Key Insights

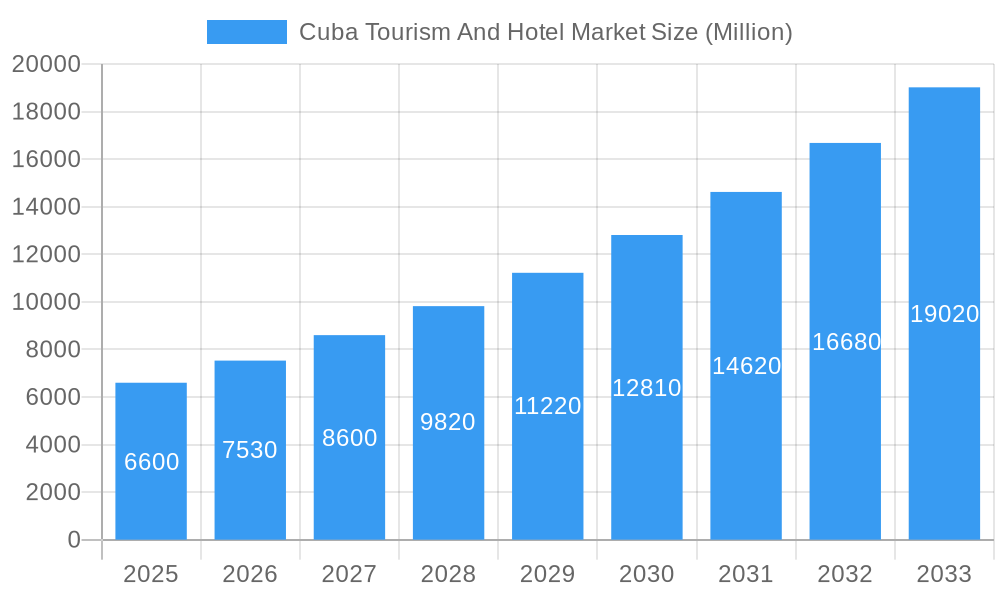

The Cuba tourism and hotel market, valued at $6.60 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.17% from 2025 to 2033. This significant expansion is driven by several factors. Increased international flight accessibility, post-pandemic travel resurgence, and Cuba's unique cultural appeal are attracting a growing number of tourists. Furthermore, ongoing investments in infrastructure improvements, including hotel renovations and new constructions across various segments (budget, mid-scale, luxury, and alternative accommodations like homestays and hostels), are bolstering the market's capacity and appeal. The market's segmentation reflects a diverse tourist base, catering to budget-conscious travelers as well as luxury seekers. Major hotel chains like Kempinski, Iberostar, Melia, Accor, and Barcelo, alongside local brands such as Gran Caribe and Blue Diamond, contribute significantly to the sector’s competitiveness and offerings. However, challenges remain, including the need for continued infrastructure development to handle increasing tourist numbers, and potential economic volatility affecting tourist spending. Effective management of these factors will be key to sustaining the market's impressive growth trajectory.

Cuba Tourism And Hotel Market Market Size (In Billion)

The strong growth is expected to continue throughout the forecast period, driven by strategic government initiatives aimed at tourism development and the increasing appeal of Cuba as a unique and culturally rich destination. The market's segmentation ensures a wide range of accommodation options, further fueling its growth. The presence of established international hotel chains alongside local operators fosters competition and innovation, driving improvements in service and quality. While potential economic uncertainties or global events could present challenges, the overall outlook for the Cuba tourism and hotel market remains positive, with significant opportunities for growth and investment in the coming years. The market's resilience and adaptation to external factors will be crucial in sustaining its long-term growth prospects.

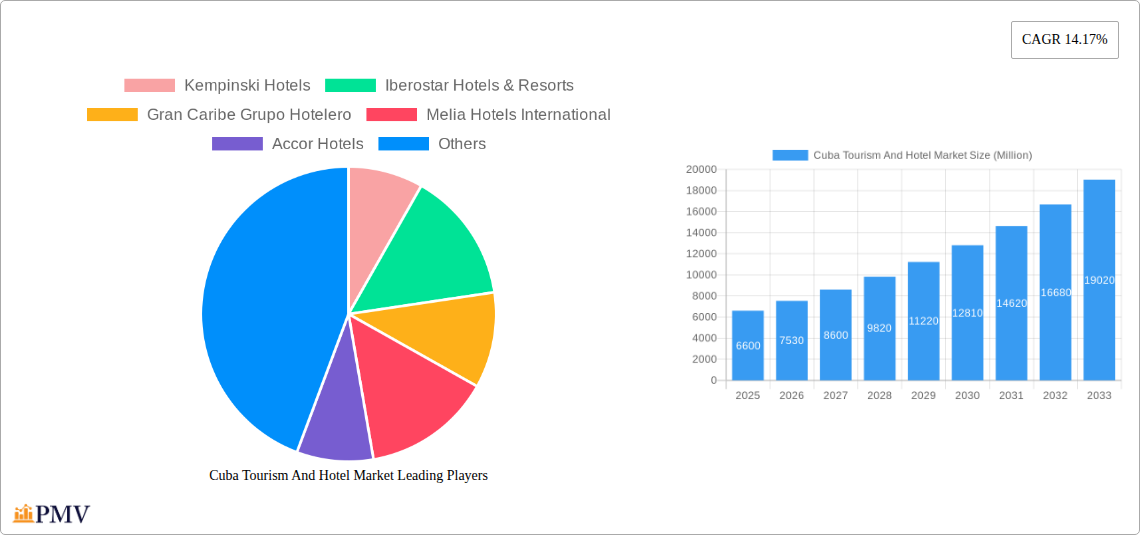

Cuba Tourism And Hotel Market Company Market Share

Cuba Tourism and Hotel Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Cuba tourism and hotel market, offering invaluable insights for investors, industry professionals, and strategic planners. Spanning the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The market size is projected to reach xx Million by 2033.

Cuba Tourism And Hotel Market Market Structure & Competitive Dynamics

The Cuban tourism and hotel market exhibits a complex interplay of domestic and international players, shaped by evolving regulations and infrastructure developments. Market concentration is moderate, with a few dominant international chains like Meliá Hotels International, Iberostar Hotels & Resorts, and Accor Hotels competing alongside significant domestic players such as Gran Caribe Grupo Hotelero and Grupo Cubanacan. The market share of these key players fluctuates but generally remains consistent.

- Market Concentration: The market displays moderate concentration, with the top five players holding an estimated xx% market share in 2025.

- Innovation Ecosystems: Innovation is primarily driven by international chains introducing new technologies and service models. However, limited access to certain technologies and resources creates a barrier for local innovation.

- Regulatory Frameworks: Government regulations significantly influence market entry, operations, and pricing strategies. Recent policy shifts have focused on attracting foreign investment and upgrading infrastructure.

- Product Substitutes: The primary substitutes are alternative accommodation options like homestays and private rentals, posing a competitive challenge to established hotels.

- End-User Trends: Growing demand for sustainable and experiential tourism is driving hotel offerings that incorporate local culture and environmental consciousness.

- M&A Activities: While significant M&A activity is not prevalent, strategic partnerships between international and domestic players are increasing. The total value of M&A deals in the historical period (2019-2024) was approximately xx Million.

Cuba Tourism And Hotel Market Industry Trends & Insights

The Cuban tourism and hotel market is experiencing a period of moderate growth, driven by factors such as increased international tourism, improved infrastructure, and government incentives. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, while market penetration is projected to reach xx% by 2033. Technological disruption is gradual, with the adoption of online booking platforms and digital marketing becoming more widespread. Consumer preferences are shifting towards experiences focused on culture, nature, and sustainable practices. Competitive dynamics are intensifying as international chains expand their presence, and local operators strive to enhance service quality and offerings.

Dominant Markets & Segments in Cuba Tourism And Hotel Market

Varadero remains the dominant tourist destination in Cuba, attracting the largest share of both domestic and international visitors due to its well-developed infrastructure and renowned beaches. Havana also holds significant appeal, particularly for cultural tourism.

- Key Drivers for Varadero Dominance:

- Well-established tourism infrastructure (hotels, airports, transportation).

- Extensive beachfronts and attractive natural landscapes.

- Strong government support for tourism development.

- Market Segmentation Dominance:

- Luxury Hotels: This segment experiences the highest growth potential, driven by increasing demand for high-end experiences. Key players are Kempinski Hotels and Iberostar Hotels & Resorts.

- Mid and Upper Mid-scale Hotels: This segment accounts for the largest market share, catering to the broad range of tourist demographics. Meliá Hotels International and Barceló Hotels & Resorts dominate.

- Budget and Economy Hotels: This segment is steadily growing, accommodating budget-conscious travelers and offering increased affordability.

- Others (Homestays, Hostels, etc.): This segment's growth is fueled by the appeal of authentic local experiences, increasing the competitive pressure on hotels.

The market is characterized by varied pricing strategies depending on location, seasonality, and the level of services offered.

Cuba Tourism And Hotel Market Product Innovations

Recent product developments focus on enhancing guest experiences through sustainable practices, personalized services, and technological integration, aligning with global tourism trends. For instance, several hotel chains are investing in renewable energy sources and promoting eco-tourism initiatives. Mobile check-in/out and digital concierge services are becoming more common. Smart room technologies and personalized entertainment options are also gaining traction.

Report Segmentation & Scope

The report segments the market based on hotel type: Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels, and Others (Homestays, Hostels, etc.). Growth projections vary significantly across segments, with the Luxury Hotels segment projected to experience the highest growth rate in the forecast period. Market size for each segment is detailed within the full report. Competitive dynamics are diverse across segments, with different players dominating various categories.

Key Drivers of Cuba Tourism And Hotel Market Growth

Several factors are propelling growth, including: increased foreign investment, improving infrastructure (airports, transportation), government initiatives to promote tourism, and the growing appeal of Cuba as a unique and culturally rich destination. The relaxation of travel restrictions and improved diplomatic relations have also played a crucial role. Technological advancements in the hospitality sector further enhance the overall experience.

Challenges in the Cuba Tourism And Hotel Market Sector

Challenges include infrastructure limitations, particularly outside of major tourist hubs, fluctuating economic conditions impacting consumer spending, and the need for continued investment in technology and human capital. Regulatory hurdles and the need for consistent policy implementation also pose significant challenges. Supply chain disruptions and dependence on imports could negatively affect hotel operations.

Leading Players in the Cuba Tourism And Hotel Market Market

- Kempinski Hotels

- Iberostar Hotels & Resorts

- Gran Caribe Grupo Hotelero

- Melia Hotels International

- Accor Hotels

- Barcelo Hotels & Resorts

- Grupo Cubanacan

- Blue Diamond Hotels & Resorts

- Be Live Hotels

- Blau Hotels & Resorts

Key Developments in Cuba Tourism And Hotel Market Sector

- 2019: Meliá Hotels International extends its agreement with the Cuban government for 25 years.

- Ongoing: Meliá continues expansion into Cienfuegos, Trinidad, and Camaguey.

- Ongoing: Iberostar continues its expansion in key tourist destinations across Cuba.

- Ongoing: Various hotel chains implement sustainability initiatives and invest in technology upgrades.

Strategic Cuba Tourism And Hotel Market Market Outlook

The Cuban tourism and hotel market presents significant long-term growth potential. Strategic opportunities lie in investing in sustainable tourism projects, enhancing infrastructure in less-developed regions, and capitalizing on the growing demand for unique cultural and experiential tourism. Partnerships between international and domestic players can unlock further market expansion and create synergy. The focus on improving the overall tourist experience and diversifying tourism offerings will be key to long-term success.

Cuba Tourism And Hotel Market Segmentation

-

1. Market Tourism

- 1.1. Domestic Tourism

- 1.2. International Tourism

- 2. Domestic Tourism

- 3. International Tourism

-

4. Market Hotel

- 4.1. Budget and Economy Hotels

- 4.2. Mid and Upper Mid-scale Hotels

- 4.3. Luxury Hotels

- 4.4. Others (Homestays, Hostels, etc.)

- 5. Budget and Economy Hotels

- 6. Mid and Upper Mid-scale Hotels

- 7. Luxury Hotels

- 8. Others (Homestays, Hostels, etc.)

Cuba Tourism And Hotel Market Segmentation By Geography

- 1. Cuba

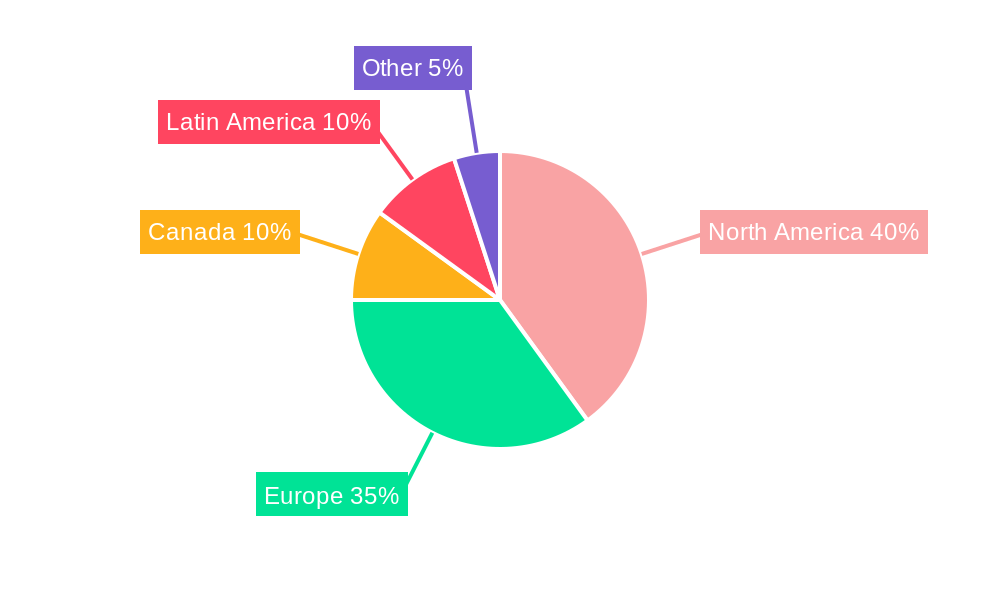

Cuba Tourism And Hotel Market Regional Market Share

Geographic Coverage of Cuba Tourism And Hotel Market

Cuba Tourism And Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Increasing Demand for Hospitality Services; Consistent Demand for Business Travel and Corporate Hospitality Services

- 3.3. Market Restrains

- 3.3.1. Stringent Government Policies and Regulations Limiting the Market Growth; Lack of Skilled Labor is a Challenge for the Market

- 3.4. Market Trends

- 3.4.1. Increasing Tourist Arrivals to Cuba is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cuba Tourism And Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Market Tourism

- 5.1.1. Domestic Tourism

- 5.1.2. International Tourism

- 5.2. Market Analysis, Insights and Forecast - by Domestic Tourism

- 5.3. Market Analysis, Insights and Forecast - by International Tourism

- 5.4. Market Analysis, Insights and Forecast - by Market Hotel

- 5.4.1. Budget and Economy Hotels

- 5.4.2. Mid and Upper Mid-scale Hotels

- 5.4.3. Luxury Hotels

- 5.4.4. Others (Homestays, Hostels, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Budget and Economy Hotels

- 5.6. Market Analysis, Insights and Forecast - by Mid and Upper Mid-scale Hotels

- 5.7. Market Analysis, Insights and Forecast - by Luxury Hotels

- 5.8. Market Analysis, Insights and Forecast - by Others (Homestays, Hostels, etc.)

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Cuba

- 5.1. Market Analysis, Insights and Forecast - by Market Tourism

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kempinski Hotels

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iberostar Hotels & Resorts

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gran Caribe Grupo Hotelero

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melia Hotels International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accor Hotels

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Barcelo Hotels & Resorts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Other Prominent Hotel Brands/Chains**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grupo Cubanacan

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blue Diamond Hotels & Resorts

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Be Live Hotels

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Blau Hotels & Resorts

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kempinski Hotels

List of Figures

- Figure 1: Cuba Tourism And Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cuba Tourism And Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: Cuba Tourism And Hotel Market Revenue Million Forecast, by Market Tourism 2020 & 2033

- Table 2: Cuba Tourism And Hotel Market Revenue Million Forecast, by Domestic Tourism 2020 & 2033

- Table 3: Cuba Tourism And Hotel Market Revenue Million Forecast, by International Tourism 2020 & 2033

- Table 4: Cuba Tourism And Hotel Market Revenue Million Forecast, by Market Hotel 2020 & 2033

- Table 5: Cuba Tourism And Hotel Market Revenue Million Forecast, by Budget and Economy Hotels 2020 & 2033

- Table 6: Cuba Tourism And Hotel Market Revenue Million Forecast, by Mid and Upper Mid-scale Hotels 2020 & 2033

- Table 7: Cuba Tourism And Hotel Market Revenue Million Forecast, by Luxury Hotels 2020 & 2033

- Table 8: Cuba Tourism And Hotel Market Revenue Million Forecast, by Others (Homestays, Hostels, etc.) 2020 & 2033

- Table 9: Cuba Tourism And Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Cuba Tourism And Hotel Market Revenue Million Forecast, by Market Tourism 2020 & 2033

- Table 11: Cuba Tourism And Hotel Market Revenue Million Forecast, by Domestic Tourism 2020 & 2033

- Table 12: Cuba Tourism And Hotel Market Revenue Million Forecast, by International Tourism 2020 & 2033

- Table 13: Cuba Tourism And Hotel Market Revenue Million Forecast, by Market Hotel 2020 & 2033

- Table 14: Cuba Tourism And Hotel Market Revenue Million Forecast, by Budget and Economy Hotels 2020 & 2033

- Table 15: Cuba Tourism And Hotel Market Revenue Million Forecast, by Mid and Upper Mid-scale Hotels 2020 & 2033

- Table 16: Cuba Tourism And Hotel Market Revenue Million Forecast, by Luxury Hotels 2020 & 2033

- Table 17: Cuba Tourism And Hotel Market Revenue Million Forecast, by Others (Homestays, Hostels, etc.) 2020 & 2033

- Table 18: Cuba Tourism And Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cuba Tourism And Hotel Market?

The projected CAGR is approximately 14.17%.

2. Which companies are prominent players in the Cuba Tourism And Hotel Market?

Key companies in the market include Kempinski Hotels, Iberostar Hotels & Resorts, Gran Caribe Grupo Hotelero, Melia Hotels International, Accor Hotels, Barcelo Hotels & Resorts, Other Prominent Hotel Brands/Chains**List Not Exhaustive, Grupo Cubanacan, Blue Diamond Hotels & Resorts, Be Live Hotels, Blau Hotels & Resorts.

3. What are the main segments of the Cuba Tourism And Hotel Market?

The market segments include Market Tourism, Domestic Tourism, International Tourism, Market Hotel, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels, Others (Homestays, Hostels, etc.).

4. Can you provide details about the market size?

The market size is estimated to be USD 6.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Increasing Demand for Hospitality Services; Consistent Demand for Business Travel and Corporate Hospitality Services.

6. What are the notable trends driving market growth?

Increasing Tourist Arrivals to Cuba is Driving the Market.

7. Are there any restraints impacting market growth?

Stringent Government Policies and Regulations Limiting the Market Growth; Lack of Skilled Labor is a Challenge for the Market.

8. Can you provide examples of recent developments in the market?

Melia and Iberostar are among the large foreign hotel chains which continue with their expansion in Cuba, to the point that the first of them extended its agreement with the Cuban government for 25 years in 2019. Melia has establishments in Varadero, Cayo Santa María, Havana, and very soon in Cienfuegos, Trinidad, and Camaguey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cuba Tourism And Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cuba Tourism And Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cuba Tourism And Hotel Market?

To stay informed about further developments, trends, and reports in the Cuba Tourism And Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence