Key Insights

The India Battery Energy Storage Systems (BESS) market is poised for significant expansion, projected to reach 385 million by 2033. This robust growth, with a Compound Annual Growth Rate (CAGR) of 14% from the base year 2025 to 2033, is propelled by escalating electricity demand, the integration of intermittent renewable energy sources like solar and wind, and supportive government policies aimed at energy independence and grid stability. Lithium-ion batteries are the market's leading technology due to their superior energy density and performance. The off-grid segment, crucial for electrifying rural areas, and the on-grid segment, vital for large-scale renewable projects and grid resilience, are key growth catalysts. Technological advancements are further enhancing BESS efficiency and reducing costs. Potential market restraints include high initial investment, battery lifecycle limitations, and the necessity for advanced recycling infrastructure. Geographically, the market is segmented across North, South, East, and West India, with regional growth influenced by renewable energy penetration and industrial activity.

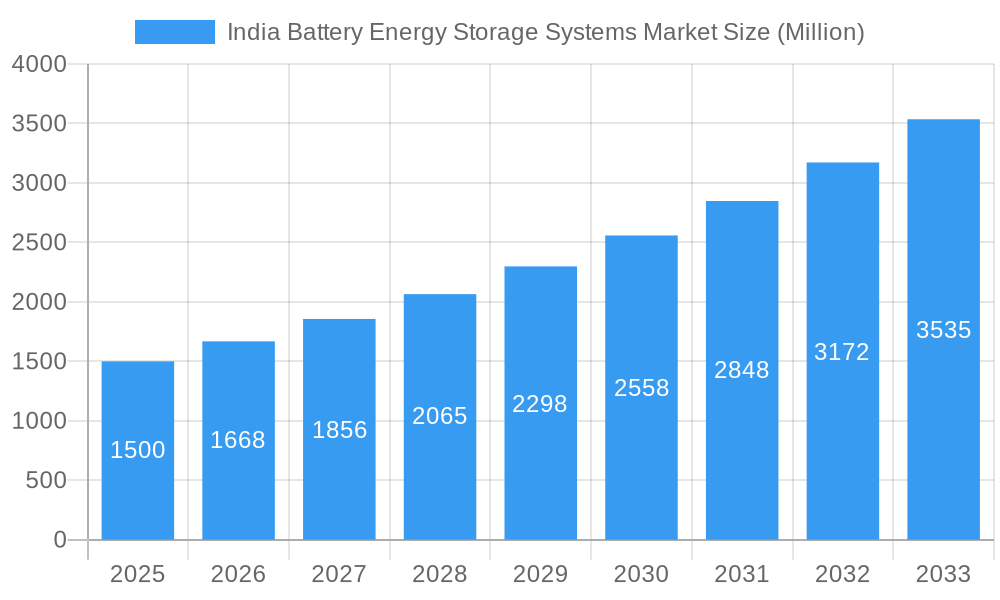

India Battery Energy Storage Systems Market Market Size (In Million)

The competitive arena features prominent international and domestic players. The forecast period (2025-2033) indicates sustained market expansion driven by ongoing government support for renewable energy mandates, enhanced grid infrastructure, and the decreasing cost of BESS technologies. While precise regional market share data requires deeper analysis, strong growth is anticipated nationwide, particularly in regions with high renewable energy adoption and significant economic development. Detailed regional market drivers and restraints are essential for refining future growth projections.

India Battery Energy Storage Systems Market Company Market Share

India Battery Energy Storage Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Battery Energy Storage Systems (BESS) market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The Indian BESS market is poised for significant expansion, driven by government initiatives and increasing renewable energy adoption. This report quantifies the market size in Millions (USD) across various segments and provides actionable intelligence to navigate this rapidly evolving landscape.

India Battery Energy Storage Systems Market Structure & Competitive Dynamics

The Indian Battery Energy Storage Systems market exhibits a moderately concentrated structure, with both established international players and domestic companies vying for market share. The market is characterized by a dynamic innovation ecosystem, with ongoing research and development efforts focused on improving battery technology, enhancing energy density, and reducing costs. The regulatory framework, while evolving, plays a significant role in shaping market growth and investment decisions. Product substitutes, primarily conventional grid infrastructure and alternative energy sources, exert competitive pressure. End-user trends are shifting towards more efficient and sustainable energy solutions, driving demand for BESS. M&A activities are expected to increase as companies consolidate their positions and gain access to new technologies and markets. Market share data for key players will be presented in the full report, with an estimated xx% market share held by the top three players in 2025. Several significant M&A deals valued at over USD xx Million are expected to take place between 2026 and 2028, primarily focused on securing lithium-ion battery supply chains.

India Battery Energy Storage Systems Market Industry Trends & Insights

The Indian Battery Energy Storage Systems (BESS) market is experiencing a period of accelerated growth and significant transformation. A primary catalyst for this expansion is the nation's ambitious drive to integrate a higher percentage of renewable energy sources, such as solar and wind power, into its grid. The inherent intermittency of these sources necessitates robust energy storage solutions to ensure grid stability and reliability. Government policy plays a crucial role, with initiatives like the announced financial incentives of USD 455.2 Million in June 2023 for 400 MWh projects acting as a substantial accelerator for market adoption. Parallel to these policy drivers, ongoing technological advancements are continuously enhancing the efficiency, cost-effectiveness, and performance of BESS. Innovations in battery chemistry, leading to improved energy density and longer lifespans, are making these systems more viable. This is complemented by a discernible shift in consumer preferences towards sustainable and eco-friendly energy solutions, fostering increased adoption of BESS across residential, commercial, and industrial sectors. Projections indicate a robust Compound Annual Growth Rate (CAGR) of **XX%** during the forecast period (2025-2033), with market penetration expected to rise from **XX%** in 2025 to **XX%** by 2033. The competitive arena is vibrant, featuring a dynamic interplay between established domestic manufacturers and international players, which fuels continuous innovation and competitive pricing strategies.

Dominant Markets & Segments in India Battery Energy Storage Systems Market

The Indian BESS market exhibits a geographically diverse growth pattern. While a comprehensive regional analysis is detailed within the full market report, states like Maharashtra, Tamil Nadu, and Karnataka are projected to lead in BESS deployment. This leadership is attributed to their significant existing renewable energy capacities and the presence of supportive policy frameworks designed to encourage energy storage. In terms of technology segments, Lithium-ion batteries currently hold a dominant position in terms of market value. This is largely due to their superior energy density, longer operational lifespan, and improving cost-efficiency. Nevertheless, lead-acid batteries continue to play a vital role, particularly in applications where cost is a primary consideration and lower energy density requirements are acceptable.

-

Key Drivers for Lithium-ion Battery Dominance:

- Superior energy density and extended lifespan when compared to lead-acid alternatives.

- Continuous technological advancements leading to reduced costs and enhanced performance characteristics.

- Increasing demand for long-duration energy storage solutions to complement renewable energy integration.

-

Key Drivers for On-Grid Segment Dominance:

- Strong government backing and policy support for large-scale, grid-connected renewable energy projects.

- The ongoing modernization of the power grid and the implementation of smart grid technologies.

- The critical need for a stable, reliable, and consistent power supply to meet growing energy demands.

India Battery Energy Storage Systems Market Product Innovations

Product innovations within the Indian BESS market are predominantly focused on enhancing critical performance attributes such as battery longevity, operational durability, and overall safety. Emerging advanced battery chemistries, including the promising development of solid-state batteries, are poised to further elevate energy density and potentially drive down costs significantly. Simultaneously, advancements in Battery Management Systems (BMS) are crucial, contributing to optimized energy utilization and extended battery service life. The application landscape for BESS is also broadening, with novel uses emerging in areas like microgrids for remote or off-grid communities, infrastructure for electric vehicle charging, and the provision of essential backup power for critical facilities and industries. These continuous innovations underscore the market's unwavering commitment to achieving superior performance, enhancing safety standards, and reducing the overall cost of energy storage solutions.

Report Segmentation & Scope

This report segments the India BESS market based on battery type (Lithium-ion, Lead-acid, Flow, Other Battery Types) and connection type (On-grid, Off-grid). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The Lithium-ion segment is projected to experience the highest CAGR, driven by technological advancements and government support for renewable energy integration. The On-grid segment is expected to dominate due to large-scale renewable energy projects. The market size for each segment is projected and documented within the complete report.

Key Drivers of India Battery Energy Storage Systems Market Growth

Several interconnected factors are propelling the growth trajectory of the India BESS market. A pivotal driver is the Indian government's resolute commitment to achieving ambitious renewable energy targets, coupled with substantial financial incentives that directly stimulate investment and deployment. The escalating integration of variable renewable energy sources like solar and wind power inherently creates a strong demand for reliable energy storage to mitigate their intermittency. Technological advancements are playing a relentless role, consistently improving the performance, affordability, and lifespan of battery technologies. Furthermore, the persistent and growing demand for a reliable and uninterrupted power supply across both urban centers and rural areas is a significant contributor to the market's expansion.

Challenges in the India Battery Energy Storage Systems Market Sector

Notwithstanding its considerable growth potential, the Indian BESS market confronts a set of persistent challenges that require strategic attention. The substantial initial capital investment required for BESS deployment remains a significant impediment to widespread adoption, particularly for smaller enterprises and individual residential consumers. Vulnerabilities within the global supply chain for essential battery materials, such as lithium and cobalt, pose potential risks to market stability and price fluctuations. The regulatory landscape governing BESS is still in its nascent stages of development, which can lead to a degree of uncertainty for investors and project developers. The competitive intensity, stemming from both established market players and emerging new entrants, can exert downward pressure on market pricing and impact profitability margins.

Leading Players in the India Battery Energy Storage Systems Market Market

- Delta Electronics Inc

- Toshiba Corporation

- Panasonic Corporation

- Exide Industries Ltd

- AES Corporation

- Amara Raja Group

Key Developments in India Battery Energy Storage Systems Market Sector

- June 2023: The Indian government announced USD 455.2 Million in incentives for battery energy storage projects totaling 400 MWh, demonstrating a commitment to renewable energy integration and accelerating BESS market growth.

- April 2023: India Grid Trust's successful completion of its first BESS project in Maharashtra, coupled with solar panels at the Dhule substation, showcases the practicality and viability of integrated renewable energy and storage solutions.

Strategic India Battery Energy Storage Systems Market Outlook

The Indian BESS market presents a compelling investment opportunity with considerable growth potential. Continued government support, technological advancements, and increasing demand for reliable power will drive market expansion. Strategic partnerships, technological innovation, and efficient supply chain management will be critical for success. The market is expected to witness a significant increase in both the volume and value of BESS installations over the forecast period.

India Battery Energy Storage Systems Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion

- 1.2. Lead-acid

- 1.3. Flow

- 1.4. Other Battery Types

-

2. Connection Type

- 2.1. On-grid

- 2.2. Off-grid

India Battery Energy Storage Systems Market Segmentation By Geography

- 1. India

India Battery Energy Storage Systems Market Regional Market Share

Geographic Coverage of India Battery Energy Storage Systems Market

India Battery Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Energy Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion

- 5.1.2. Lead-acid

- 5.1.3. Flow

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Connection Type

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exide Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amara Raja Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics Inc

List of Figures

- Figure 1: India Battery Energy Storage Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Battery Energy Storage Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 3: India Battery Energy Storage Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 6: India Battery Energy Storage Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Energy Storage Systems Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the India Battery Energy Storage Systems Market?

Key companies in the market include Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation*List Not Exhaustive, Exide Industries Ltd, AES Corporation, Amara Raja Group.

3. What are the main segments of the India Battery Energy Storage Systems Market?

The market segments include Battery Type, Connection Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 385 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

June 2023: The Indian government shall offer USD 455.2 million as incentives to the companies for installing battery energy storage projects of 400 MWh. The government intends to reach its 2030 goal of 500 MW of renewable capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Energy Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Energy Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Energy Storage Systems Market?

To stay informed about further developments, trends, and reports in the India Battery Energy Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence