Key Insights

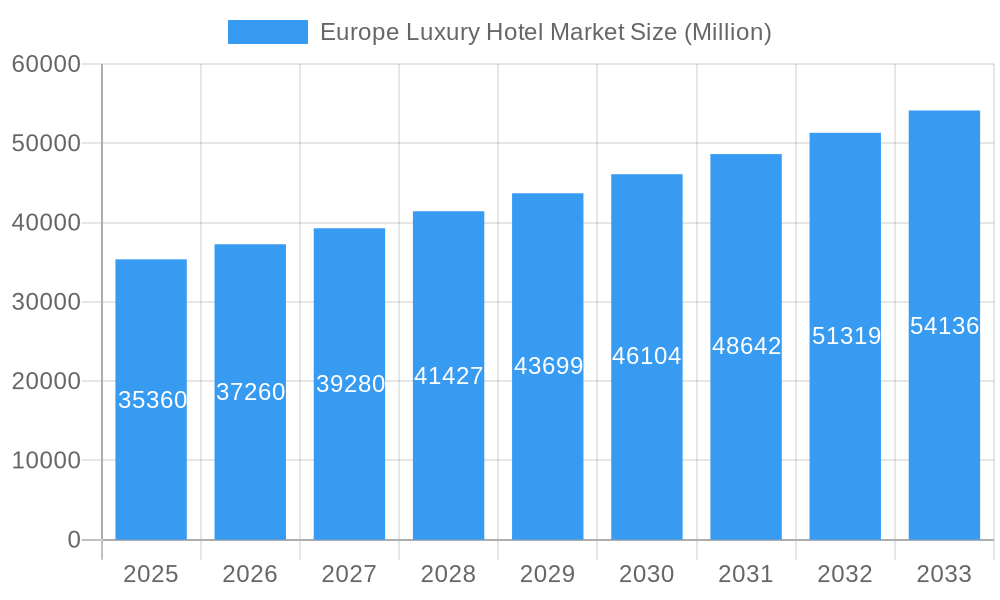

The European luxury hotel market, valued at €35.36 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.14% from 2025 to 2033. This expansion is fueled by several key drivers. A resurgence in high-net-worth individual travel, particularly within Europe, post-pandemic, is a significant factor. The increasing popularity of experiential travel, with luxury hotels offering unique and personalized experiences, further contributes to market growth. Furthermore, the expansion of luxury hotel brands into new, desirable European locations and the ongoing renovation and modernization of existing properties are boosting capacity and appeal. Strong demand from both business and leisure travelers, coupled with the appeal of European cultural heritage and diverse landscapes, contributes to the market’s overall dynamism.

Europe Luxury Hotel Market Market Size (In Billion)

However, the market also faces some restraints. Economic fluctuations, particularly inflation and potential recessions, could impact consumer spending on luxury travel. Furthermore, increasing operating costs, including labor and energy expenses, pose challenges to profitability for luxury hotels. Competition among established luxury hotel brands and the emergence of new, independent luxury properties also necessitate continuous innovation and adaptation to maintain market share. The segment analysis reveals strong performance across all service types—business hotels, airport hotels, holiday hotels, and resorts & spas—with each catering to specific travel needs within the luxury segment. Leading players such as Accor, IHG Hotels & Resorts, Hyatt, Hilton Worldwide, and Marriott International are key competitors, continuously striving to enhance their offerings and expand their presence across major European cities and destinations. Germany, France, Italy, and the United Kingdom are currently the leading national markets within the European region, due to their established tourism infrastructure and high concentration of affluent clientele.

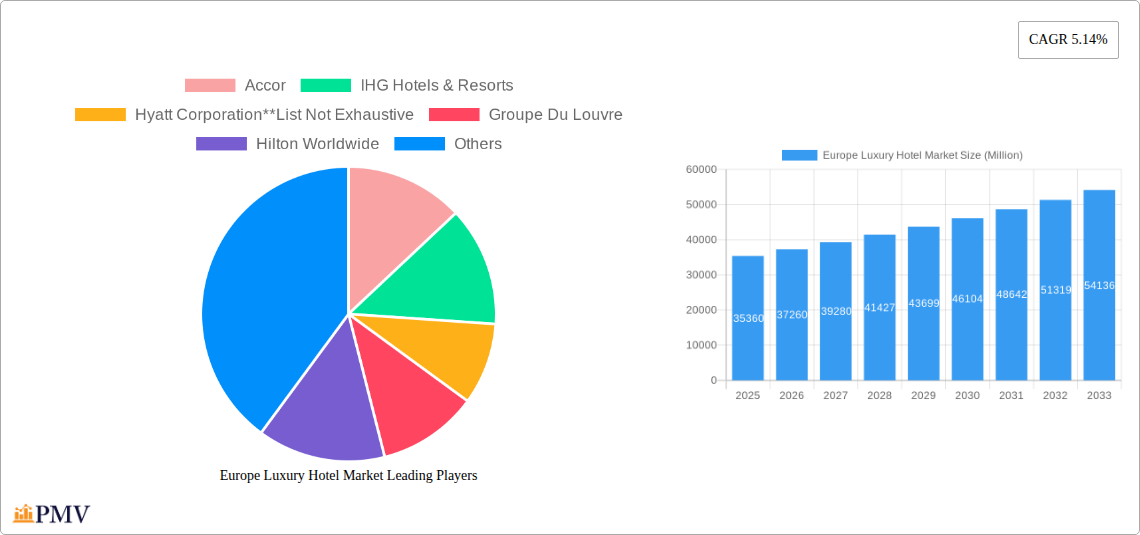

Europe Luxury Hotel Market Company Market Share

Europe Luxury Hotel Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the Europe luxury hotel market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth prospects, equipping industry stakeholders with actionable intelligence for strategic decision-making. The report includes detailed segmentations, market sizing (in Millions), and forecasts, enabling informed investment and expansion strategies within this lucrative sector. The base year for this report is 2025, with an estimated year of 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

Europe Luxury Hotel Market Structure & Competitive Dynamics

The European luxury hotel market exhibits a moderately concentrated structure, with several key players commanding significant market share. Accor, IHG Hotels & Resorts, Hyatt Corporation, Groupe Du Louvre, Hilton Worldwide, Best Western, Carlson-Rezidor, NH Hotels, Marriott International Inc, and Melia International are among the dominant players. However, the market also accommodates numerous smaller, independent luxury hotels and boutique properties. Market share fluctuates based on expansion strategies, brand recognition, and economic conditions. Recent M&A activities have involved substantial investments, with some deals exceeding xx Million. These acquisitions often aim to expand geographic reach and strengthen brand portfolios within the competitive landscape. Regulatory frameworks, particularly concerning environmental sustainability and labor practices, are increasingly impacting operations. Product substitutes, such as high-end vacation rentals (e.g., Airbnb Luxe) and private villas, pose a growing competitive threat, demanding continuous innovation and differentiation from luxury hotels. End-user trends show a preference for personalized experiences, sustainable practices, and technological integration within the luxury hotel offerings.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Ecosystems: Significant investment in technological upgrades and personalized service offerings.

- Regulatory Frameworks: Increasingly stringent regulations focusing on sustainability and labor standards.

- Product Substitutes: Rise of high-end vacation rentals and private villas impacting market share.

- End-User Trends: Demand for personalized experiences, sustainable practices, and technological integration.

- M&A Activities: Significant M&A activity, with deal values exceeding xx Million in recent years.

Europe Luxury Hotel Market Industry Trends & Insights

The Europe luxury hotel market is experiencing robust growth, driven by several key factors. Rising disposable incomes in key European markets, coupled with a growing preference for luxury travel experiences, fuels demand. Technological advancements, including AI-powered personalization tools and seamless booking platforms, enhance customer experience and operational efficiency. However, economic uncertainties and geopolitical events can impact growth trajectories. The market exhibits a CAGR of xx% during the forecast period (2025-2033), with specific segments exhibiting varied growth rates. Market penetration varies significantly based on location, with established tourist destinations showcasing higher penetration. Competitive intensity remains high, with players actively investing in brand differentiation, loyalty programs, and strategic partnerships to maintain market share. The increasing focus on sustainability and responsible tourism practices is reshaping the landscape, compelling hotels to adopt environmentally friendly operational models.

Dominant Markets & Segments in Europe Luxury Hotel Market

The dominance within the European luxury hotel market is geographically dispersed, with key countries including France, Italy, the UK, Spain, and Germany exhibiting significant market share. Within these countries, specific regions often become central hubs for luxury tourism, depending on factors like historical significance, natural beauty, and infrastructure development. Specific segments (By Service Type) exhibit varied performance:

Resorts & Spa: This segment enjoys strong growth potential driven by increasing demand for wellness tourism and leisure travel. Key drivers include climate, landscape, and infrastructure related to wellness facilities.

Business Hotels: This segment is strongly correlated to business travel activity and economic performance in major metropolitan areas. Economic policies impacting corporate travel budgets significantly influence demand.

Airport Hotels: This segment’s growth is directly linked to air travel patterns and infrastructure improvements at major airports. Strong air connectivity significantly boosts demand.

Holiday Hotels: Demand within this segment is influenced by seasonal factors, tourism marketing campaigns, and access to popular tourist attractions.

The dominance of particular regions and segments is analyzed through various factors, including infrastructure development, government policies, tourism promotional campaigns, and geographic appeal.

Europe Luxury Hotel Market Product Innovations

The luxury hotel sector constantly innovates to cater to evolving consumer preferences. Recent innovations include the implementation of advanced technologies such as AI-powered chatbots for enhanced guest services, personalized in-room entertainment systems, and contactless check-in/check-out processes. These technologies improve operational efficiency and provide a more personalized and seamless guest experience, driving competitive advantage. Sustainability initiatives, such as implementing energy-efficient systems and using eco-friendly products, are also gaining prominence, appealing to environmentally conscious travelers.

Report Segmentation & Scope

This report segments the Europe luxury hotel market by service type:

- Business Hotels: This segment covers hotels primarily catering to business travelers, offering services like meeting rooms and business centers. Growth projections are linked to business travel trends.

- Airport Hotels: This segment encompasses hotels located near major airports, prioritizing convenience for air travelers. Growth relies heavily on air traffic.

- Holiday Hotels: This segment includes hotels targeting leisure travelers, offering various recreational amenities. Seasonal factors influence growth.

- Resorts & Spa: This segment focuses on relaxation and wellness, featuring spa facilities and other leisure activities. Growth projections are influenced by wellness tourism trends.

Each segment's market size, growth projections, and competitive dynamics are detailed in the full report.

Key Drivers of Europe Luxury Hotel Market Growth

Several factors drive the growth of the European luxury hotel market. Strong economic performance in several European countries leads to increased disposable income and luxury spending. The growing popularity of luxury travel experiences, especially among high-net-worth individuals, significantly boosts demand. Technological advancements, enhancing the customer experience, and strategic investments in sustainable practices further propel market growth. Government policies promoting tourism also create a positive impact.

Challenges in the Europe Luxury Hotel Market Sector

Despite favorable growth prospects, the sector faces challenges. Economic downturns and geopolitical instability can significantly impact travel patterns and spending. Intense competition necessitates continuous innovation and differentiation. Supply chain disruptions, particularly in sourcing materials and staffing, add operational costs. Regulatory compliance and evolving environmental standards require significant investment and adjustments.

Leading Players in the Europe Luxury Hotel Market Market

- Accor

- IHG Hotels & Resorts

- Hyatt Corporation

- Groupe Du Louvre

- Hilton Worldwide

- Best Western

- Carlson-Rezidor

- NH Hotels

- Marriott International Inc

- Melia International

Key Developments in Europe Luxury Hotel Market Sector

September 2023: Marriott Hotels inaugurated a new 398-room hotel in Munich, Germany (Munich Marriott Hotel City West). This expansion signifies Marriott's continued investment in the German luxury hotel market.

December 2022: IHG Hotels & Resorts added the Carlton Cannes to its Regent Hotels & Resorts network. This strategic move strengthens IHG's luxury portfolio and expands its presence in a prime tourist location.

Strategic Europe Luxury Hotel Market Outlook

The Europe luxury hotel market holds significant future potential. Continued investment in technology, sustainable practices, and personalized experiences will be critical for success. Strategic partnerships and acquisitions will help companies expand their reach and market share. Focus on niche markets and emerging luxury travel trends will offer opportunities for differentiation and growth. The market's resilience and adaptability, coupled with the enduring appeal of luxury travel, ensure its continued expansion.

Europe Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Holiday Hotels

- 1.4. Resorts & Spa

Europe Luxury Hotel Market Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. Spain

- 4. France

- 5. Switzerland

- 6. United Kingdom

- 7. Rest of Europe

Europe Luxury Hotel Market Regional Market Share

Geographic Coverage of Europe Luxury Hotel Market

Europe Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income; Rising Tourism and Travel Trends

- 3.3. Market Restrains

- 3.3.1. Increased Competition from Alternative Accommodation Such as Vacation Rentals; Stringent Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Growing Focus Toward Sustainability is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Holiday Hotels

- 5.1.4. Resorts & Spa

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.2.2. Germany

- 5.2.3. Spain

- 5.2.4. France

- 5.2.5. Switzerland

- 5.2.6. United Kingdom

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Italy Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Holiday Hotels

- 6.1.4. Resorts & Spa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Germany Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Holiday Hotels

- 7.1.4. Resorts & Spa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Spain Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Holiday Hotels

- 8.1.4. Resorts & Spa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. France Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Holiday Hotels

- 9.1.4. Resorts & Spa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Switzerland Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Holiday Hotels

- 10.1.4. Resorts & Spa

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. United Kingdom Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Business Hotels

- 11.1.2. Airport Hotels

- 11.1.3. Holiday Hotels

- 11.1.4. Resorts & Spa

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Rest of Europe Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service Type

- 12.1.1. Business Hotels

- 12.1.2. Airport Hotels

- 12.1.3. Holiday Hotels

- 12.1.4. Resorts & Spa

- 12.1. Market Analysis, Insights and Forecast - by Service Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Accor

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IHG Hotels & Resorts

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hyatt Corporation**List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Groupe Du Louvre

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hilton Worldwide

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Best Western

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Carlson-Rezidor

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 NH Hotels

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Marriott International Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Melia International

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Accor

List of Figures

- Figure 1: Europe Luxury Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Luxury Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Europe Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Europe Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Luxury Hotel Market?

The projected CAGR is approximately 5.14%.

2. Which companies are prominent players in the Europe Luxury Hotel Market?

Key companies in the market include Accor, IHG Hotels & Resorts, Hyatt Corporation**List Not Exhaustive, Groupe Du Louvre, Hilton Worldwide, Best Western, Carlson-Rezidor, NH Hotels, Marriott International Inc, Melia International.

3. What are the main segments of the Europe Luxury Hotel Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income; Rising Tourism and Travel Trends.

6. What are the notable trends driving market growth?

Growing Focus Toward Sustainability is Driving the Market.

7. Are there any restraints impacting market growth?

Increased Competition from Alternative Accommodation Such as Vacation Rentals; Stringent Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

September 2023: Marriott Hotels inaugurated a new 398-room hotel in Munich, Germany. The Munich Marriott Hotel City West is located in the Westend neighborhood. It offers four dining options: a roof terrace, a fitness center, and an M Club lounge exclusively for Elite Marriott Bonvoy members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the Europe Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence