Key Insights

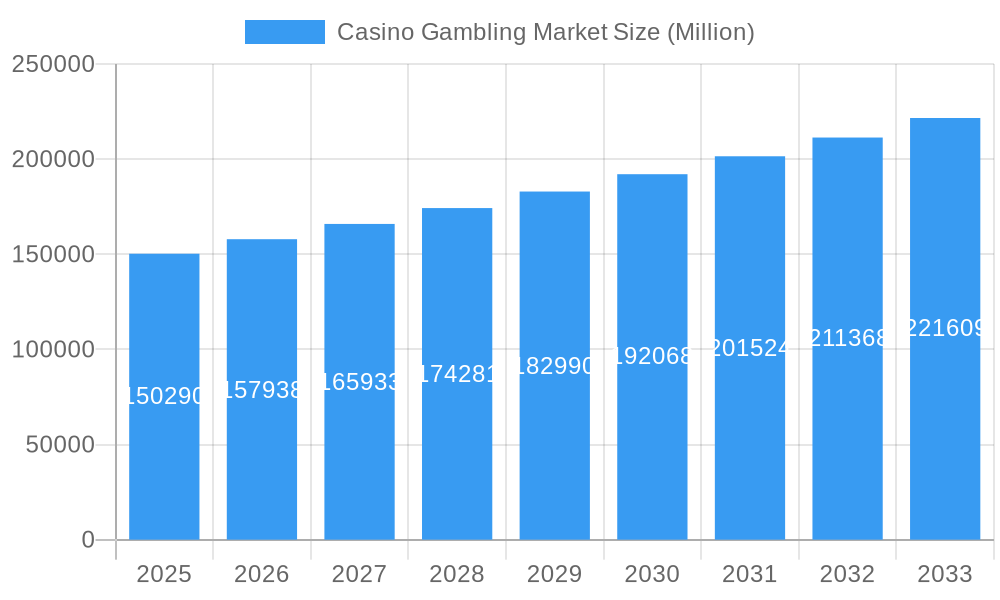

The global casino gambling market, valued at $150.29 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.95% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of online casino games, particularly live casino options, offers players enhanced convenience and accessibility, driving market expansion beyond traditional brick-and-mortar casinos. Technological advancements, such as virtual reality (VR) and augmented reality (AR) integration, are enhancing the gaming experience, attracting a wider demographic. Furthermore, strategic partnerships between casino operators and technology providers are leading to innovative game development and improved customer engagement. The rise of mobile gaming and the increasing penetration of smartphones contribute to this trend. While regulatory hurdles and concerns surrounding responsible gambling remain potential restraints, the overall market outlook remains positive.

Casino Gambling Market Market Size (In Billion)

Geographical diversification also plays a significant role in market growth. North America, with its established casino infrastructure and strong player base, currently commands a substantial market share. However, Asia-Pacific is expected to exhibit faster growth due to the rising disposable incomes and a burgeoning middle class in key markets like China, Japan, and Southeast Asia. Europe, with its mature gaming industry, is also contributing significantly. The expansion into emerging markets in South America and the Middle East and Africa presents promising opportunities for future growth, although market penetration in these regions may be slower due to varying regulatory landscapes and cultural factors. The diverse range of games, including live casino, baccarat, blackjack, poker, and slots, caters to a wide range of player preferences, further contributing to market expansion. Leading operators like Caesars Entertainment, Melco Resorts & Entertainment, and MGM Resorts International are constantly innovating and expanding their offerings to maintain their competitive edge.

Casino Gambling Market Company Market Share

Casino Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Casino Gambling Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Casino Gambling Market Market Structure & Competitive Dynamics

The Casino Gambling Market is characterized by a moderately concentrated structure, with key players like Caesars Entertainment, Melco Resorts & Entertainment, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, and Hard Rock International holding significant market share. However, the market also accommodates numerous smaller regional operators and emerging online platforms. The competitive landscape is shaped by intense rivalry, driven by factors such as brand recognition, geographic reach, and the continuous development of innovative gaming products.

Market concentration is further influenced by stringent regulatory frameworks that vary across jurisdictions, creating both opportunities and challenges for market expansion. The industry witnesses frequent mergers and acquisitions (M&A) activity, with deal values reaching into the Billions. For instance, recent M&A activity includes MGM Resorts International's acquisition of Push Gaming, signaling the importance of technological advancements in shaping the market. Substitution effects, though limited for traditional brick-and-mortar casinos, are felt more significantly in the online segment with alternatives like mobile gaming and virtual reality entertainment. End-user preferences, shifting towards personalized experiences and technological integration, further drive market dynamics.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2025 estimate).

- M&A Activity: Significant activity, with deal values exceeding xx Billion in the last five years.

- Innovation Ecosystems: Focused on technological advancements, personalization, and omnichannel integration.

- Regulatory Frameworks: Vary widely across jurisdictions, impacting market access and operational costs.

- Product Substitutes: Limited for traditional casinos; more prevalent in online gaming with alternative digital entertainment.

- End-user Trends: Increased demand for personalized experiences, mobile accessibility, and diverse gaming options.

Casino Gambling Market Industry Trends & Insights

The Casino Gambling Market is experiencing robust growth, fueled by several factors. Rising disposable incomes, particularly in emerging economies, and the increasing popularity of online casino gaming contribute significantly to this expansion. Technological advancements, including the integration of virtual reality (VR) and augmented reality (AR) technologies, are reshaping the gaming experience, attracting a broader range of players. Further contributing to market growth is the ongoing development and adoption of mobile-friendly casino games and applications. This allows players to access their favorite games at their convenience through smartphones and tablets.

Furthermore, the industry's strategic partnerships and collaborations, such as MGM's recent acquisition of Push Gaming, showcase the focus on enhancing game offerings and optimizing player engagement. However, the market faces challenges from stringent regulations and increased competition. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a projected market value of xx Million by 2033. Market penetration for online casino gaming is expected to increase significantly, driven by the accessibility and convenience of online platforms.

Dominant Markets & Segments in Casino Gambling Market

The Asia-Pacific region, particularly regions like Macau and Singapore, currently holds the leading position in the global Casino Gambling Market, owing to high tourism rates, large disposable incomes and supportive government policies. However, North America and Europe remain significant markets with substantial revenue generation. Among casino game types, Slots consistently generates the highest revenue globally.

- Key Drivers for Asia-Pacific Dominance:

- High tourism and high-roller spending.

- Supportive regulatory environment in certain key jurisdictions.

- Robust infrastructure development.

- Significant investment in luxury resorts and integrated entertainment facilities.

- Slots Market Dominance: High popularity and ease of access contribute to the largest market segment share. This is further supported by the vast number of themed and branded games developed.

Casino Gambling Market Product Innovations

The Casino Gambling Market is witnessing rapid product innovation, driven by advancements in technology and evolving consumer preferences. We're seeing an increase in mobile-first casino games, immersive VR/AR experiences, and personalized game offerings catered to individual player preferences. These innovations enhance player engagement and drive revenue growth, creating strong competitive advantages for firms that invest significantly in research and development.

Report Segmentation & Scope

This report segments the Casino Gambling Market by game type: Live Casino, Baccarat, Blackjack, Poker, Slots, and Others Casino Games. Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The "Slots" segment is projected to hold the largest market share throughout the forecast period, followed by "Live Casino" and "Baccarat." Each segment's analysis details its market size, projected growth, and influential factors including technological trends and competitive pressures.

- Live Casino: Growing rapidly due to immersive player experience.

- Baccarat: Strong market share, driven by high-roller demand.

- Blackjack: Consistent popularity, with online variations gaining traction.

- Poker: Maintains a dedicated player base but faces competition from other games.

- Slots: The largest segment due to its wide appeal and diverse game offerings.

- Others Casino Games: Includes various table and card games that collectively contribute to significant market share.

Key Drivers of Casino Gambling Market Growth

Several factors drive the growth of the Casino Gambling Market. Technological advancements, including mobile gaming and VR/AR integration, enhance accessibility and player engagement. The rise of disposable incomes in various regions fuels increased spending on entertainment, including casino gaming. Favorable regulatory environments in certain jurisdictions encourage market expansion.

Challenges in the Casino Gambling Market Sector

The Casino Gambling Market faces challenges like stringent regulations, which can hinder expansion and profitability. Supply chain disruptions can impact the availability of gaming equipment, and intense competition requires continuous innovation to maintain market share. Increased scrutiny of responsible gaming practices presents further challenges impacting operational strategies.

Leading Players in the Casino Gambling Market Market

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Key Developments in Casino Gambling Market Sector

- May 2023: MGM Resorts International's LeoVegas subsidiary acquired Push Gaming, strengthening its game development capabilities.

- April 2023: Caesars Entertainment reopened the Tropicana Online Casino in New Jersey, enhancing its digital offerings.

Strategic Casino Gambling Market Market Outlook

The Casino Gambling Market presents significant growth opportunities, particularly in emerging markets and through technological innovation. Strategic investments in online platforms, personalized gaming experiences, and responsible gaming initiatives will be crucial for success. The market's continued growth is expected to be propelled by increasing digitalization, evolving player preferences, and the emergence of new gaming technologies.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence