Key Insights

The North American alfalfa hay market is projected for substantial growth, driven by escalating global demand for premium animal feed, particularly from the dairy and beef cattle sectors. Growing producer awareness of alfalfa's nutritional benefits for animal health and productivity is a key factor. Advancements in farming technology, including efficient irrigation and crop management, are boosting production efficiency and quality. The rise of organic and sustainable agriculture also presents new market opportunities for premium alfalfa hay.

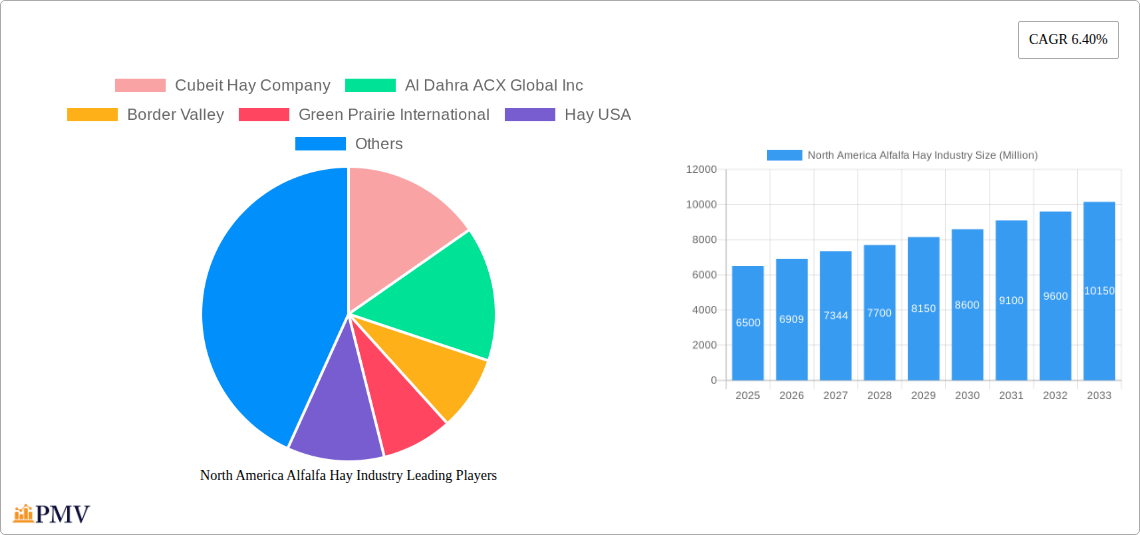

North America Alfalfa Hay Industry Market Size (In Billion)

Challenges for the North American alfalfa hay industry include weather volatility impacting yields and pricing, water usage regulations in certain regions, and increasing costs for fertilizers and labor. Mitigation strategies, such as drought-resistant varieties and improved preservation techniques, are being developed. Leading companies are investing in R&D, capacity expansion, and distribution networks to meet growing demand from international markets, especially in Asia and the Middle East.

North America Alfalfa Hay Industry Company Market Share

North America Alfalfa Hay Market Analysis Report: 2019-2033

This comprehensive report offers in-depth analysis of the North America alfalfa hay market from 2019 to 2033, covering production, consumption, trade, and price trends. With a base year of 2025, the report provides critical intelligence for stakeholders in the forage, livestock feed, and agricultural commodities sectors. Discover market structure, competitive landscape, industry trends, dominant segments, product innovations, and strategic outlooks with actionable data and precise projections. The market is expected to reach approximately $6.9 billion by 2025, with a CAGR of 5.5%.

North America Alfalfa Hay Industry Market Structure & Competitive Dynamics

The North America alfalfa hay industry exhibits a moderately concentrated market structure, characterized by the presence of established alfalfa hay suppliers and a growing number of regional players. Key companies such as Cubeit Hay Company, Al Dahra ACX Global Inc, Border Valley, Green Prairie International, Hay USA, Haykingdom In, Bailey Farms, and Anderson Hay & Grain Inc. are significant contributors to market share. Innovation ecosystems are driven by advancements in alfalfa cultivation techniques, hay processing technologies, and quality control measures to meet stringent international standards. Regulatory frameworks, primarily focusing on agricultural subsidies, export regulations, and food safety standards, play a crucial role in shaping market operations. Product substitutes, including other forage crops and processed feed alternatives, present a competitive challenge, necessitating continuous improvement in alfalfa hay quality and nutritional value. End-user trends are predominantly influenced by the dairy farming sector, beef cattle production, and equine industries, all demanding high-quality, consistent alfalfa feed. Merger and acquisition (M&A) activities, though not consistently high, have historically aimed at consolidating supply chains and expanding geographical reach, with significant deal values in certain periods. The market share of leading players can vary by region and segment, with some companies holding substantial sway in specific alfalfa export markets.

North America Alfalfa Hay Industry Industry Trends & Insights

The North America alfalfa hay industry is experiencing robust growth, projected to achieve a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is primarily fueled by the escalating global demand for high-quality dairy feed and beef cattle nutrition, driven by a growing global population and increasing meat and dairy consumption. Technological disruptions are significantly impacting the sector, with advancements in precision agriculture, genetically modified alfalfa varieties offering enhanced yield and nutritional profiles, and sophisticated hay drying and baling technologies improving product quality and shelf life. Consumer preferences are increasingly leaning towards sustainably produced and traceable alfalfa forage, pushing producers to adopt eco-friendly farming practices and implement advanced tracking systems. Competitive dynamics are intensifying, with companies focusing on product differentiation through superior nutritional content, moisture control, and specific varietal offerings tailored to different livestock needs. The market penetration of premium alfalfa pellets and alfalfa cubes is on the rise as they offer convenience and ease of handling for end-users. The alfalfa seed market is also witnessing innovation to develop varieties resistant to diseases and adapted to diverse climatic conditions, further bolstering production capabilities. Government initiatives supporting livestock agriculture and agricultural exports are also contributing to the positive market trajectory. The increasing adoption of alfalfa hay for export markets, particularly in Asia, is a significant growth driver. The demand for organic alfalfa hay is also an emerging trend.

Dominant Markets & Segments in North America Alfalfa Hay Industry

The North America alfalfa hay industry is dominated by several key regions and segments, each contributing to the overall market dynamics.

Production Analysis:

- Dominant Regions: The United States, particularly states like California, Idaho, and Washington, remains the leading producer of alfalfa hay due to favorable climatic conditions, fertile soils, and established alfalfa farming infrastructure. Canada also holds significant production capacity, especially in provinces like Alberta and Saskatchewan.

- Key Drivers: Economic policies supporting crop insurance and agricultural research, readily available irrigation infrastructure, and the presence of a skilled agricultural workforce are crucial economic policies driving high production volumes.

Consumption Analysis:

- Dominant End-Users: The dairy farming sector is the largest consumer of alfalfa hay in North America, relying on its high protein and fiber content for optimal milk production. The beef cattle industry is the second-largest consumer, utilizing alfalfa for backgrounding and finishing operations. The equine sector also represents a significant niche market.

- Key Drivers: The increasing herd sizes of dairy cows and beef cattle, coupled with a growing emphasis on animal health and feed efficiency, are primary consumption drivers. Favorable feed prices and the availability of high-quality forage directly influence consumption patterns.

Import Market Analysis (Value & Volume):

- Dominant Importers: While North America is a net exporter, certain regions or specific end-users might import specialized or premium grades of alfalfa hay to supplement local supplies. For instance, specific regions might import based on short-term supply deficits or unique varietal requirements. The value of alfalfa hay imports is influenced by global commodity prices and currency exchange rates.

- Key Drivers: The demand for consistent, high-quality forage to meet the nutritional needs of intensive livestock operations, particularly during periods of domestic supply shortages or when specific nutritional profiles are required, drives import volumes.

Export Market Analysis (Value & Volume):

- Dominant Exporters: The United States is the leading exporter of alfalfa hay globally, with major markets including China, Japan, South Korea, and the United Arab Emirates. Canada also contributes to the export landscape. The volume of alfalfa hay exports is a significant indicator of market health.

- Key Drivers: The insatiable demand for premium alfalfa hay from rapidly growing Asian dairy industries, driven by increasing per capita consumption of dairy products, is the primary export driver. Favorable trade agreements, competitive pricing, and established alfalfa supply chains further bolster export volumes and value.

Price Trend Analysis:

- Key Influencers: Alfalfa hay prices are influenced by a confluence of factors including weather patterns, impacting crop yields; global commodity prices for competing feed ingredients; transportation costs; and currency fluctuations. The price of alfalfa hay can exhibit significant volatility.

- Key Drivers: Fluctuations in irrigation water availability, the cost of fertilizers and agricultural inputs, and the overall supply-demand balance in both domestic and international markets are critical price drivers. The prevalence of alfalfa hay futures contracts also plays a role in price discovery.

North America Alfalfa Hay Industry Product Innovations

Product innovations in the North America alfalfa hay industry are primarily focused on enhancing nutritional value, improving quality, and increasing convenience for end-users. This includes the development of high-density alfalfa bales, alfalfa pellets, and alfalfa cubes that offer improved storage, handling, and feeding efficiency for livestock operations. Advancements in alfalfa seed genetics have led to the introduction of varieties with higher protein content, increased digestibility, and resistance to common diseases and pests, directly contributing to improved feed quality. Technological innovations in hay processing, such as advanced drying and curing techniques, ensure optimal moisture content and nutrient retention, crucial for premium alfalfa feed. These innovations provide a significant competitive advantage by meeting the evolving demands of the dairy and beef industries for consistent, high-performance forage.

Report Segmentation & Scope

This report offers a comprehensive market segmentation of the North America alfalfa hay industry. It meticulously analyzes the Production Analysis: , encompassing regional output, cultivation practices, and yield projections. The Consumption Analysis: delves into the demand patterns across various livestock segments, including dairy, beef, and equine, detailing per capita consumption trends. The Import Market Analysis (Value & Volume): provides insights into inbound trade flows, key importing countries, and factors influencing import values and volumes. Conversely, the Export Market Analysis (Value & Volume): highlights outbound trade, identifying major export destinations and the overall contribution of exports to market growth. The Price Trend Analysis: offers a granular view of historical and projected price movements, identifying key drivers of price volatility. Each segment includes market size estimations and growth projections.

Key Drivers of North America Alfalfa Hay Industry Growth

The North America alfalfa hay industry is propelled by several key drivers. The ever-increasing global demand for protein-rich livestock feed, particularly from burgeoning Asian dairy markets, is a primary growth accelerator. Advancements in alfalfa cultivation technologies and the development of high-yield alfalfa varieties are enhancing production efficiency and quality. Furthermore, government support for agricultural exports and favorable trade policies contribute significantly to market expansion. The growing recognition of alfalfa hay's superior nutritional profile for dairy cattle health and milk production and beef cattle growth underpins its sustained demand. The adoption of sustainable farming practices is also becoming a competitive advantage, appealing to environmentally conscious consumers and regulatory bodies.

Challenges in the North America Alfalfa Hay Industry Sector

Despite its growth, the North America alfalfa hay industry sector faces several challenges. Weather volatility and climate change pose significant risks to crop yields and quality, impacting supply stability. Rising input costs, including fertilizers, water, and labor, can squeeze profit margins for alfalfa farmers. Transportation and logistics bottlenecks, especially for international shipments, can lead to increased costs and delays. Intense competition from other forage crops and synthetic feed alternatives necessitates continuous innovation and cost-effectiveness. Stringent import regulations in certain destination countries can create trade barriers, impacting export volumes. Supply chain disruptions, as seen in recent global events, can also pose significant hurdles.

Leading Players in the North America Alfalfa Hay Industry Market

- Cubeit Hay Company

- Al Dahra ACX Global Inc

- Border Valley

- Green Prairie International

- Hay USA

- Haykingdom In

- Bailey Farms

- Anderson Hay & Grain Inc

Key Developments in North America Alfalfa Hay Industry Sector

- 2023/2024: Increased investment in alfalfa seed research and development focusing on drought resistance and higher protein content.

- 2022/2023: Expansion of alfalfa pellet and cube production facilities to meet growing demand for processed forage.

- 2021/2022: Enhanced adoption of precision agriculture techniques by major alfalfa producers to optimize irrigation and fertilization.

- 2020/2021: Significant growth in alfalfa hay exports to Asian markets, driven by increased dairy herd sizes.

- 2019/2020: Focus on developing traceability systems within the alfalfa hay supply chain to meet stringent food safety standards.

Strategic North America Alfalfa Hay Industry Market Outlook

The North America alfalfa hay industry is poised for continued growth, driven by robust international demand and ongoing technological advancements. Strategic opportunities lie in expanding market reach into emerging economies, further diversifying export destinations beyond traditional markets. Investments in sustainable alfalfa cultivation and value-added products like specialized alfalfa feeds will cater to evolving consumer preferences and regulatory demands. Companies that focus on enhancing product quality, ensuring supply chain resilience, and adopting innovative farming practices will be best positioned to capitalize on future market potential. Strategic partnerships and M&A activities aimed at consolidating supply chains and expanding geographical footprints will likely remain key growth accelerators.

North America Alfalfa Hay Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

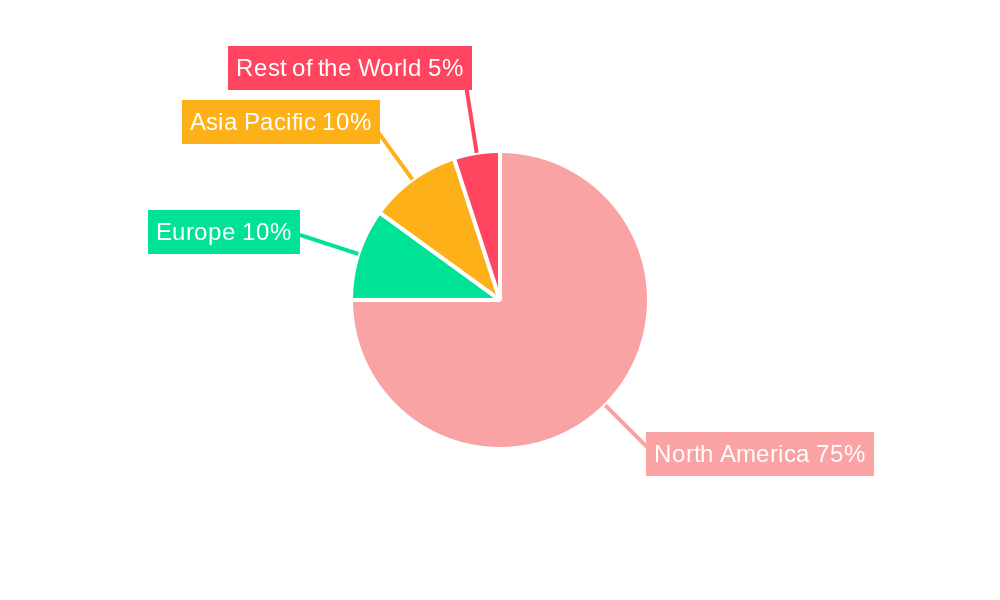

North America Alfalfa Hay Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Alfalfa Hay Industry Regional Market Share

Geographic Coverage of North America Alfalfa Hay Industry

North America Alfalfa Hay Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Animal Production is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Alfalfa Hay Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cubeit Hay Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Dahra ACX Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Border Valley

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Green Prairie International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hay USA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haykingdom In

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bailey Farms

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anderson Hay & Grain Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cubeit Hay Company

List of Figures

- Figure 1: North America Alfalfa Hay Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Alfalfa Hay Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Alfalfa Hay Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Alfalfa Hay Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Alfalfa Hay Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Alfalfa Hay Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Alfalfa Hay Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Alfalfa Hay Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Alfalfa Hay Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Alfalfa Hay Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Alfalfa Hay Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Alfalfa Hay Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Alfalfa Hay Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Alfalfa Hay Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Alfalfa Hay Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Alfalfa Hay Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Alfalfa Hay Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Alfalfa Hay Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the North America Alfalfa Hay Industry?

Key companies in the market include Cubeit Hay Company, Al Dahra ACX Global Inc, Border Valley, Green Prairie International, Hay USA, Haykingdom In, Bailey Farms, Anderson Hay & Grain Inc.

3. What are the main segments of the North America Alfalfa Hay Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing Animal Production is Driving the Market.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Alfalfa Hay Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Alfalfa Hay Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Alfalfa Hay Industry?

To stay informed about further developments, trends, and reports in the North America Alfalfa Hay Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence