Key Insights

The North American feed testing market is projected for significant expansion, driven by robust demand for safe and high-quality animal products. Stringent food safety regulations and increasing concerns over foodborne illnesses are key market catalysts. Advancements in testing technologies, including PCR, ELISA, and chromatography, are enabling faster, more accurate, and cost-effective detection of pathogens, mycotoxins, pesticide residues, and nutritional components, further fueling market growth.

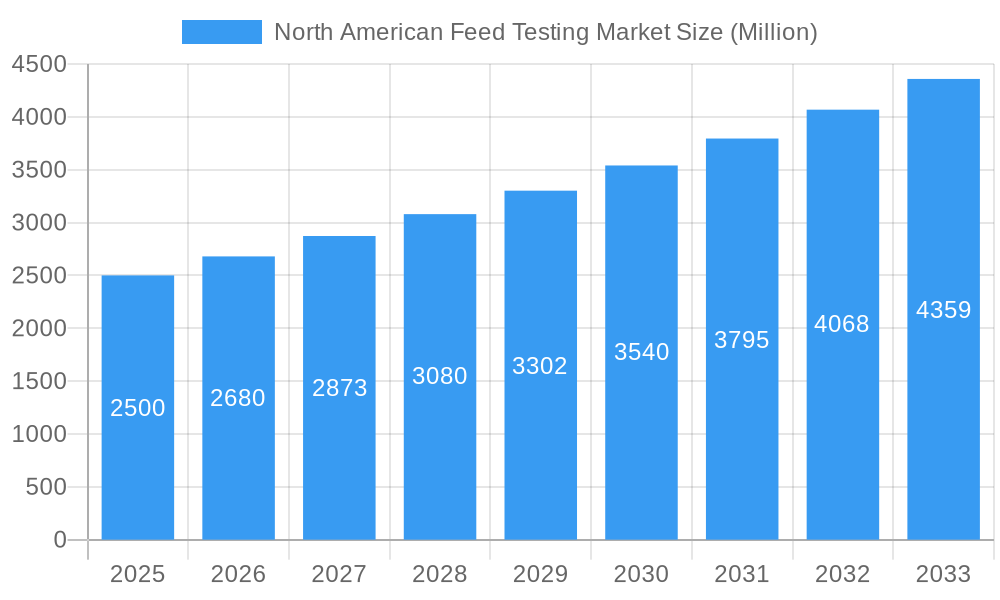

North American Feed Testing Market Market Size (In Million)

The pathogen testing segment currently dominates, reflecting critical food safety concerns across the supply chain. However, the nutritional labeling analysis segment is experiencing accelerated growth due to heightened awareness of feed quality and the importance of accurate nutritional information. The ruminant feed segment holds a substantial market share, largely attributed to the extensive beef and dairy production in North America. Future growth is anticipated across all feed types, with particular strength expected in poultry and aquaculture feed, aligning with rising global demand for these protein sources.

North American Feed Testing Market Company Market Share

While challenges such as high testing costs and a shortage of skilled personnel exist, technological innovations and evolving regulatory pressures are expected to mitigate these restraints. The competitive landscape features a blend of multinational corporations and specialized firms actively pursuing strategic partnerships, acquisitions, and technological advancements to enhance market presence and service offerings. The market is projected to reach 539.05 million by 2033, with a compound annual growth rate (CAGR) of 7.7% during the forecast period of 2025-2033. North America's established regulatory framework and strong animal agriculture sector are integral to this projected growth.

This report delivers a comprehensive analysis of the North American feed testing market, offering strategic insights for industry stakeholders. Spanning from 2019 to 2033, with 2025 as the base and estimated year, it meticulously examines market size, segmentation, growth drivers, challenges, and competitive dynamics. The detailed findings will empower informed strategic decision-making within the dynamic North American feed testing landscape.

North American Feed Testing Market Market Structure & Competitive Dynamics

The North American feed testing market exhibits a moderately consolidated structure with several key players dominating the landscape. Market share is largely influenced by technological capabilities, regulatory compliance expertise, and geographical reach. SGS SA, NSF International, and Intertek Group PLC are among the leading players, commanding a significant portion of the market share, estimated at approximately xx% collectively in 2025. Smaller, specialized companies like Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, and Invisible Sentinel Inc., cater to niche segments or specific geographic areas.

The market's competitive dynamics are shaped by factors including continuous innovation in testing methodologies, stringent regulatory compliance requirements, and increasing demand for accurate and rapid testing solutions. Mergers and acquisitions (M&A) activities have played a significant role in shaping the market structure. Recent M&A deals, though not publicly disclosed in detail, show a trend toward consolidation, with larger companies acquiring smaller players to expand their service offerings and geographical reach. The average M&A deal value in the past five years is estimated at approximately xx Million. The innovation ecosystem thrives on collaborations between testing companies, research institutions, and feed manufacturers, leading to the development of advanced testing technologies. Product substitution is limited, primarily driven by advancements in analytical techniques offering improved accuracy, speed, and cost-effectiveness. End-user trends show a growing preference for comprehensive, integrated testing services, prompting providers to offer bundled packages encompassing various testing modalities.

North American Feed Testing Market Industry Trends & Insights

The North American feed testing market is experiencing robust growth, fueled by several key factors. The increasing focus on food safety and animal health drives demand for comprehensive feed testing to ensure product quality and prevent outbreaks of diseases. Growing consumer awareness of food safety and the traceability of animal feed is also a significant driver. Stringent government regulations concerning pesticide residue limits, mycotoxin contamination, and pathogen presence further stimulate the need for reliable feed testing services. Technological advancements, such as the development of rapid, high-throughput testing methods, are enhancing efficiency and reducing turnaround times. This is accompanied by a rise in the adoption of advanced analytical techniques, including PCR, ELISA, and mass spectrometry, which enhance accuracy and sensitivity. The market’s growth is further accelerated by increasing demand for animal protein and the subsequent expansion of the livestock and aquaculture industries. The market is expected to experience a CAGR of xx% from 2025 to 2033. Market penetration of advanced testing methods, such as Next Generation Sequencing (NGS), is currently low but projected to increase substantially.

Dominant Markets & Segments in North American Feed Testing Market

Dominant Segments:

By Type: Pathogen testing currently holds the largest market share due to stringent regulations and the potential for widespread disease outbreaks. Pesticide residue analysis is also a significant segment, driven by growing consumer concerns about chemical residues in animal feed. Nutritional labeling analysis ensures compliance with labeling regulations, and mycotoxin testing is crucial due to the harmful effects of mycotoxins on animal health.

By Feed Type: Poultry feed testing accounts for a substantial share of the market because of the large-scale poultry farming industry in North America. Ruminant feed testing is also a significant segment due to its importance in the beef and dairy sectors.

Key Drivers for Dominant Segments:

- Poultry Feed: High poultry consumption and intensive farming practices increase the demand for quality assurance, leading to high testing volumes.

- Pathogen Testing: Stringent regulations and the potential for severe economic consequences resulting from pathogen outbreaks drive significant investments in this segment.

- Pesticide Residue Analysis: Increasing consumer awareness and regulatory scrutiny prompt extensive testing for pesticide residue levels.

Geographic Dominance: The United States currently dominates the North American feed testing market, driven by its large livestock and poultry industry, along with robust regulatory frameworks and advanced testing infrastructure. However, Canada’s market is expected to witness considerable growth due to increased investments in its livestock and aquaculture sectors.

North American Feed Testing Market Product Innovations

Recent product innovations focus on enhancing testing speed, accuracy, and efficiency. Rapid diagnostic tests (RDTs) are gaining popularity for their quick turnaround time, while automated testing platforms are improving throughput and reducing labor costs. Developments in molecular testing technologies, including PCR and NGS, offer enhanced sensitivity and specificity for detecting pathogens and other contaminants. These innovations effectively address the demands for rapid, accurate, and high-throughput testing crucial for efficient quality control and compliance with strict regulatory guidelines. The improved sensitivity and specificity of these advanced technologies are contributing to the market's overall growth.

Report Segmentation & Scope

The report segments the North American feed testing market based on testing type (Pathogen Testing, Pesticide Residue Analysis, Nutritional Labeling Analysis, Fats and Oils Analysis, Mycotoxin Testing, Other Types) and feed type (Ruminant Feed, Poultry Feed, Swine Feed, Aquaculture Feed, Pet Food). Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive landscape assessments. The analysis encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), providing a comprehensive view of market trends and future expectations. Growth projections are based on various factors, including regulatory changes, technological advancements, and industry trends.

Key Drivers of North American Feed Testing Market Growth

Several factors drive the growth of the North American feed testing market. Stringent government regulations on food safety and animal health standards mandate regular testing, creating significant demand. Increasing consumer awareness of food safety and the traceability of animal feed also play a crucial role. Technological advancements in testing methodologies, providing faster, more accurate, and cost-effective solutions, further propel market growth. The expansion of the livestock and aquaculture industries directly contributes to the increased demand for feed testing services. Finally, growing investment in research and development of new testing technologies ensures continuous innovation and market expansion.

Challenges in the North American Feed Testing Market Sector

Despite significant growth opportunities, the North American feed testing market faces some challenges. Regulatory compliance can be complex and costly for testing laboratories, increasing operational expenses. Supply chain disruptions can impact the availability of testing reagents and equipment, leading to delays and increased costs. Intense competition among testing providers requires continuous investment in technological upgrades and service enhancements to maintain market share. Fluctuations in raw material prices can directly affect the cost of testing, impacting profitability and pricing strategies. The increasing demand for specialized and advanced testing technologies requires significant investment in research and development, posing a challenge to smaller players.

Leading Players in the North American Feed Testing Market Market

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Key Developments in North American Feed Testing Market Sector

- 2022 Q4: Launch of a new rapid PCR-based pathogen detection kit by Invisible Sentinel Inc.

- 2023 Q1: Acquisition of a smaller testing laboratory by SGS SA to expand its geographical reach.

- 2023 Q2: Introduction of a new automated mycotoxin testing platform by Eurofins Scientific. (Further developments can be added as they become available)

Strategic North American Feed Testing Market Market Outlook

The North American feed testing market presents significant opportunities for growth and innovation. Continued technological advancements, coupled with stringent regulatory frameworks, will drive demand for reliable and efficient testing solutions. The increasing consumer focus on food safety and traceability, coupled with the expanding livestock and aquaculture sectors, will fuel market expansion. Companies that invest in advanced technologies, offer comprehensive testing services, and effectively manage regulatory compliance will gain a competitive edge. Strategic partnerships between testing companies and feed manufacturers can unlock significant growth potential, leading to the development of integrated quality control solutions. The market is poised for sustained growth in the coming years, driven by these key factors.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence