Key Insights

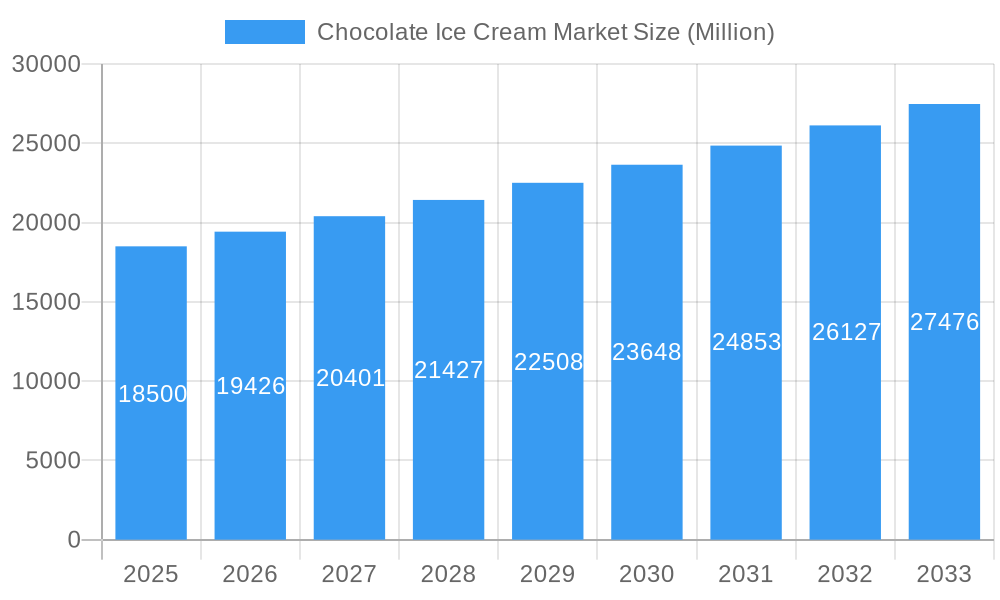

The global Chocolate Ice Cream Market is poised for robust growth, projected to reach a substantial market size of approximately $18,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.87% through 2033. This expansion is significantly driven by evolving consumer preferences towards premium and indulgent dessert experiences, with chocolate ice cream consistently ranking as a top choice. The increasing demand for artisanal and gourmet chocolate ice cream varieties, featuring unique flavor combinations and high-quality ingredients, is a key growth catalyst. Furthermore, the surge in non-dairy alternatives, catering to health-conscious consumers and those with dietary restrictions, is creating new avenues for market penetration. Innovations in product development, including the introduction of low-sugar and organic options, are also fueling market dynamism. The market is benefiting from diversified distribution channels, with specialist retailers, hypermarkets/supermarkets, and online retail stores playing crucial roles in ensuring product accessibility and convenience for a wider consumer base. The influence of social media and celebrity endorsements further amplifies consumer interest and drives purchasing decisions, especially among younger demographics.

Chocolate Ice Cream Market Market Size (In Billion)

The market landscape is characterized by intense competition among major players like Wells Enterprises Inc. (Halo Top), Inspire Brands Inc., General Mills Inc., and Nestlé S.A., who are actively engaged in product innovation and strategic collaborations to capture market share. Key trends include the growing popularity of dark chocolate and white chocolate variants, alongside the integration of superfoods and functional ingredients. However, the market faces certain restraints, such as rising raw material costs, particularly for cocoa and dairy, which can impact profit margins. Stringent regulations regarding food safety and labeling in various regions also present a compliance challenge for manufacturers. Despite these challenges, the overall outlook for the chocolate ice cream market remains highly positive, with continuous innovation and a strong consumer appetite for this beloved treat expected to propel its sustained growth across diverse market segments and geographical regions. Europe is anticipated to be a significant contributor, with Germany, the United Kingdom, and France leading the demand.

Chocolate Ice Cream Market Company Market Share

Dive deep into the dynamic Chocolate Ice Cream Market with this comprehensive, SEO-optimized report. Covering the historical period of 2019–2024 and a robust forecast extending to 2033, this analysis provides unparalleled insights into market structure, industry trends, dominant segments, and key players. Leveraging cutting-edge data and expert analysis, this report is essential for stakeholders seeking to capitalize on the burgeoning global demand for premium and diverse chocolate ice cream offerings. The estimated market value for 2025 is projected to be XX Million USD, with a projected Compound Annual Growth Rate (CAGR) of X.XX% during the forecast period.

Chocolate Ice Cream Market Market Structure & Competitive Dynamics

The global Chocolate Ice Cream Market exhibits a moderately consolidated structure, with leading players like Nestlé S.A., Unilever PLC, and Mars Incorporated holding significant market share, estimated to be above XX%. Innovation ecosystems are vibrant, driven by a constant influx of new product launches and evolving consumer preferences for healthier and more indulgent options. Regulatory frameworks primarily revolve around food safety standards and ingredient labeling, with minimal impact on overall market growth. Product substitutes, such as frozen yogurt and other frozen desserts, present a competitive challenge, though the inherent appeal of chocolate ice cream remains strong. End-user trends showcase a clear inclination towards premiumization, vegan alternatives, and novel flavor profiles, significantly influencing product development strategies. Mergers and Acquisitions (M&A) activities, though moderate, are strategically focused on expanding geographic reach and acquiring innovative brands, with estimated deal values reaching up to XX Million USD in recent years, further shaping market concentration.

Chocolate Ice Cream Market Industry Trends & Insights

The Chocolate Ice Cream Market is experiencing robust growth, propelled by several key industry trends and insights. A primary growth driver is the increasing disposable income in emerging economies, leading to a greater demand for premium and indulgent food products like high-quality chocolate ice cream. The rising global popularity of chocolate as a flavor across all food categories directly translates to its dominance in the ice cream segment. Furthermore, a significant surge in the non-dairy chocolate ice cream segment, driven by a growing vegan and lactose-intolerant population, is reshaping market dynamics. Technological disruptions, such as advancements in freezing technology and ingredient sourcing, are enabling manufacturers to develop innovative textures and flavors, catering to a wider consumer base. Consumer preferences are rapidly evolving, with a demand for artisanal, sustainably sourced, and ethically produced chocolate ice cream. This includes a growing interest in exotic chocolate varieties and unique flavor pairings. The competitive landscape is characterized by intense product innovation and strategic marketing campaigns, with companies like Wells Enterprises Inc (Halo Top) focusing on low-calorie options and Jude's emphasizing natural ingredients. The market penetration of premium chocolate ice cream is steadily increasing, indicating a shift towards value-added products. The CAGR for the global Chocolate Ice Cream Market is projected to be X.XX% during the forecast period 2025–2033, reflecting a healthy and sustained expansion. The estimated market size for 2025 is XX Million USD.

Dominant Markets & Segments in Chocolate Ice Cream Market

The Chocolate Ice Cream Market displays distinct dominance across various regions and segments, driven by economic, cultural, and infrastructural factors.

- Leading Region: North America, particularly the United States, currently dominates the Chocolate Ice Cream Market. This is attributed to high consumer spending power, a well-established retail infrastructure, and a strong tradition of ice cream consumption. Economic policies that support the food and beverage industry and well-developed supply chain networks further bolster its leadership.

- Dominant Product Type: Take-home Ice Cream holds the largest market share within product types. This segment benefits from its accessibility and suitability for family consumption and social gatherings. The convenience of purchasing larger formats for home consumption makes it a perennial favorite.

- Dominant Category: Dairy Chocolate Ice Cream continues to lead the category segment, owing to its traditional appeal, creamy texture, and widespread availability. However, the Non-dairy segment is experiencing accelerated growth, driven by health consciousness and dietary preferences.

- Dominant Distribution Channel: Off-trade channels, specifically Hypermarkets/Supermarkets, command the largest share in the distribution of chocolate ice cream. These outlets offer a wide selection, competitive pricing, and convenient shopping experiences for consumers. Online retail stores are rapidly gaining traction, reflecting the evolving purchasing habits of consumers.

Chocolate Ice Cream Market Product Innovations

Product innovations in the Chocolate Ice Cream Market are primarily focused on catering to evolving consumer demands for healthier, more indulgent, and ethically sourced options. Recent developments include the expansion of vegan and plant-based chocolate ice cream lines, utilizing ingredients like pea protein and oat milk to achieve desirable textures and flavors. Manufacturers are also experimenting with premium chocolate varieties, such as single-origin and ethically sourced cocoa, to appeal to discerning palates. Innovations in texture, such as multi-layered or inclusion-rich ice creams, are enhancing the sensory experience. These innovations provide a competitive advantage by differentiating products and tapping into niche market segments.

Report Segmentation & Scope

This report segments the Chocolate Ice Cream Market comprehensively across key categories to provide granular insights.

- Product Type: The market is analyzed by Artisanal Ice Cream, Impulse Ice Cream, and Take-home Ice Cream. Artisanal ice cream, though smaller in volume, demonstrates high growth potential due to its premium positioning and unique flavor profiles. Take-home ice cream is expected to maintain its dominant market share throughout the forecast period.

- Category: The analysis includes both Dairy and Non-dairy ice cream categories. The non-dairy segment is projected to witness the highest CAGR, driven by increasing veganism and lactose intolerance.

- Distribution Channel: The market is segmented into On-trade and Off-trade channels, with further sub-segmentation of off-trade into Specialist Retailers, Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channels. Hypermarkets/Supermarkets are expected to retain their significant market share, while online retail stores are poised for substantial growth.

Key Drivers of Chocolate Ice Cream Market Growth

The Chocolate Ice Cream Market is propelled by several significant growth drivers. The increasing global demand for premium and indulgent food products, coupled with rising disposable incomes, is a primary catalyst. The inherent popularity and versatility of chocolate as a flavor ensure its continued dominance in the ice cream sector. A key emerging driver is the substantial growth in the non-dairy ice cream segment, fueled by the rising vegan population and increasing awareness of lactose intolerance. Technological advancements in production processes and ingredient formulation enable manufacturers to create innovative textures and flavors, appealing to a broader consumer base. Furthermore, effective marketing strategies and the introduction of new product variants by key players contribute significantly to market expansion.

Challenges in the Chocolate Ice Cream Market Sector

Despite its robust growth, the Chocolate Ice Cream Market faces certain challenges. Fluctuations in the price and availability of raw materials, particularly cocoa beans, can impact production costs and profit margins. Stringent regulatory requirements related to food safety, ingredient sourcing, and labeling in different regions can pose compliance hurdles for manufacturers. Intense competition among established brands and the emergence of smaller artisanal producers lead to price pressures and the need for continuous product innovation. Furthermore, the growing consumer consciousness regarding health and wellness necessitates the development of lower-sugar and healthier variants, which can be challenging to achieve without compromising taste and texture. Supply chain disruptions due to geopolitical factors or natural disasters can also affect market stability.

Leading Players in the Chocolate Ice Cream Market Market

- Wells Enterprises Inc (Halo Top)

- Inspire Brands Inc

- General Mills Inc

- Jude's

- Unilever PLC

- Lotus Bakeries Corporate

- Mars Incorporated

- Mondelez International Inc

- Lotte Corporation

- Nestlé S A

Key Developments in Chocolate Ice Cream Market Sector

- August 2022: Jude's Plant-Based Mint Chocolate, a new vegan ice cream flavor, was launched in a partnership between United Kingdom ice cream brand Jude's and peppermint chocolate manufacturer Summerdown. This development highlights the growing trend of plant-based alternatives and strategic collaborations.

- January 2022: Unilever's Magnum brand started a vegan range of bite-sized ice creams. These ice creams are prepared with pea protein, catering to the inclination of consumers toward veganism and expanding Unilever's vegan portfolio.

- June 2021: Häagen-Dazs launched its multi-textured two-in-one ice creams in Belgian Chocolate & Vanilla Crunch, Dark Chocolate & Salted Caramel Crunch, and Belgian Chocolate & Strawberry flavors in the United Kingdom. The innovative concept includes redesigned breakthrough packaging for greater retail impact, as well as an accessible and simplified pricing point that is consistent with the brand's core range, showcasing a focus on product innovation and consumer experience.

Strategic Chocolate Ice Cream Market Market Outlook

The strategic outlook for the Chocolate Ice Cream Market is highly optimistic, driven by sustained consumer demand and ongoing innovation. Future growth accelerators include the continued expansion of the non-dairy chocolate ice cream segment, driven by evolving dietary trends and increased availability of plant-based ingredients. Opportunities lie in tapping into niche markets through premiumization, focusing on sustainable and ethically sourced ingredients, and developing unique flavor combinations. The increasing adoption of e-commerce for grocery shopping will further boost the online retail segment. Strategic partnerships and collaborations, similar to those observed in recent developments, will play a crucial role in market penetration and product development. Investments in advanced manufacturing technologies will enhance efficiency and product quality, ensuring the market's continued dynamism and profitability.

Chocolate Ice Cream Market Segmentation

-

1. Product Type

- 1.1. Artisanal Ice Cream

- 1.2. Impulse Ice Cream

- 1.3. Take-home Ice Cream

-

2. Category

- 2.1. Dairy

- 2.2. Non-dairy

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Specialist Retailers

- 3.2.2. Hypermarkets/Supermarkets

- 3.2.3. Convenience Stores

- 3.2.4. Online Retail Stores

- 3.2.5. Other Distribution Channels

Chocolate Ice Cream Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Chocolate Ice Cream Market Regional Market Share

Geographic Coverage of Chocolate Ice Cream Market

Chocolate Ice Cream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Wider distribution through supermarkets

- 3.2.2 convenience stores

- 3.2.3 and online platforms increases accessibility and convenience for consumers

- 3.3. Market Restrains

- 3.3.1. Rising health consciousness among consumers can limit consumption due to concerns about sugar and fat content

- 3.4. Market Trends

- 3.4.1. Rising Demand for Healthy Ice Creams

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Artisanal Ice Cream

- 5.1.2. Impulse Ice Cream

- 5.1.3. Take-home Ice Cream

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Dairy

- 5.2.2. Non-dairy

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Specialist Retailers

- 5.3.2.2. Hypermarkets/Supermarkets

- 5.3.2.3. Convenience Stores

- 5.3.2.4. Online Retail Stores

- 5.3.2.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Russia

- 5.4.5. Spain

- 5.4.6. Italy

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Artisanal Ice Cream

- 6.1.2. Impulse Ice Cream

- 6.1.3. Take-home Ice Cream

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Dairy

- 6.2.2. Non-dairy

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Specialist Retailers

- 6.3.2.2. Hypermarkets/Supermarkets

- 6.3.2.3. Convenience Stores

- 6.3.2.4. Online Retail Stores

- 6.3.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Artisanal Ice Cream

- 7.1.2. Impulse Ice Cream

- 7.1.3. Take-home Ice Cream

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Dairy

- 7.2.2. Non-dairy

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Specialist Retailers

- 7.3.2.2. Hypermarkets/Supermarkets

- 7.3.2.3. Convenience Stores

- 7.3.2.4. Online Retail Stores

- 7.3.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Artisanal Ice Cream

- 8.1.2. Impulse Ice Cream

- 8.1.3. Take-home Ice Cream

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Dairy

- 8.2.2. Non-dairy

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Specialist Retailers

- 8.3.2.2. Hypermarkets/Supermarkets

- 8.3.2.3. Convenience Stores

- 8.3.2.4. Online Retail Stores

- 8.3.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Artisanal Ice Cream

- 9.1.2. Impulse Ice Cream

- 9.1.3. Take-home Ice Cream

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Dairy

- 9.2.2. Non-dairy

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade

- 9.3.2. Off-trade

- 9.3.2.1. Specialist Retailers

- 9.3.2.2. Hypermarkets/Supermarkets

- 9.3.2.3. Convenience Stores

- 9.3.2.4. Online Retail Stores

- 9.3.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Artisanal Ice Cream

- 10.1.2. Impulse Ice Cream

- 10.1.3. Take-home Ice Cream

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Dairy

- 10.2.2. Non-dairy

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade

- 10.3.2. Off-trade

- 10.3.2.1. Specialist Retailers

- 10.3.2.2. Hypermarkets/Supermarkets

- 10.3.2.3. Convenience Stores

- 10.3.2.4. Online Retail Stores

- 10.3.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Artisanal Ice Cream

- 11.1.2. Impulse Ice Cream

- 11.1.3. Take-home Ice Cream

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Dairy

- 11.2.2. Non-dairy

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-trade

- 11.3.2. Off-trade

- 11.3.2.1. Specialist Retailers

- 11.3.2.2. Hypermarkets/Supermarkets

- 11.3.2.3. Convenience Stores

- 11.3.2.4. Online Retail Stores

- 11.3.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Chocolate Ice Cream Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Artisanal Ice Cream

- 12.1.2. Impulse Ice Cream

- 12.1.3. Take-home Ice Cream

- 12.2. Market Analysis, Insights and Forecast - by Category

- 12.2.1. Dairy

- 12.2.2. Non-dairy

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. On-trade

- 12.3.2. Off-trade

- 12.3.2.1. Specialist Retailers

- 12.3.2.2. Hypermarkets/Supermarkets

- 12.3.2.3. Convenience Stores

- 12.3.2.4. Online Retail Stores

- 12.3.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Wells Enterprises Inc (Halo Top)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Inspire Brands Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Mills Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Jude's

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unilever PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lotus Bakeries Corporate

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mars Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mondelez International Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lotte Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nestlé S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Wells Enterprises Inc (Halo Top)

List of Figures

- Figure 1: Chocolate Ice Cream Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chocolate Ice Cream Market Share (%) by Company 2025

List of Tables

- Table 1: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Chocolate Ice Cream Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 11: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 15: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 19: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 23: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 27: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Chocolate Ice Cream Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Chocolate Ice Cream Market Revenue Million Forecast, by Category 2020 & 2033

- Table 31: Chocolate Ice Cream Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 32: Chocolate Ice Cream Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chocolate Ice Cream Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Chocolate Ice Cream Market?

Key companies in the market include Wells Enterprises Inc (Halo Top), Inspire Brands Inc, General Mills Inc, Jude's, Unilever PLC, Lotus Bakeries Corporate, Mars Incorporated, Mondelez International Inc, Lotte Corporation, Nestlé S A.

3. What are the main segments of the Chocolate Ice Cream Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wider distribution through supermarkets. convenience stores. and online platforms increases accessibility and convenience for consumers.

6. What are the notable trends driving market growth?

Rising Demand for Healthy Ice Creams.

7. Are there any restraints impacting market growth?

Rising health consciousness among consumers can limit consumption due to concerns about sugar and fat content.

8. Can you provide examples of recent developments in the market?

In August 2022, Jude's Plant-Based Mint Chocolate, a new vegan ice cream flavor, was launched in a partnership between United Kingdom ice cream brand Jude's and peppermint chocolate manufacturer Summerdown.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chocolate Ice Cream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chocolate Ice Cream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chocolate Ice Cream Market?

To stay informed about further developments, trends, and reports in the Chocolate Ice Cream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence