Key Insights

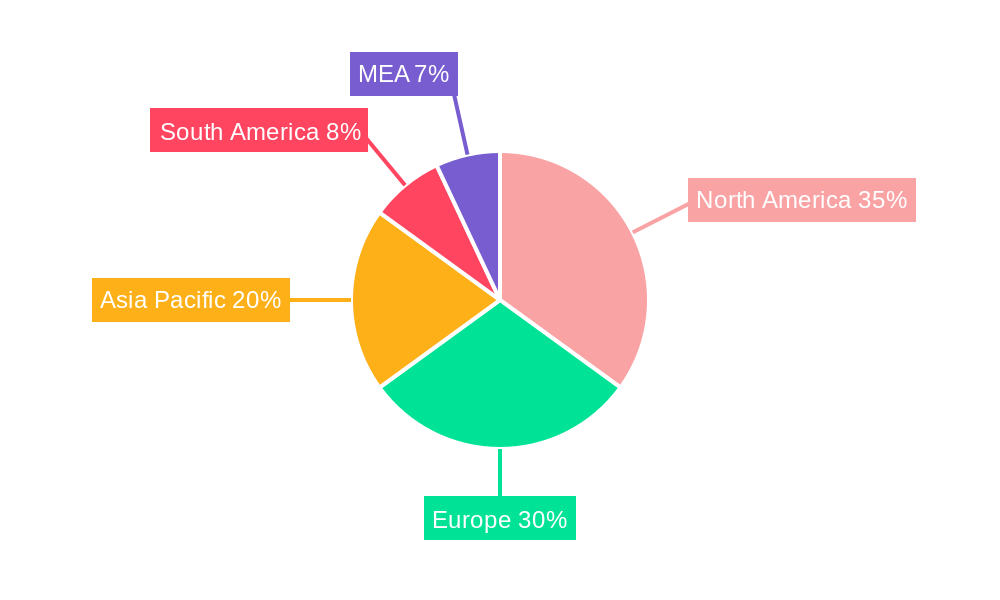

The global hops market, valued at $8.64 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of craft beers and the consequent surge in demand for high-quality hops are primary drivers. Furthermore, the expanding application of hops beyond brewing, into pharmaceuticals and cosmetics, is significantly contributing to market growth. The rising consumer awareness of natural and organic ingredients further fuels this trend, particularly within the cosmetics sector. While the market faces challenges such as fluctuating hop yields due to climate change and potential supply chain disruptions, technological advancements in hop cultivation and processing are mitigating these risks. The market is segmented by product type (whole hops, hop pellets, hop extracts, other hop products) and application (brewing, pharmaceuticals, cosmetics, others). Major players like Hopsteiner, Yakima Chief Hops, and BarthHaas Group dominate the market, leveraging their established distribution networks and brand recognition. Regional analysis indicates strong growth across North America and Europe, driven by established brewing traditions and a thriving craft beer culture. Asia-Pacific presents significant growth potential due to rising disposable incomes and changing consumer preferences.

Hops Market Market Size (In Billion)

The diverse applications of hops are a significant contributor to market segmentation. The brewing industry remains the dominant consumer, but the expansion into pharmaceuticals (leveraging hops’ purported health benefits) and cosmetics (utilizing its antioxidant properties) is creating new revenue streams and stimulating innovation within the industry. Competition among major players is intense, with companies focusing on product diversification, strategic partnerships, and research and development to maintain their market share. The continued growth of the craft brewing sector globally is expected to be a crucial driver for future expansion, necessitating strategic capacity expansions and efficient supply chain management for key players to meet this rising demand. Successful players will be those that effectively balance supply and demand, leverage technological advancements, and cater to the evolving preferences of both brewers and consumers across different application segments.

Hops Market Company Market Share

Hops Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global hops market, offering invaluable insights for industry stakeholders, investors, and researchers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. The report segments the market by product type (Whole Hops, Hop Pellets, Hop Extracts, Other Hop Products) and application (Brewing, Pharmaceuticals, Cosmetics, Others), revealing key trends and growth opportunities within this dynamic sector. With a market valued at $XX Million in 2025, and projected to reach $XX Million by 2033, understanding the market dynamics is crucial for informed decision-making. This report helps navigate the intricacies of the hops market, providing actionable insights and strategic recommendations for future success.

Hops Market Market Structure & Competitive Dynamics

The global hops market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Key players include Hopsteiner, Yakima Chief Hops, Hops Union, BarthHaas Group, CLS Farms, and KALSEC, among others. These companies compete on factors such as product quality, pricing, innovation, and supply chain efficiency. The market is characterized by a dynamic innovation ecosystem, with continuous development of new hop varieties, processing techniques, and value-added products. Regulatory frameworks vary across regions, impacting production, labeling, and trade. Product substitutes, such as synthetic flavorings, exist but have limited market penetration due to consumer preference for natural ingredients. End-user trends, particularly in the brewing industry, drive demand for specific hop varieties and processing methods. M&A activity in the hops market has been relatively limited in recent years, with deal values averaging $XX Million. Key metrics highlighting market concentration:

- Market Share: The top 5 players collectively hold approximately 60% of the global market share. Detailed breakdowns for each company are provided within the full report.

- M&A Activity: The average value of M&A deals in the last five years is $XX Million, with the largest deal valued at $XX Million (specific deal details are available in the report).

Hops Market Industry Trends & Insights

The global hops market is experiencing robust growth, driven by several key factors. The rising popularity of craft beer and premium beverages is a significant driver, fueling demand for high-quality hops with diverse aroma profiles. Technological advancements in hop processing and cultivation techniques continue to enhance product quality, yields, and efficiency. Consumer preferences are shifting towards natural and organic products, further bolstering the demand for hops. The market is characterized by intense competition among established players and emerging entrants, leading to innovative product development and strategic partnerships. The CAGR for the hops market during the forecast period (2025-2033) is projected to be XX%. Market penetration of hop extracts and other value-added products is steadily increasing, driven by their cost-effectiveness and convenience. The report provides a deep dive into specific regional trends and variations in consumer preferences.

Dominant Markets & Segments in Hops Market

The brewing segment remains the dominant application for hops, accounting for over 80% of the global market share. Within product types, hop pellets dominate the market due to their ease of use and consistent quality. The North American region, particularly the United States, holds the largest market share due to high craft beer consumption and significant hop production capacity. Key drivers of regional dominance include:

- Economic Policies: Supportive agricultural policies and favorable tax regimes in key hop-producing regions.

- Infrastructure: Well-established agricultural infrastructure and efficient supply chains contribute to cost-effectiveness and competitiveness.

- Consumer Preferences: High craft beer consumption drives demand for specific hop varieties, influencing market dynamics.

Detailed analysis of country-level market dynamics including regional production figures, import-export data, and consumption patterns are provided in the full report. The European market is a significant second, shaped by robust beer traditions and the emergence of various hop production centers.

Hops Market Product Innovations

Recent years have witnessed significant advancements in hop processing and product innovation. The introduction of cryogenic processing techniques has led to the development of concentrated lupulin pellets, offering increased aroma intensity and improved brewing efficiency. This innovation responds to growing industry demands for more concentrated flavors, which contributes to reduced waste and lowers environmental impact. New hop varieties with unique aroma profiles and desirable characteristics are continually being developed. This reflects a focus on catering to the evolving preferences of consumers, who increasingly appreciate distinctive flavor characteristics. The competitive advantage lies in delivering high-quality, consistent, and innovative hop products that meet the specific needs of brewers and other end-users.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the hops market based on product type and application.

Product Type:

- Whole Hops: This segment comprises whole hop cones, with growth projections driven by the demand for traditional brewing methods. Competitive dynamics are influenced by regional preferences for specific hop varieties.

- Hop Pellets: This segment is currently the largest and expected to maintain its dominant position, with projected growth fuelled by ease of use and consistent quality. Competitive dynamics are shaped by pricing, processing technology, and brand reputation.

- Hop Extracts: This segment is expected to experience significant growth, driven by the increasing demand for cost-effective and versatile hop products for various applications, including pharmaceuticals and cosmetics. Competitive dynamics hinge on extraction techniques, product purity, and the development of specialized extracts.

- Other Hop Products: This includes derivatives like hop oils and powders, showcasing diverse applications in brewing and other industries. The growth is expected to be moderate, with market size and competitive dynamics significantly influenced by innovation in the application of these products.

Application:

- Brewing: Remains the dominant application for hops, with growth projected to remain in line with the global beer market growth. Competitive dynamics within this sector are driven by hop variety preferences and innovative brewing methods.

- Pharmaceuticals: This segment holds potential for significant growth, however its growth is dependent on regulatory approval and R&D success. Competitive dynamics are governed by product quality, efficacy, and regulatory compliance.

- Cosmetics: This segment is an emerging market for hops, primarily leveraging their potential antioxidant properties. Market growth is linked to research on hop extracts and product development in this sector. Competitive dynamics are determined by efficacy, quality, and market positioning.

- Others: This category includes small-scale applications that exhibit diverse growth patterns.

Key Drivers of Hops Market Growth

The growth of the hops market is significantly propelled by several factors. The burgeoning craft beer industry, with its constant demand for a wide variety of hop flavors and aromas, serves as a primary driver. Technological advancements, like cryogenic processing and the development of new hop varieties, increase efficiency and offer product diversification. Furthermore, the rising consumer preference for natural ingredients in food and beverages contributes to the expanding demand. Finally, growing awareness of the potential health benefits of hops in pharmaceutical and cosmetic applications opens up new market avenues.

Challenges in the Hops Market Sector

The hops market faces challenges stemming from supply chain disruptions, especially in production and distribution. Weather-related factors can severely impact hop yields, resulting in price volatility. Intense competition among existing and emerging players necessitates continuous innovation and efficiency improvements to remain competitive. Lastly, stringent regulatory requirements and varying standards across different regions create compliance complexities and raise production costs.

Leading Players in the Hops Market Market

- Hopsteiner

- Yakima Chief Hops

- Hops Union

- BarthHaas Group

- CLS Farms

- KALSEC

Key Developments in Hops Market Sector

- January 2023: BarthHaas launched a new company website, enhancing accessibility to product and service information. This improved online presence streamlines market engagement and enhances customer experience.

- January 2023: Crosby Hops expanded its product offerings to include cryogenically processed lupulin pellets (CGX), providing brewers with a concentrated, high-yield, and environmentally friendly option. This innovation addresses market demand for improved efficiency and sustainability.

Strategic Hops Market Market Outlook

The hops market presents significant growth potential, driven by ongoing innovation in hop processing, the expansion of the craft beer industry, and the exploration of new applications in pharmaceuticals and cosmetics. Strategic opportunities lie in developing new hop varieties with unique flavor profiles, investing in advanced processing technologies, and strengthening supply chain resilience. Focusing on sustainable practices and meeting the rising consumer demand for natural and organic products will be crucial for long-term success.

Hops Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Hops Market Segmentation By Geography

-

1. North America

- 1.1. United States

-

2. Europe

- 2.1. Germany

-

3. Asia Pacific

- 3.1. China

-

4. South America

- 4.1. Brazil

-

5. Africa

- 5.1. South Africa

Hops Market Regional Market Share

Geographic Coverage of Hops Market

Hops Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Craft Beer is Elevating the Demand for Bittering Hops

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hops Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Hops Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Hops Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Hops Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Hops Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Hops Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hopsteiner

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yakima Chief Hops

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hops Union

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BarthHaas Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CLS Farms

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KALSEC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Hopsteiner

List of Figures

- Figure 1: Global Hops Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hops Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Hops Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Hops Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Hops Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Hops Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Hops Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Hops Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Hops Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Hops Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Hops Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Hops Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Hops Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hops Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: Europe Hops Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Hops Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Hops Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Hops Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Hops Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Hops Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Hops Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Hops Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Hops Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Hops Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Hops Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hops Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Hops Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Hops Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Hops Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Hops Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Hops Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Hops Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Hops Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Hops Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Hops Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Hops Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Hops Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Hops Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: South America Hops Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Hops Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: South America Hops Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Hops Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Hops Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Hops Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Hops Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Hops Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Hops Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Hops Market Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Hops Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Africa Hops Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Africa Hops Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Africa Hops Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Africa Hops Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Africa Hops Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Africa Hops Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Africa Hops Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Africa Hops Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Africa Hops Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Africa Hops Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Africa Hops Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Africa Hops Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Hops Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Hops Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Hops Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 15: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 19: Global Hops Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Hops Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 22: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 23: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 24: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 25: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 26: Global Hops Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Hops Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 29: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 30: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 33: Global Hops Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Hops Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Hops Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 36: Global Hops Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 37: Global Hops Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Hops Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Hops Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 40: Global Hops Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: South Africa Hops Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hops Market?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Hops Market?

Key companies in the market include Hopsteiner , Yakima Chief Hops , Hops Union , BarthHaas Group , CLS Farms, KALSEC .

3. What are the main segments of the Hops Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.64 Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Craft Beer is Elevating the Demand for Bittering Hops.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

January 2023: BarthHaas launched an all-new company website where hop services providers can present their extensive portfolio in an updated design and very clearly structured form. Hence, searching for information about the company, its products, and its services will be easier and more intuitive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hops Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hops Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hops Market?

To stay informed about further developments, trends, and reports in the Hops Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence