Key Insights

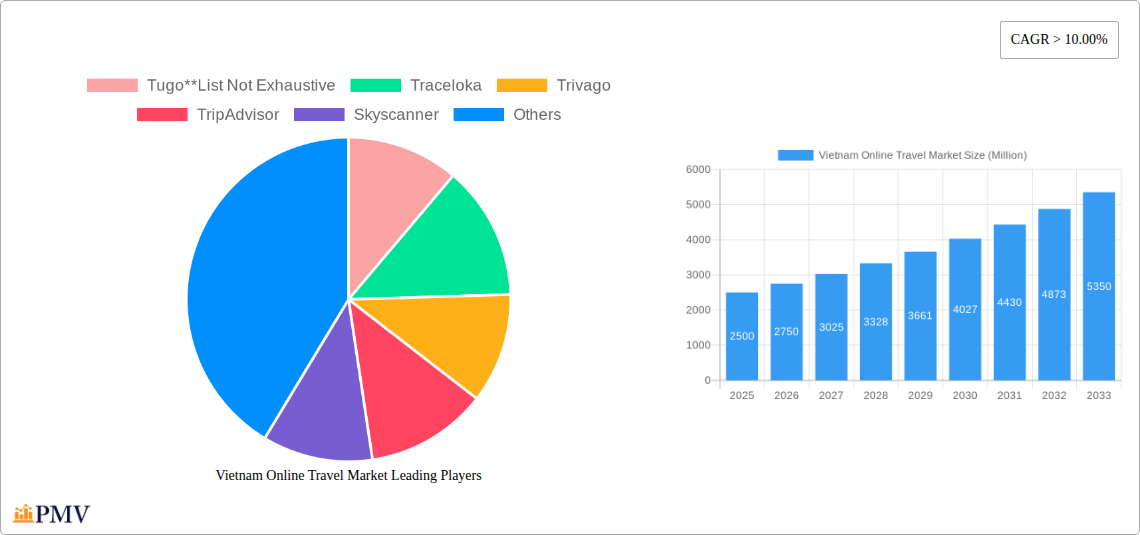

The Vietnam online travel market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024, presents a robust and expanding opportunity. Driven by rising disposable incomes, increasing internet and smartphone penetration, and a growing preference for convenient online booking, this sector is poised for continued expansion. The market's segmentation reveals significant contributions from air ticketing, hotels and packages, and burgeoning growth in bus and railway ticketing segments. The dominance of mobile platforms underscores the importance of mobile-first strategies for businesses operating within this space. Factors such as improved digital infrastructure and government support for tourism further fuel market growth. However, challenges remain, including fluctuations in currency exchange rates, potential economic downturns impacting consumer spending, and the need for robust cybersecurity measures to protect sensitive customer data. Competitive intensity is high, with both global players like Booking.com and Expedia, and regional players like TraveLoca vying for market share.

Vietnam Online Travel Market Market Size (In Billion)

Looking forward to 2033, the market is projected to maintain a healthy growth trajectory, driven by the sustained growth in tourism and the increasing adoption of online travel services. The ongoing development of digital payment systems and enhanced online travel platforms will further contribute to the expansion of this market. Strategic partnerships between online travel agencies and local tourism businesses are likely to become more prevalent. Effective marketing campaigns targeting the digitally savvy Vietnamese population will be crucial for success. While challenges related to infrastructure development in certain regions and potential economic volatility will require careful navigation, the overall outlook for the Vietnam online travel market remains exceptionally promising, presenting significant opportunities for both established players and new entrants.

Vietnam Online Travel Market Company Market Share

Vietnam Online Travel Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Vietnam online travel market, offering invaluable insights for businesses and investors seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report projects a market valued at $XX Million by the estimated year and anticipates robust growth throughout the forecast period (2025-2033). The study incorporates historical data (2019-2024) and provides actionable intelligence to understand market trends, competitive dynamics, and future opportunities.

Vietnam Online Travel Market Market Structure & Competitive Dynamics

The Vietnam online travel market exhibits a moderately concentrated structure, with several dominant players alongside a diverse landscape of smaller operators. Market share distribution is influenced by factors including brand recognition, technological capabilities, and marketing strategies. Key players such as Booking.com, Expedia, Agoda, TripAdvisor, Skyscanner, and Traceloka hold significant market share, while numerous smaller businesses contribute to the overall market volume. Innovation within the ecosystem is driven by advancements in mobile technology, personalized travel planning tools, and the integration of artificial intelligence. Regulatory frameworks, while generally supportive of the industry's growth, are constantly evolving, impacting operational aspects and data privacy. Product substitutes, such as traditional travel agencies and direct bookings, continue to exist but are facing increasing pressure from the convenience and cost-effectiveness offered by online platforms. End-user trends show a clear preference for mobile booking, personalized experiences, and value-added services. M&A activity has been relatively moderate in recent years, with deal values averaging $XX Million. However, strategic partnerships and collaborations are increasingly common, enabling smaller players to gain access to wider distribution networks and technological expertise. Notable examples include the Expedia and Qtech collaboration described further in the key developments section.

- Market Concentration: Moderately concentrated, with several dominant players and a large number of smaller players.

- Innovation Ecosystem: Driven by mobile technology, AI, and personalized travel tools.

- Regulatory Framework: Supportive of growth but constantly evolving.

- Product Substitutes: Traditional travel agencies and direct bookings, facing growing competition.

- End-User Trends: Preference for mobile booking, personalized experiences, and value-added services.

- M&A Activity: Moderate, with average deal values of $XX Million, along with increasing strategic partnerships.

Vietnam Online Travel Market Industry Trends & Insights

The Vietnam online travel market is experiencing robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient, self-service travel planning. The market exhibits a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024), and is projected to maintain a strong CAGR of XX% throughout the forecast period (2025-2033). Market penetration of online travel booking is increasing steadily, with XX% of total travel bookings now made online. Technological disruptions, such as the rise of mobile-first booking platforms and AI-powered travel recommendations, are reshaping the competitive landscape. Consumer preferences are shifting towards personalized experiences, sustainable travel options, and seamless booking processes. Competitive dynamics are characterized by price wars, strategic partnerships, and ongoing innovation in user experience. The increasing adoption of mobile booking is a significant driver of growth, as more and more Vietnamese travelers use smartphones for researching and booking trips. The market growth is also fueled by the increasing adoption of cashless payment methods and the growing popularity of package deals.

Dominant Markets & Segments in Vietnam Online Travel Market

The Vietnam online travel market exhibits strong growth across various segments. The most dominant region is Ho Chi Minh City followed by Hanoi due to higher population densities and higher disposable incomes. Analyzing the booking types, the "Hotels and Packages" segment is dominant, followed by "Air Ticketing," reflecting a preference for comprehensive travel solutions. "Other Booking Types" (e.g., activities, tours) are also experiencing significant growth. In terms of platform usage, mobile dominates, surpassing desktop in terms of booking volume.

Key Drivers:

By Booking Type:

- Hotels and Packages: High demand for convenience and bundled offerings.

- Air Ticketing: Strong air travel growth within Vietnam.

- Bus Ticketing: Increasing popularity of intercity bus travel.

- Railway Ticketing: Growing infrastructure improvements.

- Other Booking Types: Rising demand for diverse travel experiences.

By Platform:

- Mobile: High smartphone penetration and preference for mobile booking.

- Desktop: Still relevant, but its share is gradually decreasing.

Dominance Analysis:

The dominance of "Hotels and Packages" and mobile platforms reflects the changing landscape of travel preferences in Vietnam, where convenience, value, and accessibility are prioritized. The high growth of "Other Booking Types" points towards the growing sophistication of the Vietnamese traveler, increasingly seeking unique and diverse travel experiences.

Vietnam Online Travel Market Product Innovations

Recent product innovations center on personalized travel recommendations, enhanced mobile user interfaces, and seamless integration with payment gateways. Features such as AI-powered itinerary suggestions, virtual reality travel previews, and flexible booking options are enhancing the customer experience. These innovations are directly targeting the needs of the increasingly tech-savvy Vietnamese traveler, improving market penetration and fostering a more competitive landscape.

Report Segmentation & Scope

This report segments the Vietnam online travel market by booking type (Air ticketing, Hotels and Packages, Bus Ticketing, Railway Ticketing, Other Booking Types) and platform (Desktop, Mobile). Each segment’s growth projection, market size, and competitive dynamics are analyzed. The report provides detailed insights into the market size for each segment, with growth projections based on various factors, including economic growth, technological advancements, and evolving consumer preferences. The competitive dynamics within each segment are assessed, considering the market shares of leading players, and entry barriers for new businesses.

- By Booking Type: Each category presents unique characteristics influencing its growth trajectory and competitive landscape. For example, Hotels and Packages are characterized by high competition among online travel agents, while Air ticketing is subject to airline policies and pricing strategies.

- By Platform: Mobile platform growth is projected to significantly outpace desktop, reflecting the shift towards mobile-first travel planning and bookings.

Key Drivers of Vietnam Online Travel Market Growth

Several key factors propel the growth of Vietnam's online travel market. Firstly, rapidly increasing internet and smartphone penetration ensures wider accessibility to online travel platforms. Secondly, rising disposable incomes among the Vietnamese population fuel greater spending on travel and leisure. Thirdly, government initiatives supporting tourism and infrastructure development further stimulate the market. Finally, the increasing convenience and cost-effectiveness of online booking platforms compared to traditional travel agencies incentivizes online adoption.

Challenges in the Vietnam Online Travel Market Sector

Challenges facing the Vietnam online travel market include maintaining data security and privacy in the digital environment, addressing concerns about fraudulent activities, and navigating a complex and evolving regulatory landscape. Additionally, ensuring competitive pricing and offering a comprehensive range of travel products and services are essential for sustained growth. Fluctuations in currency exchange rates and global economic conditions can also negatively impact market performance, adding an element of unpredictability.

Leading Players in the Vietnam Online Travel Market Market

- Tugo

- Traceloka

- Trivago

- TripAdvisor

- Skyscanner

- Agoda

- Booking.com

- Expedia

Key Developments in Vietnam Online Travel Market Sector

- November 2022: Booking Holdings, Inc. announced the expansion of its Travel Sustainable Program, signaling a growing focus on eco-friendly tourism and potentially influencing consumer choices.

- April 2022: Expedia Group's expanded collaboration with Qtech Software broadened access to Expedia's travel inventory for businesses globally, potentially increasing competition and market efficiency. This development empowers smaller travel businesses, driving innovation and competition.

Strategic Vietnam Online Travel Market Market Outlook

The Vietnam online travel market offers considerable future potential. Continued growth is anticipated, driven by sustained economic growth, rising tourism, and technological advancements. Strategic opportunities exist for players who can effectively leverage mobile technologies, provide personalized travel experiences, and capitalize on the growing demand for sustainable tourism options. Expansion into niche markets, strategic partnerships, and investments in innovative technologies will be crucial for success in this dynamic sector.

Vietnam Online Travel Market Segmentation

-

1. Booking Type

- 1.1. Air ticketing

- 1.2. Hotels and Packages

- 1.3. Bus Ticketing

- 1.4. Railway Ticketing

- 1.5. Other Booking Types

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

Vietnam Online Travel Market Segmentation By Geography

- 1. Vietnam

Vietnam Online Travel Market Regional Market Share

Geographic Coverage of Vietnam Online Travel Market

Vietnam Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration; Government Initiatives and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Language and Cultural Barriers; Competition from Offline Travel Agencies

- 3.4. Market Trends

- 3.4.1. Vietnam Online Travel Ranks One of Five Top Countries in Asian-Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Air ticketing

- 5.1.2. Hotels and Packages

- 5.1.3. Bus Ticketing

- 5.1.4. Railway Ticketing

- 5.1.5. Other Booking Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tugo**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Traceloka

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trivago

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TripAdvisor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skyscanner

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agoda

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Booking com

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Tugo**List Not Exhaustive

List of Figures

- Figure 1: Vietnam Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Vietnam Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Vietnam Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 5: Vietnam Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Vietnam Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Online Travel Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Vietnam Online Travel Market?

Key companies in the market include Tugo**List Not Exhaustive, Traceloka, Trivago, TripAdvisor, Skyscanner, Agoda, Booking com, Expedia.

3. What are the main segments of the Vietnam Online Travel Market?

The market segments include Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration; Government Initiatives and Infrastructure Development.

6. What are the notable trends driving market growth?

Vietnam Online Travel Ranks One of Five Top Countries in Asian-Pacific Region.

7. Are there any restraints impacting market growth?

Language and Cultural Barriers; Competition from Offline Travel Agencies.

8. Can you provide examples of recent developments in the market?

November 2022: Booking Holdings, Inc. announced the expansion of the Travel Sustainable Program to relevant brands across the Booking Holdings family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Online Travel Market?

To stay informed about further developments, trends, and reports in the Vietnam Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence