Key Insights

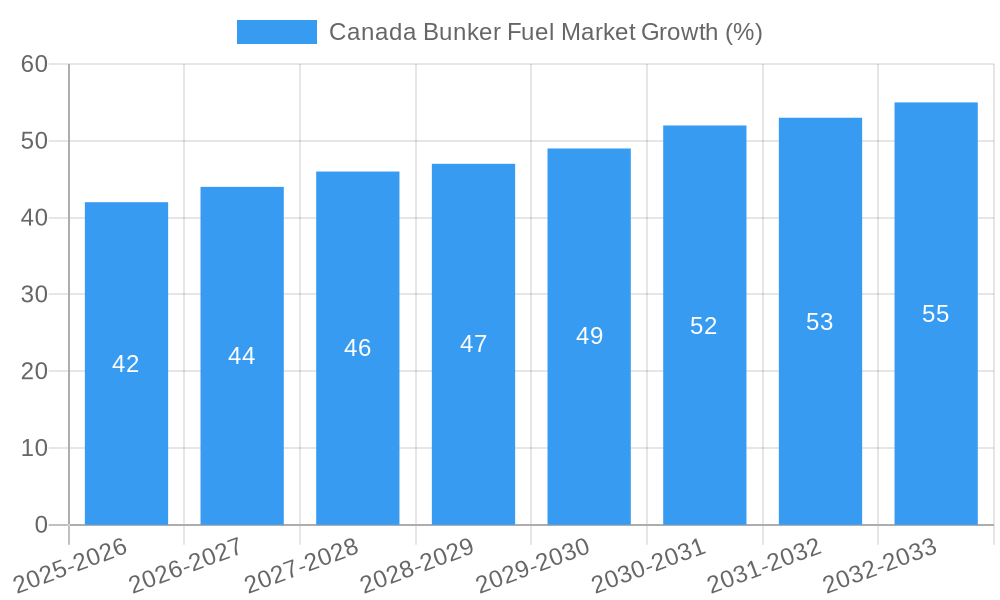

The Canadian bunker fuel market, valued at approximately $1.42 billion in 2025, is projected to experience robust growth, driven by increasing maritime trade and the expansion of port infrastructure across Canada. A Compound Annual Growth Rate (CAGR) exceeding 2.93% is anticipated from 2025 to 2033, indicating a consistently expanding market. This growth is fueled by several factors: the rising global demand for shipping services, particularly within North America; increasing containerization and trade volumes; and government investments in modernizing Canadian ports to handle larger vessels and increased cargo. The market is segmented into fuel suppliers (major players including PetroChina, TotalEnergies, Peninsula Petroleum, A.P. Møller-Mærsk, and World Fuel Services) and ship owners (significant players like COSCO, OOCL, MSC, ONE, and CMA CGM). The competitive landscape is moderately concentrated, with a few large players dominating the market share, although smaller regional suppliers also play a role. While challenges such as fluctuating fuel prices and environmental regulations exist, the overall positive outlook for maritime commerce in Canada ensures continued growth for the bunker fuel sector in the foreseeable future.

The consistent growth trajectory is expected to be influenced by ongoing developments in global shipping patterns and the Canadian economy. Increased environmental regulations, pushing towards cleaner fuel sources, will likely reshape the market landscape in the coming years. This could lead to increased adoption of low-sulfur fuels and alternative marine fuels, creating both opportunities and challenges for existing players. The market's trajectory also depends on the overall health of the global economy, with economic downturns potentially impacting trade volumes and, consequently, bunker fuel demand. Nevertheless, considering Canada's strategic geographic location and its growing role in international trade, the Canadian bunker fuel market is well-positioned for sustained growth and expansion throughout the forecast period.

Canada Bunker Fuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Bunker Fuel market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period (2025-2033), and includes detailed analysis of market size (in Millions), segmentation, competitive landscape, and key growth drivers. The base year for this analysis is 2025.

Canada Bunker Fuel Market Market Structure & Competitive Dynamics

The Canadian bunker fuel market exhibits a moderately concentrated structure, with a handful of major players dominating the supply side. Fuel suppliers like PetroChina Company Limited, TotalEnergies SE, Peninsula Petroleum Ltd, A P Møller – Mærsk AS, and World Fuel Services Corporation hold significant market share. On the demand side, major ship owners such as Cosco Shipping Lines Co Ltd, Orient Overseas Container Line (OOCL), Mediterranean Shipping Company, Ocean Network Express, and CMA CGM Group are key consumers. Many smaller independent suppliers and ship owners also contribute to the market's overall volume.

The market is characterized by an evolving innovation ecosystem, driven by the increasing focus on cleaner fuels and stringent environmental regulations. Regulatory frameworks, including those related to sulfur content and emission control, significantly impact market dynamics. The emergence of LNG and biofuels presents viable substitutes, shaping the competitive landscape. Ongoing M&A activities, such as the February 2024 merger between Cryopeak LNG Solutions and Ferus Natural Gas Fuels, aim to consolidate market share and enhance operational efficiency. These deals are estimated to be valued at xx Million, but specific deal values are difficult to ascertain due to private nature of some transactions. While precise market share figures vary, the top five fuel suppliers likely command approximately xx% of the market, indicating room for both consolidation and increased competition from smaller players. End-user trends toward larger vessels and increased shipping volumes drive overall demand for bunker fuel.

Canada Bunker Fuel Market Industry Trends & Insights

The Canadian bunker fuel market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors: increasing global trade, expanding port infrastructure, and rising demand from various sectors like container shipping, bulk carriers, and tankers. However, technological disruptions like the transition towards cleaner fuels (LNG, biofuels) and the implementation of stricter environmental regulations pose both challenges and opportunities. Consumer preferences are shifting towards more sustainable and environmentally friendly options, which influences fuel choice. The market penetration of LNG and biofuels remains relatively low but is expected to increase significantly in the coming years, driven by government incentives and environmental concerns. The competitive dynamics are shaped by price fluctuations in crude oil, the availability of alternative fuels, and stringent regulatory compliance.

Dominant Markets & Segments in Canada Bunker Fuel Market

The report identifies the Eastern Canadian ports as the most dominant segment in the market.

- Key Drivers:

- High concentration of shipping activities: Major ports in this region handle substantial cargo volumes.

- Established infrastructure: Well-developed port facilities and supporting infrastructure streamline bunker fuel delivery.

- Government support: Government policies that favor efficient transportation and trade contribute to market growth.

The dominance of Eastern Canadian ports stems from higher vessel traffic and established infrastructure. The region benefits from streamlined supply chains and established distribution networks, fostering efficient bunker fuel delivery. Government initiatives aimed at improving port efficiency and promoting trade further enhance this region’s prominence in the market. This dominance is expected to continue throughout the forecast period. Western Canada shows potential for growth but lags behind in infrastructure development and overall vessel traffic.

Canada Bunker Fuel Market Product Innovations

Significant product innovations center on cleaner fuel alternatives, focusing on LNG and biofuels like B100 biodiesel. These fuels offer lower emissions compared to conventional bunker fuels, meeting growing environmental regulations and consumer demands for sustainability. Companies are investing in new technologies and infrastructure to support the adoption of these cleaner alternatives, while leveraging existing infrastructure for seamless integration. The market fit for these innovative fuels is rapidly increasing due to environmental regulations and cost-effectiveness in specific applications.

Report Segmentation & Scope

The Canada Bunker Fuel market is segmented by fuel type (heavy fuel oil, marine gasoil, LNG, biofuels), vessel type (container ships, bulk carriers, tankers), and region (Eastern Canada, Western Canada). Growth projections for each segment vary, with LNG and biofuels showing the highest projected growth rates due to environmental concerns and government incentives. Market sizes for each segment are detailed within the full report, alongside a competitive analysis highlighting key players and their market strategies. The analysis also explores the potential for new market entrants based on segment-specific dynamics.

Key Drivers of Canada Bunker Fuel Market Growth

The growth of the Canadian bunker fuel market is driven by several key factors: increasing global trade leading to higher shipping volumes, the expansion of port infrastructure improving efficiency, and the continuous development of efficient bunker supply chains. Government regulations pushing for cleaner fuel sources and rising environmental awareness are also significant factors. Furthermore, the growing adoption of larger container ships and other cargo vessels will significantly influence fuel demand in the coming years.

Challenges in the Canada Bunker Fuel Market Sector

The Canadian bunker fuel market faces several challenges, including price volatility of crude oil impacting fuel costs, stringent environmental regulations imposing compliance burdens, and the need for continuous investment in infrastructure supporting new fuel types. Supply chain disruptions due to geopolitical instability or unforeseen events can also affect market stability. Competition, particularly in the areas of cleaner fuels, is intense and poses a considerable challenge for existing players.

Leading Players in the Canada Bunker Fuel Market Market

- PetroChina Company Limited

- TotalEnergies SE

- Peninsula Petroleum Ltd

- A P Møller – Mærsk AS

- World Fuel Services Corporation

- Cosco Shipping Lines Co Ltd

- Orient Overseas Container Line (OOCL)

- Mediterranean Shipping Company

- Ocean Network Express

- CMA CGM Group

- List of Other Prominent Companies

Key Developments in Canada Bunker Fuel Market Sector

- May 2024: CSL Group's renewed B100 biodiesel initiative for its CSL Welland vessel, in partnership with Canada Clean Fuels Inc., showcases a growing commitment to sustainable biofuels and highlights the potential of waste-based biofuel production in the Canadian market. This initiative may spur further adoption of biofuels within the shipping industry.

- February 2024: The merger of Cryopeak LNG Solutions and Ferus Natural Gas Fuels signals a significant expansion in Canada's LNG infrastructure and distribution network. This consolidates market share and strengthens the LNG supply chain. The expansion in Western Canada could influence regional fuel choices for shipping.

Strategic Canada Bunker Fuel Market Market Outlook

The Canadian bunker fuel market presents significant opportunities for growth, particularly in the adoption of cleaner alternatives like LNG and biofuels. Strategic investments in port infrastructure and sustainable fuel supply chains will be critical for success. Companies that can adapt to stringent environmental regulations and offer cost-effective, environmentally friendly solutions are well-positioned for future market leadership. The growing demand for efficient and sustainable shipping solutions will continue to drive market growth.

Canada Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

Canada Bunker Fuel Market Segmentation By Geography

- 1. Canada

Canada Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.4. Market Trends

- 3.4.1. The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fuel Suppliers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 PetroChina Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 TotalEnergies SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3 Peninsula Petroleum Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 A P Møller – Mærsk AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 5 World Fuel Services Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ship Owners

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Cosco Shipping Lines Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 2 Orient Overseas Container Line (OOCL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3 Mediterranean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 Ocean Network Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Fuel Suppliers

List of Figures

- Figure 1: Canada Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 5: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 7: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 11: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 12: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 13: Canada Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Bunker Fuel Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Bunker Fuel Market?

The projected CAGR is approximately > 2.93%.

2. Which companies are prominent players in the Canada Bunker Fuel Market?

Key companies in the market include Fuel Suppliers, 1 PetroChina Company Limited, 2 TotalEnergies SE, 3 Peninsula Petroleum Ltd, 4 A P Møller – Mærsk AS, 5 World Fuel Services Corporation, Ship Owners, 1 Cosco Shipping Lines Co Ltd, 2 Orient Overseas Container Line (OOCL), 3 Mediterranean Shipping Company, 4 Ocean Network Express, 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Canada Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

6. What are the notable trends driving market growth?

The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

8. Can you provide examples of recent developments in the market?

May 2024: CSL Group, a Canadian company, announced that its gearless bulk carrier, CSL Welland, will once again operate on B100 biodiesel for the upcoming season, signaling the revival of its biofuel initiative. In collaboration with Canada Clean Fuels Inc., the company is fueling eight of its vessels with B100 biodiesel sourced from North America and produced from waste plant materials.February 2024: Cryopeak LNG Solutions signed an agreement to merge operations with Ferus Natural Gas Fuels to develop a new liquefied natural gas (LNG) production and distribution organization across Canada. The company also manages three LNG production facilities through this expansion in Western Canada and operates the country's most significant LNG transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Canada Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence