Key Insights

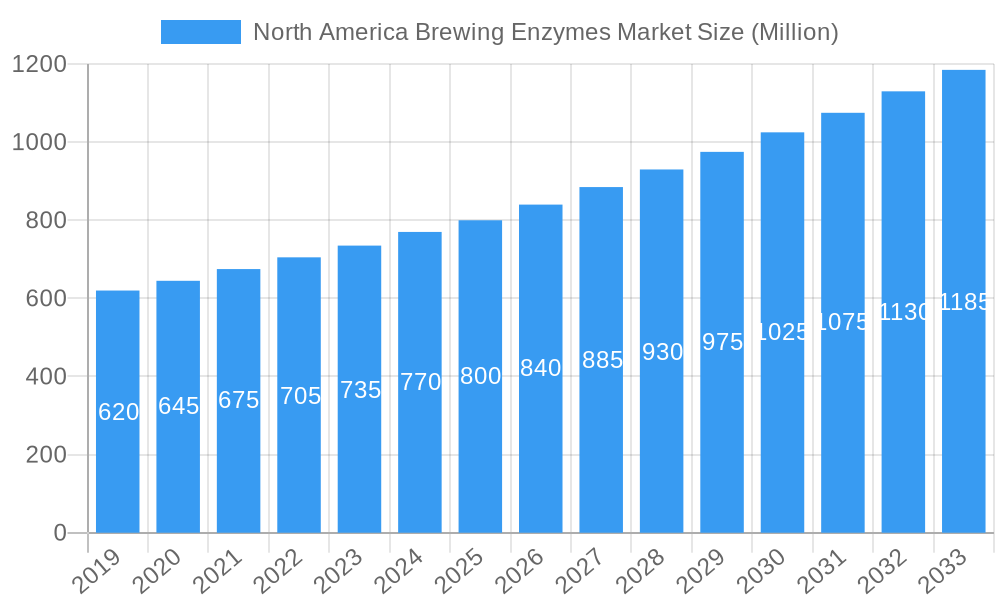

The North American brewing enzymes market is projected for substantial expansion, fueled by escalating demand for premium beer, technological innovation in brewing, and a growing consumer appetite for diverse and specialized craft beverages. The market is estimated at $559.54 billion in the base year of 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.41%, projecting a market value exceeding $1 billion by 2033. Key drivers include the microbial enzyme segment, valued for its efficiency and adaptability in brewing. The burgeoning craft beer sector and demand for enzymes that enhance flavor, optimize yield, and reduce production costs are significant growth catalysts. Prominent trends involve the increased utilization of amylase and protease enzymes for improved starch conversion and protein modification, respectively, leading to optimized fermentation and clearer beer. Liquid enzyme formulations are also gaining favor for their handling and dosing advantages in contemporary breweries.

North America Brewing Enzymes Market Market Size (In Billion)

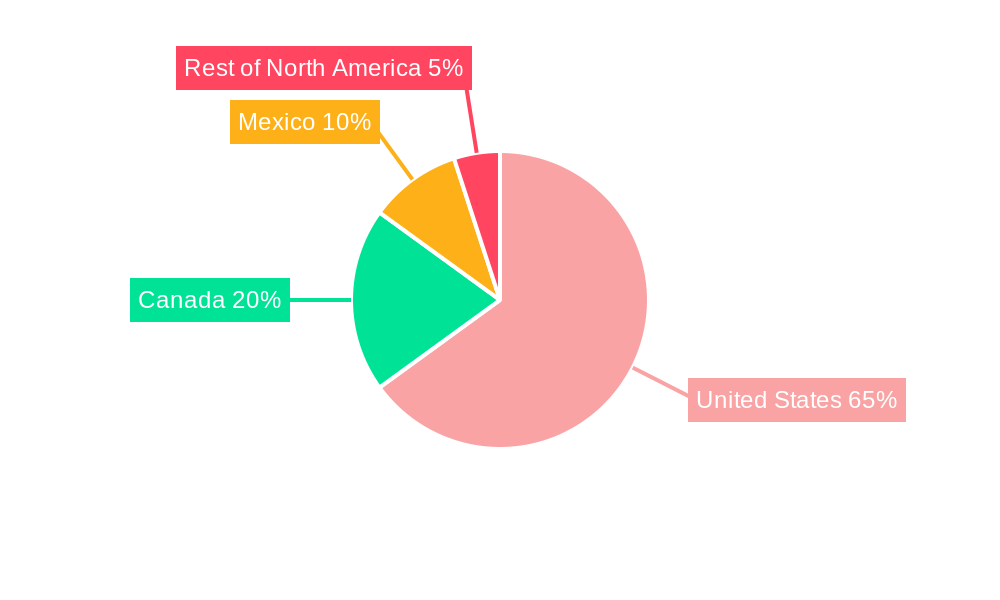

While growth prospects are strong, potential market restraints include raw material price volatility, particularly for microbial-derived enzymes, and stringent food additive regulations in select regions. The industry is actively addressing these through strategic sourcing and research and development. Geographically, the United States is expected to lead the North American market, driven by high beer consumption and a mature brewing industry. Canada and Mexico will also experience steady growth, supported by increased brewing capacity and the adoption of advanced enzymatic solutions. Emerging markets within "Rest of North America" offer significant untapped potential as brewing practices advance and incorporate innovative enzyme technologies to meet evolving consumer demands for varied and high-quality beer products.

North America Brewing Enzymes Market Company Market Share

North America Brewing Enzymes Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report offers a detailed examination of the North America Brewing Enzymes Market, providing actionable insights and robust forecasts for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delves into market structure, industry trends, dominant segments, product innovations, and key growth drivers. The report leverages high-ranking keywords such as "brewing enzymes," "North America," "amylase," "protease," "microbial enzymes," "plant enzymes," and "brewing industry" to enhance search visibility and reach key industry audiences.

North America Brewing Enzymes Market Market Structure & Competitive Dynamics

The North America Brewing Enzymes Market is characterized by a moderate to high level of market concentration, with a few key players dominating a significant share. The innovation ecosystem is robust, driven by continuous research and development in enzyme efficacy, production efficiency, and novel applications. Regulatory frameworks, primarily governed by food safety agencies in the United States (FDA) and Canada (Health Canada), play a crucial role in product approval and market entry, influencing the adoption of new enzyme technologies. The threat of product substitutes, while present in the form of alternative processing aids, is mitigated by the inherent benefits and cost-effectiveness of specialized brewing enzymes. End-user trends are increasingly leaning towards enhanced brewing efficiency, improved product quality (flavor, aroma, clarity), and the development of novel beer styles, all of which are directly addressed by advanced enzyme solutions. Mergers and acquisition (M&A) activities are sporadic but significant, aimed at consolidating market share, expanding product portfolios, and acquiring specialized technological expertise. For instance, strategic acquisitions by leading enzyme manufacturers often involve substantial deal values in the tens to hundreds of millions of dollars, signaling a competitive drive for market leadership.

North America Brewing Enzymes Market Industry Trends & Insights

The North America Brewing Enzymes Market is projected to witness substantial growth, driven by an escalating demand for craft beer and an increasing focus on optimizing brewing processes for efficiency and quality. The market penetration of brewing enzymes is steadily rising as brewers, from large-scale manufacturers to microbreweries, recognize their indispensable role in modern brewing. Technological disruptions, such as the development of more thermostable and pH-stable enzymes, are enabling brewers to achieve better yields, reduce processing times, and minimize the formation of undesirable by-products. Consumer preferences are evolving, with a growing appreciation for diverse beer flavors, aromas, and textures, all of which can be influenced and enhanced through the strategic use of enzymes like amylases for starch conversion and proteases for protein modification. The competitive landscape is dynamic, with established players investing heavily in R&D to introduce next-generation enzyme solutions. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. Key trends include the growing adoption of enzymes for gluten-free brewing, the development of enzymes that aid in haze reduction and foam stability, and the increasing integration of enzymatic solutions in automated brewing systems. The global shift towards sustainability is also influencing the market, with a growing demand for enzymes produced through eco-friendly fermentation processes, further contributing to market expansion.

Dominant Markets & Segments in North America Brewing Enzymes Market

The United States stands as the dominant market within North America for brewing enzymes, driven by its vast brewing industry, significant craft beer production, and a highly receptive market for innovative food and beverage technologies. The Microbial source segment is the largest and most influential, accounting for over 80% of the market share. This dominance stems from the cost-effectiveness, scalability, and wide range of functionalities offered by microbial enzymes, primarily derived from fungi and bacteria. Within the Type segmentation, Amylase enzymes are paramount, essential for breaking down starches into fermentable sugars, thus directly impacting alcohol yield and beer clarity. Their widespread application in virtually all beer production processes solidifies their leading position. The Liquid form of brewing enzymes is experiencing robust growth due to its ease of handling, precise dosing capabilities, and rapid dissolution in brewing mashes, though the Dry form remains significant for its shelf-life and storage advantages.

Key Drivers for US Dominance:

- Expansive Brewing Landscape: The US boasts the highest number of breweries globally, with a thriving craft beer segment that continuously experiments with new brewing techniques and ingredients.

- Technological Adoption: The brewing industry in the US is quick to adopt new technologies that promise improved efficiency, quality, and cost savings.

- Consumer Demand for Variety: Evolving consumer tastes and preferences for diverse beer styles fuel the demand for specialized enzymes that can achieve specific flavor profiles and characteristics.

- Regulatory Support: A well-established regulatory framework that supports the use of food-grade enzymes provides a stable market environment.

Dominance of Microbial Source:

- Cost-Effectiveness: Microbial fermentation offers a scalable and economically viable method for enzyme production.

- Versatility: A broad spectrum of enzymes with tailored functionalities can be engineered from microbial sources.

- High Purity and Consistency: Advanced fermentation and purification techniques ensure high purity and batch-to-batch consistency.

Leadership of Amylase Type:

- Fundamental Role in Fermentation: Amylases are critical for saccharification, the process of converting starches into fermentable sugars.

- Yield Optimization: Efficient starch conversion directly translates to higher alcohol yields and better resource utilization for brewers.

- Impact on Body and Mouthfeel: Different types of amylases can influence the residual dextrin profile, affecting the body and mouthfeel of the final beer.

North America Brewing Enzymes Market Product Innovations

Product innovations in the North America brewing enzymes market are primarily focused on enhancing brewing efficiency, improving beer quality, and enabling the production of specialized beer styles. Companies are developing enzymes with improved thermostability and pH tolerance, allowing for broader application across diverse brewing conditions. Novel enzyme formulations are emerging that specifically target haze reduction, foam stability, and the development of unique flavor and aroma profiles. For example, specialized proteases are being engineered to aid in gluten reduction for gluten-free beers, while amylases are being refined for optimal starch conversion in low-carbohydrate or high-alcohol beer production. These advancements provide brewers with greater control over their brewing processes and enable them to cater to evolving consumer demands for healthier, more diverse, and higher-quality beverages, thereby creating significant competitive advantages.

Report Segmentation & Scope

This report segments the North America Brewing Enzymes Market by Source, Type, Form, and Geography. The Source segmentation includes Microbial (e.g., fungal, bacterial) and Plant (e.g., barley, wheat). The Type segmentation encompasses Amylase, Alphalase, Protease, and Others (e.g., beta-glucanase, cellulase). The Form segmentation covers Liquid and Dry enzymes. Geographically, the market is divided into the United States, Canada, Mexico, and the Rest of North America. The United States is projected to hold the largest market share, driven by its robust brewing industry and high adoption rates of advanced brewing technologies. The Microbial source is expected to dominate due to its cost-effectiveness and versatility. Amylase enzymes will continue to lead in terms of type, owing to their fundamental role in starch conversion. The Liquid form is anticipated to witness significant growth due to its ease of use.

Key Drivers of North America Brewing Enzymes Market Growth

Several key factors are driving the growth of the North America Brewing Enzymes Market. The escalating popularity of craft beer and the increasing demand for diverse beer styles necessitate specialized enzymes to achieve desired flavor profiles and brewing efficiencies. Technological advancements in enzyme engineering, leading to more stable and effective enzymes, are a significant catalyst. Furthermore, the ongoing trend towards process optimization and cost reduction in brewing operations encourages the adoption of enzymes that enhance yields and reduce processing times. Growing consumer interest in healthier beverage options, such as gluten-free beers, also fuels demand for specific enzymatic solutions. Regulatory support for the use of food-grade enzymes further solidifies their market position.

Challenges in the North America Brewing Enzymes Market Sector

Despite robust growth prospects, the North America Brewing Enzymes Market faces several challenges. Strict regulatory hurdles for new enzyme approvals can lead to extended market entry timelines and significant R&D investment. Supply chain disruptions, particularly for raw materials used in enzyme production and logistics, can impact availability and pricing. Intense competition among established enzyme manufacturers and the emergence of new players can lead to price pressures and market fragmentation. The cost of advanced enzymatic solutions, while offering long-term benefits, can be a barrier for smaller breweries with limited capital. Additionally, educating brewers on the optimal use and benefits of a wider range of enzymes requires continuous effort and technical support.

Leading Players in the North America Brewing Enzymes Market Market

- Kerry Group plc

- Amano Enzyme Inc

- Merck KGaA

- DuPont de Nemours Inc

- Associated British Foods plc

- Koninklijke DSM N V

- The Soufflet Group

- Novozymes A/S

Key Developments in North America Brewing Enzymes Market Sector

- Q4 2023: Novozymes launched a new range of amylase enzymes designed for enhanced fermentation efficiency and improved beer clarity in craft brewing.

- Q1 2024: DuPont de Nemours Inc. acquired a biotechnology firm specializing in novel enzyme discovery for food and beverage applications, signaling a focus on expanding its enzyme portfolio.

- Q2 2024: Kerry Group plc announced strategic partnerships with several North American craft breweries to co-develop customized enzyme solutions for unique beer styles.

- Q3 2024: DSM announced significant investment in its enzyme production facilities in North America to meet the growing demand for microbial brewing enzymes.

- Q4 2024: Amano Enzyme Inc. introduced a new protease enzyme formulation aimed at improving foam stability and shelf-life in various beer types.

Strategic North America Brewing Enzymes Market Market Outlook

The strategic outlook for the North America Brewing Enzymes Market remains highly positive, fueled by ongoing innovation and expanding market penetration. Growth accelerators include the continued rise of the craft beer segment, increasing demand for enzymes that facilitate the production of novel and healthier beer styles, and advancements in enzyme technology that offer superior performance and cost-effectiveness. Opportunities lie in developing customized enzyme solutions for niche brewing applications, expanding into emerging craft brewing regions, and leveraging digital tools to enhance customer support and technical guidance. The market is poised for sustained growth as brewers increasingly recognize brewing enzymes as essential tools for achieving quality, efficiency, and innovation in their operations.

North America Brewing Enzymes Market Segmentation

-

1. Source

- 1.1. Microbial

- 1.2. Plant

-

2. Type

- 2.1. Amylase

- 2.2. Alphalase

- 2.3. Protease

- 2.4. Others

-

3. Form

- 3.1. Liquid

- 3.2. Dry

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Brewing Enzymes Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Brewing Enzymes Market Regional Market Share

Geographic Coverage of North America Brewing Enzymes Market

North America Brewing Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. High Consumption of Beer in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Brewing Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Microbial

- 5.1.2. Plant

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Amylase

- 5.2.2. Alphalase

- 5.2.3. Protease

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Liquid

- 5.3.2. Dry

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United States North America Brewing Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Microbial

- 6.1.2. Plant

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Amylase

- 6.2.2. Alphalase

- 6.2.3. Protease

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Form

- 6.3.1. Liquid

- 6.3.2. Dry

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Canada North America Brewing Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Microbial

- 7.1.2. Plant

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Amylase

- 7.2.2. Alphalase

- 7.2.3. Protease

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Form

- 7.3.1. Liquid

- 7.3.2. Dry

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Mexico North America Brewing Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Microbial

- 8.1.2. Plant

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Amylase

- 8.2.2. Alphalase

- 8.2.3. Protease

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Form

- 8.3.1. Liquid

- 8.3.2. Dry

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Rest of North America North America Brewing Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Microbial

- 9.1.2. Plant

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Amylase

- 9.2.2. Alphalase

- 9.2.3. Protease

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Form

- 9.3.1. Liquid

- 9.3.2. Dry

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kerry Group plc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amano Enzyme Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Merck KGaA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DuPont de Nemours Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Associated British Foods plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Koninklijke DSM N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Soufflet Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Novozymes A/S

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Kerry Group plc *List Not Exhaustive

List of Figures

- Figure 1: North America Brewing Enzymes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Brewing Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: North America Brewing Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: North America Brewing Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: North America Brewing Enzymes Market Revenue billion Forecast, by Form 2020 & 2033

- Table 4: North America Brewing Enzymes Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Brewing Enzymes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Brewing Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 7: North America Brewing Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Brewing Enzymes Market Revenue billion Forecast, by Form 2020 & 2033

- Table 9: North America Brewing Enzymes Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Brewing Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Brewing Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 12: North America Brewing Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: North America Brewing Enzymes Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: North America Brewing Enzymes Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Brewing Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Brewing Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 17: North America Brewing Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Brewing Enzymes Market Revenue billion Forecast, by Form 2020 & 2033

- Table 19: North America Brewing Enzymes Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Brewing Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: North America Brewing Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 22: North America Brewing Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: North America Brewing Enzymes Market Revenue billion Forecast, by Form 2020 & 2033

- Table 24: North America Brewing Enzymes Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: North America Brewing Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Brewing Enzymes Market?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the North America Brewing Enzymes Market?

Key companies in the market include Kerry Group plc *List Not Exhaustive, Amano Enzyme Inc, Merck KGaA, DuPont de Nemours Inc, Associated British Foods plc, Koninklijke DSM N V, The Soufflet Group, Novozymes A/S.

3. What are the main segments of the North America Brewing Enzymes Market?

The market segments include Source, Type, Form, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 559.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

High Consumption of Beer in the Region.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Brewing Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Brewing Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Brewing Enzymes Market?

To stay informed about further developments, trends, and reports in the North America Brewing Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence