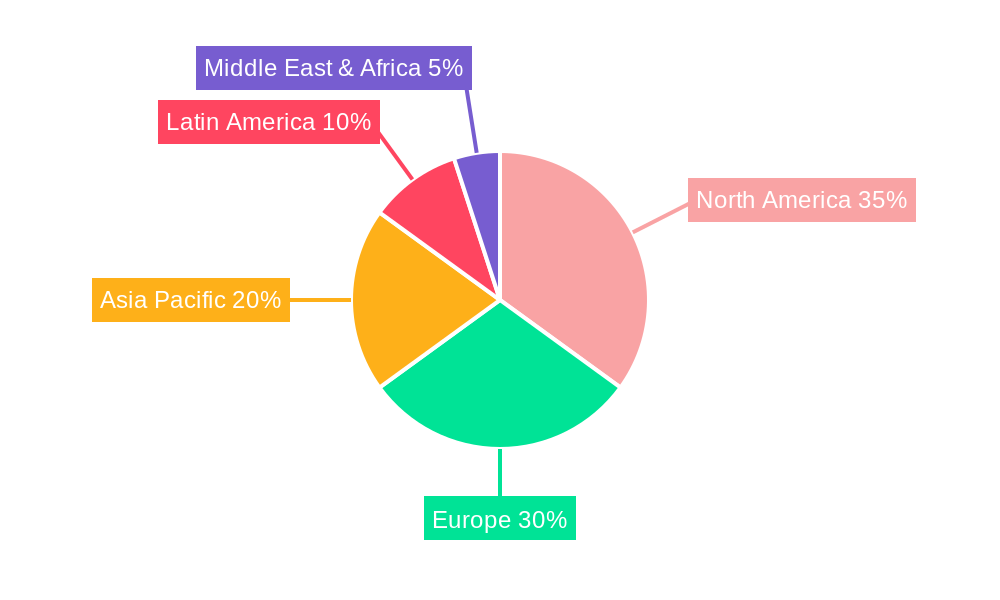

Canada Food Flavor and Enhancer Market Segmentation By Geography

- 1. Canada

Canada Food Flavor and Enhancer Market Regional Market Share

Geographic Coverage of Canada Food Flavor and Enhancer Market

Canada Food Flavor and Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Nature-Identical Flavors

- 5.1.1.3. Synthetic Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy Products

- 5.2.4. Beverages

- 5.2.5. Savory Snacks

- 5.2.6. Soups and Sauces

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Givaudan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors and Fragrances Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flavorcan International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corbion NV*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aromatics+Flavors Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Firmenich

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takasago International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke DSM N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Givaudan

List of Figures

- Figure 1: Canada Food Flavor and Enhancer Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Food Flavor and Enhancer Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Food Flavor and Enhancer Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Food Flavor and Enhancer Market?

Key companies in the market include Givaudan, International Flavors and Fragrances Inc, Flavorcan International Inc, Corbion NV*List Not Exhaustive, Aromatics+Flavors Inc, Firmenich, Archer Daniels Midland Company, Takasago International Corporation, Koninklijke DSM N V, Kerry Group.

3. What are the main segments of the Canada Food Flavor and Enhancer Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Increase in Demand for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Food Flavor and Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Food Flavor and Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Food Flavor and Enhancer Market?

To stay informed about further developments, trends, and reports in the Canada Food Flavor and Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence