Key Insights

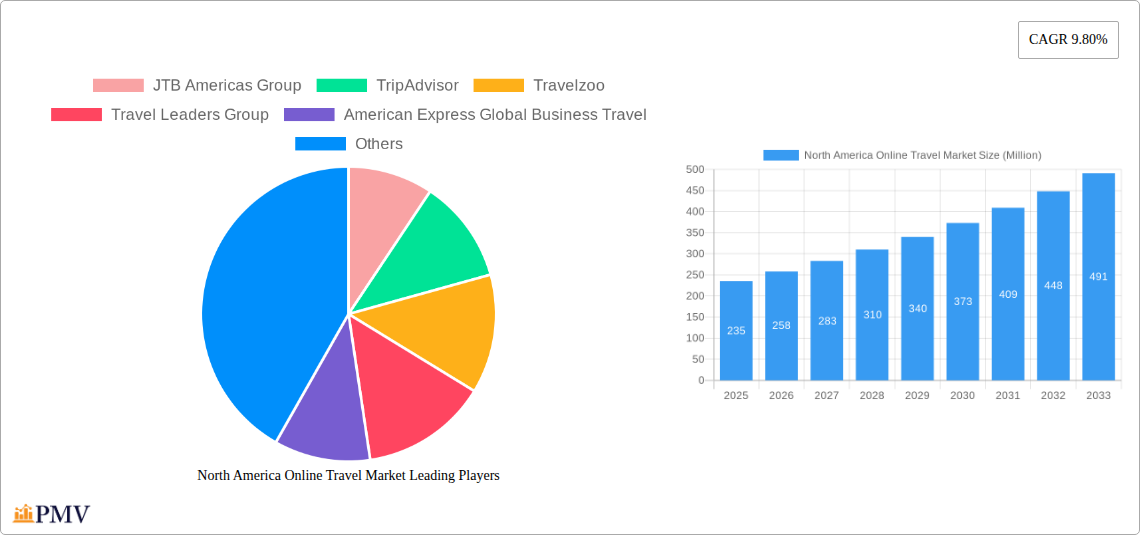

The North American online travel market, valued at $235 million in 2025, is projected to experience robust growth, driven by increasing internet and smartphone penetration, a preference for convenient online booking, and the rising popularity of experiential travel. The market's Compound Annual Growth Rate (CAGR) of 9.80% from 2025 to 2033 indicates a significant expansion. Key market segments include accommodation booking, which currently holds the largest share, followed by travel ticket and holiday package bookings. The mobile/tablet booking platform is experiencing the fastest growth, surpassing desktop bookings as the preferred method. Major players like Expedia, Booking Holdings, and Airbnb are intensely competitive, constantly innovating to enhance user experience and expand their market share. Growth is further fueled by the increasing adoption of travel management systems by businesses and the rise of personalized travel recommendations through AI-powered platforms. However, factors such as economic downturns, geopolitical instability, and cybersecurity concerns can act as potential restraints.

North America Online Travel Market Market Size (In Million)

Despite these challenges, the market's long-term outlook remains positive. The continuous development of advanced technologies like virtual reality and augmented reality is set to transform the online travel experience. Strategic partnerships between online travel agencies (OTAs) and airlines or hotels are enhancing service offerings and customer loyalty. The increasing preference for sustainable and responsible travel is expected to create new niches and opportunities within the market. Furthermore, the expanding middle class in North America and increased disposable income are major catalysts for growth in the online travel sector, strengthening the market's position and prospects for the forecast period.

North America Online Travel Market Company Market Share

North America Online Travel Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the North America online travel market, covering the period from 2019 to 2033. It offers invaluable insights into market size, segmentation, competitive dynamics, and future growth potential, empowering businesses to make informed strategic decisions. With a focus on key players like Booking Holdings, Expedia, and Airbnb, this report is essential for investors, industry professionals, and anyone seeking a thorough understanding of this dynamic market.

North America Online Travel Market Market Structure & Competitive Dynamics

The North America online travel market is characterized by a highly competitive landscape dominated by a few major players, alongside numerous smaller niche operators. Market concentration is relatively high, with the top five companies holding an estimated xx% market share in 2025. This concentration is driven by significant economies of scale, strong brand recognition, and extensive technological capabilities. Innovation within the sector is rapid, with a strong focus on AI-powered personalization, improved user interfaces, and seamless booking experiences.

The regulatory framework impacting the market includes consumer protection laws, data privacy regulations (like CCPA and GDPR), and antitrust regulations, all of which influence company strategies and operational practices. Product substitutes include traditional travel agencies, direct bookings with hotels and airlines, and peer-to-peer accommodation platforms, which continuously exert competitive pressure. End-user trends demonstrate a preference for mobile booking platforms, personalized travel experiences, and value-for-money offerings.

Mergers and acquisitions (M&A) activity has been significant, with substantial deals shaping the market landscape. Notable examples include Airbnb's USD 200 Million acquisition of Gameplanner.AI in November 2023. This deal highlights the increasing importance of AI in the sector. The overall value of M&A deals in the North America online travel market totaled an estimated USD xx Million in 2024, indicating a dynamic and evolving market structure.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- M&A Activity: Total deal value estimated at USD xx Million in 2024.

- Key Regulatory Factors: CCPA, GDPR, antitrust regulations.

- Innovation Focus: AI-powered personalization, mobile optimization, seamless booking.

North America Online Travel Market Industry Trends & Insights

The North America online travel market exhibits robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient online booking platforms. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with the market size projected to reach USD xx Million by 2033. This growth is significantly influenced by technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) for personalized recommendations, dynamic pricing, and improved customer service.

Consumer preferences are shifting towards personalized travel experiences, sustainable tourism options, and flexible booking policies. The increasing popularity of mobile booking platforms is reshaping the market dynamics, with a growing percentage of bookings originating from mobile devices. Competitive dynamics are intense, with companies constantly vying for market share through innovation, aggressive pricing strategies, and strategic partnerships. Market penetration of online travel booking platforms is steadily increasing, reaching an estimated xx% in 2025.

Dominant Markets & Segments in North America Online Travel Market

By Service Type: Accommodation booking remains the largest segment, driven by the popularity of online hotel booking platforms and the rise of alternative accommodations like Airbnb. Travel tickets booking is another significant segment, with a high demand for flight and train tickets. Holiday package booking is growing steadily, driven by the convenience and affordability it offers. Other services, including travel insurance, car rentals, and activity bookings, are also gaining traction.

By Mode of Booking: Direct booking continues to grow in popularity due to the convenience and potential cost savings, while travel agents retain market share, mainly catering to high-end customers or niche travel needs.

By Booking Platform: Mobile/Tablet bookings are experiencing significant growth, surpassing desktop bookings in terms of volume. This is driven by the increased accessibility and convenience of mobile devices.

The United States dominates the North America online travel market, accounting for the largest market share due to its large population, high disposable incomes, and advanced technological infrastructure. Economic policies promoting tourism and robust digital infrastructure contribute to the market's dominance.

North America Online Travel Market Product Innovations

Significant product innovations focus on leveraging AI and machine learning to personalize travel recommendations, optimize pricing, and improve customer service. New features like virtual reality (VR) tours and augmented reality (AR) overlays are enhancing the customer experience, allowing users to explore destinations before booking. The integration of chatbots and AI-powered assistants streamlines the booking process, while personalized itineraries and dynamic packaging options cater to individual preferences. These innovations are improving customer satisfaction and driving market growth by offering unique competitive advantages.

Report Segmentation & Scope

This report segments the North America online travel market by service type (Accommodation Booking, Travel Tickets Booking, Holiday Package Booking, Other Services), mode of booking (Direct Booking, Travel Agents), and booking platform (Desktop, Mobile/Tablet). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of the market's structure and future trends. For instance, the mobile/tablet segment is projected to grow at a faster rate than the desktop segment, reflecting the increasing preference for mobile booking.

Key Drivers of North America Online Travel Market Growth

Several factors drive the growth of the North America online travel market. Technological advancements, such as AI-powered personalization and mobile-first design, enhance user experience and drive adoption. Economic factors, including rising disposable incomes and a preference for experiential travel, fuel demand. Favorable government policies promoting tourism and investment in infrastructure also contribute to growth.

Challenges in the North America Online Travel Market Sector

The sector faces challenges, including increasing competition from established players and new entrants, the impact of geopolitical events on travel demand, and fluctuations in currency exchange rates. Cybersecurity threats and data privacy concerns pose significant challenges. Supply chain disruptions and rising fuel costs can negatively impact pricing and profitability. These factors pose both short-term and long-term challenges to market growth, though many of the effects are unpredictable.

Leading Players in the North America Online Travel Market Market

Key Developments in North America Online Travel Market Sector

- November 2023: Airbnb acquires Gameplanner.AI for USD 200 Million, accelerating AI initiatives.

- July 2023: TripAdvisor partners with OpenAI to develop an AI-powered travel itinerary generator.

Strategic North America Online Travel Market Market Outlook

The North America online travel market presents significant growth opportunities in the coming years, driven by continued technological advancements, evolving consumer preferences, and the expansion of the travel and tourism sector. Strategic partnerships, investments in innovative technologies, and a focus on personalized customer experiences will be crucial for companies seeking to thrive in this dynamic and competitive market. The continued integration of AI and the growth of the mobile booking segment present particularly promising avenues for future growth.

North America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. United States

- 4.2. Canada

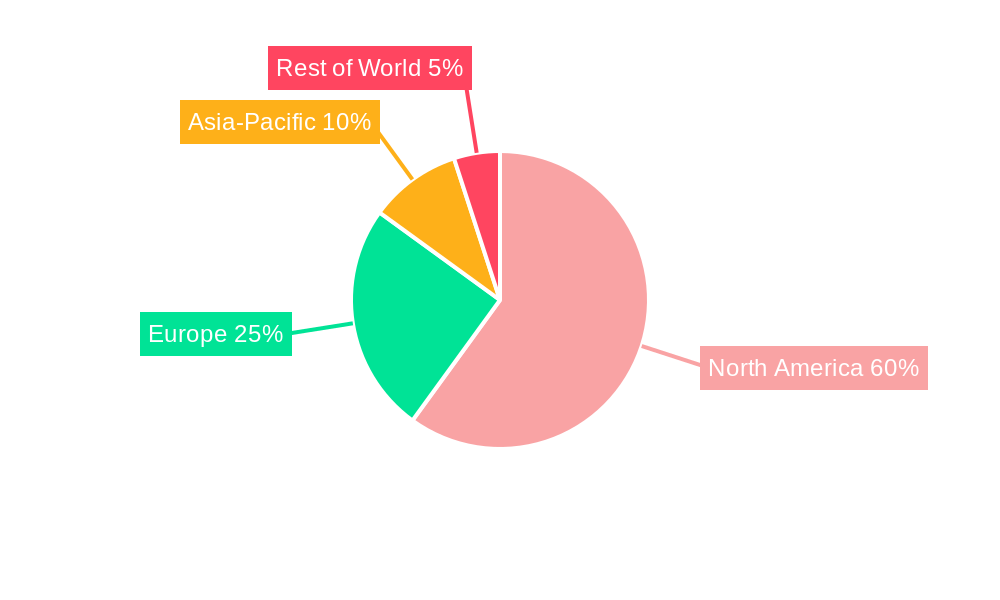

North America Online Travel Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Online Travel Market Regional Market Share

Geographic Coverage of North America Online Travel Market

North America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers

- 3.3. Market Restrains

- 3.3.1. Stringent Company Policies; Suitability of Business Travel Destinations

- 3.4. Market Trends

- 3.4.1. The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 JTB Americas Group

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 TripAdvisor

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Travelzoo

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Travel Leaders Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 American Express Global Business Travel

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Airbnb

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Travel and Transport Inc**List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Booking Holdings

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Expedia

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 eDreams

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 JTB Americas Group

List of Figures

- Figure 1: North America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Travel Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Online Travel Market?

Key companies in the market include JTB Americas Group, TripAdvisor, Travelzoo, Travel Leaders Group, American Express Global Business Travel, Airbnb, Travel and Transport Inc**List Not Exhaustive, Booking Holdings, Expedia, eDreams.

3. What are the main segments of the North America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 235 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers.

6. What are the notable trends driving market growth?

The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions.

7. Are there any restraints impacting market growth?

Stringent Company Policies; Suitability of Business Travel Destinations.

8. Can you provide examples of recent developments in the market?

In November 2023, Airbnb has acquired a startup called Gameplanner.AI in a deal valued at USD 200 million. Some of Airbnb's AI initiatives will be accelerated by Gameplanner.AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Travel Market?

To stay informed about further developments, trends, and reports in the North America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence