Key Insights

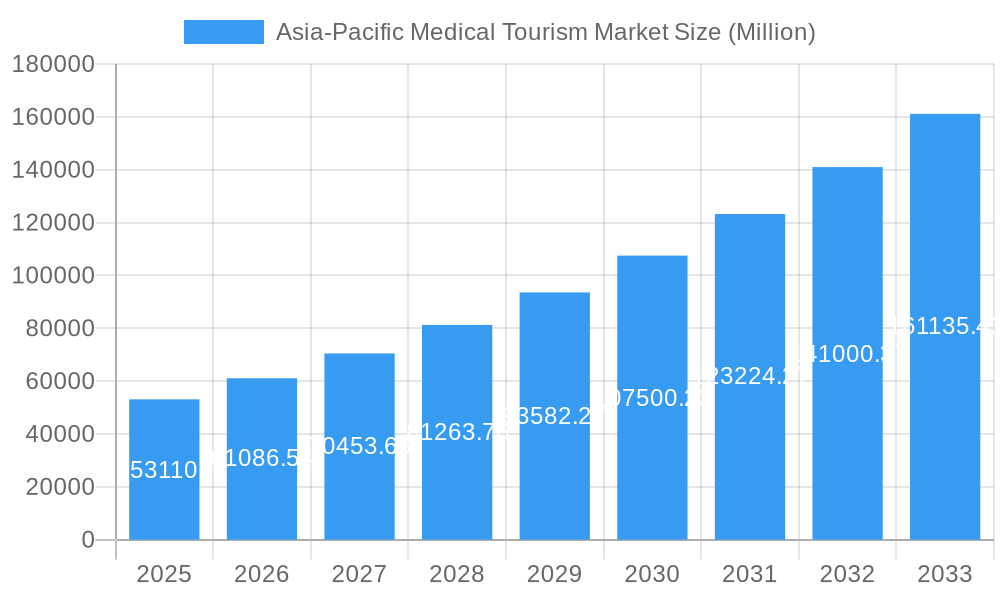

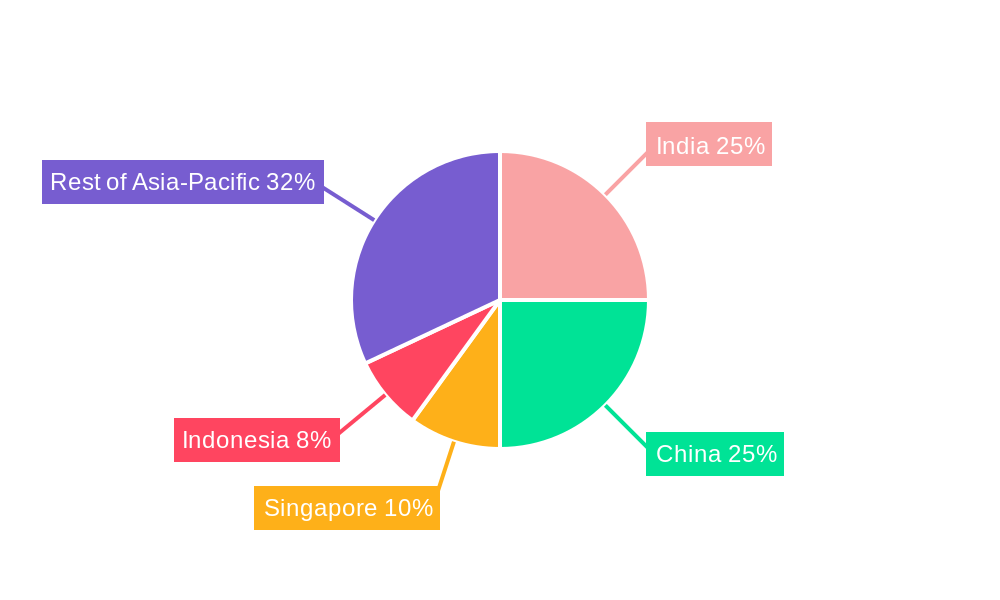

The Asia-Pacific medical tourism market is experiencing robust growth, projected to reach a market size of $53.11 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 15.34% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region's burgeoning middle class, particularly in countries like India and China, has increased disposable incomes, allowing more individuals to afford high-quality, yet more affordable, healthcare services compared to their home countries. Secondly, advancements in medical technology and expertise within the Asia-Pacific region, particularly in specialized treatments like cardiovascular and orthopedic procedures, draw patients seeking advanced care. Furthermore, the increasing prevalence of chronic diseases necessitates extensive treatment options, bolstering market demand. However, challenges remain, including regulatory hurdles concerning medical tourism and disparities in healthcare infrastructure across different nations within the region. Competition amongst providers is fierce, with both established private hospitals and burgeoning public sector initiatives vying for market share. The market segmentation reveals strong performance across various treatment types, with dental, cosmetic, and cardiovascular treatments leading the way. The private sector dominates service provision, but the public sector’s role is expanding to address accessibility concerns. Countries like India, China, Singapore, and Indonesia are key players, each leveraging its strengths in specific medical areas to attract international patients.

Asia-Pacific Medical Tourism Market Market Size (In Billion)

The forecast period (2025-2033) suggests continued significant growth, driven by factors such as rising healthcare costs in developed nations, increased awareness of medical tourism options, and continued improvements in the quality and affordability of medical services within the Asia-Pacific region. Strategic collaborations between hospitals and international agencies are also likely to play a crucial role in shaping this growth trajectory. However, potential market restraints include managing the influx of medical tourists, ensuring ethical practices, maintaining high standards of care, and navigating varying regulatory landscapes across the diverse nations within the region. This market's future success hinges on addressing these factors effectively, ensuring a sustainable and ethically sound growth trajectory.

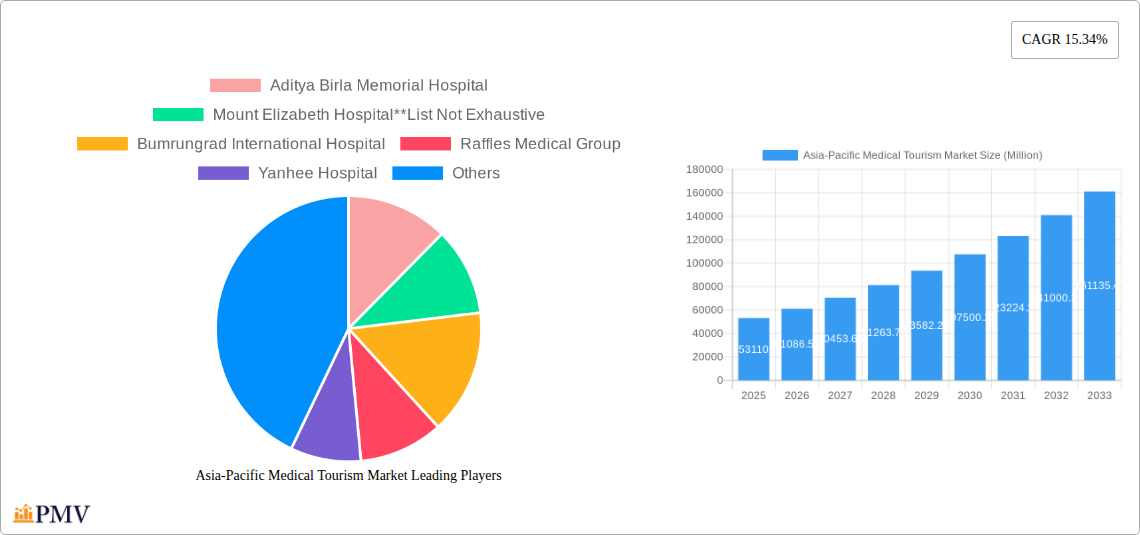

Asia-Pacific Medical Tourism Market Company Market Share

Asia-Pacific Medical Tourism Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Asia-Pacific medical tourism market, offering valuable insights for investors, healthcare providers, and industry stakeholders. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The market is segmented by treatment type, service provider, and country, providing a granular understanding of its structure and growth dynamics. Key players such as Aditya Birla Memorial Hospital, Mount Elizabeth Hospital, Bumrungrad International Hospital, Raffles Medical Group, Yanhee Hospital, Sunway Medical Centre, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Fortis Healthcare Limited, and Asian Heart Institute are analyzed, along with their market share and strategic initiatives.

Asia-Pacific Medical Tourism Market Market Structure & Competitive Dynamics

The Asia-Pacific medical tourism market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, the market also features a diverse range of smaller providers catering to niche segments. Innovation is driven by technological advancements in medical procedures, digital health platforms, and improved infrastructure. Regulatory frameworks vary across countries, impacting market access and pricing. Substitute products and services include domestic healthcare options and telemedicine, although medical tourism's appeal often lies in accessing specialized procedures and lower costs. End-user trends reflect a growing preference for high-quality, affordable care, with an increasing demand for cosmetic and elective procedures. The market has witnessed several significant mergers and acquisitions (M&A) activities in recent years, with deal values exceeding xx Million. For example, Apollo Hospitals' acquisition of a 60% stake in an Ayurveda hospital chain demonstrates strategic expansion into complementary healthcare segments. Market share analysis reveals that the top five players collectively account for approximately xx% of the market, leaving significant room for growth among smaller players and new entrants.

Asia-Pacific Medical Tourism Market Industry Trends & Insights

The Asia-Pacific medical tourism market is experiencing robust growth, driven by several key factors. Rising disposable incomes in emerging economies, coupled with increasing healthcare costs in developed nations, are leading to increased cross-border healthcare travel. Technological advancements in minimally invasive procedures, robotic surgery, and advanced diagnostics are attracting patients seeking state-of-the-art care. Changing consumer preferences favor personalized medicine, convenient healthcare access, and a holistic approach to wellness, further fuelling market expansion. Intense competition among providers is driving innovations in service delivery, pricing strategies, and patient experience. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of medical tourism services has increased significantly, particularly in countries with well-developed healthcare infrastructure and favorable regulatory environments. The ongoing digital transformation of healthcare further enhances efficiency, convenience, and accessibility, driving growth. This trend also increases transparency, and enhances communication between providers and patients. However, challenges remain, including regulatory inconsistencies across different countries, potential risks related to cross-border healthcare, and managing patient expectations effectively.

Dominant Markets & Segments in Asia-Pacific Medical Tourism Market

Leading Countries: India, Singapore, and Thailand are currently dominant markets, attracting significant patient volumes due to their well-established healthcare infrastructure, advanced medical technologies, and competitive pricing. China and Indonesia also represent substantial growth opportunities with their expanding middle class and increasing demand for healthcare services.

Leading Segments (By Treatment Type): Cardiovascular treatment, cosmetic treatment, and orthopedic treatment currently account for a substantial share of the market. The growing incidence of chronic diseases and increasing demand for aesthetic procedures are key drivers of growth in these segments.

Leading Segments (By Service Provider): The private sector dominates the Asia-Pacific medical tourism market due to its investment in advanced infrastructure, specialization of medical professionals, and focus on patient experience. Public sector involvement in medical tourism is limited, as it usually focuses on serving domestic patients.

Key Drivers:

- India: Favorable government policies, a large pool of skilled medical professionals, and cost-effectiveness are key drivers.

- Singapore: Superior healthcare infrastructure, advanced medical technology, and strong reputation for medical expertise are prominent factors.

- Thailand: Affordable prices, high-quality medical services, and specialized treatment options attract patients from neighboring countries.

The dominance of specific countries and treatment types is primarily influenced by economic factors, healthcare infrastructure, regulatory frameworks, and the availability of specialized medical expertise.

Asia-Pacific Medical Tourism Market Product Innovations

Recent innovations focus on minimally invasive surgical techniques, advanced diagnostic imaging, and personalized medicine approaches. These advancements enhance treatment outcomes, reduce recovery times, and improve patient experience. The adoption of telemedicine and digital health platforms is revolutionizing patient engagement, appointment scheduling, and remote monitoring. These innovative approaches are improving convenience and reducing costs. Companies are also focusing on developing specialized treatment packages catering to specific medical needs and preferences, further enhancing competitiveness.

Report Segmentation & Scope

This report segments the Asia-Pacific medical tourism market in three ways:

By Treatment Type: Dental Treatment, Cosmetic Treatment, Cardiovascular Treatment, Orthopedic Treatment, Neurological Treatment, Cancer Treatment, Fertility Treatment, Other Treatments. Each segment's market size, growth projection, and competitive landscape are analyzed.

By Service Provider: Public and Private. The report examines the role of each segment in driving market growth and highlights the key differences in pricing, service quality, and patient experience.

By Country: India, China, Indonesia, Singapore, and Rest of Asia-Pacific. Country-specific market analysis provides insights into local market dynamics, growth potential, and challenges.

Key Drivers of Asia-Pacific Medical Tourism Market Growth

The Asia-Pacific medical tourism market is propelled by several key growth drivers. Rising disposable incomes across the region enable greater access to healthcare services, including cross-border treatments. Technological advancements enhance the quality and effectiveness of medical procedures. Moreover, favorable government policies in certain countries actively promote medical tourism, making the region an attractive destination for patients globally. Finally, competitive pricing in some Asian countries makes medical tourism a cost-effective choice for patients from more expensive healthcare systems.

Challenges in the Asia-Pacific Medical Tourism Market Sector

Despite its growth potential, the Asia-Pacific medical tourism sector faces significant challenges. Regulatory inconsistencies across countries create complexities in licensing, accreditation, and insurance coverage. Maintaining consistent quality standards and ensuring patient safety are crucial concerns. Supply chain issues, such as access to specialized equipment and skilled professionals, may limit the expansion of certain segments. Lastly, intense competition among providers necessitates continuous innovation and improvement to maintain market share.

Leading Players in the Asia-Pacific Medical Tourism Market Market

- Aditya Birla Memorial Hospital

- Mount Elizabeth Hospital

- Bumrungrad International Hospital

- Raffles Medical Group

- Yanhee Hospital

- Sunway Medical Centre

- KPJ Healthcare Berhad

- Apollo Hospital Enterprise Limited

- Fortis Healthcare Limited

- Asian Heart Institute

Key Developments in Asia-Pacific Medical Tourism Market Sector

October 2022: Apollo Hospitals acquired a 60% stake in an Ayurveda hospital chain, expanding its service offerings and strengthening its position in the market. This strategic move signifies the integration of traditional and modern medicine, enhancing the scope of medical tourism services.

May 2022: Fortis Healthcare planned to add approximately 1,500 new beds to its network, demonstrating significant expansion plans and commitment to growth in the sector. This expansion will increase capacity and improve accessibility for medical tourists.

Strategic Asia-Pacific Medical Tourism Market Market Outlook

The Asia-Pacific medical tourism market exhibits substantial growth potential over the next decade. Continued economic development, technological innovation, and strategic investments in healthcare infrastructure are expected to further expand the market. Opportunities exist for providers to focus on specialized services, leverage digital technologies, and enhance patient experiences to remain competitive. Strategic partnerships and collaborations can unlock new market segments and enhance operational efficiency. The market is poised for significant growth driven by emerging technologies, increasing affordability, and expanding demand for quality healthcare.

Asia-Pacific Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Other Treatments

-

2. Service Provider

- 2.1. Public

- 2.2. Private

Asia-Pacific Medical Tourism Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Medical Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific Medical Tourism Market

Asia-Pacific Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Tourist Arrivals; Quality and Service Standards

- 3.3. Market Restrains

- 3.3.1. Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens

- 3.4. Market Trends

- 3.4.1 Increasing Demand for Affordable Healthcare (Oncology

- 3.4.2 Cardiovascular Diseases

- 3.4.3 and Cosmetic Surgery) is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Other Treatments

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aditya Birla Memorial Hospital

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mount Elizabeth Hospital**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bumrungrad International Hospital

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Raffles Medical Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yanhee Hospital

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunway Medical Centre

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KPJ Healthcare Berhad

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apollo Hospital Enterprise Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fortis Healthcare Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Heart Institute

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aditya Birla Memorial Hospital

List of Figures

- Figure 1: Asia-Pacific Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medical Tourism Market?

The projected CAGR is approximately 15.34%.

2. Which companies are prominent players in the Asia-Pacific Medical Tourism Market?

Key companies in the market include Aditya Birla Memorial Hospital, Mount Elizabeth Hospital**List Not Exhaustive, Bumrungrad International Hospital, Raffles Medical Group, Yanhee Hospital, Sunway Medical Centre, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Fortis Healthcare Limited, Asian Heart Institute.

3. What are the main segments of the Asia-Pacific Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Tourist Arrivals; Quality and Service Standards.

6. What are the notable trends driving market growth?

Increasing Demand for Affordable Healthcare (Oncology. Cardiovascular Diseases. and Cosmetic Surgery) is Driving the Market.

7. Are there any restraints impacting market growth?

Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens.

8. Can you provide examples of recent developments in the market?

October 2022: Apollo Hospitals acquired a 60% stake in the Ayurveda hospital chain. Apollo Hospitals will use the primary investment to upgrade existing centers, set up new centers, strengthen enterprise platforms, and for digital health initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medical Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence