Key Insights

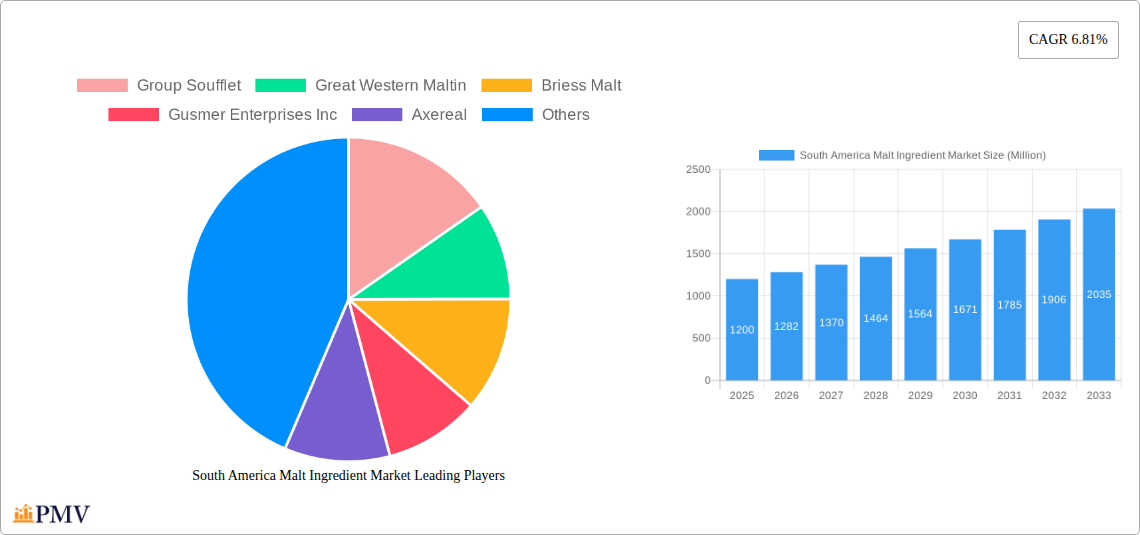

The South America Malt Ingredient Market is poised for significant expansion, with an estimated market size of $1200 million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.81% through 2033. This dynamic growth is primarily propelled by the escalating demand for malt ingredients across various applications, most notably in alcoholic and non-alcoholic beverages, where the rich flavor and functional properties of malt are highly valued. The burgeoning food industry, seeking natural ingredients for baking and confectioneries, also contributes substantially to this upward trajectory. Furthermore, the increasing utilization of malt in pharmaceutical formulations and the consistent demand from the animal feed sector, particularly for livestock and poultry, underpin the market's sustained expansion. Key drivers include evolving consumer preferences towards premium and craft beverages, the growing awareness of malt's nutritional benefits, and advancements in malting technologies that enhance efficiency and product quality. The market is segmented by sources such as barley, wheat, and other grains, with barley and wheat dominating due to their widespread availability and established malting processes.

South America Malt Ingredient Market Market Size (In Billion)

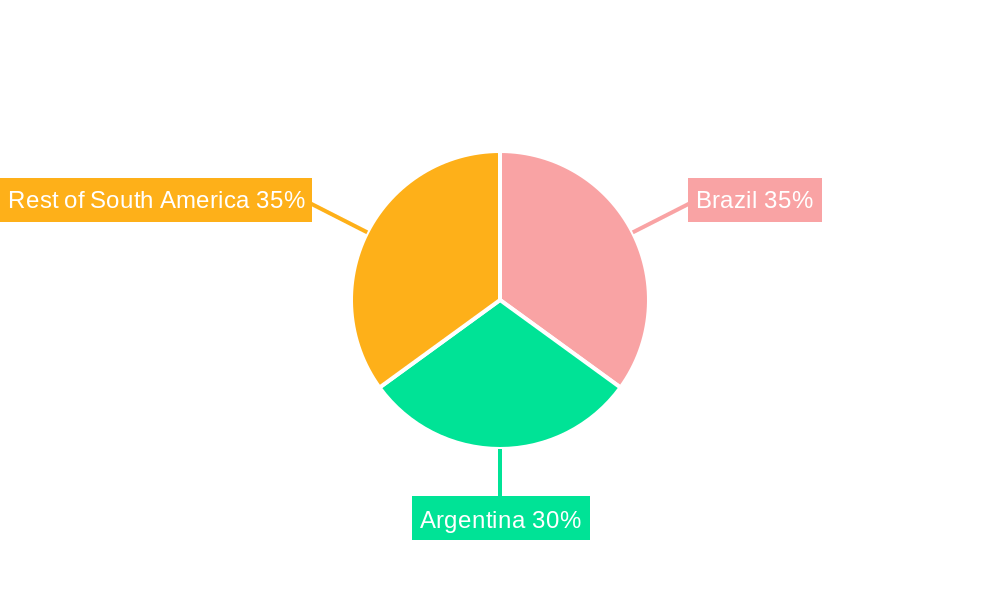

While the market exhibits strong growth, certain restraints may influence its pace. These include potential price volatility of raw materials like barley and wheat, influenced by agricultural yields and global commodity markets, as well as increasing competition from alternative ingredients in specific applications. However, the overarching trend is one of innovation and diversification, with companies actively exploring new applications for malt ingredients and optimizing production processes. Geographically, Brazil and Argentina are expected to be dominant markets, driven by their established brewing industries and significant agricultural output. The "Rest of South America" region also presents considerable opportunities, fueled by increasing disposable incomes and a growing middle class with a preference for diverse food and beverage options. Strategic collaborations, mergers, and acquisitions among key players like Group Soufflet, Cargill, and AB InBev are likely to shape the competitive landscape, driving market consolidation and technological advancements to cater to the diverse needs of the South American market.

South America Malt Ingredient Market Company Market Share

This detailed report offers an in-depth analysis of the South America Malt Ingredient Market, providing critical insights into its structure, trends, dominant segments, product innovations, growth drivers, challenges, and competitive landscape. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning opportunities within this dynamic market.

South America Malt Ingredient Market Market Structure & Competitive Dynamics

The South America Malt Ingredient Market is characterized by a moderate to high level of market concentration, with key players like Cargill, Incorporated, AB InBev (Anheuser-Busch InBev), Group Soufflet, and Axereal holding significant market shares. The innovation ecosystem is driven by advancements in malting technologies and a growing demand for premium and specialized malt ingredients. Regulatory frameworks, particularly concerning food safety and agricultural standards, play a crucial role in shaping market entry and product development. Product substitutes, though present, are often niche, with malt's unique flavor and functional properties in brewing, baking, and other applications proving difficult to replicate. End-user trends lean towards natural ingredients and sustainable sourcing, influencing ingredient choices across alcoholic and non-alcoholic beverages, food products, and animal feed sectors. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their regional presence and product portfolios. For instance, recent acquisitions in the sector have seen deal values reaching hundreds of millions of dollars, indicating strategic consolidation.

- Market Concentration: Moderate to High, dominated by a few large multinational corporations.

- Innovation Ecosystem: Driven by R&D in malting processes, flavor profiles, and functional ingredient development.

- Regulatory Frameworks: Strict adherence to food safety, agricultural, and import/export regulations.

- Product Substitutes: Limited, but evolving with demand for allergen-free and specialized ingredients.

- End-User Trends: Growing preference for natural, sustainable, and traceable malt ingredients.

- M&A Activities: Significant, focused on market expansion and portfolio diversification. Estimated M&A deal value in the past 5 years: $500 Million.

South America Malt Ingredient Market Industry Trends & Insights

The South America Malt Ingredient Market is poised for substantial growth, propelled by several key industry trends. A significant market growth driver is the expanding alcoholic beverage industry, particularly craft beer and premium spirits production, which relies heavily on high-quality malt for flavor complexity and character. The increasing demand for non-alcoholic beverages, including malt-based drinks and functional beverages, is also contributing to market expansion. Furthermore, the food industry's growing interest in malt extracts for baking, confectionery, and savory applications, leveraging its natural sweetness and coloring properties, presents a substantial opportunity. Technological advancements in malting processes, such as improved germination control and kilning techniques, are leading to the development of specialized malt ingredients with tailored flavor profiles and functionalities, enhancing their appeal across various applications. Consumer preferences are increasingly shifting towards natural, less processed ingredients, benefiting malt due to its natural origins. The animal feed sector is also witnessing a steady demand for malt co-products, further supporting market growth. The competitive dynamics are characterized by both established players and emerging regional producers, fostering innovation and price competitiveness. The CAGR for the South America Malt Ingredient Market is estimated to be 6.2% during the forecast period. Market penetration of specialty malts in niche applications is expected to grow significantly.

Dominant Markets & Segments in South America Malt Ingredient Market

The South America Malt Ingredient Market exhibits distinct regional and segmental dominance. Brazil emerges as the leading market geographically, owing to its robust brewing industry and expanding food processing sector. Argentina also holds a significant position, driven by its established agricultural base and growing export potential for malt and malt derivatives. The Rest of South America is a rapidly growing segment, with countries like Colombia and Chile showing increasing consumption.

From a source perspective, Barley remains the dominant raw material, accounting for over 75% of the market share due to its widespread use in brewing and its desirable enzymatic properties. Wheat is gaining traction, particularly in baking and for specific brewing styles, representing approximately 20% of the market. Other Sources, including corn and rye, hold a smaller but growing share as ingredient manufacturers explore diversification.

In terms of applications, Alcoholic beverages represent the largest segment, capturing over 60% of the market, with beer production being the primary consumer. The Non-alcoholic beverages segment is experiencing the fastest growth, fueled by the rising popularity of malt-based health drinks and infant nutrition products. The Food application segment, encompassing bakery, confectionery, and processed foods, contributes a substantial 15% to the market. The Animal Feed and Pharmaceuticals segments, while smaller, offer consistent demand.

- Dominant Geography: Brazil, followed by Argentina.

- Key Drivers for Brazil: Large domestic beer market, growing craft brewing scene, expanding food processing industry.

- Key Drivers for Argentina: Strong agricultural infrastructure, export capabilities, established malting facilities.

- Dominant Source: Barley (estimated 75% market share).

- Growing Source: Wheat (estimated 20% market share).

- Dominant Application: Alcoholic beverages (estimated 60% market share).

- Fastest Growing Application: Non-alcoholic beverages.

- Significant Application: Food (estimated 15% market share).

South America Malt Ingredient Market Product Innovations

Product innovation in the South America Malt Ingredient Market is centered around developing specialty malts with unique flavor profiles and functional attributes. Manufacturers are focusing on enzyme-enhanced malts for improved brewing efficiency, gluten-free malt options to cater to dietary restrictions, and malts with specific caramelization and roasting levels for diverse culinary applications. The competitive advantage lies in offering customized solutions, sustainable sourcing, and traceable supply chains. Technological advancements in malting techniques are enabling finer control over the malting process, leading to the creation of novel malt extracts and ingredients for the food and pharmaceutical industries. The market fit for these innovations is strong, driven by evolving consumer preferences for natural and premium ingredients.

Report Segmentation & Scope

This report segments the South America Malt Ingredient Market by Source, Application, and Geography.

- Source: The market is analyzed across Barley, Wheat, and Other Sources (e.g., corn, rye). Growth projections for Barley remain robust due to established demand. Wheat is anticipated to exhibit higher growth rates due to its versatility. Other sources offer niche opportunities.

- Application: The market is segmented into Alcoholic beverages, Non-alcoholic beverages, Food, Pharmaceuticals, and Animal Feed. Alcoholic beverages will continue to dominate in terms of market size. Non-alcoholic beverages and Food applications are projected to experience the fastest growth. Pharmaceuticals and Animal Feed segments offer stable demand.

- Geography: The analysis covers Brazil, Argentina, and the Rest of South America. Brazil is expected to lead in market size, while the Rest of South America offers significant untapped growth potential.

Key Drivers of South America Malt Ingredient Market Growth

Several factors are propelling the growth of the South America Malt Ingredient Market. The expanding alcoholic beverage industry, particularly the surge in craft beer production across the region, is a primary driver. Increasing consumer demand for healthier and natural ingredients is boosting the use of malt in non-alcoholic beverages and food products. Technological advancements in malting processes are enabling the creation of specialized malt ingredients with tailored functionalities. Furthermore, supportive government policies for agricultural and food processing industries in key South American nations are fostering market expansion. The growing trend of premiumization across food and beverage categories also favors the use of high-quality malt ingredients.

Challenges in the South America Malt Ingredient Market Sector

Despite robust growth prospects, the South America Malt Ingredient Market faces several challenges. Volatility in raw material prices, particularly for barley and wheat, can impact profitability and pricing strategies. Stringent regulatory requirements related to food safety, labeling, and agricultural practices can pose barriers to entry and increase operational costs. Supply chain disruptions, influenced by weather patterns, logistics infrastructure, and geopolitical factors, can affect the availability and timely delivery of malt ingredients. Intense competitive pressures from both domestic and international players necessitate continuous innovation and cost optimization. Furthermore, the development of alternative ingredients in certain food and beverage applications could pose a threat to market share.

Leading Players in the South America Malt Ingredient Market Market

- Group Soufflet

- Great Western Maltin

- Briess Malt

- Gusmer Enterprises Inc

- Axereal

- Otro Mundo Brewing Company

- Patagonia Malt

- Maltexco SA

- Cargill, Incorporated

- AB InBev (Anheuser-Busch InBev)

Key Developments in South America Malt Ingredient Market Sector

- 2023: Group Soufflet announces expansion of malting capacity in Argentina to meet growing regional demand for brewing ingredients.

- 2023: Great Western Maltin partners with a major South American brewery to develop a new line of specialty malts for premium lagers.

- 2024: Briess Malt launches a new range of organic malt extracts for the burgeoning health food sector in Brazil.

- 2024: Axereal invests in advanced kilning technology to enhance the flavor profiles of its malt offerings.

- 2024: Cargill, Incorporated acquires a regional malting facility to strengthen its supply chain and distribution network in South America.

- 2025: Maltexco SA announces a strategic partnership to develop sustainable malting practices and improve traceability for barley sourcing.

Strategic South America Malt Ingredient Market Market Outlook

The South America Malt Ingredient Market presents a promising outlook, driven by sustained demand from the brewing industry and expanding applications in food and non-alcoholic beverages. The trend towards premiumization and natural ingredients will continue to fuel the demand for high-quality and specialized malt ingredients. Strategic opportunities lie in focusing on sustainable sourcing practices, investing in technological advancements for product innovation, and expanding into emerging markets within the Rest of South America. Companies that can offer customized solutions, ensure supply chain resilience, and adapt to evolving consumer preferences are well-positioned for significant growth and market leadership in the coming years. The market is projected to see consistent growth, with a strategic focus on value-added products and sustainable operations.

South America Malt Ingredient Market Segmentation

-

1. Source

- 1.1. Barley

- 1.2. Wheat

- 1.3. Other Sources

-

2. Application

- 2.1. Alcoholic beverages

- 2.2. Non-alcoholic beverages

- 2.3. Food

- 2.4. Pharmaceuticals

- 2.5. Animal Feed

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Malt Ingredient Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Malt Ingredient Market Regional Market Share

Geographic Coverage of South America Malt Ingredient Market

South America Malt Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Craft Beer Boosting the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Malt Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Barley

- 5.1.2. Wheat

- 5.1.3. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Alcoholic beverages

- 5.2.2. Non-alcoholic beverages

- 5.2.3. Food

- 5.2.4. Pharmaceuticals

- 5.2.5. Animal Feed

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Brazil South America Malt Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Barley

- 6.1.2. Wheat

- 6.1.3. Other Sources

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Alcoholic beverages

- 6.2.2. Non-alcoholic beverages

- 6.2.3. Food

- 6.2.4. Pharmaceuticals

- 6.2.5. Animal Feed

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Argentina South America Malt Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Barley

- 7.1.2. Wheat

- 7.1.3. Other Sources

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Alcoholic beverages

- 7.2.2. Non-alcoholic beverages

- 7.2.3. Food

- 7.2.4. Pharmaceuticals

- 7.2.5. Animal Feed

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of South America South America Malt Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Barley

- 8.1.2. Wheat

- 8.1.3. Other Sources

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Alcoholic beverages

- 8.2.2. Non-alcoholic beverages

- 8.2.3. Food

- 8.2.4. Pharmaceuticals

- 8.2.5. Animal Feed

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Group Soufflet

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Great Western Maltin

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Briess Malt

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Gusmer Enterprises Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Axereal

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Otro Mundo Brewing Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Patagonia Malt

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Maltexco SA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cargill Incorporated

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 AB InBev (Anheuser-Busch InBev)

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Group Soufflet

List of Figures

- Figure 1: South America Malt Ingredient Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Malt Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: South America Malt Ingredient Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 3: South America Malt Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: South America Malt Ingredient Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South America Malt Ingredient Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: South America Malt Ingredient Market Revenue Million Forecast, by Source 2020 & 2033

- Table 10: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 11: South America Malt Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: South America Malt Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: South America Malt Ingredient Market Revenue Million Forecast, by Source 2020 & 2033

- Table 18: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 19: South America Malt Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: South America Malt Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: South America Malt Ingredient Market Revenue Million Forecast, by Source 2020 & 2033

- Table 26: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 27: South America Malt Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: South America Malt Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Malt Ingredient Market?

The projected CAGR is approximately 6.81%.

2. Which companies are prominent players in the South America Malt Ingredient Market?

Key companies in the market include Group Soufflet, Great Western Maltin, Briess Malt, Gusmer Enterprises Inc, Axereal, Otro Mundo Brewing Company, Patagonia Malt, Maltexco SA, Cargill, Incorporated , AB InBev (Anheuser-Busch InBev).

3. What are the main segments of the South America Malt Ingredient Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1200 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

Growing Popularity of Craft Beer Boosting the Market Studied.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

Recent developments in the South America Malt Ingredient Sector include: Acquisitions and mergers New product launches Strategic partnerships Technological advancements

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Malt Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Malt Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Malt Ingredient Market?

To stay informed about further developments, trends, and reports in the South America Malt Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence