Key Insights

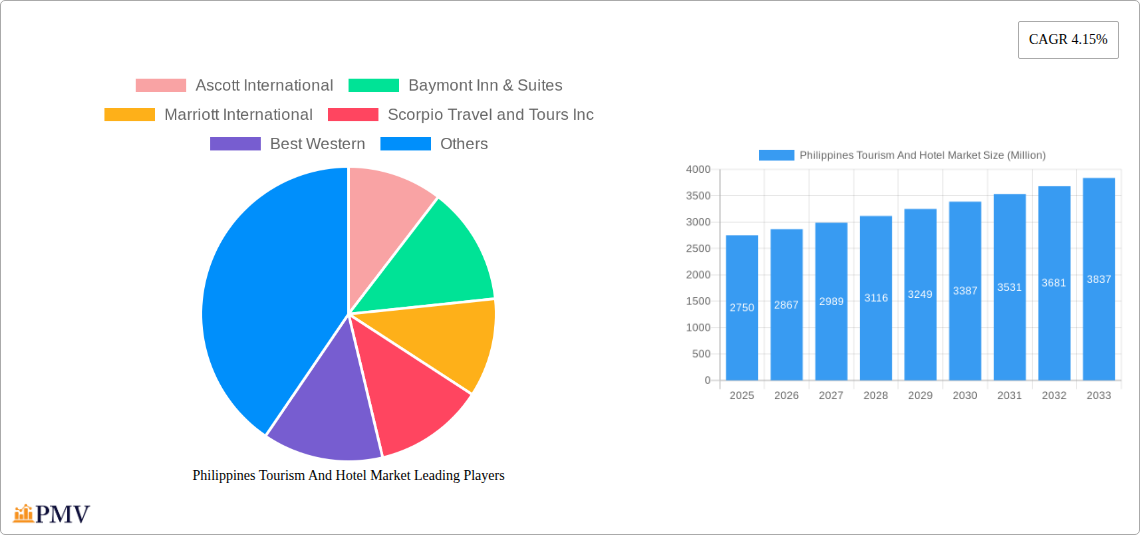

The Philippines tourism and hotel market, valued at $2.75 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.15% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of the Philippines as a diverse travel destination, encompassing stunning beaches, rich cultural heritage, and exciting adventure activities, attracts both domestic and international tourists. Furthermore, the growth of online booking platforms has significantly improved accessibility and convenience for travelers, contributing to the market's upward trajectory. The segmentation of the market highlights the strength of various tourism types, with vacation tourism, eco-tourism, and cultural tourism likely leading the growth, attracting a broad spectrum of travelers with varying interests. While the specific contribution of each segment isn't detailed, the overall market's strong growth indicates a healthy distribution across these categories. The presence of established international hotel chains alongside local players demonstrates a competitive landscape that caters to a range of budgets and preferences. Continued infrastructural development and government initiatives focused on tourism promotion are expected to further stimulate market growth throughout the forecast period.

Philippines Tourism And Hotel Market Market Size (In Billion)

However, the market faces potential restraints. Seasonality remains a factor, with tourist arrivals peaking during certain months, impacting hotel occupancy and revenue streams. Economic conditions, both domestically and globally, can significantly influence travel patterns and spending behavior. Furthermore, maintaining sustainable tourism practices and managing the environmental impact of increasing tourist numbers will be crucial for long-term growth. Addressing these challenges strategically will be essential for the Philippines tourism and hotel market to realize its full growth potential and ensure its long-term sustainability. The competitive landscape will likely see continued consolidation and innovation as companies strive to capture market share in a dynamic and evolving sector.

Philippines Tourism And Hotel Market Company Market Share

Philippines Tourism and Hotel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Philippines tourism and hotel market, offering actionable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and growth opportunities. The report analyzes market size in Millions, dissects key segments, identifies leading players, and highlights crucial industry developments.

Philippines Tourism And Hotel Market Market Structure & Competitive Dynamics

The Philippines tourism and hotel market exhibits a moderately concentrated structure, with a mix of international and domestic players vying for market share. Market leaders such as Marriott International, Ascott International, and Best Western hold significant positions, but a large number of smaller hotels and boutique establishments also contribute significantly to the overall market. The market is characterized by a dynamic innovation ecosystem, with continuous upgrades in technology and service offerings. Regulatory frameworks, while generally supportive of tourism growth, impact market operations, particularly licensing and environmental regulations. The market faces competition from substitute experiences, such as home-sharing platforms, but the strong appeal of the Philippines' unique destinations continues to drive demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Key M&A activities include [Insert specific examples of M&A activities if available, otherwise use "xx" for values and descriptions.]. This activity reflects a consolidation trend, as larger players seek to expand their reach and enhance their competitive positions. The market share of the top three players in 2024 was estimated at approximately xx%, while the remaining market share is distributed among numerous smaller players.

- Market Concentration: Moderately concentrated, with a few major players and many smaller operators.

- Innovation: Strong emphasis on technological advancements and service improvements.

- Regulatory Framework: Supportive but with certain regulatory impacts on operations.

- Product Substitutes: Competition from alternative accommodation options, such as home-sharing platforms.

- M&A Activity: Moderate, with deals valued at xx Million to xx Million, indicating consolidation.

- End-User Trends: Increasing demand for unique and sustainable tourism experiences.

Philippines Tourism And Hotel Market Industry Trends & Insights

The Philippines tourism and hotel market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, reflecting strong domestic and international tourism. This growth is fueled by increasing disposable incomes, rising affordability of travel, and effective government initiatives promoting tourism. Technological disruptions, such as online travel agencies (OTAs) and mobile booking platforms, have significantly altered booking behavior, leading to higher market penetration of online bookings. Consumer preferences are shifting towards unique, sustainable, and experiential travel, impacting demand for eco-tourism, adventure tourism, and cultural tourism. The increasing adoption of technology in the hospitality industry, from smart hotel rooms to AI-powered customer service, is improving the overall guest experience. Competitive dynamics are intensified by the influx of new entrants and the ongoing consolidation among established players. Market penetration of online booking channels has shown a steady increase, exceeding xx% in 2024.

Dominant Markets & Segments in Philippines Tourism And Hotel Market

The Philippines tourism and hotel market is segmented by tourist type (domestic and international), booking channel (phone, in-person, online), and tourism type (business, vacation, eco, cultural, adventure, event). The dominant segment is domestic tourism, which constitutes the largest share of the overall market due to a growing middle class and rising disposable incomes within the country. International tourism also shows significant growth potential, fueled by the Philippines' natural beauty and cultural richness. Online booking is the fastest-growing booking channel, reflecting the increasing adoption of digital technologies. Within tourism types, vacation tourism remains dominant, followed by a growing demand for eco-tourism and cultural tourism.

- Key Drivers of Domestic Tourism Dominance:

- Strong domestic economy and rising middle class.

- Increasing accessibility of domestic destinations.

- Government initiatives promoting domestic tourism.

- Key Drivers of Online Booking Channel Dominance:

- Increasing smartphone penetration and internet access.

- Convenience and accessibility of online booking platforms.

- Competitive pricing and promotional offers on OTAs.

- Key Drivers of Vacation Tourism Dominance:

- Philippines’ diverse attractions and beautiful beaches.

- Affordable travel options.

- Strong demand for leisure and relaxation activities.

Philippines Tourism And Hotel Market Product Innovations

Product innovation in the Philippines tourism and hotel market is focused on enhancing guest experiences and improving operational efficiency. Technological advancements, such as smart hotel rooms, mobile check-in/check-out, AI-powered customer service, and personalized travel recommendations, are shaping the future of the industry. Hotels are increasingly incorporating sustainable practices, from energy-efficient technologies to eco-friendly amenities, to cater to the growing demand for responsible tourism. These innovations are key to attracting and retaining guests in an increasingly competitive market. The adoption of cloud-based property management systems and revenue management tools is improving operational efficiency and optimizing profitability.

Report Segmentation & Scope

This report provides a detailed segmentation of the Philippines tourism and hotel market across various dimensions:

- By Tourists: Domestic tourism is projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx Million by 2033, while international tourism is expected to reach xx Million.

- By Booking Channel: Online booking is anticipated to continue its dominance, with a market share exceeding xx% by 2033, fueled by the increasing adoption of smartphones and digital technologies.

- By Type: Vacation tourism is expected to remain the largest segment, while eco-tourism and adventure tourism are predicted to exhibit the highest growth rates.

Key Drivers of Philippines Tourism And Hotel Market Growth

The growth of the Philippines tourism and hotel market is driven by several factors:

- Economic Growth: Rising disposable incomes and a growing middle class are fueling demand for travel and leisure activities.

- Government Initiatives: Government policies promoting tourism, such as infrastructure development and marketing campaigns, are boosting the sector.

- Technological Advancements: Innovation in online booking platforms, mobile applications, and hotel management systems is enhancing the guest experience and operational efficiency.

Challenges in the Philippines Tourism And Hotel Market Sector

The Philippines tourism and hotel market faces several challenges:

- Infrastructure Limitations: Insufficient infrastructure in some tourist destinations can hinder accessibility and limit the overall tourism experience.

- Environmental Concerns: Sustainable tourism practices are crucial to protect the natural environment and ensure the long-term viability of the industry.

- Competitive Pressure: The sector faces increasing competition from both domestic and international players, necessitating continuous improvement in services and offerings.

Leading Players in the Philippines Tourism And Hotel Market Market

- Ascott International

- Baymont Inn & Suites

- Marriott International

- Scorpio Travel and Tours Inc

- Best Western

- Crown Regency Hotels & Resorts

- Vansol Travel & Tours

- GoldenSky Travel and Tours

- Baron Travel

- Citadines

Key Developments in Philippines Tourism And Hotel Market Sector

- June 2023: BWH Hotels expanded its presence in North America, Europe, Africa, and Asia, including Austria, Canada, Dubai (UAE), Ethiopia, France, India, Japan, the Netherlands, Saudi Arabia, Sweden, Tanzania, and the United States. This expansion significantly increases the hotel chain's global reach and competitive landscape.

- March 2023: Wyndham Hotels & Resorts partnered with Groups360, enabling immediate online multi-room bookings. This streamlined booking process enhances customer experience and increases efficiency.

Strategic Philippines Tourism And Hotel Market Market Outlook

The Philippines tourism and hotel market exhibits significant growth potential. Continued investments in infrastructure, focus on sustainable tourism practices, and technological innovation will be key to realizing this potential. Strategic partnerships, effective marketing campaigns targeting diverse market segments, and the diversification of tourism offerings will enhance the country's competitiveness in the global tourism market. The long-term outlook is positive, driven by increasing global demand for travel and leisure, coupled with the Philippines’ unique appeal as a premier tourist destination.

Philippines Tourism And Hotel Market Segmentation

-

1. Type

- 1.1. Business Tourism

- 1.2. Vacation Tourism

- 1.3. Eco-tourism

- 1.4. Cultural Tourism

- 1.5. Adventure Tourism

- 1.6. Event Tourism

-

2. Tourist

- 2.1. Domestic

- 2.2. International

-

3. Booking Channel

- 3.1. Phone Booking

- 3.2. In-person Booking

- 3.3. Online Booking

Philippines Tourism And Hotel Market Segmentation By Geography

- 1. Philippines

Philippines Tourism And Hotel Market Regional Market Share

Geographic Coverage of Philippines Tourism And Hotel Market

Philippines Tourism And Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry

- 3.3. Market Restrains

- 3.3.1. Language Barriers for International Tourists; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Expanding Airways Network in Philippines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Tourism And Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business Tourism

- 5.1.2. Vacation Tourism

- 5.1.3. Eco-tourism

- 5.1.4. Cultural Tourism

- 5.1.5. Adventure Tourism

- 5.1.6. Event Tourism

- 5.2. Market Analysis, Insights and Forecast - by Tourist

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Phone Booking

- 5.3.2. In-person Booking

- 5.3.3. Online Booking

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ascott International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Baymont Inn & Suites

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marriott International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scorpio Travel and Tours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Best Western

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Regency Hotels & Resorts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vansol Travel & Tours

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GoldenSky Travel and Tours**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baron Travel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Citadines

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ascott International

List of Figures

- Figure 1: Philippines Tourism And Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Tourism And Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 3: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 4: Philippines Tourism And Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 7: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 8: Philippines Tourism And Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Tourism And Hotel Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Philippines Tourism And Hotel Market?

Key companies in the market include Ascott International, Baymont Inn & Suites, Marriott International, Scorpio Travel and Tours Inc, Best Western, Crown Regency Hotels & Resorts, Vansol Travel & Tours, GoldenSky Travel and Tours**List Not Exhaustive, Baron Travel, Citadines.

3. What are the main segments of the Philippines Tourism And Hotel Market?

The market segments include Type, Tourist, Booking Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry.

6. What are the notable trends driving market growth?

Expanding Airways Network in Philippines.

7. Are there any restraints impacting market growth?

Language Barriers for International Tourists; Labor Shortages.

8. Can you provide examples of recent developments in the market?

June 2023: BWH Hotels expanded its presence in North America and Europe, as well as in Africa and Asia. The BWH hotels are now available in Austria, Canada, Dubai, the United Arab Emirates, Ethiopia, France, India, Japan, the Netherlands, Saudi Arabia, Sweden, Tanzania, and the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Tourism And Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Tourism And Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Tourism And Hotel Market?

To stay informed about further developments, trends, and reports in the Philippines Tourism And Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence