Key Insights

The China online travel booking market is experiencing robust growth, projected to reach a substantial market size by 2033. Fueled by increasing internet and smartphone penetration, a burgeoning middle class with rising disposable incomes, and a preference for convenience and online booking platforms, the market demonstrates significant potential. The 15.25% CAGR from 2019-2033 indicates a consistently expanding market, driven by factors such as improved digital infrastructure, the popularity of mobile travel apps, and the expansion of diverse travel options, including domestic and international tourism. The market segmentation reveals that mobile/tablet platforms are likely dominant, reflecting the mobile-first nature of the Chinese consumer. Furthermore, the robust growth is likely distributed across various service types, with accommodation booking, travel tickets booking, and holiday package bookings forming significant segments, while "other services" could represent emerging trends such as personalized travel itineraries or niche travel experiences. The intense competition among established players like LY.com, Trip.com Group Ltd., Meituan Dianping, and emerging companies indicates a dynamic and rapidly evolving market landscape.

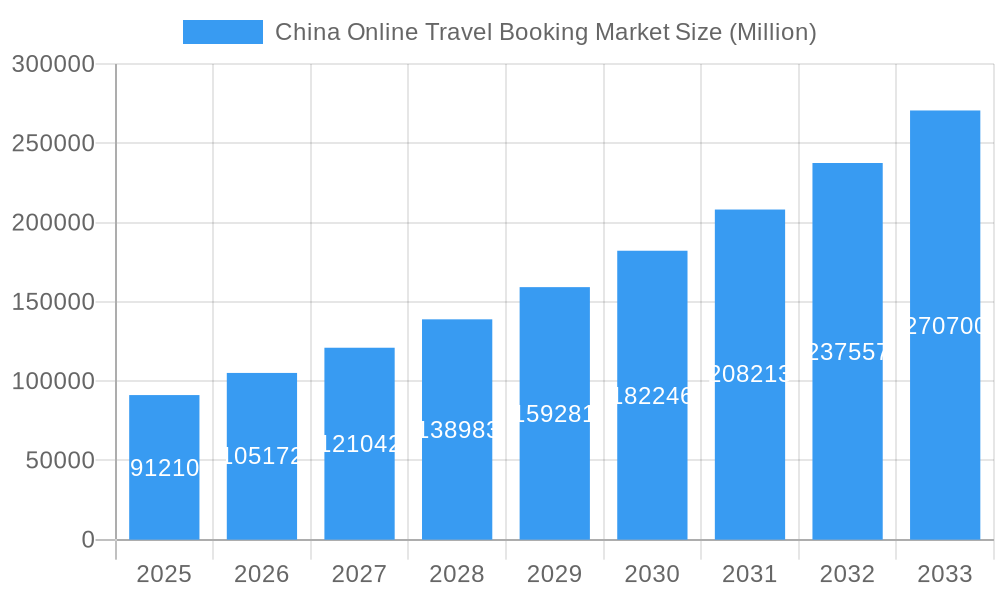

China Online Travel Booking Market Market Size (In Billion)

The continued growth of the China online travel booking market is expected to be sustained by several long-term trends. Government initiatives to boost tourism, both domestic and inbound, will undoubtedly contribute positively. The continuous development of innovative technologies, such as AI-powered travel recommendations and personalized travel planning tools, further enhance the user experience, attracting more consumers to online booking platforms. However, potential challenges exist, including economic fluctuations impacting consumer spending and competition from traditional travel agencies. The market's success hinges on adapting to evolving consumer preferences and leveraging technological advancements to offer superior services that meet the diverse demands of the Chinese traveler. Maintaining a competitive edge necessitates continuous innovation and a deep understanding of the evolving consumer landscape in China.

China Online Travel Booking Market Company Market Share

China Online Travel Booking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China online travel booking market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth potential, equipping stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The report uses 2025 as the base and estimated year, with a forecast period spanning 2025-2033 and a historical period covering 2019-2024. Market values are expressed in Millions.

China Online Travel Booking Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the China online travel booking market, examining market concentration, innovation, regulations, and mergers and acquisitions (M&A) activity. The market is characterized by a mix of established players and emerging disruptors, with significant competition and rapid innovation. Key players such as Trip.com Group Ltd, Ctrip, and Meituan Dianping hold substantial market share, but smaller players continue to carve out niches.

The level of market concentration is currently [XX]% with the top 5 players holding [XX]% of the market share in 2024. M&A activity has been robust in recent years, with deal values totaling approximately [XX] Million in 2024. The regulatory environment is evolving, with a focus on consumer protection and data privacy, shaping the competitive dynamics. Rapid technological advancements, particularly in mobile technology and AI, are creating new opportunities and challenges. The market is also influenced by broader economic trends, such as changes in disposable income and travel preferences. Substitution effects from alternative booking platforms and direct-to-hotel bookings are notable.

- Market Concentration: [XX]% in 2024, expected to [increase/decrease] to [XX]% by 2033.

- Top 5 Players Market Share: [XX]% in 2024.

- M&A Deal Value (2024): [XX] Million.

- Key Regulatory Factors: Data privacy regulations, consumer protection laws.

- End-User Trends: Increasing preference for mobile booking, personalized travel experiences.

China Online Travel Booking Market Industry Trends & Insights

This section delves into the key trends shaping the China online travel booking market. The market has experienced significant growth driven by factors like rising disposable incomes, increased internet and smartphone penetration, and a growing preference for online travel planning. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was [XX]%, and is projected to be [XX]% for 2025-2033. Market penetration currently stands at [XX]% and is projected to reach [XX]% by 2033. Technological disruptions, such as the rise of mobile booking platforms and AI-powered personalization, are transforming the industry. Consumer preferences are shifting towards customized travel experiences and value-added services. Intense competition is driving innovation and price wars.

Dominant Markets & Segments in China Online Travel Booking Market

This section identifies the dominant segments within the China online travel booking market.

By Mode of Booking: Direct booking is gaining significant traction, driven by the convenience and cost-effectiveness it offers consumers. However, travel agents continue to play a role, particularly for complex or customized travel arrangements. The direct booking segment is projected to capture [XX]% of market share by 2033.

By Platform: Mobile/Tablet booking has surpassed desktop, reflecting the increasing smartphone penetration in China. Mobile bookings are projected to account for [XX]% of the total market by 2033.

By Service Type: Accommodation booking remains the largest segment, followed by travel tickets booking. Holiday package bookings are growing rapidly, driven by demand for customized travel experiences.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased tourism spending fuel market growth.

- Infrastructure Development: Improved transportation infrastructure enhances accessibility to various destinations.

- Government Policies: Supportive government policies promote tourism development.

- Technological Advancements: Mobile apps and AI-powered recommendations enhance user experience.

China Online Travel Booking Market Product Innovations

The China online travel booking market is witnessing continuous product innovation. Key trends include the integration of AI for personalized recommendations, the development of mobile-first platforms offering seamless user experiences, and the expansion of services beyond simple booking to encompass concierge-style travel planning and curated experiences. The focus on enhancing the customer journey through technology leads to competitive advantages, particularly in areas of personalized service and seamless integration across different travel services.

Report Segmentation & Scope

This report segments the China online travel booking market across several dimensions:

- By Mode of Booking: Direct booking, Travel agents

- By Platform: Desktop, Mobile/Tablet

- By Service Type: Accommodation booking, Travel tickets booking, Holiday package booking, Other Services (e.g., activities, tours, visa assistance)

Each segment is analyzed in detail, presenting growth projections, market size, and competitive dynamics. Growth projections vary across segments depending on factors such as consumer preferences and technological advancements.

Key Drivers of China Online Travel Booking Market Growth

Several factors contribute to the growth of the China online travel booking market. These include: rising disposable incomes driving increased travel expenditure; enhanced smartphone penetration and internet access leading to convenient online booking; government initiatives promoting tourism; and increasing sophistication of online travel platforms offering personalized experiences.

Challenges in the China Online Travel Booking Market Sector

The China online travel booking market faces challenges such as intensifying competition, data security and privacy concerns, and the need to adapt to evolving consumer preferences. Regulatory changes also pose a significant challenge, requiring companies to constantly adapt and comply with the latest rules. Fluctuations in the global economy can directly impact travel spending.

Leading Players in the China Online Travel Booking Market Market

- LY.com

- Trip.com Group Ltd

- Meituan Dianping

- eLong

- Airbnb

- Fliggy

- Tuniu

- Didi Chuxing

- Qunar

- Mafengwo

- Lvmama

Key Developments in China Online Travel Booking Market Sector

- July 2021: Trip.com became the first OTA to offer Eurail and Interrail Train Passes via its app, expanding its product offerings and attracting international travelers.

- February 2022: CWT launched myCWT, a platform simplifying business travel in China, showcasing a focus on the corporate travel segment.

Strategic China Online Travel Booking Market Market Outlook

The China online travel booking market presents significant growth opportunities driven by rising disposable incomes, increased internet penetration, and the ongoing adoption of mobile booking. Strategic opportunities lie in personalized service offerings, leveraging AI and big data, and expanding into niche travel segments. The market is poised for continued growth, with opportunities for both established and emerging players.

China Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

China Online Travel Booking Market Segmentation By Geography

- 1. China

China Online Travel Booking Market Regional Market Share

Geographic Coverage of China Online Travel Booking Market

China Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in China is Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LY com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trip com Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan Dianping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eLong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbnb**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fliggy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tuniu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Didi Chuxing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qunar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mafengwo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lvmama

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LY com

List of Figures

- Figure 1: China Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: China Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 7: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: China Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Travel Booking Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the China Online Travel Booking Market?

Key companies in the market include LY com, Trip com Group Ltd, Meituan Dianping, eLong, Airbnb**List Not Exhaustive, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, Lvmama.

3. What are the main segments of the China Online Travel Booking Market?

The market segments include Service Type, Mode of Booking, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in China is Helping in Market Expansion.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: CWT launched myCWT, a flagship platform in China aimed at simplifying business travel for companies and employees. CWT is a global B2B4E travel management specialist based in the United States. The myCWT platform offers extensive international and domestic travel content, including rail, flights, hotels, and ground transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the China Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence