Key Insights

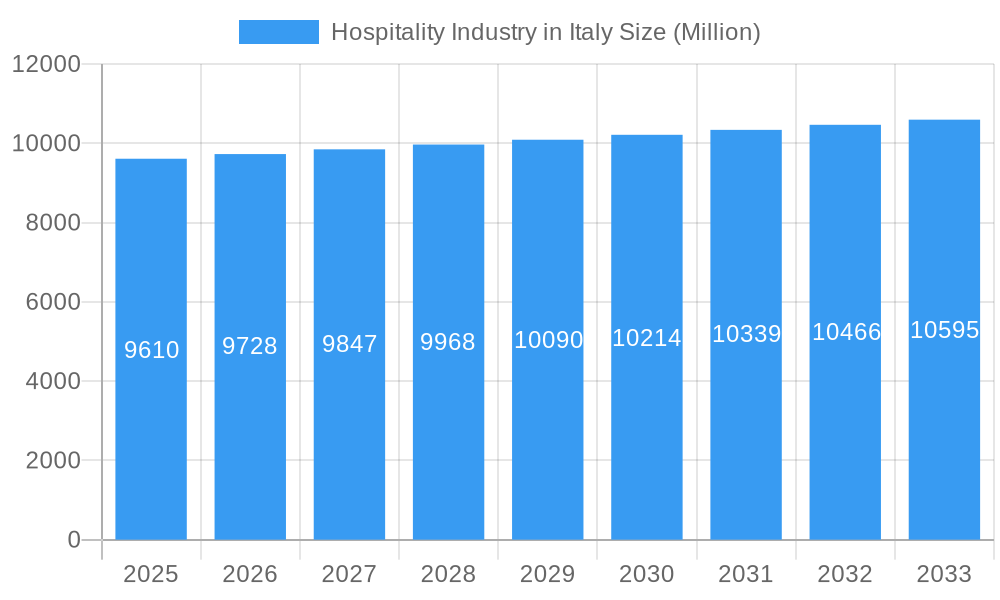

The Italian hospitality industry, valued at €9.61 billion in 2025, presents a stable yet evolving landscape. A compound annual growth rate (CAGR) of 1.22% from 2025-2033 projects moderate expansion, driven primarily by increasing inbound tourism, particularly from European and North American markets seeking cultural experiences and high-quality accommodations. Growth is further fueled by the increasing popularity of experiential travel, leading to demand for unique boutique hotels and service apartments catering to diverse traveler preferences beyond traditional chain hotels. However, the industry faces challenges including seasonal fluctuations in demand, rising operational costs (especially labor and energy), and competition from alternative accommodation platforms like Airbnb. The segment breakdown reveals a diversified market, with luxury hotels and service apartments commanding higher price points and experiencing relatively stronger growth due to increased disposable income among high-spending tourists. Budget and economy hotels, while maintaining a significant market share, face pressure from increased competition and need to adapt their offerings to appeal to price-conscious travelers. The concentration of major players such as Hilton Worldwide, Accor SA, and Marriott International Inc. indicates a competitive market requiring strong branding, innovative marketing, and efficient operational strategies for success. Loyalty programs, employed by major brands like Best Western, play a crucial role in retaining customer base and mitigating the impact of competitive pressures.

Hospitality Industry in Italy Market Size (In Billion)

The future success of Italian hospitality hinges on adaptability. Hotels must leverage technology to improve operational efficiency, enhance guest experiences through personalized services, and adopt sustainable practices to attract environmentally conscious travelers. Focusing on niche markets, building strong brand identities, and capitalizing on Italy's rich cultural heritage will be key differentiators in a market characterized by both steady growth and intense competition. A strategic focus on attracting a broader range of tourists beyond the traditional peak seasons will also help to stabilize revenue streams and mitigate the risk of seasonal volatility. The continued expansion of luxury and service apartment segments indicates a growing preference for upscale travel experiences, signaling an opportunity for hotels catering to discerning and affluent travelers.

Hospitality Industry in Italy Company Market Share

Italy's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Italian hospitality industry, offering invaluable insights for investors, businesses, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages rigorous data analysis and expert commentary to present a clear, actionable picture of this dynamic market. The report uses millions (M) as the unit for all values.

Hospitality Industry in Italy Market Structure & Competitive Dynamics

The Italian hospitality market, valued at xx M in 2024, exhibits a moderately concentrated structure. Key players like Hilton Worldwide, Marriott International Inc, Accor SA, NH Hotel Group SA, InterContinental Hotel Group PLC, and Gruppo Una hold significant market share, estimated collectively at xx%. However, numerous independent hotels and smaller chains also contribute substantially, creating a diverse landscape. The market is characterized by a robust innovation ecosystem, driven by technological advancements in areas like online booking systems, revenue management software, and customer relationship management (CRM) tools. Regulatory frameworks, including those related to tourism taxes and environmental sustainability, influence operational costs and strategic decisions. The presence of alternative accommodation options like Airbnb presents a degree of substitution. M&A activity is notable, with recent deals like Sixth Street's acquisition of Le Palme Hotel & Resort in January 2022 signaling investor interest in the luxury segment.

- Market Concentration: xx% held by top 6 players in 2024.

- M&A Activity: Significant investments in luxury hotels, with deal values exceeding xx M in the past 3 years.

- Innovation: Strong adoption of technology for operational efficiency and customer experience enhancement.

- Regulatory Landscape: Significant impact on operational costs and sustainability practices.

Hospitality Industry in Italy Industry Trends & Insights

The Italian hospitality sector is poised for robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR Here, e.g., 5.5%]% during the forecast period (2025-2033). This growth is fueled by a confluence of factors, including a discernible rise in disposable incomes and a persistent surge in global tourism attracted to Italy's unparalleled cultural tapestry and scenic beauty. The landscape is continuously reshaped by technological innovations, most notably the expanding influence of Online Travel Agencies (OTAs) and the growing consumer demand for hyper-personalized travel experiences that move beyond the conventional. Current consumer sentiment strongly favors unique, authentic immersions into local culture and a heightened emphasis on sustainable tourism practices. The luxury hotel segment is witnessing consistent market penetration, driven by an affluent clientele seeking premium experiences. Concurrently, budget and economy hotels continue to record high occupancy rates during peak travel seasons, primarily due to the price-conscious nature of a significant segment of tourists. This creates a dynamic, segmented market where diverse operators cater to a spectrum of traveler needs and budgets. The prevailing competitive environment is characterized by intense rivalry and a relentless pursuit of innovation. Established market participants are strategically differentiating themselves through aggressive brand enhancement initiatives and the cultivation of robust loyalty programs, aiming to secure a lasting connection with their clientele.

Dominant Markets & Segments in Hospitality Industry in Italy

The Italian hospitality market exhibits regional variations, with key areas such as Rome, Milan, Venice, Florence, and coastal regions dominating. These areas benefit from established tourism infrastructure, cultural attractions, and accessibility.

- By Type: Chain hotels currently represent a larger market share than independent hotels due to brand recognition and economies of scale. However, independent hotels are growing their market share through differentiation and unique offerings.

- By Segment: The luxury hotel segment demonstrates the highest revenue generation and growth potential, driven by high-spending tourists seeking premium experiences. The budget and economy segments experience significant fluctuations depending on seasonal demand and broader economic factors. Mid-scale hotels maintain a consistent market position. Service apartments showcase steady growth catering to extended-stay travelers and families.

Key Drivers of Dominance:

- Strong tourism infrastructure: Efficient transportation links and well-developed visitor services.

- Cultural attractions: Historic sites, museums, and events draw significant visitor numbers.

- Favorable economic policies: Government initiatives supporting the tourism sector.

- Strategic location: proximity to key transport hubs.

Hospitality Industry in Italy Product Innovations

Recent innovations within the Italian hospitality industry focus on enhancing the guest experience through technology. Smart room technologies, personalized service offerings tailored through data analytics, and integrated mobile applications are becoming increasingly prevalent. These technological advancements aim to improve operational efficiency, increase guest satisfaction, and create a competitive advantage for hotels. Sustainability initiatives are also gaining traction, with hotels adopting eco-friendly practices and showcasing these to attract environmentally conscious travelers.

Report Segmentation & Scope

This comprehensive report meticulously segments the Italian hospitality market into two primary categories: Hotel Type (encompassing Chain Hotels and Independent Hotels) and Hotel Segment (further divided into Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, and Luxury Hotels). For each meticulously defined segment, the report provides an in-depth analysis of its market size, future growth projections, and intricate competitive dynamics. The study period spans from 2019 to 2033, with 2025 designated as the pivotal base and estimated year. The historical analysis covers the period from 2019 to 2024, while the forward-looking forecast extends from 2025 to 2033, offering a complete chronological perspective.

Key Drivers of Hospitality Industry in Italy Growth

Growth in the Italian hospitality sector is primarily driven by factors such as increased tourism from both domestic and international markets. Government initiatives to promote tourism and investment in infrastructure play a critical role. Technological innovations focused on improving customer experience and operational efficiency also contribute to this growth. Furthermore, the increasing preference for unique and experiential travel adds to market expansion.

Challenges in the Hospitality Industry in Italy Sector

The vibrant Italian hospitality industry navigates a complex terrain marked by several significant challenges. The inherent seasonality of tourism often leads to fluctuations in occupancy rates, creating periods of high demand followed by lulls. Intense competition is further amplified by the growing popularity of alternative accommodation options, which offer varied price points and unique experiences. Moreover, escalating operational costs, exacerbated by persistent inflation and rising energy prices, present a formidable hurdle for businesses striving to maintain profitability. Navigating intricate regulatory frameworks and addressing persistent labor shortages also contribute to operational complexities, potentially impacting service quality and financial performance. A unique and ongoing challenge for the sector is the delicate equilibrium required to preserve Italy's invaluable cultural heritage while simultaneously embracing essential modernization and technological advancements to meet evolving guest expectations.

Leading Players in the Hospitality Industry in Italy Market

- TH Resorts

- ITI Hotels Group

- Bluserena SPA

- Best Western International Inc.

- Hilton Worldwide Holdings Inc.

- Gruppo Una

- InterContinental Hotels Group PLC (IHG)

- Marriott International Inc.

- Accor S.A.

- NH Hotel Group S.A. (part of Minor Hotels)

Key Developments in Hospitality Industry in Italy Sector

- September 2022: Omnam Group and Mohari Hospitality formed a strategic partnership to expand their European hotel portfolio. This signifies increased investment and consolidation within the market.

- January 2022: Sixth Street's acquisition of Le Palme Hotel & Resort underscores the growing interest in the Italian luxury hotel segment.

Strategic Hospitality Industry in Italy Market Outlook

The Italian hospitality market is strategically positioned for substantial growth and presents a wealth of opportunities in the forthcoming years. Continued, targeted investment in upgrading and expanding tourism infrastructure will be paramount. Embracing and integrating cutting-edge technological advancements will be crucial for enhancing guest experiences and optimizing operational efficiency. A strong and unwavering commitment to sustainable tourism practices is not merely a trend but a fundamental necessity for long-term success and environmental stewardship. These strategic imperatives, combined with the enduring allure of Italy's rich cultural heritage, unique gastronomy, and breathtaking landscapes, firmly position the country as a premier destination within the global hospitality landscape. The long-term outlook for the Italian hospitality sector remains exceptionally positive, underpinned by the sustained global growth in tourism and the continuous wave of investment flowing into the industry, signaling a bright and promising future.

Hospitality Industry in Italy Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Service Apartments

- 1.3. Independent Hotels

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper mid scale Hotels

- 2.3. Luxury Hotels

Hospitality Industry in Italy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Italy Regional Market Share

Geographic Coverage of Hospitality Industry in Italy

Hospitality Industry in Italy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diversification of Tourism Products; Government Support and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. High Dependency on Tourism

- 3.4. Market Trends

- 3.4.1. Dominating Domestic Brands are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Service Apartments

- 5.1.3. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper mid scale Hotels

- 5.2.3. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Service Apartments

- 6.1.3. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Budget and Economy Hotels

- 6.2.2. Mid and Upper mid scale Hotels

- 6.2.3. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Service Apartments

- 7.1.3. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Budget and Economy Hotels

- 7.2.2. Mid and Upper mid scale Hotels

- 7.2.3. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Service Apartments

- 8.1.3. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Budget and Economy Hotels

- 8.2.2. Mid and Upper mid scale Hotels

- 8.2.3. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Service Apartments

- 9.1.3. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Budget and Economy Hotels

- 9.2.2. Mid and Upper mid scale Hotels

- 9.2.3. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Italy Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Service Apartments

- 10.1.3. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Budget and Economy Hotels

- 10.2.2. Mid and Upper mid scale Hotels

- 10.2.3. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TH Resorts

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ITI Hotels Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bluserena SPA**List Not Exhaustive 6 3 Loyalty Programs Offered by Major Hotel Brand

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Best Western International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 6 COMPETITVE INTELLIGENCE6 1 Market Concentration6 2 Company profiles

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hilton Worldwide

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gruppo Una

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InterContinental Hotel Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marriott International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NH Hotel Group SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 TH Resorts

List of Figures

- Figure 1: Global Hospitality Industry in Italy Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Italy Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Italy Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Italy Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Italy Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Italy Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Italy Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Italy Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Italy Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Italy Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Italy Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Italy Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Italy Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Italy Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Italy Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Italy Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Italy Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Italy Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Italy Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Italy Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Italy Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Italy Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Italy Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Italy Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Italy Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Italy Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Italy Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Italy Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Italy Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Italy Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Italy Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Italy Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Italy Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Italy Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Italy Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Italy Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Italy Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Italy Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Italy Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Italy Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Italy?

The projected CAGR is approximately 1.22%.

2. Which companies are prominent players in the Hospitality Industry in Italy?

Key companies in the market include TH Resorts, ITI Hotels Group, Bluserena SPA**List Not Exhaustive 6 3 Loyalty Programs Offered by Major Hotel Brand, Best Western International Inc, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration6 2 Company profiles, Hilton Worldwide, Gruppo Una, InterContinental Hotel Group PLC, Marriott International Inc, Accor SA, NH Hotel Group SA.

3. What are the main segments of the Hospitality Industry in Italy?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Diversification of Tourism Products; Government Support and Infrastructure Development.

6. What are the notable trends driving market growth?

Dominating Domestic Brands are Driving the Market.

7. Are there any restraints impacting market growth?

High Dependency on Tourism.

8. Can you provide examples of recent developments in the market?

September 2022: Omnam Group and Mohari Hospitality announced the formation of a strategic partnership aimed at expanding and accelerating the development of a portfolio of European hotels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Italy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Italy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Italy?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Italy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence