Key Insights

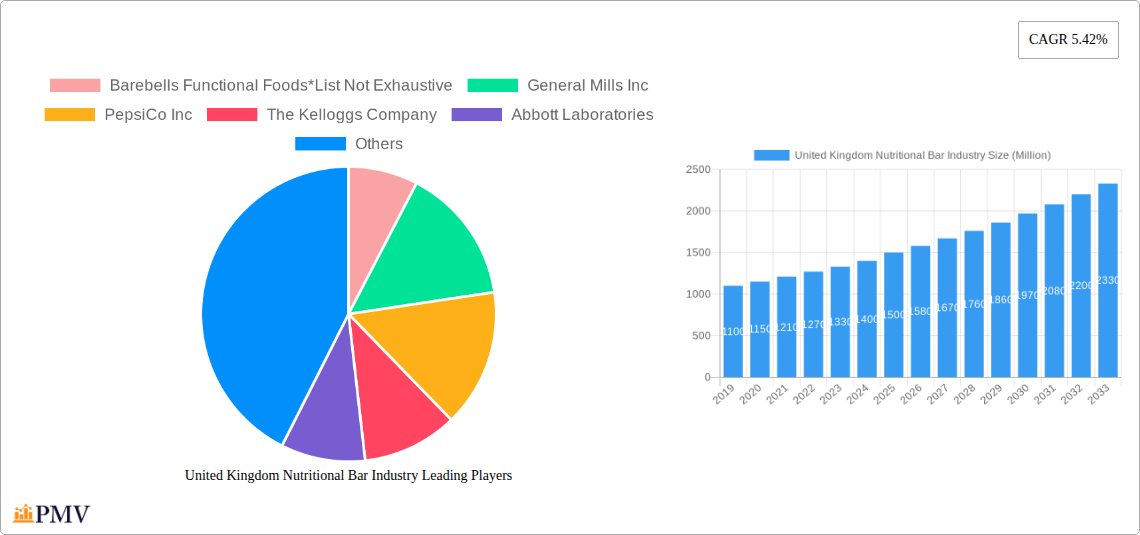

The United Kingdom's nutritional bar market is projected to achieve substantial growth, with an estimated market size of £16.72 billion by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.45% through 2033. This expansion is driven by increasing consumer focus on health and wellness, alongside a rising demand for convenient, on-the-go nutritional solutions. Growing adoption of active lifestyles and greater emphasis on dietary management are key contributors. Consumers are actively seeking products that support specific health objectives, such as energy enhancement, muscle recovery, or balanced nutrition, making nutritional bars a daily staple. The expanding retail environment, including traditional supermarkets, hypermarkets, online platforms, and specialized health food stores, ensures broad product accessibility. The market features a dynamic competition between established brands and emerging innovators.

United Kingdom Nutritional Bar Industry Market Size (In Billion)

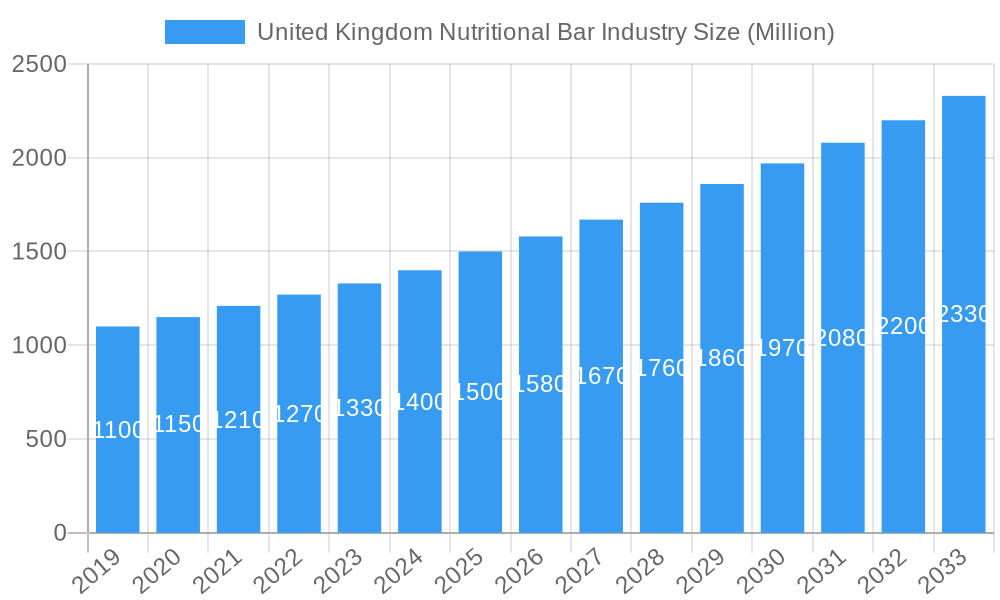

Within this market, the distinction between organic and conventional energy bars is becoming more defined. A growing consumer segment prefers organic products, perceived as healthier and more sustainably sourced. This trend is influenced by heightened scrutiny of ingredient lists and a preference for natural, minimally processed foods. While growth drivers are strong, market restraints include the potential high cost of premium nutritional bars, especially organic options, which may deter price-sensitive consumers. The competitive landscape, with numerous brands and offerings, demands continuous innovation and effective marketing for customer retention and acquisition. The market is segmented by product type and distribution channel, with key players including General Mills, PepsiCo, and The Kellogg Company, alongside specialized functional benefit brands.

United Kingdom Nutritional Bar Industry Company Market Share

This report offers comprehensive insights into the United Kingdom nutritional bar market, covering the period from 2019 to 2033, with 2025 as the base year. It provides critical data and strategic recommendations for stakeholders looking to leverage the growing demand for healthy, convenient snack options. Key segments analyzed include organic and conventional energy bars, and the impact of distribution channels such as supermarkets, convenience stores, specialty retailers, and online platforms. Gain a competitive advantage by analyzing market trends, product innovations, and the strategic landscape shaped by leading players like Mondelēz International, General Mills, and PepsiCo.

United Kingdom Nutritional Bar Industry Market Structure & Competitive Dynamics

The United Kingdom nutritional bar industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share, estimated to be around 55% for the top five companies. Innovation ecosystems are robust, driven by increasing consumer demand for health-conscious and functional food options. Key players are actively investing in research and development to launch novel products catering to diverse dietary needs and preferences. The regulatory framework, primarily governed by the Food Standards Agency (FSA), ensures product safety and accurate labeling, influencing product formulations and marketing claims. Product substitutes, such as functional drinks, protein powders, and other healthy snacks, present a constant competitive challenge. End-user trends highlight a growing preference for plant-based, low-sugar, and high-protein formulations, particularly among fitness enthusiasts and health-conscious consumers. Mergers and acquisition (M&A) activities have played a crucial role in market consolidation and expansion, with significant deal values, for example, Mondelēz International's acquisition of Grenade in March 2021, valued at approximately £200 Million, significantly reshaping the competitive landscape. Future M&A is anticipated as companies seek to acquire innovative brands and expand their product portfolios, contributing to market dynamics.

United Kingdom Nutritional Bar Industry Industry Trends & Insights

The United Kingdom nutritional bar industry is poised for substantial growth, driven by an escalating consumer focus on health and wellness, which translates to an estimated Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period of 2025–2033. This upward trajectory is fueled by several key trends. Firstly, the increasing prevalence of sedentary lifestyles and a growing awareness of the importance of balanced nutrition are compelling consumers to seek convenient yet healthy snack alternatives. Nutritional bars, offering a controlled intake of macronutrients and specific functional benefits, are perfectly positioned to meet this demand. Secondly, technological advancements in food science and manufacturing have enabled the development of innovative products with enhanced nutritional profiles, improved taste, and diverse functional ingredients. This includes the incorporation of natural sweeteners, plant-based proteins, and added vitamins and minerals. The market penetration of specialized bars, such as those catering to keto diets, vegan lifestyles, and allergen-free requirements, is rapidly expanding.

Consumer preferences are continuously evolving, with a pronounced shift towards transparent ingredient lists, ethically sourced products, and sustainable packaging. Brands that can effectively communicate their commitment to these values are gaining significant traction. The rise of online retail channels has also democratized access to a wider array of nutritional bars, allowing niche brands to reach a broader customer base and challenging traditional retail dominance. Furthermore, the integration of nutritional bars into broader wellness regimes, including fitness, weight management, and on-the-go energy solutions, is a significant market driver. The competitive dynamics are characterized by intense product differentiation, with companies focusing on unique flavor profiles, functional benefits, and targeted marketing campaigns to capture specific consumer segments. The market is expected to witness continued innovation in product formulation and distribution strategies to maintain a competitive edge and meet the evolving demands of the health-conscious British consumer. The estimated market size for nutritional bars in the UK in 2025 is projected to reach approximately £1.2 Billion.

Dominant Markets & Segments in United Kingdom Nutritional Bar Industry

The United Kingdom nutritional bar industry is characterized by distinct dominant segments that are shaping its growth and competitive landscape. Within Product Type, Conventional Energy Bars currently hold the largest market share, estimated at around 60% of the total market value, driven by their widespread availability, established brand recognition, and generally lower price points. However, Organic Energy Bars are experiencing a significantly higher growth rate, projected to expand at a CAGR of 9.5% over the forecast period, as consumer demand for natural, clean-label, and sustainably produced products continues to surge. This segment is expected to capture a more substantial market share by 2033.

In terms of Distribution Channels, Supermarkets/Hypermarkets remain the most dominant, accounting for approximately 55% of sales, owing to their extensive reach and ability to cater to bulk purchasing needs. However, Online Retail Stores are rapidly gaining ground, with an estimated market share of 25% and a projected CAGR of 11%, driven by the convenience of home delivery, wider product selection, and personalized shopping experiences. This channel is expected to witness the most aggressive growth in the coming years. Convenience Stores represent a significant, albeit smaller, segment at 15%, serving impulse purchases and on-the-go consumption. Specialty Stores, though niche, are crucial for premium and highly specialized nutritional bars, contributing around 5% to the market share but often commanding higher profit margins. The dominance of supermarkets is underpinned by established supply chain efficiencies and broad consumer appeal. The growth of online retail is propelled by digital transformation and evolving consumer shopping habits. Economic policies promoting healthy lifestyles and increased disposable income also play a vital role in driving demand across all segments. Infrastructure development, particularly in logistics and e-commerce capabilities, further supports the expansion of online channels and the efficient distribution of nutritional bars across the UK.

United Kingdom Nutritional Bar Industry Product Innovations

Product innovation in the UK nutritional bar industry is a key differentiator, with companies focusing on enhanced nutritional profiles, unique flavor combinations, and specialized functional benefits. Innovations include the development of bars with high protein content (averaging 15-20g per bar), catering to the fitness and sports nutrition market. Sugar-free and low-sugar options, utilizing natural sweeteners, are gaining significant traction, aligning with growing health consciousness. Furthermore, there's a notable trend towards plant-based and vegan formulations, utilizing ingredients like pea protein, rice protein, and various seeds. Competitive advantages are being gained through allergen-free offerings (gluten-free, dairy-free, soy-free) and the incorporation of superfoods and adaptogens for added health benefits.

Report Segmentation & Scope

This report segments the United Kingdom nutritional bar market by Product Type and Distribution Channel. The Product Type segmentation includes Organic Energy Bar and Conventional Energy Bar. The Organic Energy Bar segment is characterized by strong growth driven by consumer preference for natural ingredients and sustainable sourcing, with projected market size of £400 Million by 2025. The Conventional Energy Bar segment, while mature, still holds the largest market share, estimated at £800 Million in 2025, due to its established presence and affordability.

The Distribution Channel segmentation encompasses Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, and Other Distribution Channels. The Supermarkets/Hypermarkets segment is the largest, expected to reach £660 Million by 2025, benefiting from high foot traffic and broad product availability. Online Retail Stores are the fastest-growing segment, projected to reach £300 Million by 2025, fueled by e-commerce expansion and consumer convenience. Convenience Stores are estimated at £180 Million in 2025, serving immediate purchase needs, while Specialty Stores are projected at £60 Million, catering to niche consumer demands.

Key Drivers of United Kingdom Nutritional Bar Industry Growth

The growth of the United Kingdom nutritional bar industry is primarily propelled by a confluence of technological, economic, and lifestyle factors. A paramount driver is the escalating consumer awareness and demand for healthier food choices, influenced by widespread health and wellness campaigns and a growing understanding of the impact of diet on overall well-being. This translates into a preference for products that offer functional benefits, such as increased energy, protein for muscle recovery, and reduced sugar content. Economically, rising disposable incomes allow consumers to invest more in premium and specialized health foods, including nutritional bars. Technological advancements in food processing and ingredient development have enabled the creation of more palatable, diverse, and nutritionally optimized bars, catering to a wider array of dietary needs and preferences, such as plant-based and gluten-free options. The convenience factor of nutritional bars also plays a crucial role, fitting seamlessly into busy modern lifestyles.

Challenges in the United Kingdom Nutritional Bar Industry Sector

Despite its robust growth, the United Kingdom nutritional bar industry faces several challenges that could temper its expansion. Intense market competition from both established brands and emerging players leads to price wars and necessitates continuous innovation to maintain market share. Regulatory hurdles, particularly concerning health claims and labeling accuracy, require meticulous adherence and can impact product development timelines and marketing strategies. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of key ingredients, impacting production and profitability. Furthermore, evolving consumer perceptions regarding the "naturalness" and perceived healthiness of processed snacks can pose a challenge, as some consumers express concerns about added sugars, artificial ingredients, or excessive processing, necessitating clear communication and formulation strategies. The projected impact of these challenges could lead to a marginal increase in production costs by approximately 5-10% and potentially slower adoption rates for certain product innovations if consumer trust is not actively cultivated.

Leading Players in the United Kingdom Nutritional Bar Industry Market

- Barebells Functional Foods

- General Mills Inc

- PepsiCo Inc

- The Kelloggs Company

- Abbott Laboratories

- HNC Healthy Nutrition Company (UK) Ltd (Maximuscle)

- Post Holdings Inc (PowerBar Inc)

- Oatein Limited

- Ultimate Sports Nutrition (USN)

- Glanbia Plc

- Mondelēz International Inc

Key Developments in United Kingdom Nutritional Bar Industry Sector

- September 2022: Mondelēz's protein bar brand Grenade launched two new multipack protein bar variants in Tesco and Sainsbury. The multipack features a 10-pack of selected Grenade's best-selling (60g) protein bars. These comprise two bars of each of the following five flavors: chocolate chips salted caramel, white chocolate salted peanut, cookie dough, white chocolate cookie and fudged up. Also, a three-pack variant would be launched across over 1,000 Co-op stores that featured three 35g bars in Grenade's best-selling protein bar flavor, Chocolate Chip Salted Caramel. This development signifies a strategic move to increase product accessibility and cater to bulk purchasing demand.

- March 2021: Mondelēz International acquired majority shares of Grenade, a prominent player offering a range of performance nutrition products, including energy and protein bars in the United Kingdom. This acquisition is a significant indicator of market consolidation and the strategic importance of the functional food and beverage sector.

- March 2021: Barebells, a United Kingdom functional food brand, added Double Bite, a "bar of two halves," to its line of energy/protein-enriched snack bars. Double Bite is available in two flavors: caramel crisp and chocolate crisp. Both flavors provide 16g of protein and do not contain any added sugar or palm oil. This product innovation highlights the trend towards sugar-free, high-protein offerings and novel product formats.

Strategic United Kingdom Nutritional Bar Industry Market Outlook

The strategic outlook for the United Kingdom nutritional bar industry is exceptionally promising, driven by a sustained and amplified demand for convenient, health-conscious snacking solutions. Future growth will be accelerated by continued innovation in product formulation, focusing on plant-based ingredients, personalized nutrition, and the inclusion of functional benefits such as gut health support and enhanced cognitive function. The expansion of online retail channels presents a significant opportunity for both established brands and agile newcomers to reach a wider consumer base and offer tailored purchasing experiences. Strategic collaborations and partnerships, particularly between food manufacturers and fitness or wellness influencers, will be crucial for brand building and market penetration. Furthermore, a growing emphasis on sustainability and ethical sourcing will become a key competitive differentiator, influencing consumer purchasing decisions. Companies that can effectively align their product development and marketing strategies with these evolving trends are poised for substantial market success.

United Kingdom Nutritional Bar Industry Segmentation

-

1. Product Type

- 1.1. Organic Energy Bar

- 1.2. Conventional Energy Bar

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

United Kingdom Nutritional Bar Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Nutritional Bar Industry Regional Market Share

Geographic Coverage of United Kingdom Nutritional Bar Industry

United Kingdom Nutritional Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits

- 3.3. Market Restrains

- 3.3.1. Popularity Of Healthy Snacking And Other Alternatives

- 3.4. Market Trends

- 3.4.1. Increasing Number of Health and Fitness Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Nutritional Bar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Organic Energy Bar

- 5.1.2. Conventional Energy Bar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Barebells Functional Foods*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Mills Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PepsiCo Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Kelloggs Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HNC Healthy Nutrition Company (UK) Ltd (Maximuscle)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Post Holdings Inc (PowerBar Inc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oatein Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ultimate Sports Nutrition (USN)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Glanbia Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mondelēz International Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Barebells Functional Foods*List Not Exhaustive

List of Figures

- Figure 1: United Kingdom Nutritional Bar Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Nutritional Bar Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: United Kingdom Nutritional Bar Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Nutritional Bar Industry?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the United Kingdom Nutritional Bar Industry?

Key companies in the market include Barebells Functional Foods*List Not Exhaustive, General Mills Inc, PepsiCo Inc, The Kelloggs Company, Abbott Laboratories, HNC Healthy Nutrition Company (UK) Ltd (Maximuscle), Post Holdings Inc (PowerBar Inc), Oatein Limited, Ultimate Sports Nutrition (USN), Glanbia Plc, Mondelēz International Inc.

3. What are the main segments of the United Kingdom Nutritional Bar Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.72 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits.

6. What are the notable trends driving market growth?

Increasing Number of Health and Fitness Centers.

7. Are there any restraints impacting market growth?

Popularity Of Healthy Snacking And Other Alternatives.

8. Can you provide examples of recent developments in the market?

September 2022: Mondelēz's protein bar brand Grenade launched two new multipack protein bar variants in Tesco and Sainsbury. The multipack features a 10-pack of selected Grenade's best-selling (60g) protein bars. These comprise two bars of each of the following five flavors: chocolate chips salted caramel, white chocolate salted peanut, cookie dough, white chocolate cookie and fudged up. Also, a three-pack variant would be launched across over 1,000 Co-op stores that featured three 35g bars in Grenade's best-selling protein bar flavor, Chocolate Chip Salted Caramel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Nutritional Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Nutritional Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Nutritional Bar Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Nutritional Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence