Key Insights

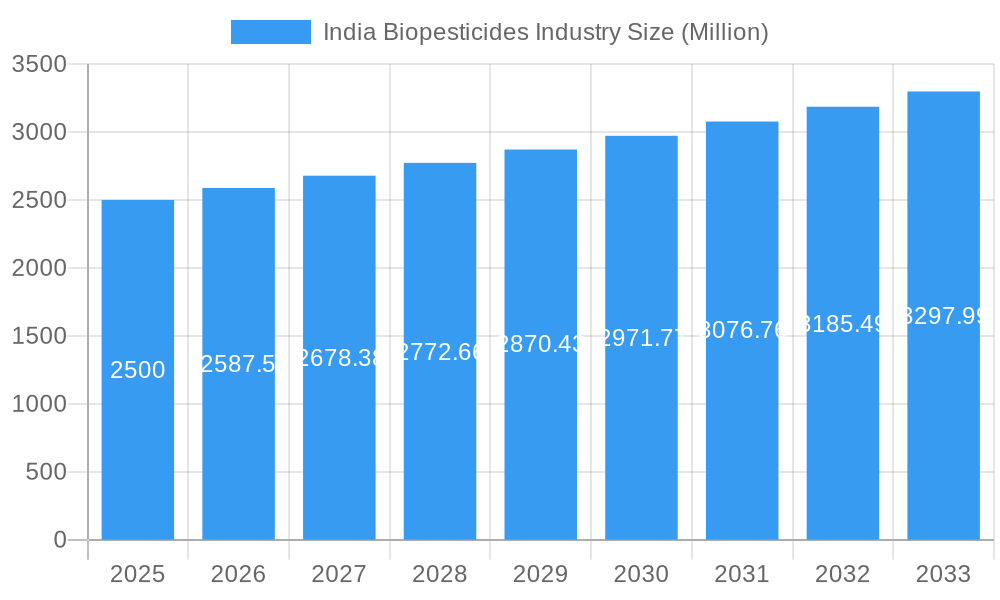

The India biopesticides market is projected for significant expansion, estimated at 286.8 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.49% from 2025 to 2033. This growth is propelled by heightened awareness of sustainable agriculture and stricter regulations on chemical pesticides. Key drivers include growing consumer preference for pesticide-free produce, government support for organic farming, and the increasing incidence of crop diseases and pest infestations.

India Biopesticides Industry Market Size (In Million)

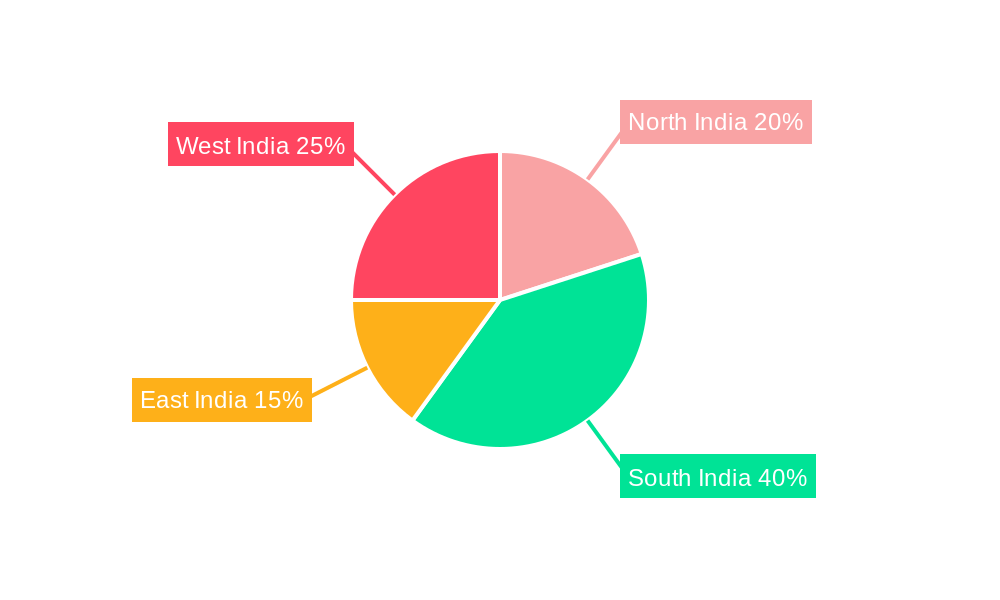

The market is segmented by product type, including biofungicides, bioherbicides, and bioinsecticides, and by crop type, such as cash crops, horticultural crops, and row crops. Regional dynamics show dominance in the South and West regions due to substantial agricultural output, while the North and East offer considerable untapped growth potential, especially within the horticultural segment.

India Biopesticides Industry Company Market Share

Challenges such as the higher cost of biopesticides relative to chemical alternatives, limited farmer awareness of their effectiveness and application, and the necessity for robust supply chain infrastructure are being addressed. Ongoing research and development, bolstered by government initiatives and farmer education programs, are expected to overcome these hurdles. The presence of key industry players underscores the market's commercial viability and attracts further investment and innovation. Continued market advancement depends on concerted efforts to enhance awareness, affordability, and accessibility of high-quality biopesticides nationwide.

India Biopesticides Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides an in-depth analysis of the burgeoning India biopesticides industry, offering valuable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report utilizes data from the historical period (2019-2024) and provides estimates for 2025. All financial values are expressed in Million.

India Biopesticides Industry Market Structure & Competitive Dynamics

The Indian biopesticides market exhibits a moderately concentrated structure, with a handful of large players alongside numerous smaller regional companies. Market share is currently dominated by a few multinational corporations and large domestic firms, though the increasing participation of startups and SMEs is contributing to a more dynamic competitive landscape. The innovation ecosystem is developing rapidly, driven by government initiatives promoting sustainable agriculture and increasing research and development (R&D) investments. Regulatory frameworks, while evolving, present both opportunities and challenges, influencing market access and product approvals. The market witnesses competition from conventional chemical pesticides, but increasing awareness of environmental concerns and consumer demand for organic produce fuels biopesticide adoption. Mergers and acquisitions (M&A) are becoming increasingly common, as larger players seek to expand their product portfolios and market reach. For example, the xx Million merger between Liberty Pesticides and Fertilizers Limited and Coromandel SQM (India) Private Limited in 2021 signifies this trend. The total value of M&A deals in the sector during the historical period is estimated at xx Million. The average market share of the top 5 players is estimated to be around xx%.

India Biopesticides Industry Industry Trends & Insights

The India biopesticides market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, fueled by the rising demand for organic and sustainably produced food, stringent regulations on chemical pesticide use, growing awareness of environmental protection, and supportive government policies promoting sustainable agriculture. Technological disruptions, such as the development of novel biopesticides with enhanced efficacy and improved formulations, are further accelerating market expansion. Consumer preferences are increasingly shifting towards safer and eco-friendly agricultural products, boosting the demand for biopesticides across various crop types. The market penetration of biopesticides in the overall pesticides market is currently estimated at xx% and is expected to significantly increase by 2033. Competitive dynamics are shaping the market landscape, with companies focusing on product innovation, strategic partnerships, and market expansion to gain a competitive edge.

Dominant Markets & Segments in India Biopesticides Industry

The Indian biopesticides market is geographically diverse, with significant growth potential across various regions. However, specific regions with favorable climatic conditions and high agricultural output are experiencing faster adoption. The dominant segment within the biopesticides market is currently Bioinsecticides, driven by the prevalence of insect pests in various crops.

Key Drivers for Dominance:

- High prevalence of insect pests: A significant portion of crop losses is attributed to insect infestations, leading to high demand for effective bioinsecticides.

- Government initiatives: Numerous government programs supporting organic farming and sustainable agriculture indirectly promote the adoption of bioinsecticides.

- Growing consumer awareness: Consumers are increasingly aware of the potential health and environmental risks associated with chemical pesticides.

Among Crop Types, Horticultural Crops currently represent the largest segment, owing to the high value and sensitivity of these crops to pest damage and consumer preference for pesticide-free produce.

Dominant Segments (detailed analysis):

- Biofungicides: Growing concerns over the development of fungicide-resistant pathogens are driving the adoption of biofungicides.

- Bioherbicides: Although a smaller segment currently, bioherbicides are gaining traction as environmentally friendly alternatives to chemical herbicides.

- Bioinsecticides: This segment is dominant due to the high prevalence of insect pests and the increasing demand for safer pest control methods.

- Other Biopesticides: This segment encompasses a range of biopesticides with diverse applications and is expected to witness significant growth.

- Cash Crops: These crops often command higher prices, making the investment in biopesticides more financially viable.

- Row Crops: The large acreage dedicated to row crops presents a significant market opportunity for biopesticides.

India Biopesticides Industry Product Innovations

Recent years have witnessed significant innovations in biopesticide formulations, encompassing advancements in delivery systems, enhanced efficacy, and broader crop applications. Nanotechnology is being leveraged to improve the effectiveness and shelf life of biopesticides, while novel microbial strains are continuously being explored for their pesticidal potential. This focus on technological advancements is enabling the development of biopesticides with superior performance, cost-effectiveness, and enhanced market fit. Companies are strategically focusing on developing integrated pest management (IPM) solutions combining biopesticides with other sustainable pest control methods.

Report Segmentation & Scope

This report segments the India biopesticides market based on form (Biofungicides, Bioherbicides, Bioinsecticides, Other Biopesticides) and crop type (Cash Crops, Horticultural Crops, Row Crops). Each segment’s growth projections, market size (in Million), and competitive dynamics are analyzed in detail. The analysis further considers regional variations and the evolving regulatory landscape impacting market access and product adoption. The projected market size for Biofungicides in 2033 is estimated at xx Million, Bioherbicides at xx Million, Bioinsecticides at xx Million, and Other Biopesticides at xx Million. Similarly, the market size for Cash Crops, Horticultural Crops, and Row Crops is predicted to be xx Million, xx Million, and xx Million, respectively, by 2033.

Key Drivers of India Biopesticides Industry Growth

Several factors are driving the growth of the India biopesticides industry. These include:

- Government support: Initiatives promoting sustainable agriculture and organic farming provide favorable policy environments.

- Technological advancements: Innovations in biopesticide formulations are resulting in more effective and user-friendly products.

- Growing consumer awareness: Increasing consumer demand for organic and pesticide-free produce is fueling market growth.

- Environmental concerns: Growing concerns about the environmental impact of chemical pesticides are leading to increased adoption of biopesticides.

Challenges in the India Biopesticides Industry Sector

Despite its potential, the India biopesticides industry faces several challenges:

- High initial investment costs: Developing and commercializing biopesticides can be expensive compared to chemical pesticides.

- Limited awareness among farmers: Many farmers remain unaware of the benefits of biopesticides or lack the necessary training for their effective use.

- Shorter shelf life: Biopesticides generally have shorter shelf lives compared to chemical pesticides, requiring efficient cold chain logistics and storage infrastructure.

- Regulatory hurdles: Obtaining regulatory approvals for new biopesticides can be time-consuming and complex.

Leading Players in the India Biopesticides Industry Market

- GrowTech Agri Science Private Limited

- T Stanes and Company Limited

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Samriddhi Crops India Pvt Ltd

- Jaipur Bio Fertilizers

- IPL Biologicals Limited

- Andermatt Group AG

- Volkschem Crop Science Private Limited

- Central Biotech Private Limited

Key Developments in India Biopesticides Industry Sector

- April 2022: The merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) expanded Coromandel International Ltd's biopesticide portfolio.

- January 2022: The merger of Andermatt Biocontrol AG with Andermatt Group AG streamlined management and improved operational efficiency.

Strategic India Biopesticides Industry Market Outlook

The future of the India biopesticides industry is promising. Continued government support, technological advancements, and rising consumer demand will propel market growth. Strategic opportunities exist for companies investing in R&D, expanding their product portfolios, and strengthening their distribution networks. The market's potential extends beyond current applications, encompassing the development of novel biopesticides addressing specific pest and disease challenges in diverse agricultural settings. This presents significant opportunities for both established players and emerging companies to capture significant market share.

India Biopesticides Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Biopesticides Industry Segmentation By Geography

- 1. India

India Biopesticides Industry Regional Market Share

Geographic Coverage of India Biopesticides Industry

India Biopesticides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Biopesticides Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GrowTech Agri Science Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 T Stanes and Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coromandel International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat State Fertilizers & Chemicals Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samriddhi Crops India Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaipur Bio Fertilizers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IPL Biologicals Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andermatt Group AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volkschem Crop Science Private Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Central Biotech Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GrowTech Agri Science Private Limited

List of Figures

- Figure 1: India Biopesticides Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Biopesticides Industry Share (%) by Company 2025

List of Tables

- Table 1: India Biopesticides Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Biopesticides Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Biopesticides Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Biopesticides Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Biopesticides Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Biopesticides Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Biopesticides Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Biopesticides Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Biopesticides Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Biopesticides Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Biopesticides Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Biopesticides Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Biopesticides Industry?

The projected CAGR is approximately 10.49%.

2. Which companies are prominent players in the India Biopesticides Industry?

Key companies in the market include GrowTech Agri Science Private Limited, T Stanes and Company Limited, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Samriddhi Crops India Pvt Ltd, Jaipur Bio Fertilizers, IPL Biologicals Limited, Andermatt Group AG, Volkschem Crop Science Private Limite, Central Biotech Private Limited.

3. What are the main segments of the India Biopesticides Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 286.8 million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2022: The company approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 01, 2021. This merger is anticipated to expand the company's product portfolio, including its biopesticides, in the long run.January 2022: The company announced the merger of Andermatt Biocontrol AG with Andermatt Group AG. After the merger, all companies report directly to Andermatt Group AG, increasing the effectiveness of the management and simplifying the company's structure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Biopesticides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Biopesticides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Biopesticides Industry?

To stay informed about further developments, trends, and reports in the India Biopesticides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence