Key Insights

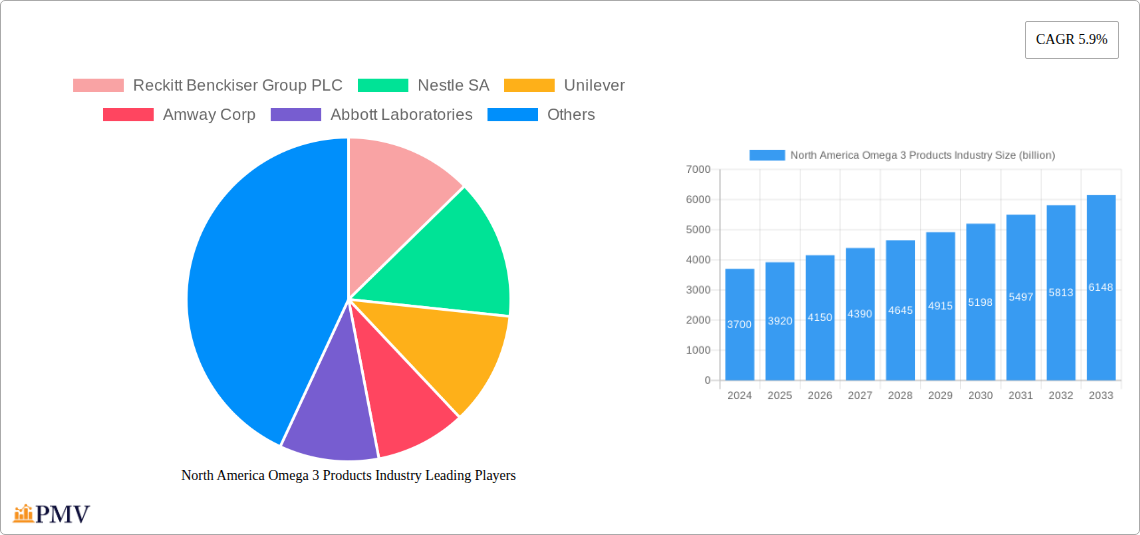

The North America Omega 3 Products Industry is poised for substantial growth, driven by increasing consumer awareness of the health benefits associated with omega-3 fatty acids, such as improved cardiovascular health, cognitive function, and anti-inflammatory properties. This heightened health consciousness, coupled with a growing demand for natural and preventive healthcare solutions, is significantly fueling market expansion. Key drivers include the rising prevalence of chronic diseases, an aging population seeking to maintain their well-being, and the expanding applications of omega-3s beyond traditional dietary supplements into functional foods and infant nutrition. The market is projected to reach an estimated $3.7 billion in 2024, exhibiting a robust CAGR of 5.9% over the forecast period, indicating a healthy and dynamic market landscape. This growth trajectory is further supported by ongoing product innovation, including the development of more palatable and bioavailable forms of omega-3s, and a broadening distribution network that makes these products more accessible to a wider consumer base.

North America Omega 3 Products Industry Market Size (In Billion)

The industry is characterized by dynamic trends and segments that are shaping its evolution. Functional foods and beverages are witnessing significant uptake as consumers seek convenient ways to incorporate omega-3s into their daily diets. Simultaneously, dietary supplements continue to hold a strong market position due to their perceived efficacy and targeted health benefits. Infant nutrition is another rapidly growing segment, as parents increasingly recognize the importance of omega-3s for infant brain and eye development. While the market is largely propelled by these positive drivers, potential restraints include fluctuating raw material prices, particularly for fish oil, and stringent regulatory frameworks for health claims. However, advancements in aquaculture and alternative sources of omega-3s are mitigating some of these challenges. North America, led by the United States, is a dominant region, benefiting from high disposable incomes, a strong health and wellness culture, and advanced research and development in nutritional science. The distribution landscape is also evolving, with internet retailing emerging as a significant channel, complementing traditional grocery retailers and pharmacies.

North America Omega 3 Products Industry Company Market Share

This in-depth report provides a detailed examination of the North America Omega 3 Products Industry, offering critical insights into market dynamics, trends, and future growth trajectories from 2019 to 2033. With a base year of 2025, the report leverages historical data, current market conditions, and expert estimations to deliver actionable intelligence for industry stakeholders. Explore the evolving landscape of omega 3 supplements, fish oil products, EPA and DHA fortified foods, and algal oil omega 3, crucial for human and animal health. Uncover market opportunities within dietary supplements, infant nutrition, functional foods, pharmaceuticals, and pet food. Understand the influence of distribution channels including grocery retailers, pharmacies, health stores, and internet retailing. This report is essential for manufacturers, suppliers, investors, and market strategists seeking to capitalize on the burgeoning North American omega 3 market.

North America Omega 3 Products Industry Market Structure & Competitive Dynamics

The North America Omega 3 Products Industry exhibits a moderately concentrated market structure, characterized by the significant presence of multinational corporations alongside emerging niche players. Innovation ecosystems are driven by ongoing research into novel omega 3 sources, improved bioavailability technologies, and targeted health applications. Regulatory frameworks, primarily governed by the FDA in the United States and Health Canada, significantly influence product development, labeling, and health claims, ensuring consumer safety and product efficacy. Product substitutes, while present in the broader dietary supplement landscape, offer limited direct competition to the unique health benefits of omega 3 fatty acids, particularly EPA and DHA. End-user trends are shifting towards preventative healthcare, with increasing consumer awareness of omega 3's role in cardiovascular health, brain function, and infant development. Mergers and acquisitions (M&A) activities, valued in the billions, are instrumental in consolidating market share and expanding product portfolios. For instance, recent M&A deals in the nutraceuticals industry have focused on acquiring companies with strong R&D capabilities in marine and plant-based omega 3 sources. Market share estimations indicate leading companies hold substantial portions of the total market value, with key players like Reckitt Benckiser Group PLC, Nestle SA, and Unilever actively pursuing strategic acquisitions to bolster their omega 3 product lines.

North America Omega 3 Products Industry Industry Trends & Insights

The North America Omega 3 Products Industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through the forecast period. This upward trajectory is fueled by several key market growth drivers. Heightened consumer awareness regarding the essential role of omega 3 fatty acids, particularly EPA and DHA, in maintaining overall health and well-being is a primary catalyst. This awareness stems from extensive scientific research linking omega 3 consumption to improved cardiovascular health, enhanced cognitive function, reduced inflammation, and crucial support for infant brain and eye development. Consequently, the demand for omega 3 dietary supplements and omega 3 enriched foods is on a significant rise.

Technological disruptions are playing a crucial role in shaping the industry. Advancements in extraction and purification techniques have led to the development of higher-quality, more bioavailable omega 3 products, addressing previous limitations in absorption. Furthermore, the emergence of sustainable sourcing methods, including advanced algal oil cultivation and krill harvesting technologies, is appealing to environmentally conscious consumers and mitigating concerns about overfishing of wild fish stocks. These innovations are expanding the market penetration of premium omega 3 products.

Consumer preferences are evolving, with a growing demand for transparent sourcing, third-party certifications, and products free from contaminants like heavy metals and PCBs. This has spurred greater investment in quality control and traceability throughout the supply chain. The rise of personalized nutrition is also influencing the market, with consumers seeking omega 3 formulations tailored to specific life stages (e.g., prenatal, geriatric) and health goals. The market penetration of omega 3 products is further amplified by the increasing integration of omega 3s into a wider array of consumer goods, beyond traditional supplements, including dairy products, beverages, and baked goods. The competitive dynamics are intensifying, with companies differentiating themselves through product innovation, branding, and strategic partnerships, especially in the functional food and beverage market.

Dominant Markets & Segments in North America Omega 3 Products Industry

The United States stands as the dominant market within the North America Omega 3 Products Industry, driven by its large, health-conscious population, high disposable income, and advanced healthcare infrastructure. The U.S. market accounts for an estimated 70% of the total North American omega 3 sales, with a market size exceeding several billion dollars.

Within the Product Type segment, Dietary Supplements are the leading category, commanding a substantial market share of over 60%. This dominance is attributed to the widespread use of omega 3 capsules, softgels, and liquids for targeted health benefits, from cardiovascular support to cognitive enhancement. The segment's growth is propelled by strong consumer demand for preventative health solutions and the availability of a diverse range of products catering to specific needs, such as high-potency EPA/DHA formulas.

The Functional Food segment is experiencing rapid growth, projected to capture a significant portion of the market share in the coming years. Key drivers include the increasing consumer preference for convenient health solutions and the growing adoption of omega 3-fortified products in daily diets. This includes omega 3-enriched milk, yogurt, juices, and spreads, making it easier for consumers to meet their daily omega 3 intake without relying solely on supplements.

In terms of Distribution Channels, Internet Retailing is emerging as a powerful force, with an estimated market share growth of over 20% annually. The convenience of online purchasing, coupled with the vast selection and competitive pricing offered by e-commerce platforms, is reshaping consumer buying habits. This channel is particularly favored by younger demographics seeking to access specialized omega 3 products and compare offerings from various brands.

Grocery Retailers continue to hold a significant market share, serving as a primary point of purchase for many consumers. The increasing availability of omega 3 fortified foods and supplements in mainstream grocery aisles further solidifies their position. Pharmacies and Health Stores remain crucial channels, particularly for consumers seeking expert advice and higher-quality, specialized omega 3 formulations.

The Infant Nutrition segment is also a critical growth area, driven by parental awareness of omega 3's vital role in fetal development and early childhood brain and vision health. This has led to a surge in demand for omega 3-fortified infant formulas and supplements. Similarly, the Pet Food and Feed segment is witnessing substantial growth as pet owners increasingly recognize the health benefits of omega 3s for their pets' skin, coat, and joint health. The Pharmaceuticals segment, while smaller, focuses on highly regulated, prescription-grade omega 3 formulations for specific medical conditions.

North America Omega 3 Products Industry Product Innovations

Product innovation in the North America Omega 3 Products Industry is characterized by a focus on enhancing bioavailability, sustainability, and targeted health benefits. Advancements in triglyceride form omega 3s and phospholipid-based omega 3s from krill and other sources are offering superior absorption rates compared to ethyl esters. The development of microencapsulation technologies is improving the stability and palatability of omega 3 products, especially for use in functional foods and beverages, minimizing fishy aftertastes. Furthermore, the exploration of novel, sustainable omega 3 sources like specific strains of microalgae and genetically modified crops is addressing concerns about marine resource depletion and offering vegan and vegetarian alternatives, appealing to a broader consumer base and expanding the market for plant-based omega 3.

Report Segmentation & Scope

This report meticulously segments the North America Omega 3 Products Industry by Product Type, including Functional Food, Dietary Supplements, Infant Nutrition, Pet Food and Feed, and Pharmaceuticals. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Dietary Supplements segment is projected to reach a market value of over $8 billion by 2025, driven by its established consumer base and diverse product offerings.

The industry is also segmented by Distribution Channel: Grocery Retailers, Pharmacies and Health Stores, Internet Retailing, and Other Distribution Channels. Internet Retailing is expected to witness the highest growth rate, projected to reach over $4 billion by 2025.

Geographically, the North American market is divided into the United States, Canada, Mexico, and the Rest of North America. The United States is expected to maintain its dominance, contributing over $15 billion to the market by 2025.

Key Drivers of North America Omega 3 Products Industry Growth

The North America Omega 3 Products Industry is propelled by a confluence of powerful growth drivers. Increasing consumer awareness of the critical health benefits of omega 3 fatty acids, particularly EPA and DHA, for cardiovascular health, brain function, and inflammation management, is a primary impetus. This is further fueled by a growing emphasis on preventative healthcare and wellness. Technological advancements in extraction and purification processes have led to higher-quality, more bioavailable omega 3 products, enhancing consumer satisfaction and product efficacy. The rising popularity of plant-based diets has also stimulated innovation in algal oil and other vegan omega 3 sources, broadening the market appeal. Government initiatives promoting healthier lifestyles and supporting research into dietary supplements also contribute to the industry's expansion.

Challenges in the North America Omega 3 Products Industry Sector

Despite its growth, the North America Omega 3 Products Industry faces several challenges. Regulatory scrutiny regarding health claims and product quality, though vital for consumer safety, can sometimes lead to delays in product launches and necessitate extensive testing, impacting market entry timelines. Supply chain volatility, particularly concerning the sourcing of fish oil due to fluctuating fish populations and environmental factors, can affect product availability and pricing. Furthermore, intense market competition, with numerous brands vying for consumer attention, requires significant investment in marketing and product differentiation. The presence of counterfeit or low-quality products in the market also poses a threat, eroding consumer trust and potentially damaging the reputation of legitimate omega 3 products.

Leading Players in the North America Omega 3 Products Industry Market

- Reckitt Benckiser Group PLC

- Nestle SA

- Unilever

- Amway Corp

- Abbott Laboratories

- Herbalife Nutrition

- Nutrigold Inc.

- GNC

Key Developments in North America Omega 3 Products Industry Sector

- 2023: Launch of new algal oil-based omega 3 supplements with enhanced EPA/DHA ratios, targeting vegan and vegetarian consumers.

- 2023: Increased investment in sustainable krill harvesting practices by major players to ensure long-term supply chain stability.

- 2024: Introduction of omega 3-fortified infant formula with added choline and vitamin D, responding to growing parental demand for comprehensive infant nutrition.

- 2024: Expansion of e-commerce strategies by key companies, including direct-to-consumer (DTC) sales channels and strategic partnerships with online retailers.

- 2024: Significant M&A activity within the nutraceutical sector, focusing on companies with patented technologies for omega 3 delivery systems.

Strategic North America Omega 3 Products Industry Market Outlook

The strategic outlook for the North America Omega 3 Products Industry remains exceptionally positive, driven by sustained consumer interest in health and wellness. Growth accelerators include the continued innovation in product formulations, particularly those offering superior bioavailability and targeted health benefits, such as cognitive support and immune system enhancement. The expansion of omega 3 fortification into a wider array of food and beverage products presents significant opportunities for market penetration and increased per capita consumption. Furthermore, the growing demand for ethically sourced and sustainable omega 3 products will favor companies that prioritize environmental responsibility. Strategic investments in research and development, coupled with robust marketing campaigns emphasizing the scientific backing of omega 3 benefits, will be crucial for companies aiming to capture market share and maintain a competitive edge in this dynamic industry.

North America Omega 3 Products Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Dietary Supplements

- 1.3. Infant Nutrition

- 1.4. Pet Food and Feed

- 1.5. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Grocery Retailers

- 2.2. Pharmacies and Health Stores

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

North America Omega 3 Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Omega 3 Products Industry Regional Market Share

Geographic Coverage of North America Omega 3 Products Industry

North America Omega 3 Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Omega-3 supplements can be expensive compared to other nutritional products

- 3.4. Market Trends

- 3.4.1. Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Omega 3 Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Dietary Supplements

- 5.1.3. Infant Nutrition

- 5.1.4. Pet Food and Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Grocery Retailers

- 5.2.2. Pharmacies and Health Stores

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herbalife Nutrition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nutrigold Inc.

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GNC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: North America Omega 3 Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Omega 3 Products Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Omega 3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Omega 3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Omega 3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Omega 3 Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Omega 3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Omega 3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Omega 3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Omega 3 Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Omega 3 Products Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North America Omega 3 Products Industry?

Key companies in the market include Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Nutrigold Inc., GNC.

3. What are the main segments of the North America Omega 3 Products Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources.

7. Are there any restraints impacting market growth?

Omega-3 supplements can be expensive compared to other nutritional products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Omega 3 Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Omega 3 Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Omega 3 Products Industry?

To stay informed about further developments, trends, and reports in the North America Omega 3 Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence