Key Insights

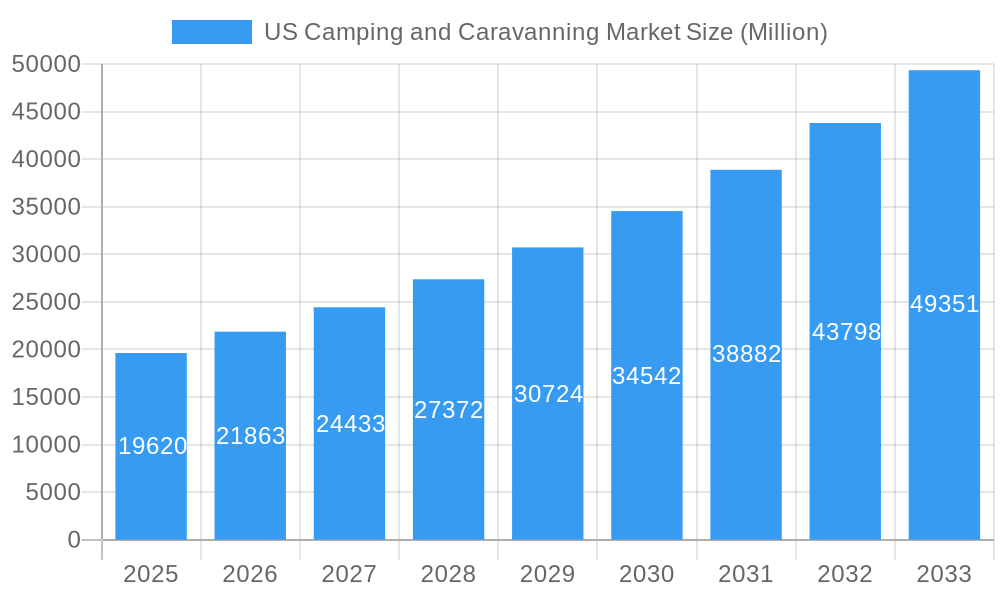

The US camping and caravanning market, valued at $19.62 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This significant expansion is fueled by several key drivers. The rising popularity of outdoor recreation and adventure tourism, coupled with a growing preference for experiential travel, significantly boosts demand. Increased disposable income, particularly among millennials and Gen Z, further fuels this trend, enabling more individuals to invest in recreational vehicles (RVs) and camping gear. Furthermore, advancements in RV technology, offering greater comfort and convenience, contribute to market growth. The diverse range of camping options, encompassing state parks, private campgrounds, and backcountry experiences, caters to a broad spectrum of consumer preferences. While potential restraints such as environmental concerns related to outdoor recreation and increasing fuel costs exist, the overall market outlook remains positive. The market segmentation, categorized by destination type (state parks, private campgrounds, etc.), camper type (car camping, RV camping, etc.), and distribution channel (direct sales, online travel agencies, etc.), reveals valuable insights into consumer behavior and market dynamics. Understanding these segments is crucial for effective market penetration and growth strategies for businesses within this industry.

US Camping and Caravanning Market Market Size (In Billion)

The regional distribution of the market across the United States (Northeast, Southeast, Midwest, Southwest, West) presents significant opportunities for targeted marketing and regional-specific product development. Regions with established national parks and abundant natural landscapes generally exhibit higher demand. The leading companies in the sector, including Newmar, Thor Industries, Forest River, Winnebago Industries, Coachmen RV, Kampgrounds of America (KOA), Thousand Trails, and Camping World Holdings, play a significant role in shaping market trends through innovation and expanding service offerings. The historical data from 2019 to 2024, combined with the forecast period extending to 2033, provides a comprehensive view of market evolution, allowing for informed decision-making by industry players and investors. This detailed analysis highlights the significant growth trajectory of the US camping and caravanning market, offering compelling opportunities for businesses to capitalize on rising demand.

US Camping and Caravanning Market Company Market Share

US Camping and Caravanning Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the US camping and caravanning market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, this report delivers a detailed overview of market size, segmentation, growth drivers, challenges, and future outlook. The report leverages extensive data analysis and incorporates key industry developments to provide actionable intelligence. The total market size in 2025 is estimated to be xx Million, with projections extending to 2033.

US Camping and Caravanning Market Market Structure & Competitive Dynamics

The US camping and caravanning market exhibits a moderately concentrated structure, with several major players commanding significant market share. Key players include Newmar, Thor Industries, Forest River, Winnebago Industries, and Coachmen RV, among others. However, the market also features numerous smaller players, particularly in the privately owned campground segment. The competitive landscape is characterized by intense rivalry, driven by factors such as product innovation, pricing strategies, and acquisitions. The recent acquisition of Ashley Outdoors by Camping World Holdings illustrates the ongoing M&A activity within the sector. The deal value of this and other recent transactions is xx Million.

Market share among the leading players varies based on segment. For example, Thor Industries holds a significant share in the RV manufacturing segment, while Kampgrounds of America (KOA) dominates the privately owned campground sector. The regulatory framework significantly impacts market operations, particularly concerning environmental regulations and land usage. Innovation ecosystems are focused on enhancing RV technologies and campground amenities, while consumer trends are leaning toward more luxurious and technologically advanced camping experiences. Product substitutes, such as alternative vacation options like hotels or short-term rentals, create competitive pressure. Increased disposable income and a shift towards experiential travel are strong drivers of growth.

US Camping and Caravanning Market Industry Trends & Insights

The US camping and caravanning market experienced robust growth during the historical period (2019-2024) with a CAGR of xx%, driven by multiple factors. The increasing popularity of outdoor recreation and a renewed interest in nature-based tourism fueled the market's expansion. This trend is further bolstered by the rise of "glamping" – a luxurious form of camping – and the growing appeal of RV travel for family vacations. Technological advancements, such as the integration of Starlink internet connectivity into RVs, enhance the overall camping experience and attract a wider customer base. This technology significantly improved market penetration by xx% since its launch.

The market also witnessed a rise in the popularity of online travel agencies (OTAs) for booking campsites and rentals, which adds another layer to the competitive dynamics. This trend has significant implications for traditional travel agencies and direct sales channels. Consumer preferences are increasingly focused on sustainability and eco-friendly practices, influencing campground development and RV manufacturing. The competitive dynamics are influenced by new entrants offering unique camping experiences and technologies. These factors have shaped the market outlook, leading to an anticipated CAGR of xx% during the forecast period (2025-2033).

Dominant Markets & Segments in US Camping and Caravanning Market

- By Destination Type: Privately owned campgrounds represent the largest segment, driven by their diverse offerings and strategic locations. State or national park campgrounds hold a substantial market share, primarily due to their affordable pricing and accessibility. This segment benefits from government investments in park infrastructure and accessibility programs. Backcountry camping and National Forest/Wilderness areas appeal to a niche segment of adventurous campers seeking remote and untouched landscapes. This segment's growth is constrained by limited access and regulatory restrictions.

- By Type of Camper: RV camping accounts for the most significant share of the market, reflecting the convenience and comfort offered by RVs. The growth of this segment is fueled by the increasing availability of well-equipped RVs and related infrastructure. Car camping and backpacking also hold considerable shares, catering to budget-conscious travelers and adventure enthusiasts respectively.

- By Distribution Channel: Direct sales remain the dominant channel, reflecting the significant role of RV dealerships and campground operators. However, online travel agencies (OTAs) are rapidly gaining traction, attracting customers seeking convenient booking options and competitive pricing. This shift presents both opportunities and challenges for traditional travel agencies.

US Camping and Caravanning Market Product Innovations

Recent innovations in the US camping and caravanning market are focused on enhancing comfort, convenience, and connectivity. Manufacturers are integrating advanced technologies such as solar panels, smart home systems, and high-speed internet connectivity into RVs. Campgrounds are incorporating features like electric vehicle charging stations and improved sanitation facilities to cater to evolving consumer preferences. The emphasis is on creating a seamless and luxurious camping experience, blurring the lines between traditional camping and other forms of vacation. These innovations are boosting market growth by attracting new customer segments.

Report Segmentation & Scope

This report segments the US camping and caravanning market across multiple dimensions:

- By Destination Type: This includes State or National Park Campgrounds, Privately Owned Campgrounds, Public or Privately Owned Land Other Than a Campground, Backcountry, National Forest or Wilderness Areas, Parking Lots, and Others. Growth projections vary significantly across these segments, with privately owned campgrounds showing strong growth.

- By Type of Camper: This encompasses Car Camping, RV Camping, Backpacking, and Others. RV Camping is expected to maintain its dominance due to increasing RV sales and infrastructure improvements.

- By Distribution Channel: This includes Direct Sales, Online Travel Agencies, and Traditional Travel Agencies. Online Travel Agencies are projected to witness significant growth.

Key Drivers of US Camping and Caravanning Market Growth

The growth of the US camping and caravanning market is driven by several factors. The rising disposable incomes among consumers, coupled with a growing preference for experiential travel, are fueling demand. The development of improved infrastructure at campgrounds and advancements in RV technology, such as the integration of Starlink, enhance the overall experience. Favorable government policies promoting outdoor recreation and conservation also contribute significantly.

Challenges in the US Camping and Caravanning Market Sector

The US camping and caravanning market faces challenges such as increased competition from other forms of travel, environmental regulations impacting land access, and supply chain disruptions affecting RV production and equipment availability. These factors could impact market growth by limiting access to raw materials and delaying product launches. Furthermore, the fluctuating prices of raw materials and fuel also pose a significant challenge.

Leading Players in the US Camping and Caravanning Market Market

- Newmar

- Thor Industries

- Forest River

- Winnebago Industries

- Coachmen RV

- Kampgrounds of America (KOA)

- Thousand Trails

- Road Bear RV

- Grand Design RV

- Camping World Holdings

Key Developments in US Camping and Caravanning Market Sector

- November 2022: Camping World Holdings acquired Ashley Outdoors, expanding its presence in Alabama. This acquisition signifies consolidation within the RV dealership sector.

- January 2023: Thor Industries partnered with SpaceX's Starlink to integrate high-speed internet connectivity into select RVs. This technological advancement is expected to significantly enhance the RV camping experience and drive market growth.

Strategic US Camping and Caravanning Market Market Outlook

The US camping and caravanning market is poised for continued growth, driven by the enduring appeal of outdoor recreation, technological advancements, and supportive government policies. Strategic opportunities exist for companies that can capitalize on the growing demand for luxury camping experiences and sustainable tourism practices. Investing in technological improvements, enhancing campground amenities, and expanding into niche markets are key strategies for achieving market leadership.

US Camping and Caravanning Market Segmentation

-

1. Destination Type

- 1.1. State or National Park Campgrounds

- 1.2. Privately Owned Campgrounds

- 1.3. Public o

- 1.4. Backcountry, National Forest or Wilderness Areas

- 1.5. Parking Lots

- 1.6. Others

-

2. Type of Camper

- 2.1. Car Camping

- 2.2. RV Camping

- 2.3. Backpacking

- 2.4. Others

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Online Travel Agencies

- 3.3. Traditional Travel Agencies

US Camping and Caravanning Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Camping and Caravanning Market Regional Market Share

Geographic Coverage of US Camping and Caravanning Market

US Camping and Caravanning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rise of RV and Van Life in the United States is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 5.1.1. State or National Park Campgrounds

- 5.1.2. Privately Owned Campgrounds

- 5.1.3. Public o

- 5.1.4. Backcountry, National Forest or Wilderness Areas

- 5.1.5. Parking Lots

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Camper

- 5.2.1. Car Camping

- 5.2.2. RV Camping

- 5.2.3. Backpacking

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Online Travel Agencies

- 5.3.3. Traditional Travel Agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 6. North America US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination Type

- 6.1.1. State or National Park Campgrounds

- 6.1.2. Privately Owned Campgrounds

- 6.1.3. Public o

- 6.1.4. Backcountry, National Forest or Wilderness Areas

- 6.1.5. Parking Lots

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type of Camper

- 6.2.1. Car Camping

- 6.2.2. RV Camping

- 6.2.3. Backpacking

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Online Travel Agencies

- 6.3.3. Traditional Travel Agencies

- 6.1. Market Analysis, Insights and Forecast - by Destination Type

- 7. South America US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination Type

- 7.1.1. State or National Park Campgrounds

- 7.1.2. Privately Owned Campgrounds

- 7.1.3. Public o

- 7.1.4. Backcountry, National Forest or Wilderness Areas

- 7.1.5. Parking Lots

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type of Camper

- 7.2.1. Car Camping

- 7.2.2. RV Camping

- 7.2.3. Backpacking

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Online Travel Agencies

- 7.3.3. Traditional Travel Agencies

- 7.1. Market Analysis, Insights and Forecast - by Destination Type

- 8. Europe US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination Type

- 8.1.1. State or National Park Campgrounds

- 8.1.2. Privately Owned Campgrounds

- 8.1.3. Public o

- 8.1.4. Backcountry, National Forest or Wilderness Areas

- 8.1.5. Parking Lots

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type of Camper

- 8.2.1. Car Camping

- 8.2.2. RV Camping

- 8.2.3. Backpacking

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Online Travel Agencies

- 8.3.3. Traditional Travel Agencies

- 8.1. Market Analysis, Insights and Forecast - by Destination Type

- 9. Middle East & Africa US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination Type

- 9.1.1. State or National Park Campgrounds

- 9.1.2. Privately Owned Campgrounds

- 9.1.3. Public o

- 9.1.4. Backcountry, National Forest or Wilderness Areas

- 9.1.5. Parking Lots

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type of Camper

- 9.2.1. Car Camping

- 9.2.2. RV Camping

- 9.2.3. Backpacking

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Online Travel Agencies

- 9.3.3. Traditional Travel Agencies

- 9.1. Market Analysis, Insights and Forecast - by Destination Type

- 10. Asia Pacific US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination Type

- 10.1.1. State or National Park Campgrounds

- 10.1.2. Privately Owned Campgrounds

- 10.1.3. Public o

- 10.1.4. Backcountry, National Forest or Wilderness Areas

- 10.1.5. Parking Lots

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type of Camper

- 10.2.1. Car Camping

- 10.2.2. RV Camping

- 10.2.3. Backpacking

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Online Travel Agencies

- 10.3.3. Traditional Travel Agencies

- 10.1. Market Analysis, Insights and Forecast - by Destination Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Newmar

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thor Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forest River

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Winnebago Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coachmen RV**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kampgrounds of America (KOA)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thousand Trails

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Road Bear RV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grand Design RV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Camping World Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Newmar

List of Figures

- Figure 1: Global US Camping and Caravanning Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 3: North America US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 4: North America US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 5: North America US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 6: North America US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 11: South America US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 12: South America US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 13: South America US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 14: South America US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 19: Europe US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 20: Europe US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 21: Europe US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 22: Europe US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 27: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 28: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 29: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 30: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 35: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 36: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 37: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 38: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 2: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 3: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Camping and Caravanning Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 6: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 7: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 13: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 14: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 20: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 21: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 33: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 34: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 43: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 44: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Camping and Caravanning Market?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the US Camping and Caravanning Market?

Key companies in the market include Newmar, Thor Industries, Forest River, Winnebago Industries, Coachmen RV**List Not Exhaustive, Kampgrounds of America (KOA), Thousand Trails, Road Bear RV, Grand Design RV, Camping World Holdings.

3. What are the main segments of the US Camping and Caravanning Market?

The market segments include Destination Type, Type of Camper, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Rise of RV and Van Life in the United States is Driving the Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

January 2023: THOR Industries (THO) agreed with SpaceX's Starlink to integrate flat high-performance Starlinks. Even in motion, it provides high-speed, low-latency internet into select motorized RVs in the United States across the THOR family of companies in 2023. THOR will also explore opportunities to bring Starlink's innovative connectivity solutions to additional RVs made by their operating companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Camping and Caravanning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Camping and Caravanning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Camping and Caravanning Market?

To stay informed about further developments, trends, and reports in the US Camping and Caravanning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence