Key Insights

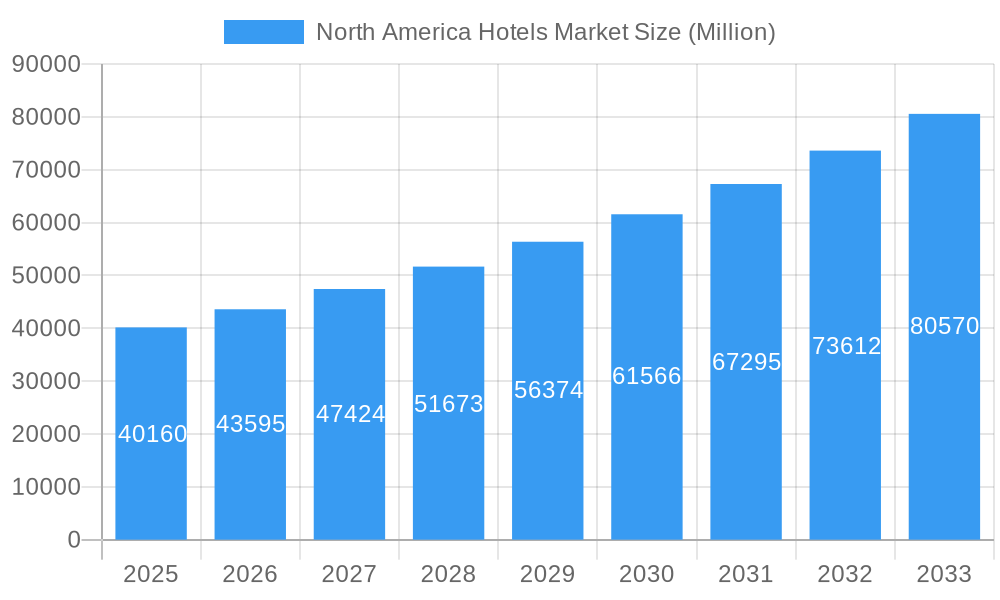

The North American hotels market, valued at $40.16 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This expansion is driven by several key factors. Increased domestic and international tourism, fueled by economic growth and a rising middle class, is a significant contributor. Furthermore, the burgeoning business travel sector and the increasing popularity of leisure travel, including extended stays and experiential tourism, are bolstering demand. The diverse hotel segment landscape, encompassing business hotels, airport hotels, suite hotels, resorts, and other service types, caters to a wide range of traveler needs and preferences, further contributing to market growth. Strategic investments in hotel infrastructure, technological advancements enhancing guest experiences (e.g., mobile check-in, personalized services), and the rise of sustainable tourism practices are also positive market drivers.

North America Hotels Market Market Size (In Billion)

However, the market faces certain challenges. Economic fluctuations, geopolitical instability, and unforeseen events like pandemics can significantly impact travel patterns and hotel occupancy rates. Rising operational costs, including labor and energy expenses, pose a challenge to profitability. Increasing competition within the industry, particularly from alternative accommodations like Airbnb, requires hotels to constantly innovate and enhance their offerings to maintain a competitive edge. Nevertheless, the long-term outlook for the North American hotels market remains positive, driven by the continued growth of the tourism sector and the adaptability of major hotel chains in meeting evolving traveler expectations. Key players like Hyatt, Marriott, Hilton, and Four Seasons are strategically positioned to capitalize on these trends through expansion, brand diversification, and targeted marketing campaigns. The regional focus on North America within this analysis highlights the significant contribution of the US, Canada, and Mexico to the overall market value.

North America Hotels Market Company Market Share

North America Hotels Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America hotels market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, industry trends, and future growth prospects, offering valuable insights for investors, industry professionals, and strategic decision-makers. The report includes detailed segmentation by service type (Business Hotels, Airport Hotels, Suite Hotels, Resorts, and Others) and incorporates key developments, market sizing, and growth projections. The Base Year for this report is 2025, with the Estimated Year also being 2025, the Forecast Period spanning 2025-2033, and the Historical Period covering 2019-2024. The market size is projected to reach xx Million by 2033.

North America Hotels Market Structure & Competitive Dynamics

The North American hotels market is characterized by a dynamic interplay of established players and emerging entrants. Market concentration is moderate, with several large chains holding significant market share, yet smaller independent hotels and boutique brands also contributing significantly. The competitive landscape is shaped by factors including brand recognition, service offerings, location strategy, technological adoption, and pricing strategies. Innovation ecosystems are flourishing, with advancements in technology driving improvements in guest experience, operational efficiency, and revenue management. Regulatory frameworks, varying by jurisdiction, influence operational costs and compliance requirements. Product substitutes, such as vacation rentals (Airbnb, VRBO), impact market share, particularly in the leisure segment. End-user trends, such as increasing demand for sustainable and experiential travel, are reshaping the industry. Significant mergers and acquisitions (M&A) activity is reshaping the competitive landscape.

- Market Share: Marriott International, Hilton Worldwide, and Hyatt Corporation hold a combined market share of approximately xx%.

- M&A Activity: Recent deals like Choice Hotels' acquisition of Radisson Hotel Group Americas ($675 Million) and Marriott's acquisition of Hoteles City Express demonstrate the ongoing consolidation within the sector.

North America Hotels Market Industry Trends & Insights

The North American hotels market is experiencing robust growth, driven by several factors. Increased domestic and international tourism, coupled with rising disposable incomes, fuels demand. Technological disruptions, such as the rise of online travel agencies (OTAs) and sophisticated revenue management systems, have transformed operations and booking processes. Consumer preferences are shifting towards personalized experiences, sustainable practices, and technology-enabled services, influencing hotel offerings. Competitive dynamics are characterized by intense rivalry, with players vying for market share through strategic acquisitions, brand expansion, loyalty programs, and service innovation. The Compound Annual Growth Rate (CAGR) for the market during the forecast period is estimated to be xx%, driven primarily by growth in the leisure and business travel segments. Market penetration of technology-enabled services is steadily increasing, with a projected xx% penetration rate by 2033.

Dominant Markets & Segments in North America Hotels Market

The United States remains the dominant market within North America, followed by Canada and Mexico. Within the service type segments, Business Hotels hold the largest market share, driven by strong corporate travel demand. However, Resorts are also exhibiting significant growth due to increasing leisure travel.

- Key Drivers for Business Hotels: Strong corporate travel, proximity to business districts, and well-developed infrastructure.

- Key Drivers for Resorts: Growth in leisure travel, attractive tourist destinations, and demand for luxurious amenities.

- Dominance Analysis: The dominance of the US market is attributed to its large economy, well-developed tourism infrastructure, and high levels of business and leisure travel.

North America Hotels Market Product Innovations

Recent product innovations focus on enhancing guest experiences through technological advancements. This includes smart room technology, personalized service platforms, and mobile check-in/check-out options. Companies are investing in sustainable practices, implementing eco-friendly technologies and promoting responsible tourism initiatives. These innovations improve operational efficiency, attract environmentally conscious travelers, and enhance the overall guest experience.

Report Segmentation & Scope

This report segments the North America hotels market by service type:

- Business Hotels: This segment is projected to experience steady growth driven by corporate travel. Market size is estimated at xx Million in 2025. Competitive intensity is high.

- Airport Hotels: This segment benefits from the convenience of location. Growth is linked to air passenger volume. The 2025 market size is projected at xx Million.

- Suite Hotels: This segment caters to extended-stay travelers. Market size is expected to reach xx Million in 2025. Competition is moderate.

- Resorts: This segment shows strong growth due to increasing leisure travel. The 2025 market size is projected at xx Million. Competition is diverse.

- Other Service Types: This includes boutique hotels, hostels, and other lodging options. Market size in 2025 is estimated at xx Million.

Key Drivers of North America Hotels Market Growth

Several factors drive the growth of the North America hotels market. These include:

- Economic Growth: Increased disposable incomes and a rise in tourism contribute to higher demand.

- Technological Advancements: Innovations in guest services and operational efficiency improve the overall hotel experience and attract more customers.

- Favorable Government Policies: Supportive tourism policies boost the industry.

Challenges in the North America Hotels Market Sector

The North American hotels market faces several challenges including:

- Economic Fluctuations: Recessions or economic downturns can reduce travel and tourism.

- Increased Competition: Intense competition among hotels requires constant innovation and investment.

- Labor Shortages: The industry often struggles with attracting and retaining skilled employees.

Leading Players in the North America Hotels Market Market

- Hyatt Corporation

- Four Seasons Hotels and Resorts

- Trump International Hotel and Tower

- Radisson Hotels

- Hilton Worldwide

- Wyndham Hotels & Resorts

- Fairmont Hotels and Resorts

- Rosewood Hotels & Resorts

- Marriott International Inc

- Ritz-Carlton Hotel Company LLC

Key Developments in North America Hotels Market Sector

- July 2023: Choice Hotels acquired Radisson Hotel Group Americas for approximately $675 Million, acquiring nine brands, 624 hotels, and over 67,000 rooms. This significantly alters the competitive landscape.

- November 2022: Hyatt acquired Dream Hotel Group's lifestyle hotel brand, expanding its portfolio and strengthening its presence in key markets.

- October 2022: Marriott International acquired Hoteles City Express, expanding its footprint in Latin America and becoming a leading player in the region.

Strategic North America Hotels Market Outlook

The North America hotels market exhibits strong growth potential. Continued investment in technology, strategic acquisitions, and a focus on personalized guest experiences are key growth accelerators. The market is poised to benefit from the increasing demand for sustainable travel and experiential tourism. Opportunities exist for innovative hotel concepts and technology-enabled services. The focus on improving operational efficiency and managing labor costs will be crucial for sustained success.

North America Hotels Market Segmentation

-

1. Service Type

- 1.1. Business Hotel

- 1.2. Airport Hotel

- 1.3. Suite Hotels

- 1.4. Resorts

- 1.5. Others Services Types

-

2. Geography

- 2.1. United States of America

- 2.2. Canada

- 2.3. Mexico

North America Hotels Market Segmentation By Geography

- 1. United States of America

- 2. Canada

- 3. Mexico

North America Hotels Market Regional Market Share

Geographic Coverage of North America Hotels Market

North America Hotels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. North America Dominates the Luxury Hotel Segment Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hotels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotel

- 5.1.2. Airport Hotel

- 5.1.3. Suite Hotels

- 5.1.4. Resorts

- 5.1.5. Others Services Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States of America

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States of America

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States of America North America Hotels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotel

- 6.1.2. Airport Hotel

- 6.1.3. Suite Hotels

- 6.1.4. Resorts

- 6.1.5. Others Services Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States of America

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Hotels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotel

- 7.1.2. Airport Hotel

- 7.1.3. Suite Hotels

- 7.1.4. Resorts

- 7.1.5. Others Services Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States of America

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Mexico North America Hotels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotel

- 8.1.2. Airport Hotel

- 8.1.3. Suite Hotels

- 8.1.4. Resorts

- 8.1.5. Others Services Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States of America

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Hyatt Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Four Seasons Hotels and Resorts

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Trump International Hotel and Tower

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Radisson Hotels

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hilton Worldwide

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Wyndham Hotels & Resorts

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Fairmont Hotels and Resorts*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Rosewood Hotels & Resorts

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Marriott International Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ritz-Carlton Hotel Company LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Hyatt Corporation

List of Figures

- Figure 1: North America Hotels Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Hotels Market Share (%) by Company 2025

List of Tables

- Table 1: North America Hotels Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: North America Hotels Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America Hotels Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Hotels Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: North America Hotels Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Hotels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America Hotels Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: North America Hotels Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America Hotels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: North America Hotels Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: North America Hotels Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Hotels Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hotels Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the North America Hotels Market?

Key companies in the market include Hyatt Corporation, Four Seasons Hotels and Resorts, Trump International Hotel and Tower, Radisson Hotels, Hilton Worldwide, Wyndham Hotels & Resorts, Fairmont Hotels and Resorts*List Not Exhaustive, Rosewood Hotels & Resorts, Marriott International Inc, Ritz-Carlton Hotel Company LLC.

3. What are the main segments of the North America Hotels Market?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

North America Dominates the Luxury Hotel Segment Globally.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

July 2023: Choice Hotels acquired Radisson Hotel Group Americas. The deal was worth around $675 million, and with this deal, Choice Hotels acquired nine new brands, 624 hotels, and over 67,000 rooms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hotels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hotels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hotels Market?

To stay informed about further developments, trends, and reports in the North America Hotels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence