Key Insights

The African Beta Glucan market is poised for significant expansion, projected to reach an estimated USD 198.6 million in 2024 with a robust Compound Annual Growth Rate (CAGR) of 7% through 2033. This growth is propelled by increasing consumer awareness of beta glucan's health benefits, particularly its immune-boosting and cholesterol-lowering properties. The growing demand for functional foods and beverages across Africa, driven by rising disposable incomes and a greater focus on preventative healthcare, is a primary catalyst. Furthermore, the burgeoning healthcare and dietary supplement sector, seeking natural and effective ingredients, is also a key driver. The market is segmented by source into Cereal, Yeast, Mushroom, and Others, with Cereal-based beta glucans likely dominating due to their widespread availability and established applications. Yeast and Mushroom sources are also gaining traction due to their unique properties and perceived health advantages.

Africa Beta Glucan Market Market Size (In Million)

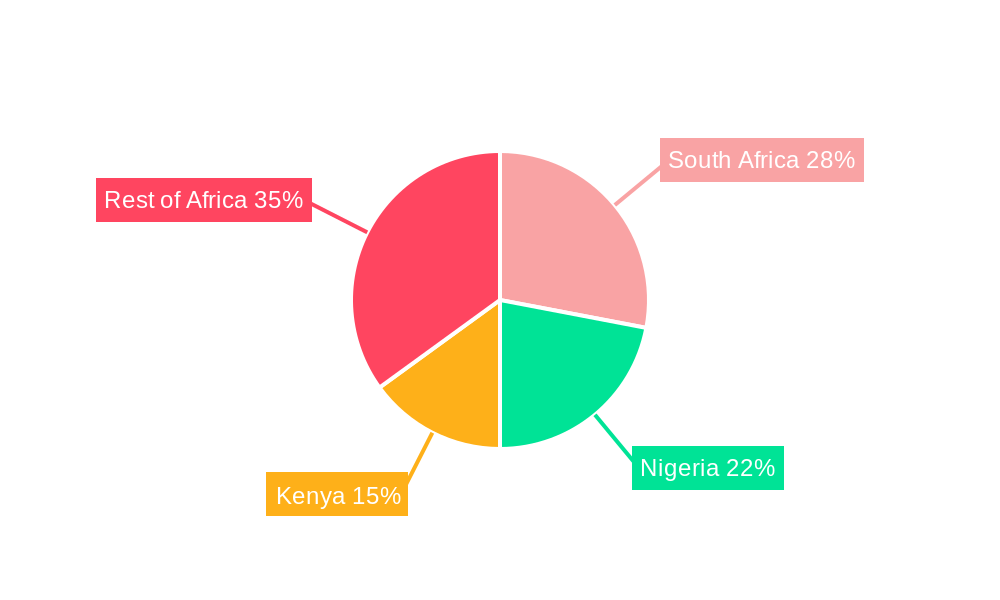

Geographically, the African market is characterized by the strong presence of South Africa, Nigeria, and Kenya, which are expected to lead adoption rates. The broader "Rest of Africa" region presents substantial untapped potential, with growing opportunities as awareness and infrastructure improve. Key restraints include the relatively high cost of some beta glucan sources and limited consumer education in certain emerging markets. However, the continuous innovation in product development, coupled with strategic investments by leading companies such as Kerry Group, Koninklijke DSM N.V., and Tate & Lyle PLC, is expected to overcome these challenges. The market will witness an increasing preference for soluble beta glucans in food and beverage applications, while insoluble forms will find a growing niche in healthcare and dietary supplements, indicating a dynamic and evolving market landscape.

Africa Beta Glucan Market Company Market Share

This in-depth report offers an exhaustive analysis of the Africa Beta Glucan Market, providing critical insights into its structure, trends, dominant segments, and future outlook. Spanning the Study Period of 2019–2033, with 2025 as the Base Year and Estimated Year, and a Forecast Period from 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning African Beta Glucan landscape. We meticulously examine Beta Glucan applications across Food and Beverage, Healthcare and Dietary Supplements, and Other Applications, with a granular breakdown by Source (Cereal, Yeast, Mushroom, Others) and Category (Soluble, Insoluble). Geographic coverage includes key markets like South Africa, Nigeria, Kenya, and the Rest of Africa.

Africa Beta Glucan Market Market Structure & Competitive Dynamics

The Africa Beta Glucan Market is characterized by a dynamic interplay of established global players and emerging local manufacturers. Market concentration is moderate, with key players like Kerry Group, Koninklijke DSM N V, Tate & Lyle PLC, Lesaffre, Merck KGaA, and Kemin Industries holding significant stakes, though regional fragmentation also exists. Innovation ecosystems are evolving, driven by a growing demand for natural ingredients and functional foods. Regulatory frameworks, while still developing across some African nations, are increasingly aligning with international standards, impacting product approvals and market access. Product substitutes, primarily other soluble fiber alternatives, pose a competitive challenge, necessitating a focus on the unique health benefits and efficacy of beta-glucans. End-user trends are leaning towards preventative healthcare and clean-label products, directly fueling beta-glucan demand. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation, with recent deal values in the global beta-glucan sector reaching hundreds of millions, signaling potential for strategic alliances and market expansion within Africa.

- Market Concentration: Moderate, with a mix of global giants and regional specialists.

- Innovation Ecosystems: Flourishing, driven by health trends and R&D investments.

- Regulatory Frameworks: Evolving, with increasing alignment to international standards.

- Product Substitutes: Other soluble fibers and functional ingredients.

- End-User Trends: Rising demand for natural, health-boosting ingredients.

- M&A Activities: Expected to increase for market consolidation and strategic growth.

Africa Beta Glucan Market Industry Trends & Insights

The Africa Beta Glucan Market is experiencing robust growth, projected to achieve a significant CAGR of approximately 8.5% from 2025 to 2033. This expansion is primarily propelled by increasing consumer awareness regarding the health benefits of beta-glucans, particularly their role in immune system support, cholesterol management, and gut health. The Food and Beverage industry is a dominant application segment, with beta-glucans being incorporated into a wide array of products, including cereals, baked goods, dairy alternatives, and beverages, enhancing their nutritional profile and appealing to health-conscious consumers. The Healthcare and Dietary Supplements sector is another critical growth engine, driven by the rising prevalence of lifestyle diseases and a proactive approach to wellness. The demand for soluble beta-glucans, derived predominantly from Oats and Barley (Cereal) and Yeast, is outstripping that for insoluble variants due to their proven efficacy in cholesterol reduction and blood sugar regulation.

Technological advancements in extraction and processing methods are improving the purity, functionality, and cost-effectiveness of beta-glucans, further stimulating market penetration. For instance, enzymatic hydrolysis techniques are enabling the production of beta-glucans with specific molecular weights tailored for diverse applications. The African population's increasing disposable income and growing middle class are also contributing to market expansion, enabling greater access to premium health-focused products. Furthermore, the growing interest in functional foods and beverages that offer tangible health benefits is a significant market penetration driver. The competitive landscape is intensifying, with both global corporations and nimble local producers vying for market share. Strategic partnerships and product innovation are becoming paramount for maintaining a competitive edge. The overall market penetration of beta-glucans in Africa is still nascent compared to developed regions, indicating substantial untapped potential and a promising growth trajectory.

Dominant Markets & Segments in Africa Beta Glucan Market

The Africa Beta Glucan Market exhibits distinct regional and segmental dominance. South Africa currently leads the market, driven by its well-established food and beverage industry, higher disposable incomes, and a more mature consumer understanding of health and wellness products. The prevalence of lifestyle-related diseases in South Africa also fuels demand for beta-glucans in healthcare and dietary supplements. Nigeria, with its large and growing population, represents a rapidly expanding market, fueled by increasing urbanization and a burgeoning middle class that is increasingly health-conscious. Kenya is also emerging as a significant market, with a growing focus on fortified foods and functional ingredients.

Within the Source segment, Cereal-derived beta-glucans, particularly from oats and barley, are dominant due to their widespread availability and established use in food products. However, Yeast-derived beta-glucans are gaining traction in the healthcare and dietary supplement sector due to their potent immune-modulating properties. Mushroom-derived beta-glucans are carving out a niche, particularly in premium health supplements, owing to their unique bioactive compounds.

In terms of Category, Soluble beta-glucans command the largest market share. Their proven efficacy in lowering LDL cholesterol and improving gut health makes them highly sought after in both the Food and Beverage and Healthcare and Dietary Supplement applications. Insoluble beta-glucans have more niche applications, primarily in bulking agents and certain food texturizers.

The Application segment of Food and Beverage is the largest contributor to the Africa Beta Glucan Market. This is attributable to the versatility of beta-glucans in enhancing the nutritional value and functional properties of everyday food items. The Healthcare and Dietary Supplements segment is the second largest and is experiencing the fastest growth, driven by rising health awareness and preventative healthcare trends. The Other Applications segment, though smaller, includes promising areas like cosmetics and animal feed, which are expected to see moderate growth.

Africa Beta Glucan Market Product Innovations

Recent product innovations in the Africa Beta Glucan Market are focused on enhancing bioavailability and diversifying applications. Manufacturers are developing beta-glucan ingredients with improved solubility and palatability for wider incorporation into beverages and infant foods. Advancements in enzymatic processing are yielding beta-glucans with specific molecular weights, optimizing their immune-boosting and prebiotic effects for targeted Healthcare and Dietary Supplements. Competitive advantages are being forged through the development of novel beta-glucan formulations that offer superior functional benefits, such as enhanced antioxidant properties or improved digestive health support, aligning with the growing demand for functional and natural ingredients across Food and Beverage and wellness sectors.

Report Segmentation & Scope

This report comprehensively segments the Africa Beta Glucan Market across multiple dimensions to provide granular insights. The Source segmentation includes Cereal (e.g., oats, barley), Yeast, Mushroom, and Others, each with projected market sizes and growth rates indicating the evolving preference for different raw materials. The Category segmentation details Soluble and Insoluble beta-glucans, with soluble variants projected to maintain dominance due to their well-established health benefits, contributing to an estimated xx million market size in 2025. The Application segmentation covers Food and Beverage, Healthcare and Dietary Supplements, and Other Applications, highlighting the significant market share of food and beverage due to its broad utility, and the rapid growth of healthcare applications, estimated at xx million in 2025. Geographically, the report meticulously analyzes Africa, breaking down the market into key regions: South Africa, Nigeria, Kenya, and the Rest of Africa, with each region exhibiting unique growth drivers and competitive dynamics, contributing to a collective xx million market value in 2025.

Key Drivers of Africa Beta Glucan Market Growth

Several key factors are propelling the Africa Beta Glucan Market forward. A primary driver is the escalating consumer demand for healthier food options and functional ingredients that offer tangible health benefits, such as improved cardiovascular health and immune support. This trend is further amplified by growing awareness of the link between diet and chronic disease prevention. Technological advancements in extraction and purification processes are making beta-glucans more accessible and cost-effective for a wider range of applications. Furthermore, supportive government initiatives promoting functional foods and natural health products, alongside increasing disposable incomes in emerging African economies, are creating a more favorable market environment for beta-glucan consumption.

Challenges in the Africa Beta Glucan Market Sector

Despite the promising growth trajectory, the Africa Beta Glucan Market faces certain challenges. The relatively underdeveloped regulatory landscape in some African countries can lead to inconsistencies in product standards and market access. Supply chain complexities, including logistics and sourcing of raw materials, can also pose hurdles. High production costs for certain high-purity beta-glucans can impact their affordability for a broader consumer base. Moreover, a lack of widespread consumer education regarding the specific benefits of beta-glucans, compared to more established functional ingredients, presents a barrier to market penetration, requiring concerted marketing and educational efforts to overcome.

Leading Players in the Africa Beta Glucan Market Market

- Kerry Group

- Koninklijke DSM N V

- Tate & Lyle PLC

- Lesaffre

- Merck KGaA

- Kemin Industries

Key Developments in Africa Beta Glucan Market Sector

- 2023/Q4: Launch of new beta-glucan fortified breakfast cereals in South Africa by a leading local food manufacturer, targeting health-conscious consumers.

- 2024/Q1: Kemin Industries expands its global beta-glucan production capacity, with a strategic focus on catering to growing African market demand.

- 2024/Q2: Tate & Lyle PLC introduces a new line of soluble fiber ingredients, including beta-glucans, aimed at the African beverage and dairy sectors.

- 2024/Q3: Merck KGaA announces collaborations with African research institutions to explore novel applications of yeast-derived beta-glucans in healthcare.

- 2024/Q4: Lesaffre announces significant investment in expanding its yeast production facilities in North Africa to meet regional demand for beta-glucan ingredients.

Strategic Africa Beta Glucan Market Market Outlook

The Africa Beta Glucan Market is poised for substantial growth, driven by favorable demographic shifts, increasing health consciousness, and ongoing product innovation. Strategic opportunities lie in targeting the burgeoning Food and Beverage and Healthcare and Dietary Supplements sectors with tailored beta-glucan solutions. Expansion into underserved regions within Africa, coupled with strategic partnerships with local manufacturers and distributors, will be crucial for market penetration. Continued investment in R&D to develop more cost-effective and versatile beta-glucan ingredients, alongside targeted marketing campaigns to educate consumers on the health benefits, will accelerate market expansion and solidify the position of beta-glucans as a key functional ingredient in the African wellness landscape.

Africa Beta Glucan Market Segmentation

-

1. Source

- 1.1. Cereal

- 1.2. Yeast

- 1.3. Mushroom

- 1.4. Others

-

2. Category

- 2.1. Soluble

- 2.2. Insoluble

-

3. Application

- 3.1. Food and Beverage

- 3.2. Healthcare and Dietary Supplements

- 3.3. Other Applications

-

4. Geography

-

4.1. Africa

- 4.1.1. South Africa

- 4.1.2. Nigeria

- 4.1.3. Kenya

- 4.1.4. Rest of Africa

-

4.1. Africa

Africa Beta Glucan Market Segmentation By Geography

-

1. Africa

- 1.1. South Africa

- 1.2. Nigeria

- 1.3. Kenya

- 1.4. Rest of Africa

Africa Beta Glucan Market Regional Market Share

Geographic Coverage of Africa Beta Glucan Market

Africa Beta Glucan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Demand of Soluble Beta-Glucan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Beta Glucan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Cereal

- 5.1.2. Yeast

- 5.1.3. Mushroom

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Soluble

- 5.2.2. Insoluble

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare and Dietary Supplements

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Africa

- 5.4.1.1. South Africa

- 5.4.1.2. Nigeria

- 5.4.1.3. Kenya

- 5.4.1.4. Rest of Africa

- 5.4.1. Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kerry Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koninklijke DSM N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tate & Lyle PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lesaffre

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merck KGaA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemin Industries*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Kerry Group

List of Figures

- Figure 1: Global Africa Beta Glucan Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Africa Africa Beta Glucan Market Revenue (undefined), by Source 2025 & 2033

- Figure 3: Africa Africa Beta Glucan Market Revenue Share (%), by Source 2025 & 2033

- Figure 4: Africa Africa Beta Glucan Market Revenue (undefined), by Category 2025 & 2033

- Figure 5: Africa Africa Beta Glucan Market Revenue Share (%), by Category 2025 & 2033

- Figure 6: Africa Africa Beta Glucan Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: Africa Africa Beta Glucan Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Africa Africa Beta Glucan Market Revenue (undefined), by Geography 2025 & 2033

- Figure 9: Africa Africa Beta Glucan Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Africa Africa Beta Glucan Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: Africa Africa Beta Glucan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Africa Beta Glucan Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Global Africa Beta Glucan Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 3: Global Africa Beta Glucan Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Africa Beta Glucan Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global Africa Beta Glucan Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Africa Beta Glucan Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 7: Global Africa Beta Glucan Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 8: Global Africa Beta Glucan Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Africa Beta Glucan Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global Africa Beta Glucan Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: South Africa Africa Beta Glucan Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Nigeria Africa Beta Glucan Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Kenya Africa Beta Glucan Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of Africa Africa Beta Glucan Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Beta Glucan Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Africa Beta Glucan Market?

Key companies in the market include Kerry Group, Koninklijke DSM N V, Tate & Lyle PLC, Lesaffre, Merck KGaA, Kemin Industries*List Not Exhaustive.

3. What are the main segments of the Africa Beta Glucan Market?

The market segments include Source, Category, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Demand of Soluble Beta-Glucan.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Beta Glucan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Beta Glucan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Beta Glucan Market?

To stay informed about further developments, trends, and reports in the Africa Beta Glucan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence