Key Insights

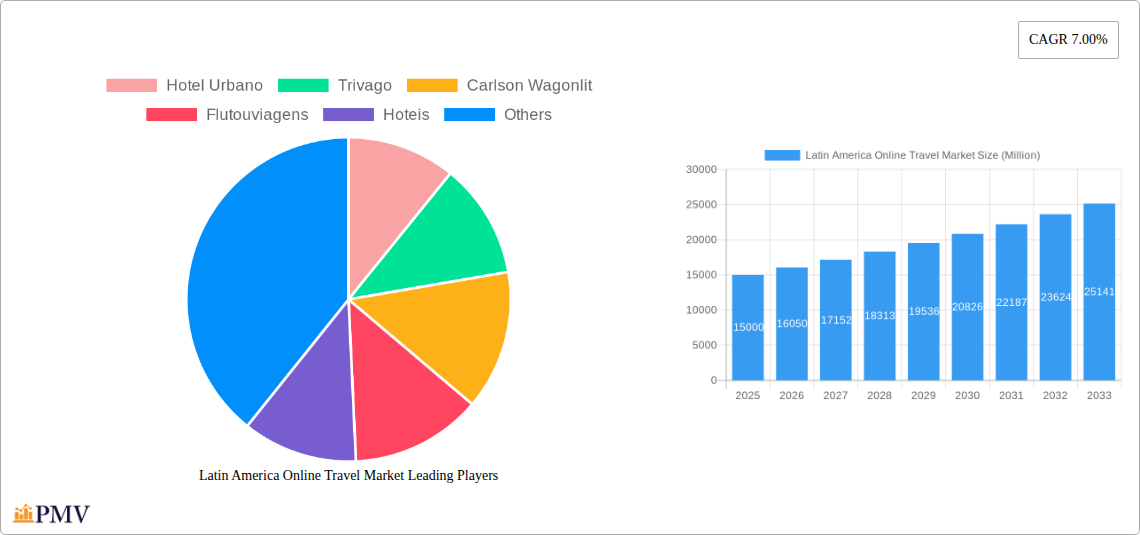

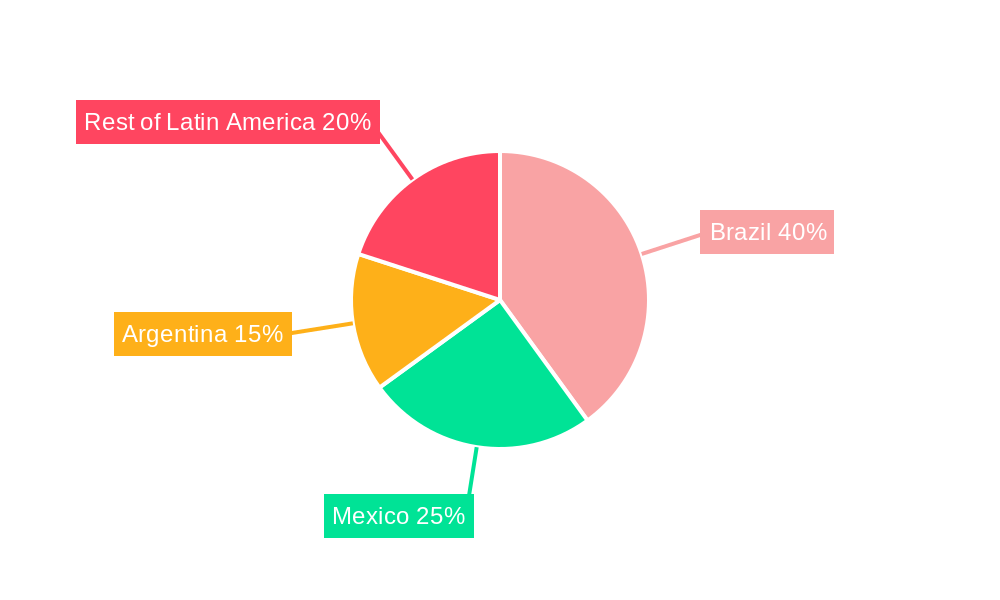

The Latin American online travel market is experiencing robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a burgeoning middle class eager to explore both domestic and international destinations. The market's 7% CAGR from 2019 to 2024 suggests a significant expansion, and this upward trajectory is projected to continue through 2033. While precise market size figures for 2019-2024 aren't provided, a reasonable estimation based on a 7% CAGR and assuming a 2025 market size of, say, $15 billion, would indicate substantial growth over the forecast period. Key segments fueling this expansion include accommodation booking, followed closely by holiday package bookings, reflecting a preference for convenient, all-inclusive travel options. The mobile/tablet booking platform dominates, reflecting the region's high mobile adoption rate, while the balance between direct bookings and travel agents suggests a dynamic market where consumers are increasingly comfortable booking directly online while still valuing the expertise offered by travel agencies. Brazil, Mexico, and Argentina lead the regional market share, due to their larger populations and higher economic activity. The market faces certain challenges, such as economic volatility and potential infrastructure limitations in some areas. However, these are counterbalanced by the accelerating digitalization and increasing preference for convenient online travel planning.

Latin America Online Travel Market Market Size (In Billion)

The competitive landscape is dynamic, featuring both global giants like Booking Holdings and Airbnb, alongside successful regional players such as Despegar and Decolar. These companies are vying for market share through innovative technologies, personalized offerings, and competitive pricing strategies. This competition further stimulates market expansion by providing consumers with greater choice and value. The continued expansion of online payment systems and improved logistics infrastructure will further enhance the market's growth. The shift towards sustainable and experiential travel represents a key emerging trend, with tourists increasingly seeking eco-friendly options and authentic cultural experiences. Companies that successfully integrate these elements into their offerings will gain a competitive edge. The long-term outlook for the Latin American online travel market remains highly positive, promising continued expansion and innovation.

Latin America Online Travel Market Company Market Share

Latin America Online Travel Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the Latin America online travel market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, dominant segments, and future growth potential. Expect in-depth analysis across various segments, including accommodation, travel tickets, holiday packages, and more, considering booking platforms (desktop, mobile) and booking methods (direct, travel agents). The report also explores key industry developments, highlighting mergers and acquisitions that reshape the competitive dynamics.

Latin America Online Travel Market Market Structure & Competitive Dynamics

The Latin American online travel market exhibits a dynamic structure characterized by both established giants and emerging players. Market concentration is relatively high, with a few major players commanding significant shares. However, a vibrant ecosystem of smaller agencies and niche players fosters innovation and competition. Regulatory frameworks vary across Latin American countries, impacting market access and operations. The market witnesses substantial M&A activity, reflecting consolidation trends and strategic expansion efforts. Substitute products, such as traditional travel agencies and offline booking methods, continue to coexist, but the online segment shows robust growth. End-user trends lean towards mobile-first booking, personalized experiences, and value-driven offerings.

- Market Concentration: The top 5 players command approximately 65% of the market share in 2025 (estimated).

- M&A Activity: Significant deals like Despegar's acquisition of Viajanet in 2022 for approximately US$15 Million illustrate the consolidation within the market. Further acquisitions, totaling an estimated xx Million in value, occurred during the historical period.

- Innovation: Key players are investing heavily in AI-powered personalization, dynamic pricing, and improved user interfaces.

- Regulatory Landscape: Varied regulations across countries create complexities for market entry and operation.

Latin America Online Travel Market Industry Trends & Insights

The Latin America online travel market exhibits robust growth, fueled by rising disposable incomes, increasing internet and smartphone penetration, and a growing preference for convenient online booking. The market is undergoing a technological disruption driven by the adoption of mobile-first strategies, artificial intelligence (AI) for personalized recommendations, and the integration of big data analytics for optimized pricing and inventory management. Consumer preferences shift towards seamless user experiences, secure payment gateways, and transparent pricing. Competitive dynamics are shaped by the ongoing consolidation through mergers and acquisitions, creating larger entities with increased market power. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), driven by increasing market penetration, particularly within mobile booking. By 2033, the market penetration is projected to reach xx%.

Dominant Markets & Segments in Latin America Online Travel Market

- Leading Region: Brazil dominates the market due to its large population, significant economic activity, and high internet penetration.

- Leading Country: Brazil consistently leads in market size and growth, followed by Mexico and Argentina.

- Dominant Segment (By Service Type): Accommodation booking holds the largest market share, followed by holiday package bookings.

- Dominant Segment (By Mode of Booking): Online travel agencies (OTAs) command a larger share than direct bookings due to their extensive reach and bundled services.

- Dominant Segment (By Booking Platform): Mobile/Tablet bookings are rapidly overtaking desktop bookings reflecting the increasing smartphone penetration.

Key Drivers:

- Economic Growth: Rising disposable incomes fuel increased travel spending.

- Technological Advancements: Mobile technology and AI-powered personalization enhance user experience.

- Infrastructure Development: Improved internet connectivity and digital literacy across the region.

Latin America Online Travel Market Product Innovations

The Latin American online travel market is witnessing significant product innovation, driven by technological advancements. Key developments include AI-powered personalized recommendations, seamless mobile booking experiences, virtual reality (VR) and augmented reality (AR) integration for immersive travel planning, and blockchain technology for secure and transparent transactions. These innovations enhance user experience, improve operational efficiency, and create new revenue streams for companies. The market sees a strong fit for products catering to budget-conscious travelers and those seeking unique, personalized travel experiences.

Report Segmentation & Scope

This report segments the Latin America online travel market by service type (Accommodation Booking, Travel Tickets Booking, Holiday Package Booking, Other Service Types), mode of booking (Direct Booking, Travel Agents), and booking platform (Desktop, Mobile/Tablet). Each segment is thoroughly analyzed, providing market size estimations (in Millions), growth projections for the forecast period (2025-2033), and insights into competitive dynamics. The accommodation booking segment shows the highest growth, while mobile/tablet booking is rapidly gaining market share.

Key Drivers of Latin America Online Travel Market Growth

Several key factors drive the growth of the Latin America online travel market. The rising adoption of smartphones and increasing internet penetration are crucial, alongside growing disposable incomes and a preference for convenient online booking. Furthermore, government initiatives promoting tourism and investment in infrastructure enhance the appeal of online travel services. The expansion of affordable flight options and the increasing popularity of budget-friendly accommodation platforms also significantly contribute to market expansion.

Challenges in the Latin America Online Travel Market Sector

Challenges impacting the market include varied regulatory landscapes across countries creating operational complexities and inconsistent standards. Fluctuations in currency exchange rates and economic instability in certain regions pose risks. Furthermore, intense competition from established players and emerging start-ups necessitates continuous innovation and strategic differentiation. Cybersecurity concerns and the protection of customer data are also paramount.

Leading Players in the Latin America Online Travel Market Market

- Hotel Urbano

- Trivago

- Carlson Wagonlit

- Flutouviagens

- Hoteis

- CVC Corp

- Airbnb

- Booking Holdings

- Decolar

- Pricetravel

- Despegar

Key Developments in Latin America Online Travel Market Sector

- November 2022: The European Commission's investigation into Booking Holdings' acquisition of Etraveli highlights the increasing scrutiny of M&A activity in the online travel sector.

- May 2022: Despegar's acquisition of Viajanet strengthens its position in the Brazilian market, illustrating the ongoing consolidation trend.

Strategic Latin America Online Travel Market Market Outlook

The Latin America online travel market presents substantial growth opportunities. Further penetration of mobile technology, expansion into underserved markets, and the development of innovative products and services will be key to future success. Strategic partnerships and investments in technology, particularly AI and big data analytics, will be crucial for companies seeking to gain a competitive edge. The focus on personalized experiences and sustainable travel options will also drive growth in the years to come.

Latin America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Service Types

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

Latin America Online Travel Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Online Travel Market Regional Market Share

Geographic Coverage of Latin America Online Travel Market

Latin America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growing Tourism Sector is Helping the Market to Grow Further

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Mexico Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Brazil Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Argentina Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Accommodation Booking

- 8.1.2. Travel Tickets Booking

- 8.1.3. Holiday Package Booking

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Direct Booking

- 8.2.2. Travel Agents

- 8.3. Market Analysis, Insights and Forecast - by Booking Platform

- 8.3.1. Desktop

- 8.3.2. Mobile/Tablet

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Latin America Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Accommodation Booking

- 9.1.2. Travel Tickets Booking

- 9.1.3. Holiday Package Booking

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Direct Booking

- 9.2.2. Travel Agents

- 9.3. Market Analysis, Insights and Forecast - by Booking Platform

- 9.3.1. Desktop

- 9.3.2. Mobile/Tablet

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hotel Urbano

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivago

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Carlson Wagonlit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutouviagens

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hoteis

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CVC Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Airbnb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Booking Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Decolar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pricetravel**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Despegar

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hotel Urbano

List of Figures

- Figure 1: Latin America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 19: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 23: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 24: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Online Travel Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Online Travel Market?

Key companies in the market include Hotel Urbano, Trivago, Carlson Wagonlit, Flutouviagens, Hoteis, CVC Corp, Airbnb, Booking Holdings, Decolar, Pricetravel**List Not Exhaustive, Despegar.

3. What are the main segments of the Latin America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growing Tourism Sector is Helping the Market to Grow Further.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In November 2022, The European Commission has opened an investigation into the proposed acquisition of Sweden's Flugo Group Holdings AB which operates as Etraveli by Booking Holdings Inc.. The proposed transaction would allow Booking to strengthen its position in the market for online travel agencies, and increase the barrier to entry and expansion for rivals

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Online Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence