Key Insights

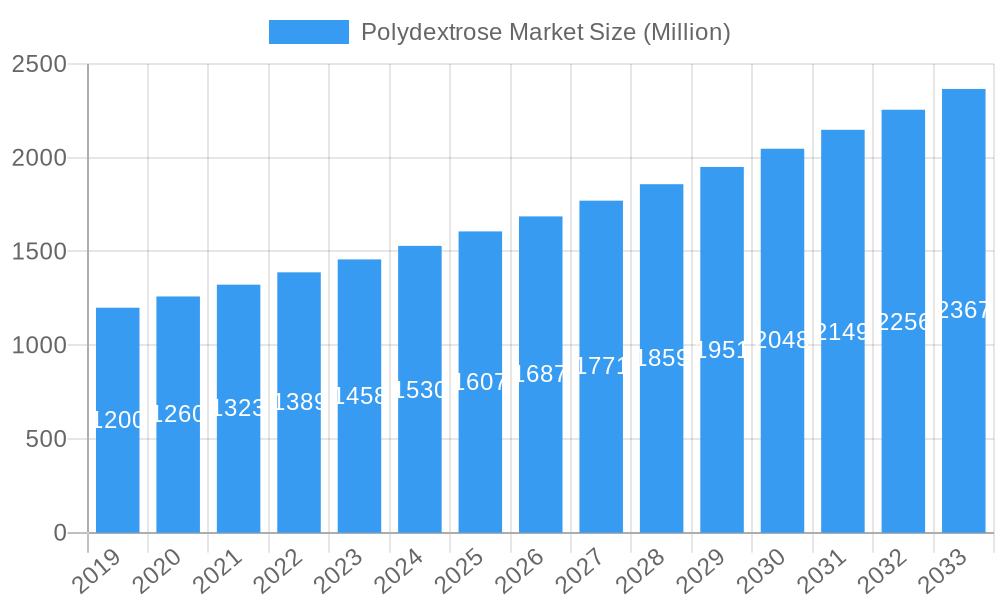

The global Polydextrose market is poised for significant expansion, projected to reach USD 154 million by 2025, driven by a projected CAGR of 5.8%. This growth is primarily attributed to increasing consumer preference for healthier food options and the recognized versatility of polydextrose as a functional dietary fiber and bulking agent. Key applications fueling this trend include the Bakery and Confectionery sector, where it improves texture and enables sugar reduction, and the Beverages industry, offering a low-calorie sweetening solution. The Yogurts and Dairy Products segment also presents substantial opportunities as manufacturers focus on enhancing product nutritional value. While Powder polydextrose currently leads due to its ease of incorporation, the Liquid form is gaining traction for specialized uses, indicating a dynamic market.

Polydextrose Market Market Size (In Million)

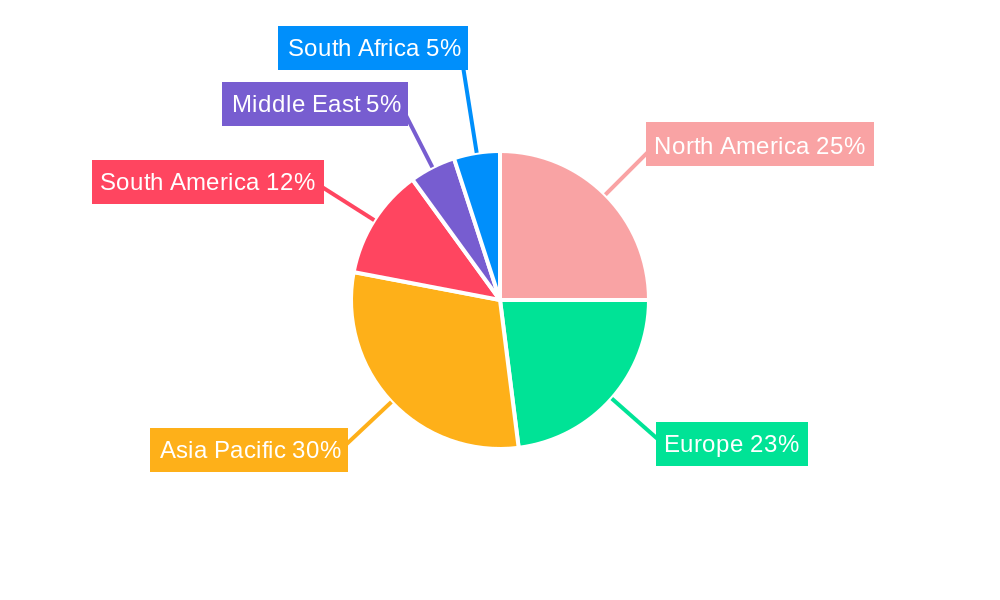

Market growth is further bolstered by continuous innovation in food and beverage product development leveraging polydextrose's functional attributes. Leading companies such as Dupont Nutrition & Health, Tate & Lyle, and CJ CheilJedang Corp are actively investing in R&D, expanding production, and forming strategic alliances to secure market positions. Potential challenges include raw material price volatility and the ongoing need for consumer education regarding its health benefits. Geographically, Asia Pacific is anticipated to be a major growth engine, supported by its large population and rising disposable incomes, complementing mature markets in North America and Europe. The forecast period from 2025 to 2033 is expected to show sustained market growth, highlighting polydextrose's critical role in the evolving food industry.

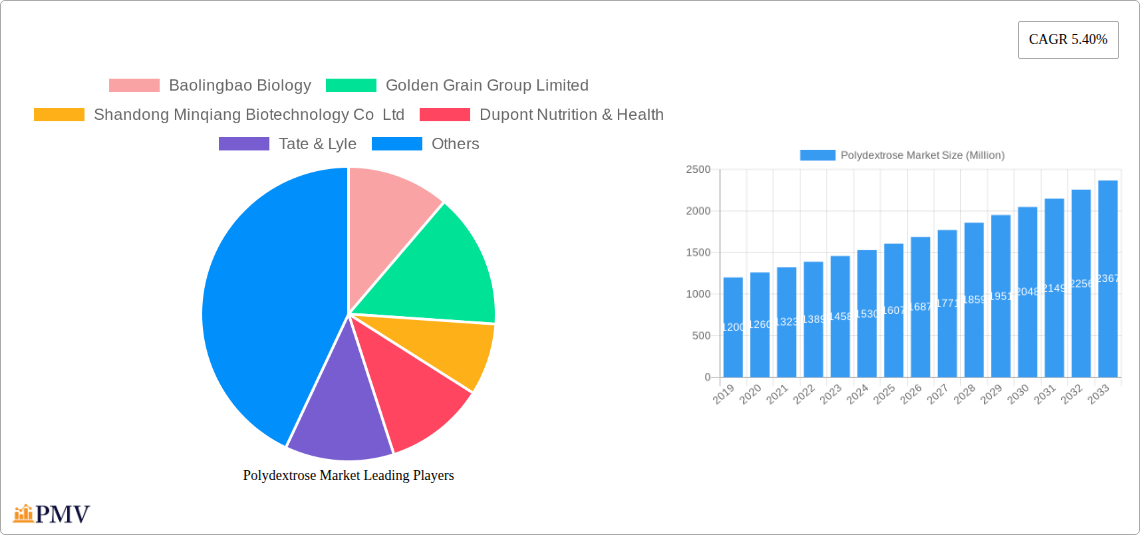

Polydextrose Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Polydextrose Market, an essential ingredient driving innovation in the food and beverage sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast to 2033, this study provides actionable market intelligence. It examines market structure, industry trends, dominant segments, product innovations, growth drivers, challenges, key players, strategic developments, and an outlook for the market. Gain valuable insights into this rapidly expanding market.

Polydextrose Market Market Structure & Competitive Dynamics

The Polydextrose Market exhibits a moderately consolidated structure, characterized by the strategic presence of key global manufacturers and a growing number of regional players. Innovation ecosystems are thriving, fueled by continuous research and development focused on enhancing polydextrose's functional properties and expanding its application spectrum. Regulatory frameworks, particularly concerning food safety and labeling in major consumption hubs like North America and Europe, play a significant role in shaping market entry and product development strategies. Product substitutes, such as inulin, fructans, and other dietary fibers, pose a competitive challenge, necessitating continuous differentiation through superior quality, cost-effectiveness, and tailored functionalities. End-user trends lean towards demand for healthier, low-calorie, and sugar-free food and beverage options, directly boosting polydextrose consumption. Mergers and acquisitions (M&A) activities, while not dominant, are observed as companies seek to expand their geographical reach, product portfolios, or technological capabilities. For instance, acquisitions aimed at integrating specialized production techniques or gaining access to emerging markets are strategic maneuvers. Market share is largely distributed among the top players, with a competitive landscape driven by product quality, pricing strategies, and established distribution networks. The overall market concentration is balanced by the emergence of niche players catering to specific application requirements.

- Market Concentration: Moderate, with a few global leaders and a rising number of regional participants.

- Innovation Ecosystems: Active R&D for functional enhancements and new applications.

- Regulatory Frameworks: Stringent food safety and labeling regulations influencing market dynamics.

- Product Substitutes: Inulin, fructans, and other dietary fibers present competition.

- End-User Trends: Growing demand for low-calorie, sugar-free, and healthier food options.

- M&A Activities: Strategic acquisitions for market expansion and technological advancement.

Polydextrose Market Industry Trends & Insights

The global Polydextrose Market is experiencing robust growth, driven by a confluence of factors propelling its adoption across diverse food and beverage applications. The escalating global health consciousness, coupled with an increasing prevalence of lifestyle diseases such as obesity and diabetes, has fueled a significant shift in consumer preferences towards healthier food alternatives. This trend directly benefits polydextrose, a versatile soluble dietary fiber known for its low caloric value, prebiotic properties, and ability to reduce sugar and fat content in food products without compromising taste and texture. The market’s Compound Annual Growth Rate (CAGR) is projected to remain strong throughout the forecast period, reflecting sustained demand from evolving consumer lifestyles and dietary habits. Technological disruptions are playing a pivotal role, with advancements in enzymatic synthesis and fermentation processes leading to more efficient and cost-effective production of high-quality polydextrose. These innovations enhance its functionality, such as improved solubility, viscosity, and stability under various processing conditions, making it a preferred ingredient for food manufacturers. Furthermore, the growing awareness of the gut health benefits associated with dietary fiber intake is a major market penetrator. Polydextrose, acting as a prebiotic, supports the growth of beneficial gut bacteria, contributing to improved digestive health, which is a key consumer concern. The food and beverage industry's ongoing quest for clean-label ingredients and sugar reduction strategies further strengthens the market position of polydextrose. Manufacturers are increasingly reformulating products to meet consumer demand for less sugar and more fiber, making polydextrose an indispensable tool in their arsenal. The competitive dynamics are characterized by product differentiation based on purity, functional attributes, and application-specific grades. Leading companies are investing in expanding their production capacities and geographical reach to cater to the burgeoning demand from emerging economies. The regulatory landscape, while sometimes posing challenges, also provides opportunities for compliant and innovative product development. The ongoing dialogue around the health benefits of dietary fiber continues to shape consumer perception and drive market penetration. The market penetration is expected to deepen as more countries adopt dietary guidelines recommending increased fiber intake.

Dominant Markets & Segments in Polydextrose Market

The Polydextrose Market demonstrates significant regional and segmental dominance, driven by distinct consumer behaviors, regulatory environments, and industry structures.

Dominant Region: North America North America currently leads the global Polydextrose Market. This dominance is attributed to several key factors:

- High Consumer Health Consciousness: A well-established and growing awareness among consumers regarding the benefits of low-calorie, high-fiber, and sugar-reduced food products. This translates into substantial demand for polydextrose in various food and beverage categories.

- Advanced Food Processing Industry: The region boasts a highly developed food and beverage manufacturing sector with a strong inclination towards adopting innovative ingredients to meet evolving consumer preferences.

- Stringent Regulatory Landscape Promoting Health: While regulations are strict, they often align with the promotion of healthier food choices, inadvertently favoring ingredients like polydextrose that aid in sugar and calorie reduction.

- Economic Policies Supporting Health & Wellness: Government initiatives and private sector investments often focus on promoting healthier lifestyles and food options, creating a fertile ground for polydextrose.

- Strong Presence of Major Food Manufacturers: The presence of large, multinational food corporations that are actively reformulating products with health-conscious ingredients.

Dominant Segment: Application Within the application segment, Bakery and Confectionery stands out as the most significant contributor to the Polydextrose Market.

- Versatility in Baking: Polydextrose serves as an excellent bulking agent, sugar replacer, and fiber enhancer in baked goods like cakes, cookies, bread, and pastries, offering improved texture and moisture retention while reducing sugar and calories.

- Sugar Reduction in Confectionery: The confectionery industry heavily relies on polydextrose to create sugar-free or reduced-sugar candies, chocolates, and chewing gum, catering to a broad consumer base seeking guilt-free indulgence. The demand for diabetic-friendly and low-glycemic index confectioneries further fuels this segment.

- Impact of Economic Policies: Favorable economic policies encouraging the production and consumption of healthier food options directly benefit this segment.

- Consumer Preferences: A persistent demand for confectionery and baked goods, coupled with a growing preference for healthier versions, makes this segment a powerhouse for polydextrose.

Dominant Segment: Form The Powder form of polydextrose dominates the market.

- Ease of Handling and Incorporation: The powder form is highly versatile and easy to incorporate into dry mixes, batters, doughs, and various food formulations. Its stability and shelf-life are also advantageous for manufacturers.

- Widespread Use in Dry Products: This form is ideal for powdered beverage mixes, instant cereals, protein powders, and dry dessert mixes, where it functions as a bulking agent, texturizer, and fiber source.

- Logistical Advantages: Powdered ingredients often offer logistical benefits in terms of storage, transportation, and reduced spoilage compared to liquid forms.

- Application in Bakery and Confectionery: The powder form's suitability for the dominant Bakery and Confectionery application further solidifies its market leadership.

Secondary Dominant Segments:

- Yogurts and Dairy Products: Polydextrose is increasingly used in yogurts, dairy-based desserts, and flavored milk to increase fiber content, reduce sugar, and improve mouthfeel. The growing popularity of functional dairy products supports this segment.

- Beverages: In the beverage sector, polydextrose is utilized in functional drinks, juices, and sports drinks to enhance fiber content and act as a sugar substitute, catering to the demand for healthier hydration options.

Polydextrose Market Product Innovations

Product innovations in the Polydextrose Market are primarily focused on enhancing its functional attributes and expanding its application potential. Manufacturers are developing specialized grades of polydextrose with improved solubility, heat stability, and texturizing properties, making them ideal for a wider range of food processing conditions. Innovations include creating polydextrose with specific molecular weight distributions to fine-tune viscosity and mouthfeel in low-fat or low-sugar products. Novel applications are emerging in areas like specialized nutrition, infant food formulations, and even in non-food sectors where its fiber properties can be leveraged. These advancements allow manufacturers to offer superior product performance, meet stringent clean-label requirements, and create differentiated consumer offerings, thereby gaining a competitive edge in the market.

Report Segmentation & Scope

This report segments the Polydextrose Market based on key parameters to provide a granular view of market dynamics. The segmentation includes:

Application:

- Bakery and Confectionery: This segment is projected to witness significant growth due to the extensive use of polydextrose in sugar reduction and fiber enrichment of baked goods and sweets. Market sizes and competitive dynamics within this application are thoroughly analyzed.

- Beverages: Demand for functional beverages with added fiber and reduced sugar is driving growth in this segment. Projections for market size and key players are detailed.

- Yogurts and Dairy Products: The increasing popularity of healthy dairy alternatives and probiotic-rich yogurts makes this a key growth area for polydextrose.

- Others: This includes applications in processed foods, dietary supplements, and animal feed, representing niche but expanding markets.

Form:

- Powder: This form is expected to maintain its dominance owing to its versatility, ease of use, and widespread application across various food categories. Growth projections and market share are analyzed.

- Liquid: While currently a smaller segment, the liquid form is gaining traction in specific applications where its solubility and ease of integration are advantageous.

Key Drivers of Polydextrose Market Growth

The Polydextrose Market is propelled by a combination of robust growth drivers:

- Rising Global Health Awareness: Consumers are increasingly seeking healthier food options with reduced sugar, fat, and calories, directly increasing demand for polydextrose as a functional ingredient.

- Prevalence of Lifestyle Diseases: The growing incidence of obesity, diabetes, and other lifestyle-related ailments is accelerating the adoption of low-calorie and sugar-free food products.

- Demand for Sugar Reduction: Stringent government regulations and public health campaigns aimed at reducing sugar consumption in food and beverages are driving manufacturers to use polydextrose as a sugar replacer.

- Prebiotic Properties: The recognized benefits of polydextrose as a prebiotic, promoting gut health, are a significant factor in its increasing inclusion in functional foods and dietary supplements.

- Technological Advancements: Continuous improvements in production technologies are enhancing the cost-effectiveness and functional properties of polydextrose, making it more attractive to food manufacturers.

Challenges in the Polydextrose Market Sector

Despite its growth, the Polydextrose Market faces several challenges:

- Regulatory Hurdles: Navigating diverse and evolving food safety and labeling regulations across different countries can be complex and time-consuming for manufacturers.

- Competition from Substitutes: Alternative dietary fibers and sweeteners, such as inulin, fructans, and high-intensity sweeteners, pose significant competitive pressure, requiring continuous innovation and competitive pricing.

- Consumer Perception and Education: While awareness is growing, some consumers may still be unfamiliar with polydextrose and its benefits, necessitating ongoing educational initiatives to build trust and acceptance.

- Supply Chain Volatility: Like many food ingredients, the polydextrose supply chain can be susceptible to fluctuations in raw material availability and global logistics, potentially impacting costs and delivery times.

- Price Sensitivity: In certain price-sensitive markets, the cost of polydextrose compared to traditional ingredients can be a barrier to widespread adoption.

Leading Players in the Polydextrose Market Market

- Baolingbao Biology

- Golden Grain Group Limited

- Shandong Minqiang Biotechnology Co Ltd

- Dupont Nutrition & Health

- Tate & Lyle

- Van Wankum Ingredients

- CJ CheilJedang Corp

Key Developments in Polydextrose Market Sector

- 2023: Launch of new polydextrose grades with enhanced prebiotic activity for improved gut health applications.

- 2022: Major food ingredient manufacturers expand production capacity for polydextrose to meet rising global demand.

- 2021: Increased research into the application of polydextrose in plant-based food alternatives for improved texture and nutritional profile.

- 2020: Strategic partnerships formed to develop innovative sugar-reduction solutions leveraging polydextrose in confectionery.

- 2019: Regulatory approvals in key emerging markets facilitate wider adoption of polydextrose in food products.

Strategic Polydextrose Market Market Outlook

The strategic outlook for the Polydextrose Market remains highly positive, driven by the persistent global demand for healthier food and beverage options. Growth accelerators include the continuous innovation in product development, focusing on creating polydextrose with superior functionalities like enhanced prebiotic effects and improved textural properties, appealing to both manufacturers and consumers. The increasing adoption of clean-label ingredients and the growing consumer preference for transparency in food sourcing will further bolster the market. Strategic opportunities lie in expanding into emerging economies where health consciousness is on the rise and in developing specialized polydextrose applications for niche markets like sports nutrition and medical foods. Collaborations between ingredient suppliers and food manufacturers to co-create innovative product solutions will be crucial. The market is poised for sustained growth as it continues to be an indispensable tool for the food industry in meeting the evolving demands for healthier, balanced, and enjoyable food experiences.

Polydextrose Market Segmentation

-

1. Application

- 1.1. Bakery and Confectionery

- 1.2. Beverages

- 1.3. Yogurts and Dairy Products

- 1.4. Others (

-

2. Form

- 2.1. Powder

- 2.2. Liquid

Polydextrose Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Polydextrose Market Regional Market Share

Geographic Coverage of Polydextrose Market

Polydextrose Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products

- 3.3. Market Restrains

- 3.3.1. Stringent government regulations on food product claims

- 3.4. Market Trends

- 3.4.1. Shift Towards Low-Calorie Dietary Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery and Confectionery

- 5.1.2. Beverages

- 5.1.3. Yogurts and Dairy Products

- 5.1.4. Others (

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Powder

- 5.2.2. Liquid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bakery and Confectionery

- 6.1.2. Beverages

- 6.1.3. Yogurts and Dairy Products

- 6.1.4. Others (

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Powder

- 6.2.2. Liquid

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bakery and Confectionery

- 7.1.2. Beverages

- 7.1.3. Yogurts and Dairy Products

- 7.1.4. Others (

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Powder

- 7.2.2. Liquid

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bakery and Confectionery

- 8.1.2. Beverages

- 8.1.3. Yogurts and Dairy Products

- 8.1.4. Others (

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Powder

- 8.2.2. Liquid

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bakery and Confectionery

- 9.1.2. Beverages

- 9.1.3. Yogurts and Dairy Products

- 9.1.4. Others (

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Powder

- 9.2.2. Liquid

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bakery and Confectionery

- 10.1.2. Beverages

- 10.1.3. Yogurts and Dairy Products

- 10.1.4. Others (

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Powder

- 10.2.2. Liquid

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. South Africa Polydextrose Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Bakery and Confectionery

- 11.1.2. Beverages

- 11.1.3. Yogurts and Dairy Products

- 11.1.4. Others (

- 11.2. Market Analysis, Insights and Forecast - by Form

- 11.2.1. Powder

- 11.2.2. Liquid

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baolingbao Biology

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Golden Grain Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Shandong Minqiang Biotechnology Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dupont Nutrition & Health

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tate & Lyle

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Van Wankum Ingredients

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CJ CheilJedang Corp

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Baolingbao Biology

List of Figures

- Figure 1: Global Polydextrose Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Polydextrose Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 4: North America Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 5: North America Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 8: North America Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 9: North America Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 10: North America Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 11: North America Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 12: North America Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Polydextrose Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 16: Europe Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 17: Europe Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 20: Europe Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 21: Europe Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Europe Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 23: Europe Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Polydextrose Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 28: Asia Pacific Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 29: Asia Pacific Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 32: Asia Pacific Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 33: Asia Pacific Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 34: Asia Pacific Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 35: Asia Pacific Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Asia Pacific Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Polydextrose Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 40: South America Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 41: South America Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: South America Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 43: South America Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 44: South America Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 45: South America Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 46: South America Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 47: South America Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 48: South America Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Polydextrose Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 52: Middle East Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 53: Middle East Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 56: Middle East Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 57: Middle East Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 58: Middle East Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 59: Middle East Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 60: Middle East Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Polydextrose Market Volume Share (%), by Country 2025 & 2033

- Figure 63: South Africa Polydextrose Market Revenue (million), by Application 2025 & 2033

- Figure 64: South Africa Polydextrose Market Volume (K Tons), by Application 2025 & 2033

- Figure 65: South Africa Polydextrose Market Revenue Share (%), by Application 2025 & 2033

- Figure 66: South Africa Polydextrose Market Volume Share (%), by Application 2025 & 2033

- Figure 67: South Africa Polydextrose Market Revenue (million), by Form 2025 & 2033

- Figure 68: South Africa Polydextrose Market Volume (K Tons), by Form 2025 & 2033

- Figure 69: South Africa Polydextrose Market Revenue Share (%), by Form 2025 & 2033

- Figure 70: South Africa Polydextrose Market Volume Share (%), by Form 2025 & 2033

- Figure 71: South Africa Polydextrose Market Revenue (million), by Country 2025 & 2033

- Figure 72: South Africa Polydextrose Market Volume (K Tons), by Country 2025 & 2033

- Figure 73: South Africa Polydextrose Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: South Africa Polydextrose Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 4: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 5: Global Polydextrose Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Polydextrose Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 10: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 11: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 22: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 24: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 25: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 27: Germany Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Germany Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: France Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: France Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Russia Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Russia Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 40: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 41: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: India Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: India Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: China Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: China Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Japan Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Asia Pacific Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Asia Pacific Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 52: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 53: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 54: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 55: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 56: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 64: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 66: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 67: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 68: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Global Polydextrose Market Revenue million Forecast, by Application 2020 & 2033

- Table 70: Global Polydextrose Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 71: Global Polydextrose Market Revenue million Forecast, by Form 2020 & 2033

- Table 72: Global Polydextrose Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 73: Global Polydextrose Market Revenue million Forecast, by Country 2020 & 2033

- Table 74: Global Polydextrose Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 75: Saudi Arabia Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Saudi Arabia Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 77: Rest of Middle East Polydextrose Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Rest of Middle East Polydextrose Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polydextrose Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Polydextrose Market?

Key companies in the market include Baolingbao Biology, Golden Grain Group Limited, Shandong Minqiang Biotechnology Co Ltd, Dupont Nutrition & Health, Tate & Lyle, Van Wankum Ingredients, CJ CheilJedang Corp.

3. What are the main segments of the Polydextrose Market?

The market segments include Application, Form.

4. Can you provide details about the market size?

The market size is estimated to be USD 154 million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products.

6. What are the notable trends driving market growth?

Shift Towards Low-Calorie Dietary Trends.

7. Are there any restraints impacting market growth?

Stringent government regulations on food product claims.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polydextrose Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polydextrose Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polydextrose Market?

To stay informed about further developments, trends, and reports in the Polydextrose Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence