Key Insights

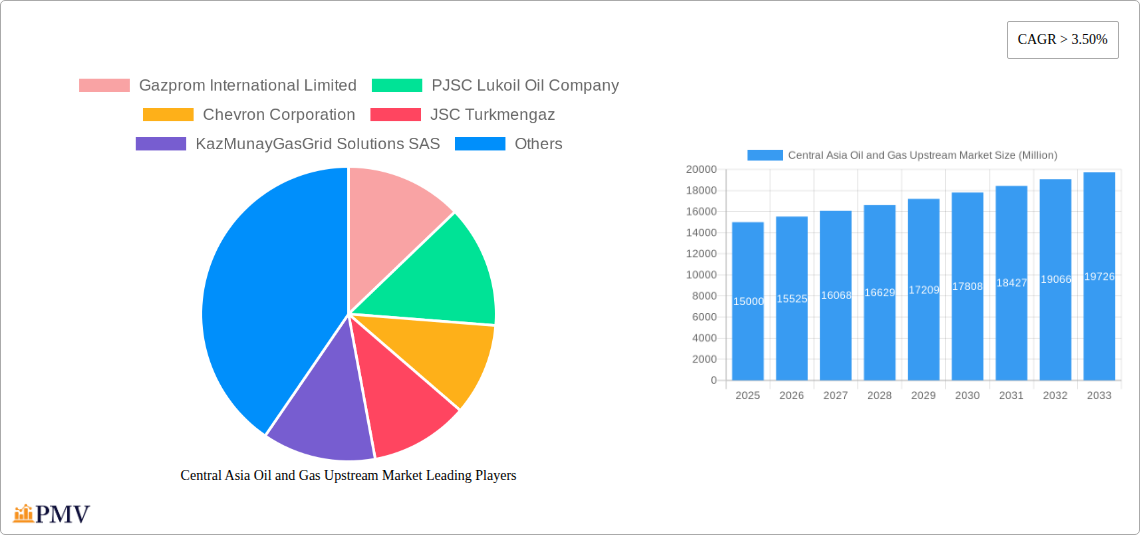

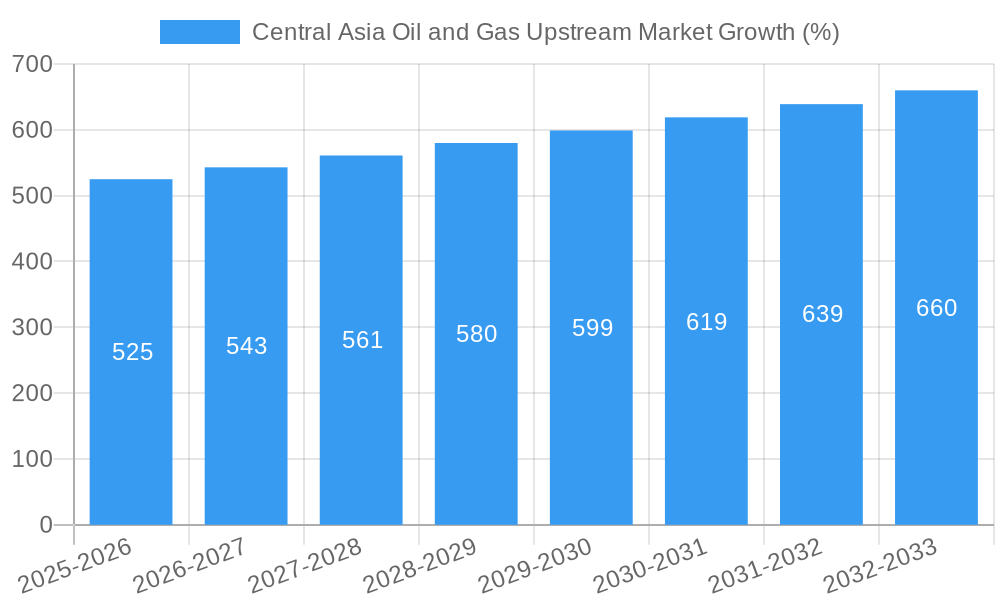

The Central Asian oil and gas upstream market, encompassing activities like exploration, drilling, and production, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region possesses significant untapped hydrocarbon reserves, attracting substantial investment from both international and national oil and gas companies. Secondly, increasing global energy demand, particularly from Asia, creates a strong market for Central Asian oil and gas exports. Thirdly, ongoing infrastructure development, including pipeline expansions and upgrades, facilitates smoother and more efficient transportation of resources to international markets. However, the market faces certain challenges. Geopolitical instability in the region poses a significant risk, impacting investment decisions and operational stability. Furthermore, environmental concerns and stricter regulations regarding emissions are prompting companies to adopt more sustainable practices, potentially increasing operational costs. The market is segmented by deployment type (onshore and offshore), with onshore activities currently dominating due to established infrastructure and lower operational complexity. Major players such as Gazprom, Lukoil, Chevron, Turkmengaz, and KazMunayGas are actively involved, strategically competing for market share and resources. The Asia-Pacific region, particularly China, India, and Japan, represents a crucial export market for Central Asian oil and gas.

The market's future growth trajectory will hinge on the successful mitigation of geopolitical risks and the adoption of environmentally conscious operational strategies. Further investment in infrastructure development, technological advancements to enhance extraction efficiency, and diversification of export markets are crucial for sustaining the projected growth rate. While offshore exploration holds potential for future expansion, the immediate focus remains on maximizing production from existing onshore fields and securing consistent export channels. The strategic positioning of key players and the continued high demand for energy will be pivotal in shaping the market landscape in the coming years. A deeper understanding of the interplay between these factors will be crucial for investors and industry participants to make informed strategic decisions.

Central Asia Oil & Gas Upstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Central Asia oil and gas upstream market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth projections, equipping stakeholders with actionable intelligence for strategic decision-making. The report meticulously examines market size, segmentation by onshore and offshore deployment, key players, and emerging trends, providing a granular understanding of this dynamic sector. With a base year of 2025 and forecast period spanning 2025-2033, this report is a must-have resource for investors, industry professionals, and government agencies.

Central Asia Oil and Gas Upstream Market Market Structure & Competitive Dynamics

The Central Asia oil and gas upstream market exhibits a moderately concentrated structure, with a few major players holding significant market share. Gazprom International Limited, PJSC Lukoil Oil Company, and Chevron Corporation are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. However, the presence of national oil companies like JSC Turkmengaz and KazMunayGas introduces a level of complexity to the competitive dynamics. The market is characterized by a mix of international and domestic companies, each with its own strategies for exploration, production, and resource development.

Innovation in exploration and extraction technologies plays a crucial role, with companies investing in enhanced oil recovery (EOR) techniques and advanced drilling methods to maximize output from mature and challenging fields. The regulatory environment in Central Asia varies across countries, influencing investment decisions and operational strategies. The presence of various fiscal regimes and licensing frameworks creates diverse opportunities and challenges for industry participants.

Product substitution, although not significant at present, is a factor to consider in the long term, with the increasing adoption of renewable energy sources potentially affecting the demand for oil and gas in the future. End-user trends, primarily driven by industrial and power generation sectors, remain a key driver of demand.

Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values estimated at approximately xx Million USD in 2024. While the frequency of M&A is not exceptionally high, strategic acquisitions by major players to secure access to reserves or enhance operational capabilities are expected to continue shaping the market landscape.

Central Asia Oil and Gas Upstream Market Industry Trends & Insights

The Central Asia oil and gas upstream market is experiencing a period of transition, with several factors shaping its future trajectory. Market growth is projected to be influenced by factors such as rising global energy demand, the availability of substantial reserves in the region, and ongoing investments in exploration and production activities. While the overall market exhibits potential for growth, certain challenges persist. These include infrastructure constraints in some areas and the need for continuous technological advancements to address operational efficiency and environmental concerns.

Technological disruptions are transforming the industry, with digitalization playing an increasing role in enhancing efficiency and optimizing operations. Advanced analytics, automation, and remote sensing technologies are being adopted to improve exploration, production, and transportation processes. However, the adoption rate varies across companies, driven by factors including investment capacity and access to technological expertise.

Consumer preferences are indirectly influencing market trends, as the global shift towards cleaner energy sources exerts pressure on oil and gas companies to adopt sustainable practices. This has prompted some companies to invest in carbon capture, utilization, and storage (CCUS) technologies and explore opportunities in lower-carbon energy projects.

Competitive dynamics are further shaped by government policies and regulations, which are crucial in determining the investment climate and operational frameworks for oil and gas companies. The market exhibits a CAGR of xx% during the forecast period (2025-2033), with market penetration driven by increasing energy demand and ongoing infrastructural development within the region.

Dominant Markets & Segments in Central Asia Oil and Gas Upstream Market

The Central Asia oil and gas upstream market is dominated by the onshore segment, accounting for a significantly larger share of total production compared to the offshore segment. This is primarily attributed to the vast onshore reserves located across the region, which are easier to access and develop compared to their offshore counterparts. While offshore exploration and production is present, it remains a relatively smaller contributor to overall market volume.

- Key Drivers of Onshore Dominance:

- Abundant onshore reserves: Central Asia possesses substantial proven and prospective onshore oil and gas reserves.

- Established infrastructure: Existing infrastructure for onshore production facilitates operational efficiency and reduces development costs.

- Favorable regulatory environment (in certain regions): Relatively easier permitting and licensing processes in specific countries enhance onshore exploration.

The onshore segment's dominance is further reinforced by the existing pipeline infrastructure, which connects production sites to processing facilities and export terminals. Investment in expanding pipeline networks continues to support growth within this segment. Further, government policies and incentives often favor onshore development to stimulate economic activity and generate revenue.

Central Asia Oil and Gas Upstream Market Product Innovations

Recent innovations in the Central Asian oil and gas upstream market have largely focused on enhancing efficiency and improving environmental performance. This includes advancements in drilling technologies, such as horizontal drilling and hydraulic fracturing, which allow for increased extraction from unconventional resources. Simultaneously, there's a growing emphasis on digitalization, utilizing data analytics and automation to optimize operations, reduce costs, and minimize environmental impact. These technological advancements improve the efficiency and sustainability of exploration and production activities.

Report Segmentation & Scope

This report segments the Central Asia oil and gas upstream market primarily by Type of Deployment:

Onshore: This segment encompasses all exploration and production activities conducted on land. It is projected to experience robust growth throughout the forecast period (2025-2033), driven by ongoing exploration efforts and the development of new fields. Competitive dynamics within this segment are largely shaped by the presence of both international and national oil companies, each with varying technological capabilities and resource management strategies. Market size for Onshore is estimated at xx Million USD in 2025.

Offshore: The offshore segment includes exploration and production activities in the Caspian Sea and other offshore areas. While currently smaller than the onshore segment, it presents potential for future growth as technological advancements make offshore exploration and extraction more viable. However, offshore operations are typically more complex and expensive, thus influencing competitive dynamics. Market size for Offshore is estimated at xx Million USD in 2025.

Key Drivers of Central Asia Oil and Gas Upstream Market Growth

Several key factors are driving the growth of the Central Asia oil and gas upstream market. These include the region's substantial hydrocarbon reserves, rising global energy demand, and ongoing investments in exploration and production activities. Government policies promoting energy development and infrastructural projects further contribute to market expansion. Technological advancements in enhanced oil recovery (EOR) techniques also enable increased extraction from mature fields. The sustained demand for oil and gas from both domestic and international markets continues to support the sector's growth trajectory.

Challenges in the Central Asia Oil and Gas Upstream Market Sector

Despite its potential, the Central Asia oil and gas upstream market faces several challenges. These include the geopolitical complexities within the region, which can impact investment decisions and operational stability. Infrastructure limitations in certain areas, coupled with the need for substantial capital investments to enhance capacity, pose a significant hurdle. Additionally, environmental concerns and the growing global pressure to reduce carbon emissions necessitate substantial investments in sustainable technologies and practices. These challenges, if not addressed effectively, could potentially hinder the market's overall growth.

Leading Players in the Central Asia Oil and Gas Upstream Market Market

- Gazprom International Limited

- PJSC Lukoil Oil Company

- Chevron Corporation

- JSC Turkmengaz

- KazMunayGas

- Sinopec Oilfield Service Corporation

Key Developments in Central Asia Oil and Gas Upstream Market Sector

- June 2022: Chevron Corporation and JSC NC 'KazMunayGas' announced a memorandum of understanding to explore lower-carbon business opportunities in Kazakhstan, focusing on CCUS technologies. This signifies a shift towards sustainable practices within the industry.

- January 2021: Karachaganak Petroleum Operating BV (KPO) sanctioned the Karachaganak Expansion Project-1A (KEP1A), a major milestone in the development of the Karachaganak field, enhancing gas production capacity. This expansion project represents significant investment and contributes to increased production within the region.

Strategic Central Asia Oil and Gas Upstream Market Market Outlook

The future of the Central Asia oil and gas upstream market appears promising, driven by sustained global energy demand and ongoing investments in exploration and production. However, the industry must adapt to evolving environmental regulations and technological advancements to ensure long-term sustainability. Companies that embrace innovation, prioritize environmental stewardship, and effectively navigate geopolitical complexities will be well-positioned to capitalize on the region's significant hydrocarbon resources and achieve sustained growth in the years ahead. The strategic opportunities lie in optimizing existing infrastructure, exploring unconventional resources, and embracing low-carbon technologies.

Central Asia Oil and Gas Upstream Market Segmentation

-

1. Type of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Kazakhstan

- 2.2. Turkmenistan

- 2.3. Uzbekistan

- 2.4. Rest of Central Asia

Central Asia Oil and Gas Upstream Market Segmentation By Geography

- 1. Kazakhstan

- 2. Turkmenistan

- 3. Uzbekistan

- 4. Rest of Central Asia

Central Asia Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kazakhstan

- 5.2.2. Turkmenistan

- 5.2.3. Uzbekistan

- 5.2.4. Rest of Central Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.3.2. Turkmenistan

- 5.3.3. Uzbekistan

- 5.3.4. Rest of Central Asia

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6. Kazakhstan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kazakhstan

- 6.2.2. Turkmenistan

- 6.2.3. Uzbekistan

- 6.2.4. Rest of Central Asia

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7. Turkmenistan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kazakhstan

- 7.2.2. Turkmenistan

- 7.2.3. Uzbekistan

- 7.2.4. Rest of Central Asia

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8. Uzbekistan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kazakhstan

- 8.2.2. Turkmenistan

- 8.2.3. Uzbekistan

- 8.2.4. Rest of Central Asia

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9. Rest of Central Asia Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kazakhstan

- 9.2.2. Turkmenistan

- 9.2.3. Uzbekistan

- 9.2.4. Rest of Central Asia

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 10. China Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 12. India Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Gazprom International Limited

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PJSC Lukoil Oil Company

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Chevron Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 JSC Turkmengaz

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 KazMunayGasGrid Solutions SAS

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sinopec Oilfield Service Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 Gazprom International Limited

List of Figures

- Figure 1: Central Asia Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central Asia Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 3: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 14: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 17: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 20: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 23: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central Asia Oil and Gas Upstream Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Central Asia Oil and Gas Upstream Market?

Key companies in the market include Gazprom International Limited, PJSC Lukoil Oil Company, Chevron Corporation, JSC Turkmengaz, KazMunayGasGrid Solutions SAS, Sinopec Oilfield Service Corporation.

3. What are the main segments of the Central Asia Oil and Gas Upstream Market?

The market segments include Type of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In June 2022, Chevron Corporation, through its subsidiary Chevron Munaigas Inc. and JSC NC 'KazMunayGas' (KMG), announced a memorandum of understanding to explore potential lower carbon business opportunities in Kazakhstan. Both companies had a plan to evaluate the potential for lower carbon projects in areas such as carbon capture, utilization, and storage (CCUS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central Asia Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central Asia Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central Asia Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Central Asia Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence