Key Insights

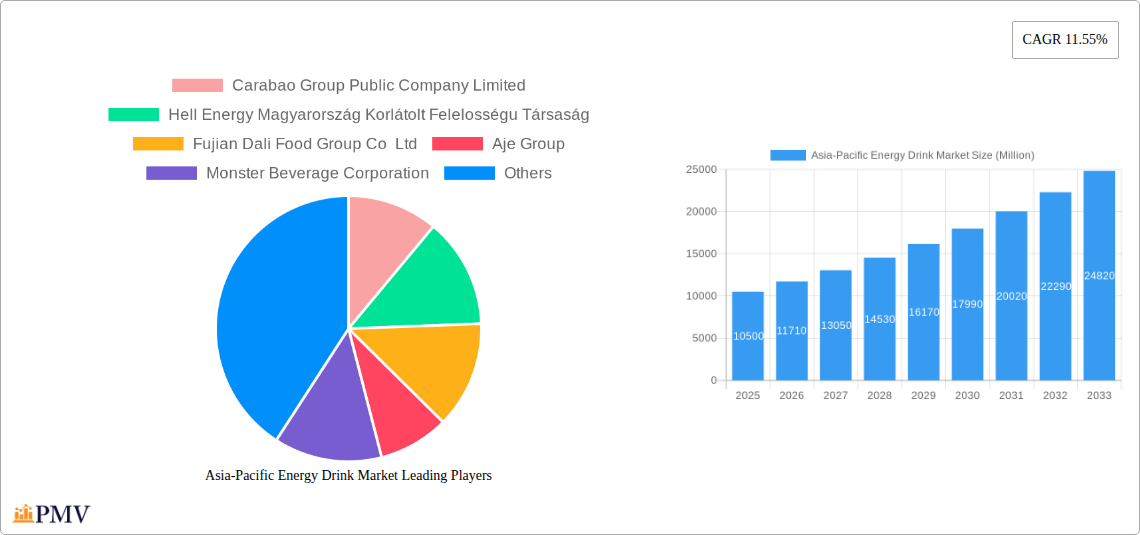

The Asia-Pacific energy drink market is poised for significant expansion, driven by a dynamic interplay of evolving consumer lifestyles and increasing product innovation. With an estimated market size of USD 10,500 million in 2025, this sector is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.55% from 2025 to 2033. This surge is primarily fueled by rising disposable incomes across key economies in the region, particularly in emerging markets like China, India, and Southeast Asian nations. Consumers are increasingly seeking convenient solutions to combat fatigue and enhance mental and physical performance, leading to a higher demand for energy drinks. Furthermore, a growing health-conscious demographic is contributing to the rise of natural/organic and sugar-free or low-calorie energy drinks, indicating a maturing market that caters to diverse preferences. The expansion of distribution networks, including a strong push towards online retail and convenience stores, is making these beverages more accessible than ever, further accelerating market penetration.

Asia-Pacific Energy Drink Market Market Size (In Billion)

The strategic landscape of the Asia-Pacific energy drink market is characterized by a vigorous competitive environment and a clear trend towards product diversification and premiumization. Leading global players such as Monster Beverage Corporation, PepsiCo Inc., and The Coca-Cola Company are actively investing in regional marketing campaigns and product development tailored to local tastes and preferences. This includes the introduction of novel flavors and functional ingredients. The packaging segment is also witnessing evolution, with a notable shift towards sustainable options like PET bottles and a continued presence of metal cans, while glass bottles maintain a niche appeal. Key drivers for this market include the fast-paced urban lifestyles, the prevalence of demanding work cultures, and a growing engagement in sports and fitness activities. However, potential restraints such as increasing regulatory scrutiny regarding sugar content and caffeine levels, along with growing consumer awareness about health implications, could pose challenges. Nevertheless, the overarching demand for quick energy solutions and the continuous introduction of innovative products are expected to propel the market forward throughout the forecast period.

Asia-Pacific Energy Drink Market Company Market Share

Asia-Pacific Energy Drink Market: Comprehensive Growth Analysis & Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the burgeoning Asia-Pacific energy drink market, offering critical insights into its structure, dynamics, and future trajectory. Covering a study period from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period from 2025 to 2033, this report is essential for stakeholders seeking to capitalize on the region's rapid expansion in the energy beverage sector. We delve into market segmentation, key growth drivers, challenges, and the competitive landscape, providing actionable intelligence for beverage manufacturers, distributors, and investors. The report identifies leading players and emerging trends, including the rise of natural/organic energy drinks and the impact of online retail on distribution channels.

Asia-Pacific Energy Drink Market Market Structure & Competitive Dynamics

The Asia-Pacific energy drink market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, particularly Red Bull GmbH, Monster Beverage Corporation, and PepsiCo Inc., alongside strong regional contenders like Carabao Group Public Company Limited and Osotspa Public Company Limited. Innovation is a key differentiator, with companies continuously introducing new formulations, flavors, and packaging solutions to cater to diverse consumer preferences. The market is further influenced by varying regulatory frameworks across countries, impacting ingredient approvals and marketing practices. Product substitutes include traditional soft drinks and functional beverages, necessitating continuous product differentiation. End-user trends are shifting towards healthier options, driving demand for sugar-free or low-calories energy drinks and natural/organic energy drinks. M&A activities are anticipated to increase as larger players seek to consolidate their market position and acquire innovative smaller brands. Market share estimations for leading companies reveal a dynamic competitive environment where strategic partnerships and market penetration are crucial for sustained growth. M&A deal values are expected to see significant upticks in the coming years, driven by the high growth potential of emerging economies.

Asia-Pacific Energy Drink Market Industry Trends & Insights

The Asia-Pacific energy drink market is experiencing robust growth, fueled by a confluence of escalating disposable incomes, a growing demand for convenient and performance-enhancing beverages, and an increasingly active and health-conscious population. The CAGR for the forecast period is projected to be exceptionally strong, reflecting the region's economic development and evolving consumer lifestyles. Technological disruptions are playing a pivotal role, with advancements in ingredient sourcing, formulation technologies that enable the development of sugar-free or low-calories energy drinks with enhanced taste profiles, and sophisticated manufacturing processes contributing to market expansion. Consumer preferences are undergoing a significant transformation, with a notable surge in demand for healthier alternatives such as natural/organic energy drinks, driven by increased awareness of the potential health implications of high sugar and artificial ingredient consumption. The convenience factor is also paramount, with energy shots gaining traction for their portability and rapid effect. Competitive dynamics are intensifying, pushing established giants like The Coca-Cola Company and PepsiCo Inc. to innovate alongside agile regional players such as Aje Group and Eastroc Beverage(Group) Co Ltd. Market penetration is steadily increasing across both urban and rural demographics, facilitated by expanding distribution networks and increased product accessibility. The trend towards premiumization is also evident, with consumers willing to pay a premium for specialized formulations and branded products.

Dominant Markets & Segments in Asia-Pacific Energy Drink Market

The Asia-Pacific energy drink market is a mosaic of diverse national markets and product segments, each contributing significantly to overall growth. China stands out as a dominant market, driven by its vast population, rapid urbanization, and a burgeoning middle class with increasing disposable income and a growing appetite for convenience and performance-enhancing beverages. India is another rapidly expanding market, showcasing immense potential due to its youthful demographic and increasing acceptance of energy drinks.

- Soft Drink Type Dominance:

- Traditional Energy Drinks continue to hold a substantial market share due to their established presence and widespread consumer familiarity. However, the landscape is rapidly shifting.

- Sugar-free or Low-calories Energy Drinks are experiencing explosive growth, directly responding to rising health consciousness and government initiatives promoting healthier lifestyles. This segment is a key growth accelerator, attracting both new and existing consumers.

- Natural/Organic Energy Drinks are emerging as a significant trend, appealing to consumers seeking cleaner labels and natural ingredients, indicating a premiumization trend.

- Energy Shots are gaining popularity, particularly in urban centers, due to their convenience and quick effectiveness, aligning with fast-paced lifestyles.

- Packaging Type Dominance:

- Metal Cans remain the preferred packaging format due to their recyclability, convenience, and ability to maintain product freshness. The aesthetic appeal of cans also contributes to their popularity.

- PET Bottles are gaining traction, especially for larger formats and in markets where cost-effectiveness is a primary consideration. Their lightweight nature and shatterproof qualities offer additional advantages.

- Glass Bottles are associated with premium offerings and niche markets, appealing to consumers seeking a more traditional or artisanal experience.

- Distribution Channel Dominance:

- Off-trade channels are by far the most dominant, with Convenience Stores and Supermarket/Hypermarkets serving as primary access points for energy drinks. These channels offer high visibility and impulse purchase opportunities.

- Online Retail is experiencing a meteoric rise, driven by the convenience of home delivery and the increasing adoption of e-commerce platforms across the region. This channel is crucial for reaching a wider consumer base and offering specialized products.

- On-trade channels, including cafes and bars, contribute to market penetration, particularly for specific brand activations and targeted promotions. The economic policies promoting consumer spending and infrastructure development in key countries are crucial drivers for the dominance of these channels.

Asia-Pacific Energy Drink Market Product Innovations

Product innovation in the Asia-Pacific energy drink market is pivotal for capturing consumer attention and market share. Companies are focusing on developing sugar-free or low-calories energy drinks with improved taste profiles and the inclusion of natural sweeteners. The emergence of natural/organic energy drinks featuring botanicals, vitamins, and adaptogens addresses growing health concerns. Energy shots are being innovated with varied caffeine levels and functional ingredients for specific needs like focus or recovery. Competitive advantages are being built through unique flavor combinations, sustainable packaging, and strategic marketing campaigns targeting younger demographics and active lifestyles.

Report Segmentation & Scope

This comprehensive report segments the Asia-Pacific energy drink market across key categories to provide granular insights.

- Soft Drink Type: The market is analyzed by Energy Shots, Natural/Organic Energy Drinks, Sugar-free or Low-calories Energy Drinks, Traditional Energy Drinks, and Other Energy Drinks. Growth projections and market sizes for each type are detailed, reflecting evolving consumer preferences and health trends.

- Packaging Type: Segmentation includes Glass Bottles, Metal Can, and PET Bottles. The report assesses the market share and growth dynamics of each packaging type, considering consumer convenience, environmental impact, and cost-effectiveness.

- Distribution Channel: The analysis covers Off-trade (further broken down into Convenience Stores, Online Retail, Supermarket/Hypermarket, and Others) and On-trade. Market sizes and competitive dynamics within each distribution channel are explored, highlighting the increasing importance of online retail and the continued dominance of convenience stores.

Key Drivers of Asia-Pacific Energy Drink Market Growth

Several key factors are propelling the Asia-Pacific energy drink market forward.

- Rising Disposable Incomes and Urbanization: Growing economies in countries like China, India, and Southeast Asian nations lead to increased consumer spending power and a greater demand for convenience beverages.

- Young and Growing Population: The large youth demographic in the Asia-Pacific region is a primary consumer base for energy drinks, driven by active lifestyles, academic pressures, and social trends.

- Increasing Health and Wellness Consciousness: While seemingly counterintuitive, this trend is driving the demand for healthier alternatives like sugar-free or low-calories energy drinks and natural/organic energy drinks, pushing innovation within the market.

- Product Innovation and Diversification: Manufacturers are continuously introducing novel flavors, functional ingredients, and healthier formulations to cater to a wider range of consumer needs and preferences.

Challenges in the Asia-Pacific Energy Drink Market Sector

Despite its promising growth, the Asia-Pacific energy drink market faces several challenges.

- Regulatory Scrutiny and Health Concerns: Governments in various countries are implementing stricter regulations on caffeine content and marketing practices due to public health concerns, potentially limiting growth.

- Intense Competition and Price Wars: The crowded market landscape, with both global and local players, leads to fierce competition and price pressures, impacting profit margins.

- Supply Chain Volatility and Raw Material Costs: Fluctuations in the availability and cost of key ingredients can disrupt production and affect pricing strategies.

- Consumer Perception and Misconceptions: Negative perceptions surrounding the health impacts of traditional energy drinks can deter some consumer segments, necessitating targeted marketing and education campaigns for healthier variants.

Leading Players in the Asia-Pacific Energy Drink Market Market

- Carabao Group Public Company Limited

- Hell Energy Magyarország Korlátolt Felelosségu Társaság

- Fujian Dali Food Group Co Ltd

- Aje Group

- Monster Beverage Corporation

- PepsiCo Inc

- The Coca-Cola Company

- Red Bull GmbH

- Henan Zhongwo Beverage Co Ltd

- Eastroc Beverage(Group) Co Ltd

- T C Pharmaceutical Industries Company Limited

- Taisho Pharmaceutical Holdings Co Ltd

- Congo Brands

- Osotspa Public Company Limited

Key Developments in Asia-Pacific Energy Drink Market Sector

- September 2023: PepsiCo India launched a limited edition flavor of its Sting Energy drink, called Sting Blue Current. Sting Blue Current is available at 200 ml in single-serve packs across India.

- April 2023: Prime has released a new energy drink, Prime Energy, containing 200mg of caffeine and zero sugar. The new drinks hold 300mg of electrolytes and contain ten calories, and come in blue raspberry, tropical punch, lemon lime, orange mango and strawberry watermelon flavours.

- January 2023: Monster is innovating its energy drinks and announced to launch affordable energy drink expansion to drive Asia growth.

Strategic Asia-Pacific Energy Drink Market Market Outlook

The strategic outlook for the Asia-Pacific energy drink market is exceptionally promising, characterized by sustained high growth driven by a dynamic consumer base and ongoing product innovation. Key growth accelerators include the continued demand for healthier sugar-free or low-calories energy drinks and natural/organic energy drinks, alongside the expansion of online retail distribution channels. Strategic opportunities lie in tapping into emerging economies within the region, focusing on localized product development, and leveraging digital marketing to connect with younger demographics. Collaborations and potential mergers with local players will be crucial for navigating diverse regulatory landscapes and achieving deeper market penetration. The market is poised for significant expansion as manufacturers continue to adapt to evolving consumer preferences and technological advancements.

Asia-Pacific Energy Drink Market Segmentation

-

1. Soft Drink Type

- 1.1. Energy Shots

- 1.2. Natural/Organic Energy Drinks

- 1.3. Sugar-free or Low-calories Energy Drinks

- 1.4. Traditional Energy Drinks

- 1.5. Other Energy Drinks

-

2. Packaging Type

- 2.1. Glass Bottles

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Asia-Pacific Energy Drink Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Energy Drink Market Regional Market Share

Geographic Coverage of Asia-Pacific Energy Drink Market

Asia-Pacific Energy Drink Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Energy Shots

- 5.1.2. Natural/Organic Energy Drinks

- 5.1.3. Sugar-free or Low-calories Energy Drinks

- 5.1.4. Traditional Energy Drinks

- 5.1.5. Other Energy Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Glass Bottles

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carabao Group Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hell Energy Magyarország Korlátolt Felelosségu Társaság

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujian Dali Food Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aje Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monster Beverage Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PepsiCo Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Coca-Cola Compan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Red Bull GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henan Zhongwo Beverage Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eastroc Beverage(Group) Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 T C Pharmaceutical Industries Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Taisho Pharmaceutical Holdings Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Congo Brands

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Osotspa Public Company Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Carabao Group Public Company Limited

List of Figures

- Figure 1: Asia-Pacific Energy Drink Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Energy Drink Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Energy Drink Market?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the Asia-Pacific Energy Drink Market?

Key companies in the market include Carabao Group Public Company Limited, Hell Energy Magyarország Korlátolt Felelosségu Társaság, Fujian Dali Food Group Co Ltd, Aje Group, Monster Beverage Corporation, PepsiCo Inc, The Coca-Cola Compan, Red Bull GmbH, Henan Zhongwo Beverage Co Ltd, Eastroc Beverage(Group) Co Ltd, T C Pharmaceutical Industries Company Limited, Taisho Pharmaceutical Holdings Co Ltd, Congo Brands, Osotspa Public Company Limited.

3. What are the main segments of the Asia-Pacific Energy Drink Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2023: PepsiCo India launched a limited edition flavor of its Sting Energy drink, called Sting Blue Current. Sting Blue Current is available at 200 ml in single-serve packs across India.April 2023: Prime has released a new energy drink, Prime Energy, containing 200mg of caffeine and zero sugar.The new drinks hold 300mg of electrolytes and contain ten calories, and come in blue raspberry, tropical punch, lemon lime, orange mango and strawberry watermelon flavours.January 2023: Monster is innovating its enery drinks and announced to launch affordable energy drink expansion to drive Asia growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Energy Drink Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Energy Drink Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Energy Drink Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Energy Drink Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence