Key Insights

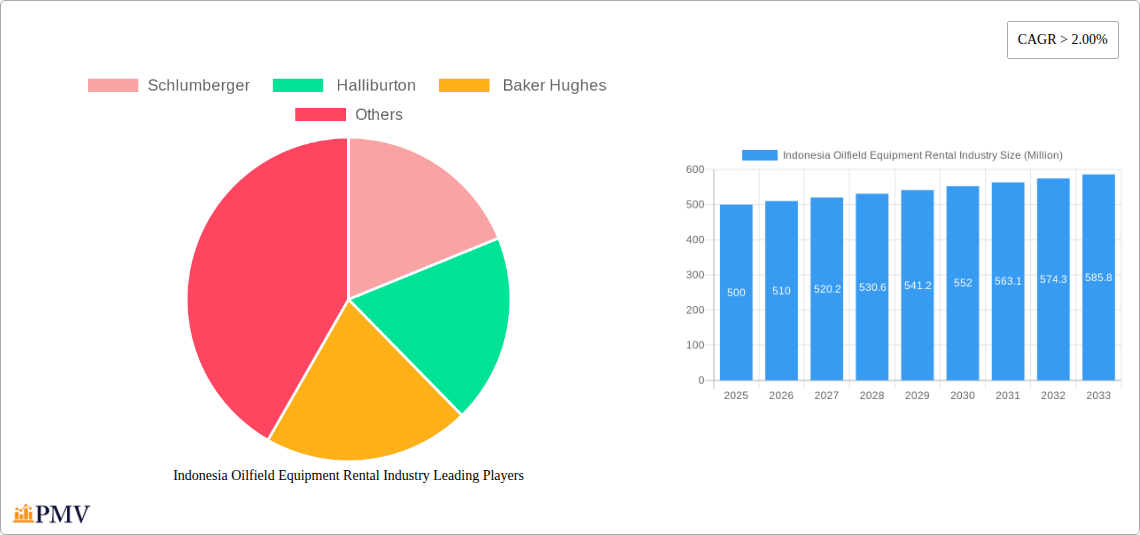

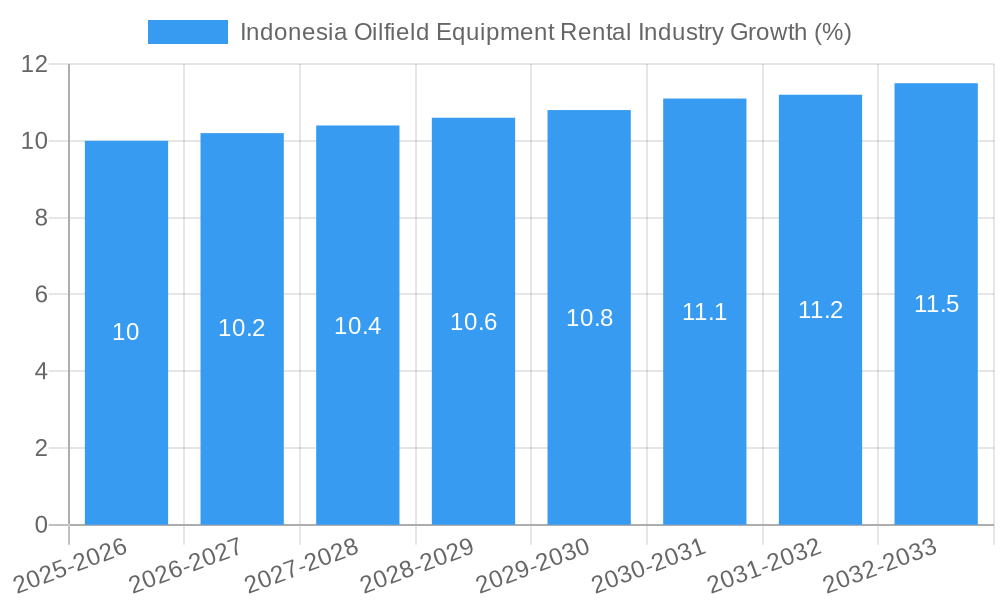

The Indonesian oilfield equipment rental market, valued at approximately $500 million in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 2.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing oil and gas exploration and production activities in Indonesia, driven by both domestic demand and global energy needs, are creating a substantial demand for rental equipment. This is especially true for advanced technologies like those used in enhanced oil recovery (EOR) techniques. Secondly, the cost-effectiveness of renting equipment compared to outright purchase is a major incentive for operators, particularly smaller companies. This reduces capital expenditure and allows for flexibility in scaling operations based on project needs. Finally, the government's ongoing investments in infrastructure development within the energy sector further supports market growth. However, the market faces some challenges, including potential fluctuations in global oil prices which can influence investment decisions and overall activity levels. Additionally, regulatory changes and environmental concerns related to oil and gas extraction could impact the market's trajectory.

The market segmentation reveals significant opportunities across various components and applications. The software segment is expected to see strong growth due to increasing demand for data analytics and remote monitoring capabilities for optimized operations. Within hardware, sensors and communication equipment are key growth drivers due to the reliance on real-time data and enhanced safety measures in oilfield operations. The power generation and transmission networks application segment is a major revenue contributor, followed by distribution and AMI applications, which are growing rapidly due to smart grid initiatives. The "other technology application areas" segment, encompassing electric vehicles (EVs) and energy storage, represents a significant emerging market, with substantial potential for future expansion as Indonesia invests in renewable energy infrastructure. Major players such as Schlumberger, Halliburton, and Baker Hughes are actively competing in this market, leveraging their expertise and technological advancements to secure market share. The focus on optimizing operations, enhancing safety, and adopting sustainable practices will shape the future of this dynamic market.

This detailed report provides a comprehensive analysis of the Indonesia Oilfield Equipment Rental industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It delves into market structure, competitive dynamics, key trends, growth drivers, challenges, and future outlook, providing actionable intelligence for strategic decision-making. The market size is projected to reach xx Million by 2033.

Indonesia Oilfield Equipment Rental Industry Market Structure & Competitive Dynamics

This section analyzes the Indonesian oilfield equipment rental market's competitive landscape, encompassing market concentration, innovation, regulatory frameworks, and M&A activity. The market is moderately concentrated, with key players like Schlumberger, Halliburton, and Baker Hughes holding significant market share, estimated at xx%, xx%, and xx% respectively in 2025. However, several smaller, regionally focused companies also contribute to the market dynamics. The Indonesian government's regulatory framework, while supportive of energy development, presents some complexities. Innovation is driven by the need for efficient and cost-effective solutions, leading to ongoing technological advancements in areas like sensor technology and remote monitoring. Substitute products, primarily used equipment, pose a competitive threat, particularly for the lower-end segments of the market. End-user trends indicate a growing preference for technologically advanced equipment with enhanced safety features and reduced environmental impact. M&A activity in the period 2019-2024 witnessed approximately xx Million in deal values, primarily driven by strategic acquisitions aimed at expanding service offerings and geographical reach.

Indonesia Oilfield Equipment Rental Industry Industry Trends & Insights

The Indonesian oilfield equipment rental market is experiencing substantial growth, driven by increasing exploration and production activities in the country. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. This growth is fuelled by rising domestic energy demand and government initiatives to boost energy independence. Technological disruptions, such as the adoption of digitalization and automation in oilfield operations, are enhancing efficiency and productivity, increasing demand for advanced equipment. Consumer preferences are shifting towards technologically advanced equipment with enhanced safety features, remote monitoring capabilities and reduced environmental impact. The market penetration of advanced technologies like remote diagnostics and predictive maintenance is steadily increasing, projected to reach xx% by 2033. Intense competition among existing players necessitates ongoing investments in R&D and strategic partnerships to maintain a competitive edge.

Dominant Markets & Segments in Indonesia Oilfield Equipment Rental Industry

The hardware segment, particularly sensors and communication equipment, dominates the Indonesian oilfield equipment rental market. This dominance is driven by the increasing need for real-time monitoring and data analytics in oilfield operations. The power generation and transmission networks application segment also shows substantial growth, supported by increasing investment in energy infrastructure.

- Key Drivers for Hardware Segment Dominance:

- Growing demand for advanced sensors for improved operational efficiency and safety.

- Increasing adoption of automation and remote monitoring technologies.

- Investment in upgrading aging oilfield infrastructure.

- Key Drivers for Power Generation & Transmission Application Segment Dominance:

- Government initiatives to expand energy infrastructure.

- Investments in renewable energy projects and upgrades to existing grids.

- Growing domestic energy demand.

The other technology application areas (EVs, energy storage, etc.) segment is expected to witness significant growth in the coming years due to increasing government support for renewable energy and electric vehicle adoption in the country. Regional variations exist, with higher growth rates observed in areas with significant oil and gas reserves and energy infrastructure development.

Indonesia Oilfield Equipment Rental Industry Product Innovations

Recent product innovations focus on enhancing efficiency, safety, and environmental sustainability. This includes the development of advanced sensors, remote monitoring systems, and equipment designed for harsh operating conditions. Companies are integrating data analytics capabilities into their equipment, enabling predictive maintenance and optimizing operational efficiency. These innovations aim to enhance competitiveness and address the rising demand for cost-effective and environmentally responsible solutions within the Indonesian oil and gas industry.

Report Segmentation & Scope

This report segments the Indonesia Oilfield Equipment Rental market by component (Software, Hardware – including Sensors, Communication Equipment, and others) and application (Power Generation and Transmission Networks, Distribution and Advanced Metering Infrastructure (AMI), Other Technology Application Areas (EVs, Energy Storage, etc.)). Each segment is analyzed based on historical data (2019-2024), estimated values (2025), and future projections (2025-2033). The report also examines the competitive dynamics within each segment, highlighting key players, market shares, and growth trends. Software solutions are projected to exhibit a CAGR of xx%, while the hardware sector is anticipated to grow at a CAGR of xx% over the forecast period. The different application segments show varying growth rates reflecting the evolving needs of the Indonesian energy sector.

Key Drivers of Indonesia Oilfield Equipment Rental Industry Growth

Several factors fuel the growth of the Indonesian oilfield equipment rental industry. Government initiatives supporting domestic energy production, including the recent announcement of a second oil and gas bidding round (September 2022), aim to increase oil production to one Million barrels/day and gas production to 12 Billion cubic feet/day. Increased investment in oil and gas exploration and production projects, coupled with advancements in drilling and production technologies, are key growth stimulants. Furthermore, the discovery of new oil reserves, such as the Kruh 27 well discovery in May 2022 by Indonesia Energy Corporation (IEC), contributes positively to market expansion.

Challenges in the Indonesia Oilfield Equipment Rental Industry Sector

Despite its growth potential, the Indonesian oilfield equipment rental industry faces several challenges. Regulatory complexities and bureaucratic hurdles can impact project timelines and investment decisions. Supply chain disruptions and logistical constraints, especially during periods of high demand, can affect the availability of equipment. Furthermore, intense competition among existing players requires continuous investment in R&D and adapting to technological advancements. These challenges are estimated to cumulatively impact market growth by approximately xx% during the forecast period.

Leading Players in the Indonesia Oilfield Equipment Rental Industry Market

Key Developments in Indonesia Oilfield Equipment Rental Industry Sector

- September 2022: Indonesian energy minister announces a second oil and gas bidding round, aiming to significantly boost oil and gas production. This is expected to drive strong demand for oilfield equipment.

- May 2022: Indonesia Energy Corporation (IEC) announces the discovery of oil in its Kruh 27 well, further stimulating exploration and production activities and subsequent equipment rental needs.

Strategic Indonesia Oilfield Equipment Rental Industry Market Outlook

The Indonesian oilfield equipment rental market presents significant growth potential driven by government policies aimed at boosting domestic energy production and the increasing demand for advanced oilfield equipment. Strategic opportunities exist for companies specializing in cutting-edge technologies such as digitalization and automation, as well as those focusing on environmentally sustainable solutions. The ongoing exploration and development activities in the country, coupled with improving infrastructure, are expected to continue driving strong growth in the coming years. Furthermore, the potential for partnerships and collaborations among international and local companies to enhance local capabilities will also shape the market's trajectory.

Indonesia Oilfield Equipment Rental Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Oilfield Equipment Rental Industry Segmentation By Geography

- 1. Indonesia

Indonesia Oilfield Equipment Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Demand for Renewable Energy

- 3.4. Market Trends

- 3.4.1. Increasing Upstream Activities Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Oilfield Equipment Rental Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Schlumberger

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Halliburton

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baker Hughes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 Schlumberger

List of Figures

- Figure 1: Indonesia Oilfield Equipment Rental Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Oilfield Equipment Rental Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Production Analysis 2019 & 2032

- Table 5: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Production Analysis 2019 & 2032

- Table 19: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Indonesia Oilfield Equipment Rental Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Indonesia Oilfield Equipment Rental Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Oilfield Equipment Rental Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Indonesia Oilfield Equipment Rental Industry?

Key companies in the market include Schlumberger , Halliburton , Baker Hughes .

3. What are the main segments of the Indonesia Oilfield Equipment Rental Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources.

6. What are the notable trends driving market growth?

Increasing Upstream Activities Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Demand for Renewable Energy.

8. Can you provide examples of recent developments in the market?

In September 2022, the Indonesian energy minister announced to launch of a second oil and gas bidding round at the end of the year. The bidding round aimed to support Indonesia's target of achieving one million barrel/day of oil and 12 billion cubic feet/day in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Oilfield Equipment Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Oilfield Equipment Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Oilfield Equipment Rental Industry?

To stay informed about further developments, trends, and reports in the Indonesia Oilfield Equipment Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence