Key Insights

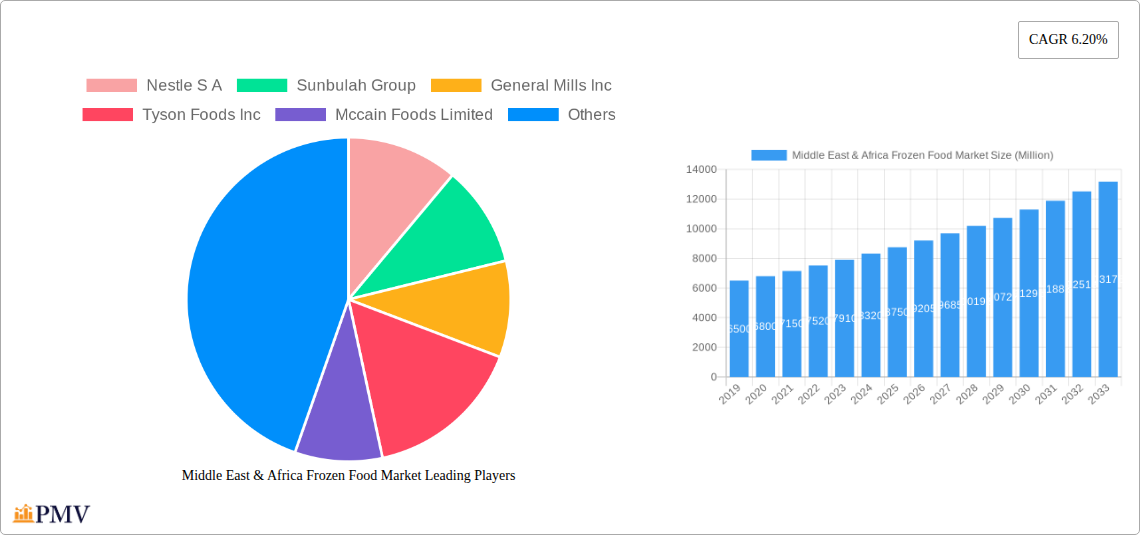

The Middle East & Africa frozen food market is poised for substantial growth, projected to reach an estimated XX million by 2025, with a robust CAGR of 6.20% anticipated over the forecast period of 2025-2033. This expansion is primarily fueled by evolving consumer lifestyles, including increasing urbanization, a growing demand for convenient meal solutions, and a rising disposable income across key regions like the United Arab Emirates, Saudi Arabia, and South Africa. The segment of frozen poultry and seafood is expected to lead the market due to its versatility and widespread consumer acceptance, followed closely by frozen prepared foods, reflecting the growing need for ready-to-eat options. E-commerce platforms are also playing an increasingly vital role, with online retailers rapidly gaining traction as a significant distribution channel, catering to the modern consumer's preference for accessibility and convenience.

Middle East & Africa Frozen Food Market Market Size (In Billion)

Furthermore, several underlying trends are shaping the market landscape. There's a noticeable shift towards healthier frozen options, with consumers actively seeking products with fewer preservatives and higher nutritional value. This includes a growing interest in plant-based frozen alternatives and organic frozen produce. However, challenges such as the need for robust cold chain infrastructure, particularly in less developed regions, and fluctuating raw material prices, could pose restraints to the market's full potential. Despite these hurdles, the inherent convenience, extended shelf life, and consistent availability of frozen foods position the market for sustained and dynamic growth, driven by innovation in product offerings and expanding distribution networks.

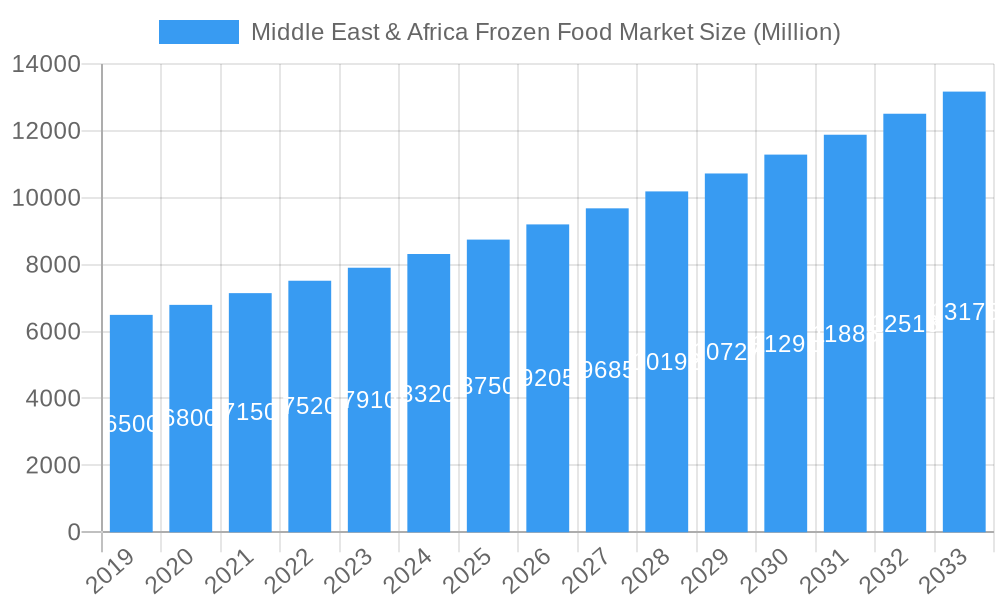

Middle East & Africa Frozen Food Market Company Market Share

This in-depth report provides an exhaustive analysis of the Middle East & Africa frozen food market. Covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this research is your definitive guide to understanding market dynamics, key trends, and future opportunities in this rapidly expanding sector. We delve into detailed segmentations, competitive landscapes, and strategic insights crucial for stakeholders, investors, and industry professionals aiming to capitalize on the burgeoning demand for frozen food in MEA. Our analysis encompasses a wide array of product types, distribution channels, and geographical footprints, making this a critical resource for informed decision-making in the frozen food industry.

Middle East & Africa Frozen Food Market Market Structure & Competitive Dynamics

The Middle East & Africa frozen food market exhibits a moderately concentrated structure, with a blend of large multinational corporations and emerging regional players vying for market share. Key market players such as Nestle S.A., Sunbulah Group, General Mills Inc., Tyson Foods Inc., McCain Foods Limited, Grupo Bimbo S.A.B. de C.V., Kerry Group, American Group Inc., Al Kabeer Group, and Kraft Heinz Company dominate significant portions of the market. Innovation ecosystems are driven by a growing emphasis on product diversification, particularly in halal frozen food, convenience-oriented frozen prepared meals, and healthier options like frozen fruits and vegetables. Regulatory frameworks are evolving, with increased scrutiny on food safety standards and labeling requirements to align with international benchmarks. Product substitutes, while present in the form of fresh and shelf-stable alternatives, are increasingly being challenged by the convenience and extended shelf-life offered by frozen options. End-user trends are leaning towards busy urban lifestyles, a burgeoning expatriate population, and increasing disposable incomes, all contributing to a higher adoption rate of convenience frozen food. Merger and acquisition (M&A) activities are anticipated to play a pivotal role in market consolidation, with projected M&A deal values expected to reach several hundred million in the coming years as companies seek to expand their geographical reach and product portfolios. Market share analysis reveals a dynamic competitive landscape, with continuous efforts to capture market dominance.

Middle East & Africa Frozen Food Market Industry Trends & Insights

The Middle East & Africa frozen food market is poised for robust growth, driven by a confluence of compelling industry trends and evolving consumer preferences. The estimated CAGR for the forecast period 2025-2033 is projected to be between 7% and 9%, indicating a strong upward trajectory for the sector. Key growth drivers include rapid urbanization across the MEA region, leading to an increase in nuclear families and dual-income households that prioritize convenience. The growing awareness regarding food safety and hygiene is also a significant factor, as consumers increasingly trust frozen food products due to their preservation methods. Technological disruptions are playing a crucial role, with advancements in freezing technology leading to improved product quality, taste, and nutritional value, thereby enhancing consumer appeal for frozen poultry and seafood, as well as frozen prepared food. The proliferation of modern retail formats, such as supermarkets/hypermarkets and the burgeoning online retail segment, is expanding access to frozen food products, further accelerating market penetration. Consumer preferences are shifting towards a wider variety of frozen snacks, frozen desserts, and value-added frozen fruits and vegetables. The increasing demand for halal-certified frozen foods specifically caters to the dominant religious demographics in the region, creating substantial market opportunities for specialized producers. The sustained increase in disposable incomes across several MEA countries also empowers consumers to opt for premium and convenient frozen food options. This dynamic interplay of economic development, technological innovation, and shifting consumer habits is shaping a highly promising future for the Middle East & Africa frozen food market, with market penetration rates expected to rise significantly across all product categories.

Dominant Markets & Segments in Middle East & Africa Frozen Food Market

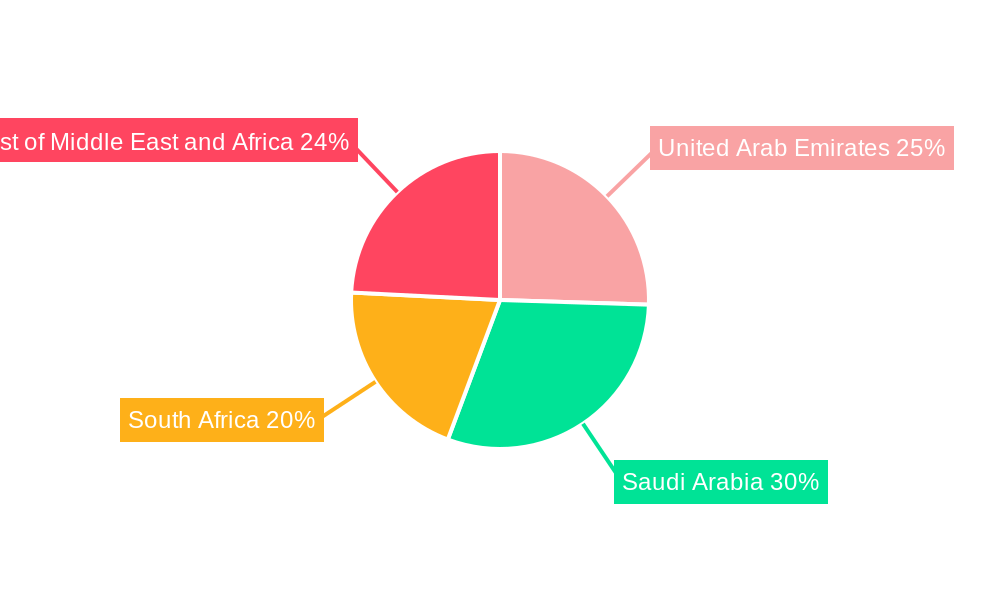

The Middle East & Africa frozen food market is characterized by distinct regional leadership and segment dominance. Saudi Arabia and the United Arab Emirates emerge as the leading geographical markets, fueled by high disposable incomes, a significant expatriate population seeking convenience, and robust retail infrastructure. The Rest of Middle-East and Africa segment, while diverse, presents substantial untapped potential, particularly in emerging economies with growing middle classes.

Dominant Product Segments:

- Frozen Poultry and Seafood: This segment holds a dominant position due to its widespread consumption, affordability, and versatility in various cuisines. Initiatives like Seara's launch of a comprehensive halal portfolio in Saudi Arabia, featuring a wide range of frozen poultry and seafood, underscore its significance.

- Frozen Prepared Food: Driven by busy lifestyles and the demand for quick meal solutions, this segment is experiencing rapid growth. Companies are increasingly focusing on introducing convenient and diverse options.

- Frozen Fruit and Vegetable: Growing health consciousness and the desire for year-round availability of produce are propelling the growth of this segment. Simplifine's expansion into frozen fresh French fries in Kenya highlights the demand for processed frozen vegetables.

Dominant Distribution Channels:

- Supermarket/Hypermarket: These channels continue to dominate due to their extensive product availability, promotions, and established consumer trust.

- Online Retailer: This segment is experiencing exponential growth, driven by the convenience of home delivery and a widening array of online frozen food offerings.

- Grocery Stores: While traditional, these remain vital, particularly in less urbanized areas, providing accessibility to a basic range of frozen products.

Key Drivers of Dominance:

- Economic Policies: Favorable import policies and government initiatives promoting food security contribute to market growth.

- Infrastructure Development: Improved cold chain logistics and transportation networks are crucial for the efficient distribution of frozen foods.

- Consumer Demographics: A young, urbanizing population with increasing purchasing power is a key driver for convenient food solutions.

- Cultural Acceptance: Growing acceptance of frozen foods as a safe and convenient alternative to fresh produce.

Middle East & Africa Frozen Food Market Product Innovations

Product innovation in the Middle East & Africa frozen food market is rapidly evolving, driven by consumer demand for convenience, health, and diverse culinary experiences. Companies are increasingly focusing on developing value-added frozen prepared foods and frozen snacks that require minimal preparation time. A significant trend is the expansion of halal-certified frozen food options, catering to the region's religious and cultural preferences, as exemplified by Al Islami Foods' foray into frozen paratha. Furthermore, the market is witnessing a rise in the availability of frozen fruits and vegetables that retain their nutritional value and taste, appealing to health-conscious consumers. Technological advancements in packaging and freezing techniques are enhancing the shelf-life and quality of frozen products, thereby building consumer confidence. Competitive advantages are being carved out through product differentiation, offering unique flavors, catering to specific dietary needs (e.g., gluten-free, organic), and ensuring consistent product quality.

Report Segmentation & Scope

The Middle East & Africa frozen food market is segmented comprehensively to provide granular insights. The report covers Product Type including Frozen Fruit and Vegetable, Frozen Poultry and Seafood, Frozen Prepared Food, Frozen Dessert, Frozen Snack, and Others. Each category is analyzed for its market size, growth projections, and competitive dynamics. The Distribution Channel segmentation encompasses Supermarket/Hypermarket, Grocery Stores, Convenience Store, Online Retailer, and Others, detailing market share and penetration rates for each. Geographically, the market is divided into key regions: United Arab Emirates, Saudi Arabia, South Africa, and the Rest of Middle-East and Africa. Growth projections and market sizes for these sub-regions are meticulously detailed, offering a holistic view of regional opportunities and challenges within the frozen food industry across MEA.

Key Drivers of Middle East & Africa Frozen Food Market Growth

Several key factors are propelling the growth of the Middle East & Africa frozen food market. The increasing urbanization and changing lifestyles, characterized by busy schedules and dual-income households, are creating a strong demand for convenient food solutions. This trend is amplified by a growing expatriate population that is accustomed to and seeks out frozen food options. Furthermore, rising disposable incomes across many MEA nations are enabling consumers to spend more on convenient and premium food products. Technological advancements in freezing and packaging technologies are enhancing the quality, safety, and shelf-life of frozen foods, thereby building consumer trust and acceptance. The expansion of modern retail infrastructure, including supermarkets, hypermarkets, and especially the rapidly growing online retail sector, is significantly improving the accessibility of frozen food products across the region. Finally, a strong emphasis on food safety and hygiene standards, coupled with an increasing demand for a wider variety of food options, further fuels the growth of this dynamic market.

Challenges in the Middle East & Africa Frozen Food Market Sector

Despite the robust growth prospects, the Middle East & Africa frozen food market faces several challenges. A significant hurdle remains the inadequate cold chain infrastructure in certain parts of the region, leading to potential spoilage and affecting product quality, which can impact consumer confidence. Fluctuations in energy prices can also impact the operational costs for freezing and transportation, affecting profitability. Stringent and varied regulatory landscapes across different countries can create complexities for market entry and expansion, particularly concerning import regulations and food safety certifications. Furthermore, a degree of consumer skepticism towards frozen food, stemming from perceptions of reduced nutritional value or taste compared to fresh alternatives, persists in some segments, requiring sustained educational efforts and product quality improvements. Intense price competition from both local and international players can also put pressure on profit margins.

Leading Players in the Middle East & Africa Frozen Food Market Market

- Nestle S.A.

- Sunbulah Group

- General Mills Inc.

- Tyson Foods Inc.

- McCain Foods Limited

- Grupo Bimbo S.A.B. de C.V.

- Kerry Group

- American Group Inc.

- Al Kabeer Group

- Kraft Heinz Company

Key Developments in Middle East & Africa Frozen Food Market Sector

- August 2022: Seara, a Brazilian food brand, launched its complete halal portfolio in Saudi Arabia, comprising 120 frozen food products, including frozen whole chicken, chicken parts, breaded chicken, chicken and beef burgers, minced meats, sausages, meatballs, frozen vegetables, frozen seafood, and frozen fruits. This move significantly expands the halal frozen food offerings in the Saudi market.

- March 2021: United Arab Emirates-based producer of frozen halal products Al Islami Foods unveiled a new dough category, starting with frozen paratha, as it looks to expand the availability, variety, and visibility of the brand. This innovation caters to the growing demand for convenient and culturally relevant frozen food products.

- January 2022: Simplifine, a food processing company, expanded its product portfolio by launching a production line of frozen fresh French fries in Kenya. This expansion addresses the increasing demand for convenient and ready-to-cook food options in the East African market.

Strategic Middle East & Africa Frozen Food Market Market Outlook

The strategic outlook for the Middle East & Africa frozen food market is exceptionally promising, driven by sustained demographic shifts, economic development, and evolving consumer habits. Future growth accelerators include further penetration of online retail channels, which offer unparalleled convenience and reach. Investments in enhancing cold chain logistics and infrastructure will be crucial to overcoming existing challenges and ensuring product integrity, thereby boosting consumer trust. The continued emphasis on halal frozen food product innovation and expansion will cater to the core market demographics. Companies that can effectively leverage technological advancements in product development, focusing on health, convenience, and diverse culinary experiences, will be well-positioned for success. Furthermore, strategic partnerships and potential M&A activities will shape the competitive landscape, offering opportunities for market consolidation and expansion into untapped territories within the broader frozen food market. The region's young population and increasing disposable incomes present a fertile ground for the sustained growth of the frozen food industry in the coming years.

Middle East & Africa Frozen Food Market Segmentation

-

1. Product Type

- 1.1. Frozen Fruit and Vegetable

- 1.2. Frozen Poultry and Seafood

- 1.3. Frozen Prepared Food

- 1.4. Frozen Dessert

- 1.5. Frozen Snack

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Grocery Stores

- 2.3. Convenience Store

- 2.4. Online Retailer

- 2.5. Others

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Rest of Middle-East and Africa

Middle East & Africa Frozen Food Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East & Africa Frozen Food Market Regional Market Share

Geographic Coverage of Middle East & Africa Frozen Food Market

Middle East & Africa Frozen Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Fruit and Vegetable

- 5.1.2. Frozen Poultry and Seafood

- 5.1.3. Frozen Prepared Food

- 5.1.4. Frozen Dessert

- 5.1.5. Frozen Snack

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Grocery Stores

- 5.2.3. Convenience Store

- 5.2.4. Online Retailer

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Arab Emirates Middle East & Africa Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Frozen Fruit and Vegetable

- 6.1.2. Frozen Poultry and Seafood

- 6.1.3. Frozen Prepared Food

- 6.1.4. Frozen Dessert

- 6.1.5. Frozen Snack

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Grocery Stores

- 6.2.3. Convenience Store

- 6.2.4. Online Retailer

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East & Africa Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Frozen Fruit and Vegetable

- 7.1.2. Frozen Poultry and Seafood

- 7.1.3. Frozen Prepared Food

- 7.1.4. Frozen Dessert

- 7.1.5. Frozen Snack

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Grocery Stores

- 7.2.3. Convenience Store

- 7.2.4. Online Retailer

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa Middle East & Africa Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Frozen Fruit and Vegetable

- 8.1.2. Frozen Poultry and Seafood

- 8.1.3. Frozen Prepared Food

- 8.1.4. Frozen Dessert

- 8.1.5. Frozen Snack

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Grocery Stores

- 8.2.3. Convenience Store

- 8.2.4. Online Retailer

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East & Africa Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Frozen Fruit and Vegetable

- 9.1.2. Frozen Poultry and Seafood

- 9.1.3. Frozen Prepared Food

- 9.1.4. Frozen Dessert

- 9.1.5. Frozen Snack

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Grocery Stores

- 9.2.3. Convenience Store

- 9.2.4. Online Retailer

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sunbulah Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tyson Foods Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mccain Foods Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Grupo Bimbo S A B De C V*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 American Group Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Al Kabeer Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kraft Heinz Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestle S A

List of Figures

- Figure 1: Middle East & Africa Frozen Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Frozen Food Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East & Africa Frozen Food Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Frozen Food Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Middle East & Africa Frozen Food Market?

Key companies in the market include Nestle S A, Sunbulah Group, General Mills Inc, Tyson Foods Inc, Mccain Foods Limited, Grupo Bimbo S A B De C V*List Not Exhaustive, Kerry Group, American Group Inc, Al Kabeer Group, Kraft Heinz Company.

3. What are the main segments of the Middle East & Africa Frozen Food Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

In August 2022, Seara, a Brazilian food brand launched its complete halal portfolio in Saudi Arabia. The portfolio comprises 120 frozen food products, including frozen whole chicken, chicken parts, breaded chicken, chicken and beef burgers, minced meats, sausages, meatballs, frozen vegetables, frozen seafood, and frozen fruits, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Frozen Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Frozen Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Frozen Food Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Frozen Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence