Key Insights

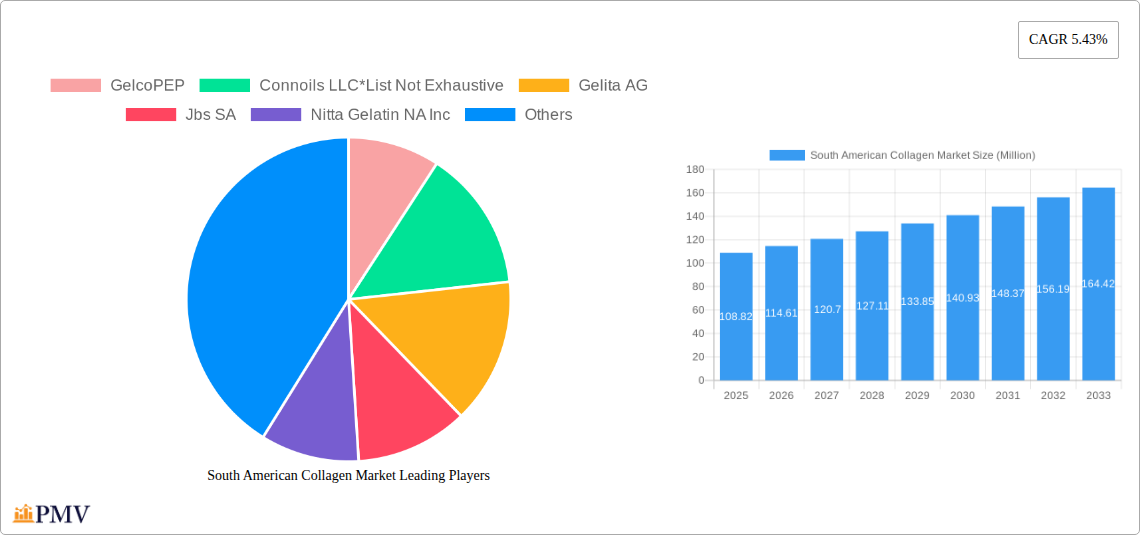

The South American collagen market is poised for significant expansion, projected to reach an estimated USD 108.82 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.43% anticipated throughout the forecast period extending to 2033. This growth is primarily propelled by the surging demand for collagen across diverse applications, most notably in dietary supplements and the cosmetics and personal care industries. Consumers in the region are increasingly prioritizing health and wellness, leading to a greater adoption of collagen-based products for their purported benefits in skin elasticity, joint health, and overall vitality. Furthermore, the growing awareness of collagen's functional properties in food and beverage enrichment and its application in meat processing are contributing to market buoyancy. The availability of both animal-based and marine-based collagen, catering to different consumer preferences and dietary needs, also plays a crucial role in market penetration.

South American Collagen Market Market Size (In Million)

Key market drivers fueling this growth include evolving consumer lifestyles, a rising disposable income in certain South American economies, and proactive marketing efforts by leading manufacturers. The trend towards natural and clean-label ingredients further supports the adoption of collagen, perceived as a beneficial and naturally derived component. While the market exhibits strong upward momentum, potential restraints such as fluctuating raw material prices and varying regulatory landscapes across different South American nations could pose challenges. However, strategic investments in research and development, coupled with an expanding distribution network, are expected to mitigate these factors. The competitive landscape features prominent players like Gelita AG, JBS SA, and Rousselot, alongside emerging regional entities, all vying for market share through product innovation and strategic partnerships. The South American market, with Brazil and Colombia leading the charge, presents a fertile ground for sustained collagen market growth.

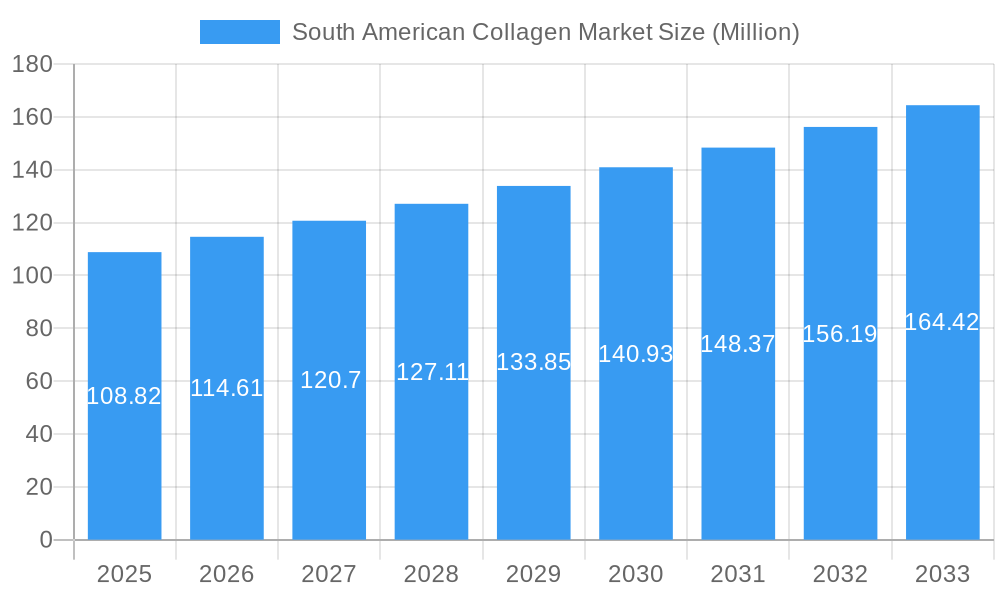

South American Collagen Market Company Market Share

This in-depth report offers a detailed examination of the South American Collagen Market, providing critical insights into market dynamics, growth drivers, segmentation, and competitive landscapes from 2019 to 2033. Leveraging historical data, current trends, and expert projections, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this vital sector. Our analysis covers the South American collagen industry, focusing on animal-based collagen, marine-based collagen, and their diverse applications in dietary supplements, meat processing, food and beverage, cosmetics and personal care, and other burgeoning sectors. We delve into the key geographies of Brazil, Colombia, and the Rest of South America, offering granular data and actionable intelligence for strategic decision-making. The report’s forecast period spans from 2025 to 2033, with 2025 serving as the base and estimated year.

South American Collagen Market Market Structure & Competitive Dynamics

The South American Collagen Market is characterized by a dynamic interplay of established global players and emerging regional enterprises, exhibiting a moderate to high concentration. Innovation ecosystems are increasingly robust, driven by growing R&D investments in advanced extraction and purification techniques for both animal-based and marine-based collagen. Regulatory frameworks, while varying across countries, are generally evolving to support the growth of the nutraceutical and functional food sectors, indirectly benefiting the collagen market. Product substitutes, primarily other protein sources, exist but are increasingly differentiated by collagen's unique functional and health benefits. End-user trends show a strong preference for naturally derived, high-purity collagen, fueling demand for premium products. Mergers and acquisitions (M&A) are becoming strategic tools for market expansion and consolidation. For instance, Darling Ingredients’ acquisition of multiple facilities in South America for an undisclosed value, with a capacity to produce 46,000 metric tons of gelatin and collagen, underscores this trend. Gelita AG and JBS SA are notable for their significant market presence, actively participating in M&A activities and capacity expansions. The market share of key players is continually shifting, influenced by their investment in new processing technologies and their ability to cater to specific application demands, such as the specialized collagen for the food and beverage industry launched by JBS SA.

- Market Concentration: Moderate to High.

- Innovation Ecosystems: Growing, with focus on advanced extraction and purification.

- Regulatory Frameworks: Evolving, generally supportive of nutraceutical and functional food growth.

- Product Substitutes: Other protein sources, but collagen offers unique benefits.

- End-User Trends: Demand for natural, high-purity collagen.

- M&A Activities: Increasing for market expansion and consolidation.

South American Collagen Market Industry Trends & Insights

The South American Collagen Market is poised for significant expansion, driven by a confluence of powerful trends and evolving consumer demands. The projected Compound Annual Growth Rate (CAGR) for the South American collagen industry is robust, fueled by increasing health consciousness and the growing demand for functional ingredients across various applications. A key growth driver is the escalating adoption of dietary supplements containing collagen, particularly as consumers in Brazil, Colombia, and the Rest of South America become more aware of its benefits for skin health, joint mobility, and overall well-being. The food and beverage sector is another substantial contributor, with manufacturers increasingly incorporating collagen into a wide range of products, from beverages and dairy items to baked goods, seeking to enhance nutritional profiles and offer health-conscious options.

Technological disruptions are also playing a pivotal role. Advancements in extraction and hydrolysis techniques are leading to the production of higher quality, more bioavailable collagen peptides, catering to specific application needs and enhancing product efficacy. This is particularly relevant for cosmetics and personal care products, where collagen is prized for its anti-aging and skin-rejuvenating properties. The meat processing industry, a traditional source of collagen and gelatin, continues to be a significant segment, leveraging by-products to create value-added collagen ingredients.

Consumer preferences are shifting towards natural, clean-label ingredients, which favors collagen derived from reputable sources. The rising disposable incomes in several South American nations are also contributing to increased spending on health and wellness products, further stimulating market growth. The competitive dynamics are intensifying, with both global players like Gelita AG and JBS SA, and emerging regional companies actively investing in capacity expansion and product innovation. For instance, the launch of a new collagen processing facility by JBS SA in Brazil, with an investment of approximately USD 78.1 Million, highlights this competitive push. Darling Ingredients' strategic acquisition of facilities across South America also signifies the growing interest and investment in the region's collagen production capabilities. The market penetration of collagen-based products is expected to rise significantly as awareness and product availability increase across diverse consumer segments.

Dominant Markets & Segments in South American Collagen Market

The South American Collagen Market is experiencing robust growth across its diverse segments, with Brazil emerging as the dominant geographical market. This dominance is attributed to a combination of factors, including a large consumer base, increasing health and wellness awareness, a well-established food and beverage industry, and significant investments in production infrastructure. The country’s strong agricultural sector also provides a readily available supply of raw materials for animal-based collagen.

Within the Source segmentation, animal-based collagen remains the leading segment due to its widespread availability, lower production costs compared to marine collagen, and its established use across various industries. However, marine-based collagen is experiencing a notable surge in demand, driven by its perceived purity, hypoallergenic properties, and unique amino acid profiles, particularly appealing to the dietary supplements and cosmetics and personal care sectors.

The Application segmentation reveals a clear leadership by dietary supplements, as consumers actively seek collagen for its perceived health benefits, including joint health, skin rejuvenation, and improved gut health. The food and beverage segment is a close second, with manufacturers strategically incorporating collagen into functional foods, fortified beverages, and protein bars to cater to the growing demand for health-conscious products. The cosmetics and personal care sector is also a significant and growing application, with collagen being a key ingredient in anti-aging creams, serums, and other skincare formulations. The meat processing industry, while a foundational source, is increasingly focusing on extracting and refining collagen for higher-value applications.

Key drivers for Brazil’s dominance include:

- Economic Policies: Government support for the food processing and health industries.

- Infrastructure: Developed logistics and manufacturing capabilities.

- Consumer Demand: High per capita consumption of health and wellness products.

- Raw Material Availability: Abundant livestock for animal-based collagen production.

Colombia and the Rest of South America are also showing promising growth trajectories, with Colombia exhibiting increasing adoption in its burgeoning nutraceutical and cosmetic industries. The Rest of South America comprises a diverse group of countries, each with its own unique market dynamics, but collectively contributing to the overall regional growth, driven by increasing disposable incomes and rising health consciousness.

South American Collagen Market Product Innovations

Product innovations in the South American Collagen Market are rapidly advancing, focusing on enhanced bioavailability, specific peptide profiles, and novel delivery systems. Companies are developing hydrolyzed collagen peptides tailored for targeted benefits, such as improved joint mobility, enhanced skin elasticity, and faster wound healing. The integration of collagen into ready-to-drink beverages, functional snacks, and specialized skincare formulations highlights the market's adaptability and responsiveness to consumer trends. For example, new collagen variants with improved solubility and neutral taste profiles are entering the market, making them more versatile for food and beverage applications. The development of plant-based collagen alternatives and the sustainable sourcing of marine collagen are also key areas of innovation, driven by ethical and environmental concerns.

Report Segmentation & Scope

This report meticulously segments the South American Collagen Market based on critical parameters to provide a comprehensive market overview. The segmentation covers:

- Source: Animal-based Collagen and Marine-based Collagen. The animal-based segment, predominantly from bovine and porcine sources, is expected to maintain a significant market share due to cost-effectiveness and availability. Marine-based collagen, particularly from fish sources, is projected for rapid growth, driven by its perceived purity and unique properties.

- Application: Dietary Supplements, Meat Processing, Food and Beverage, Cosmetics and Personal Care, and Other Applications. Dietary Supplements and Food & Beverage are anticipated to lead the market in terms of growth and volume, reflecting rising consumer health consciousness. Cosmetics & Personal Care is a high-value segment with consistent demand.

- Geography: Brazil, Colombia, and Rest of South America. Brazil is projected to remain the largest market due to its economic size and established industries. Colombia and the Rest of South America are expected to witness significant growth driven by increasing awareness and investment.

The scope of this report encompasses a detailed analysis of market sizes, growth projections, key players, and emerging trends within these segments for the study period of 2019–2033, with a focus on the forecast period of 2025–2033.

Key Drivers of South American Collagen Market Growth

The South American Collagen Market is propelled by several significant growth drivers. The escalating consumer awareness regarding the health benefits of collagen, particularly for joint health, skin vitality, and gut health, is a primary catalyst, significantly boosting demand for dietary supplements. The burgeoning food and beverage industry's focus on incorporating functional ingredients to meet the growing demand for healthier and more nutritious products is another major driver. Advancements in processing technologies have led to the development of high-purity, easily digestible collagen peptides, expanding their application scope and appeal. Furthermore, the increasing disposable incomes across several South American nations are enabling consumers to invest more in premium health and wellness products. The regulatory landscape, increasingly favorable towards nutraceuticals and functional foods, also plays a crucial role in fostering market expansion.

Challenges in the South American Collagen Market Sector

Despite its strong growth potential, the South American Collagen Market faces several challenges. Fluctuations in the price and availability of raw materials, primarily animal by-products, can impact production costs and supply chain stability. Stringent and varying regulatory requirements across different South American countries can pose hurdles for market entry and product standardization. The presence of established protein substitutes, while often lacking collagen's specific benefits, can still pose a competitive challenge, especially in price-sensitive markets. Consumer perception and education regarding the benefits and sourcing of collagen are still evolving, and misconceptions can hinder broader market penetration. Lastly, the competitive pressure from both global and local players necessitates continuous innovation and efficient cost management to maintain market share.

Leading Players in the South American Collagen Market Market

- GelcoPEP

- Connoils LLC

- Gelita AG

- JBS SA

- Nitta Gelatin NA Inc

- Gelnex Industria

- Rousselot

- Novaprom

- Bioiberica

Key Developments in South American Collagen Market Sector

- November 2022: Acquion Food Tech, a new Brazilian venture led by entrepreneur André Albuquerque, begins operations with a plan to invest BRL 250 million (USD 46.6 Million) over the next four years to produce collagen and gelatin.

- September 2022: Darling Ingredients acquired five facilities in South America and one in the United States, with the capacity to produce 46,000 metric tons of gelatin and collagen.

- August 2022: JBS SA significantly bolstered its South American presence by launching a new collagen processing facility in Brazil, investing approximately USD 78.1 Million. The facility is dedicated to processing collagen tailored to meet the standards of the food and beverage industry.

Strategic South American Collagen Market Market Outlook

The strategic outlook for the South American Collagen Market remains highly positive, driven by sustained consumer interest in health, wellness, and functional ingredients. The increasing demand for animal-based collagen and the growing traction of marine-based collagen in applications like dietary supplements and cosmetics and personal care present significant opportunities. Strategic investments in R&D for advanced extraction techniques and the development of specialized collagen peptides will be crucial for competitive advantage. Furthermore, expanding the reach of collagen into diverse food and beverage products, coupled with potential M&A activities to consolidate market presence and expand production capacities, will shape the market's trajectory. The focus on sustainability and clean-label ingredients will also be a key differentiator for market leaders. The projected robust growth indicates a fertile ground for innovation and market expansion within the region.

South American Collagen Market Segmentation

-

1. Source

- 1.1. Animal-based Collagen

- 1.2. Marine-based Collagen

-

2. Application

- 2.1. Dietary Supplements

- 2.2. Meat Processing

- 2.3. Food and Beverage

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Rest of South America

South American Collagen Market Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Rest of South America

South American Collagen Market Regional Market Share

Geographic Coverage of South American Collagen Market

South American Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Availability of potential alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand for Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Collagen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal-based Collagen

- 5.1.2. Marine-based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dietary Supplements

- 5.2.2. Meat Processing

- 5.2.3. Food and Beverage

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Brazil South American Collagen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Animal-based Collagen

- 6.1.2. Marine-based Collagen

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dietary Supplements

- 6.2.2. Meat Processing

- 6.2.3. Food and Beverage

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Colombia South American Collagen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Animal-based Collagen

- 7.1.2. Marine-based Collagen

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dietary Supplements

- 7.2.2. Meat Processing

- 7.2.3. Food and Beverage

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of South America South American Collagen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Animal-based Collagen

- 8.1.2. Marine-based Collagen

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dietary Supplements

- 8.2.2. Meat Processing

- 8.2.3. Food and Beverage

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GelcoPEP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Connoils LLC*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Gelita AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Jbs SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nitta Gelatin NA Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Gelnex Industria

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Rousselot

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Novaprom

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 PB Leiner

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Bioiberica

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 GelcoPEP

List of Figures

- Figure 1: South American Collagen Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South American Collagen Market Share (%) by Company 2025

List of Tables

- Table 1: South American Collagen Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: South American Collagen Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South American Collagen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South American Collagen Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South American Collagen Market Revenue Million Forecast, by Source 2020 & 2033

- Table 6: South American Collagen Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South American Collagen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South American Collagen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South American Collagen Market Revenue Million Forecast, by Source 2020 & 2033

- Table 10: South American Collagen Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: South American Collagen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South American Collagen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South American Collagen Market Revenue Million Forecast, by Source 2020 & 2033

- Table 14: South American Collagen Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: South American Collagen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South American Collagen Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Collagen Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the South American Collagen Market?

Key companies in the market include GelcoPEP, Connoils LLC*List Not Exhaustive, Gelita AG, Jbs SA, Nitta Gelatin NA Inc, Gelnex Industria, Rousselot, Novaprom, PB Leiner, Bioiberica.

3. What are the main segments of the South American Collagen Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry.

6. What are the notable trends driving market growth?

Growing Demand for Dietary Supplements.

7. Are there any restraints impacting market growth?

Availability of potential alternatives.

8. Can you provide examples of recent developments in the market?

November 2022: Acquion Food Tech, a new Brazilian venture led by entrepreneur André Albuquerque, begins operations with a plan to invest BRL 250 million (USD 46.6 million) over the next four years to produce collagen and gelatin for the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Collagen Market?

To stay informed about further developments, trends, and reports in the South American Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence