Key Insights

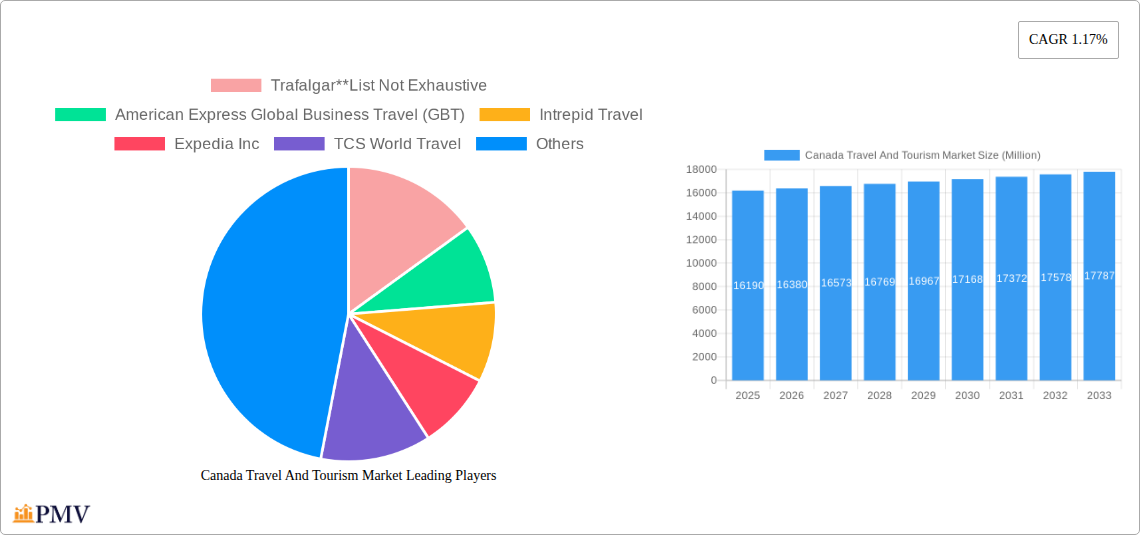

The Canadian travel and tourism market, valued at $16.19 billion in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 1.17%, projecting steady growth through 2033. This growth is driven by several factors. Increasing disposable incomes among Canadians fuel domestic leisure travel, while a strengthening Canadian dollar makes international trips more accessible. The burgeoning popularity of experiential travel, including eco-tourism and adventure activities within Canada's diverse landscapes, also contributes significantly. Furthermore, the continued investment in tourism infrastructure and marketing initiatives by both federal and provincial governments supports market expansion. However, external factors such as global economic uncertainty and fluctuating fuel prices pose potential restraints. The market is segmented by application (international vs. domestic), booking method (online vs. offline), and type of travel (leisure, education, business, sports, medical tourism, and others). Online booking platforms are experiencing rapid growth, reflecting a broader trend in consumer behavior. The leisure segment dominates the market, but business and medical tourism are also showing promising growth potential. Regional variations exist, with Eastern Canada potentially exhibiting slightly higher growth rates due to its established tourism infrastructure and proximity to major international gateways.

Canada Travel And Tourism Market Market Size (In Billion)

The dominance of online booking platforms suggests a shift towards digitalization within the industry. Companies like Expedia, Booking Holdings, and American Express Global Business Travel are key players, leveraging technology to optimize offerings and reach a wider audience. Smaller niche operators, such as those specializing in adventure tourism or specific regional experiences, are also thriving, indicating a diverse and dynamic market structure. The forecast period (2025-2033) will likely witness continued competition, with established players focusing on innovation and diversification while smaller firms leverage niche expertise to carve out their market share. Sustained growth depends on effectively managing environmental sustainability concerns, addressing infrastructure challenges, and adapting to evolving consumer preferences and technological advancements.

Canada Travel And Tourism Market Company Market Share

Canada Travel and Tourism Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada travel and tourism market, covering the period 2019-2033, with a focus on the estimated year 2025. It delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key developments, offering valuable insights for industry stakeholders, investors, and policymakers. The report utilizes data from the historical period (2019-2024) to project market growth during the forecast period (2025-2033). The report segments the market by application (International, Domestic), booking method (Online, Offline), and travel type (Leisure, Education, Business, Sports, Medical Tourism, Other). Key players analyzed include Trafalgar, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, and Booking Holdings Inc.

Canada Travel and Tourism Market Market Structure & Competitive Dynamics

The Canadian travel and tourism market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The market is characterized by a dynamic innovation ecosystem, with companies constantly seeking to improve their offerings through technological advancements and strategic partnerships. Regulatory frameworks, including visa requirements and environmental regulations, play a crucial role in shaping market dynamics. Substitute products, such as staycations and alternative leisure activities, exert a degree of competitive pressure. End-user trends, including a growing preference for sustainable and experiential travel, influence market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values varying significantly depending on the size and scope of the transaction. For instance, while precise M&A deal values for the Canadian market are not publicly available, an estimated xx Million in M&A activity was observed in the last 5 years. The market share held by the top five players is estimated to be around xx%.

Canada Travel and Tourism Market Industry Trends & Insights

The Canadian travel and tourism market is projected to experience robust growth throughout the forecast period. The Compound Annual Growth Rate (CAGR) is estimated to be xx% from 2025 to 2033, driven by several factors. A rising disposable income, increasing domestic and international tourism, and government initiatives to promote the sector are key growth drivers. Technological advancements, such as online booking platforms and personalized travel recommendations, are significantly impacting consumer behavior and industry operations. The market penetration of online booking platforms continues to increase, with an estimated xx% of bookings made online in 2025. Intense competition among players, focusing on pricing strategies, product differentiation, and customer service, shapes market dynamics. The increased demand for sustainable travel practices is also influencing market trends, requiring businesses to adopt more eco-friendly approaches.

Dominant Markets & Segments in Canada Travel and Tourism Market

By Application: The domestic tourism segment is currently dominant, benefiting from strong domestic demand and government support. However, the international segment is expected to witness significant growth driven by increasing global tourism and Canada's attractive natural landscapes and cultural experiences. Key drivers for the domestic segment include government incentives, improved infrastructure, and growing awareness of domestic tourist spots. The international segment is primarily driven by Canada's global reputation as a desirable destination.

By Booking: Online bookings are the fastest-growing segment, driven by increasing internet penetration and the convenience of online travel agencies. Offline bookings still hold a significant share, particularly among older demographics who prefer traditional booking methods.

By Type: The leisure travel segment dominates the market, encompassing a wide range of activities, from adventure tourism to city breaks. However, the business and medical tourism segments are projected to witness relatively faster growth in the forecast period. The business tourism sector thrives on strong economic activity and the presence of numerous international corporations in Canada. The medical tourism sector is gaining traction due to advancements in medical technology and Canada's reputable healthcare system.

Canada Travel and Tourism Market Product Innovations

The Canadian travel and tourism sector is witnessing significant product innovations, driven by technological advancements and evolving consumer preferences. This includes the rise of personalized travel experiences, virtual reality tours, and AI-powered travel planning tools. Companies are also focusing on developing sustainable tourism offerings that minimize environmental impact. These innovations enhance customer engagement, increase operational efficiency, and offer competitive advantages in the dynamic market landscape.

Report Segmentation & Scope

The Canada travel and tourism market report offers a comprehensive segmentation, providing deep insights into key areas of growth and development. This detailed breakdown allows stakeholders to understand the market dynamics and identify strategic opportunities.

-

By Application: The market is analyzed based on its application segments, highlighting the distinct contributions of various tourism types. International tourism is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR]%**. This growth is primarily propelled by increasing global wanderlust, effective government initiatives promoting Canada as a destination, and favorable international travel trends. Concurrently, domestic tourism, which currently holds a dominant position, is expected to exhibit sustained and robust growth at a CAGR of **[Insert Specific CAGR]%**. This continued strength is underpinned by rising disposable incomes among Canadians, a growing appreciation for domestic travel experiences, and the ongoing development of diverse local attractions.

-

By Booking Channel: The report meticulously examines the evolution of booking methods. Online bookings are predicted to experience a notably faster growth trajectory, with an anticipated CAGR of **[Insert Specific CAGR]%**. This accelerated pace reflects the undeniable and ongoing shift in consumer behavior towards digital platforms for planning and securing travel arrangements. In contrast, offline bookings are projected to grow at a more moderate CAGR of **[Insert Specific CAGR]%**, indicating their continued relevance but highlighting the increasing dominance of online channels.

-

By Type of Travel: Understanding the nature of travel is crucial for market analysis. Leisure travel is anticipated to maintain its position as the largest and most significant segment of the Canadian travel and tourism market, with a projected CAGR of **[Insert Specific CAGR]%**. This enduring popularity stems from Canadians' and international visitors' desire for relaxation, exploration, and cultural immersion. Looking at segments with potentially higher growth rates, business travel is expected to grow at a CAGR of **[Insert Specific CAGR]%**, driven by the recovery of corporate events and meetings. Furthermore, medical tourism, while a niche segment, is projected to experience comparatively higher growth rates with a CAGR of **[Insert Specific CAGR]%**, influenced by Canada's reputation for quality healthcare and specialized treatments.

Key Drivers of Canada Travel and Tourism Market Growth

Several factors drive the growth of the Canadian travel and tourism market. These include increased disposable incomes leading to higher spending on leisure activities, government initiatives promoting tourism, and infrastructure development improving accessibility to various destinations. Technological advancements like AI-powered booking platforms and personalized travel recommendations enhance customer experience and market efficiency. Favorable visa policies and increasing global interest in Canada as a tourist destination further bolster market growth.

Challenges in the Canada Travel and Tourism Market Sector

The sector faces challenges including seasonal fluctuations in tourism, infrastructure limitations in certain regions, and intense competition among various travel providers. Environmental concerns, such as the impact of tourism on natural resources, also pose a challenge, impacting the sustainability of the sector. Fluctuations in currency exchange rates can influence international travel and tourism significantly. Furthermore, global economic uncertainties may impact consumer spending, affecting demand.

Leading Players in the Canada Travel and Tourism Market Market

- Trafalgar

- American Express Global Business Travel (GBT)

- Intrepid Travel

- Expedia Inc

- TCS World Travel

- BCD Travel

- Topdeck Travel Ltd

- Exodus Travels Ltd

- Abercrombie & Kent USA LLC

- Booking Holdings Inc

Key Developments in Canada Travel and Tourism Market Sector

October 2023: The Government of Canada invested USD 500,000 in tourism across British Columbia, supporting Indigenous tourism growth via the "Invest in Iconic" strategy. This initiative is expected to stimulate local economies and attract new visitors.

October 2022: Sabre and BCD Travel's technology partnership aims to boost corporate travel bookings and accelerate technological advancements in the sector. This collaboration is anticipated to enhance efficiency and innovation within the corporate travel segment.

Strategic Canada Travel and Tourism Market Market Outlook

The Canadian travel and tourism market presents significant growth opportunities in the coming years. Strategic investments in infrastructure, sustainable tourism practices, and technological advancements are key to realizing the market's full potential. Focusing on niche segments, such as adventure tourism and wellness tourism, can create unique selling propositions. Collaboration between the public and private sectors, coupled with effective marketing and promotion strategies, will be crucial in ensuring the sector's continued success. The focus on personalized experiences and sustainable practices will continue to shape the strategic direction of the market.

Canada Travel And Tourism Market Segmentation

-

1. Type

- 1.1. Leisure

- 1.2. Education

- 1.3. Business

- 1.4. Sports

- 1.5. Medical Tourism

- 1.6. Other Types

-

2. Application

- 2.1. International

- 2.2. Domestic

-

3. Booking

- 3.1. Online

- 3.2. Offline

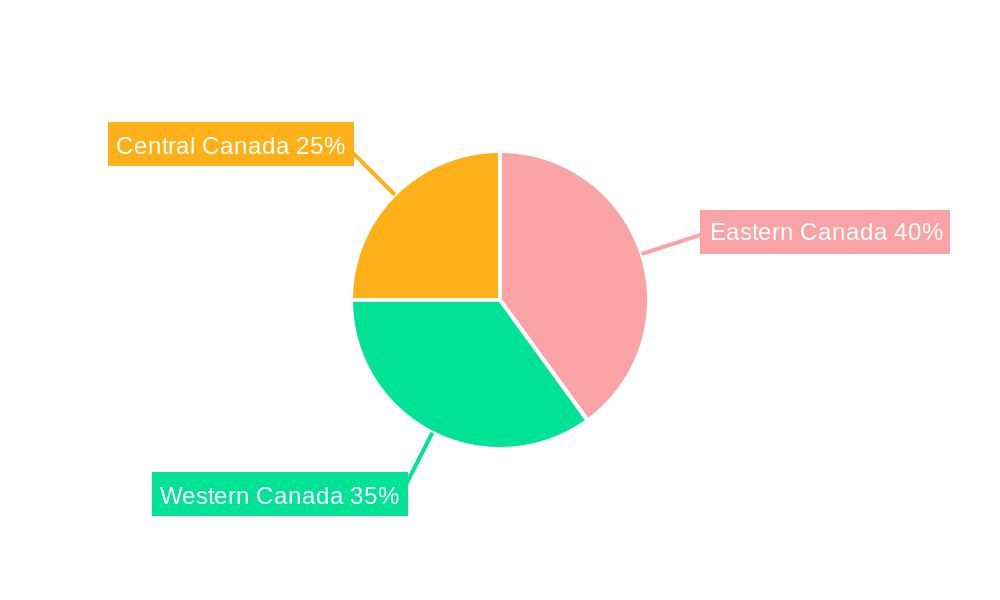

Canada Travel And Tourism Market Segmentation By Geography

- 1. Canada

Canada Travel And Tourism Market Regional Market Share

Geographic Coverage of Canada Travel And Tourism Market

Canada Travel And Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Increasing Interest in Multi-Day Tours is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Travel And Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure

- 5.1.2. Education

- 5.1.3. Business

- 5.1.4. Sports

- 5.1.5. Medical Tourism

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trafalgar**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Express Global Business Travel (GBT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intrepid Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expedia Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TCS World Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCD Travel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topdeck Travel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Exodus Travels Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abercrombie & Kent USA LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trafalgar**List Not Exhaustive

List of Figures

- Figure 1: Canada Travel And Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Travel And Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 4: Canada Travel And Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 8: Canada Travel And Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Travel And Tourism Market?

The projected CAGR is approximately 1.17%.

2. Which companies are prominent players in the Canada Travel And Tourism Market?

Key companies in the market include Trafalgar**List Not Exhaustive, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, Booking Holdings Inc.

3. What are the main segments of the Canada Travel And Tourism Market?

The market segments include Type, Application, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Increasing Interest in Multi-Day Tours is Driving the Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

October 2023: The Government of Canada invested in tourism across British Columbia to attract new visitors and stimulate local economies. Funding of USD 500,000 has been provided to the Aboriginal Tourism Association of British Columbia to help Indigenous Tourism BC develop its "Invest in Iconic" tourism strategy with Destination BC to grow the Indigenous tourism sector in British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Travel And Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Travel And Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Travel And Tourism Market?

To stay informed about further developments, trends, and reports in the Canada Travel And Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence