Key Insights

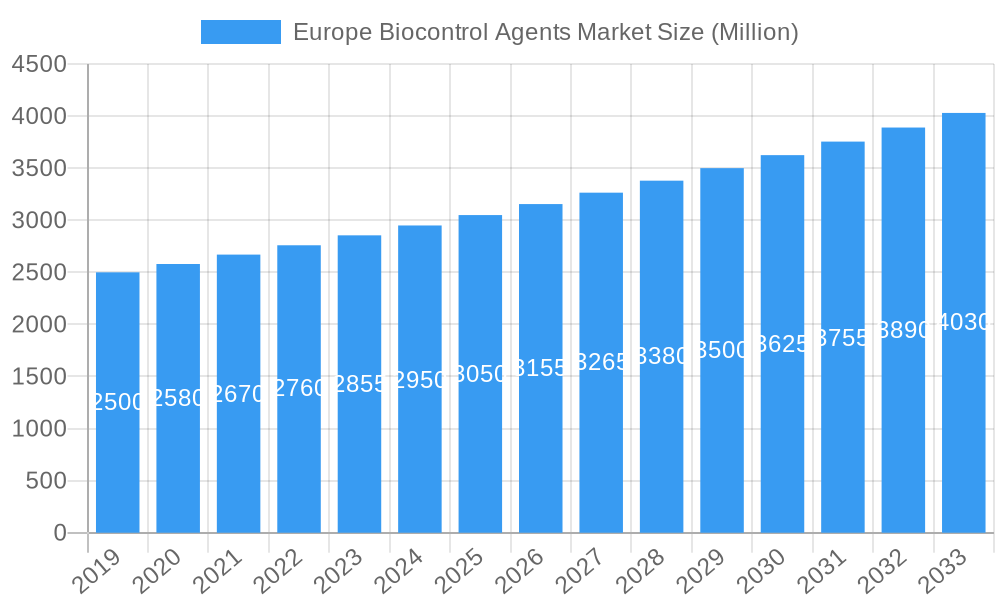

The European Biocontrol Agents Market is poised for significant expansion, driven by a growing imperative for sustainable agriculture and increasing consumer demand for organically produced food. With an estimated market size of XX million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 3.50% through 2033, the market's trajectory indicates robust investor interest and sustained innovation. Key growth drivers include stringent regulatory frameworks phasing out synthetic pesticides, heightened awareness of environmental protection, and the proven efficacy of biological solutions in pest and disease management across diverse crops. The market is segmented into detailed production, consumption, import/export dynamics (valued in millions), and price trends, all contributing to a comprehensive understanding of market performance. Companies like Koppert Biological Systems Inc., Bioline AgroSciences Ltd., and Biobest Group NV are at the forefront, actively investing in research and development to introduce novel biocontrol solutions. These players are instrumental in shaping the market by offering a range of beneficial insects, microorganisms, and biochemicals that bolster crop health and yield while minimizing ecological impact.

Europe Biocontrol Agents Market Market Size (In Billion)

The European region, encompassing the United Kingdom, Germany, France, Italy, Spain, Netherlands, Belgium, Sweden, Norway, Poland, and Denmark, represents a critical hub for biocontrol adoption. This geographical focus is characterized by proactive governmental support for sustainable farming practices and a strong consumer base willing to pay a premium for certified organic and sustainably grown produce. While the market enjoys substantial growth, certain restraints, such as the higher initial costs of some biocontrol agents compared to conventional pesticides and the need for specialized knowledge in application, present challenges. However, ongoing advancements in formulation and delivery systems, coupled with educational initiatives for farmers, are effectively mitigating these barriers. The forecast period from 2025 to 2033 is expected to witness a surge in market penetration as integrated pest management (IPM) strategies become standard practice, further solidifying Europe's leadership in the global biocontrol agents landscape.

Europe Biocontrol Agents Market Company Market Share

This in-depth report offers a detailed examination of the Europe Biocontrol Agents Market, providing critical insights into market dynamics, growth trajectories, and competitive landscapes. Spanning the historical period of 2019–2024, with a base year of 2025, and extending through a robust forecast period of 2025–2033, this analysis equips industry stakeholders with actionable intelligence for strategic decision-making. Explore market segmentation including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, crucial for understanding the multifaceted nature of Europe's burgeoning biocontrol sector. The report leverages advanced analytics to project market size, compound annual growth rate (CAGR), and penetration, crucial for agricultural biotechnology, sustainable farming, and integrated pest management (IPM) professionals.

Europe Biocontrol Agents Market Market Structure & Competitive Dynamics

The Europe Biocontrol Agents Market is characterized by a moderately concentrated structure, with key players like Koppert Biological Systems Inc, Bioline AgroSciences Ltd, and Biobest Group NV holding significant market share. Innovation ecosystems are thriving, driven by increasing R&D investments in biological pest control solutions, leading to continuous product development and market penetration. Regulatory frameworks, while evolving to support sustainable agriculture, also present a complex landscape for market entrants. Product substitutes, primarily conventional chemical pesticides, are gradually being displaced by the growing preference for environmentally friendly alternatives. End-user trends indicate a strong demand from the horticulture, arable farming, and specialty crop sectors, fueled by consumer awareness and stringent environmental policies. Mergers and acquisitions (M&A) are active, with deal values estimated in the tens of millions, consolidating market presence and expanding product portfolios. For instance, the acquisition of Agronologica by Biobest Group NV in August 2022 significantly enhanced Biobest's reach in Portugal. Analyzing these dynamics is crucial for understanding competitive advantages and future market trajectories within Europe's biocontrol industry.

Europe Biocontrol Agents Market Industry Trends & Insights

The Europe Biocontrol Agents Market is experiencing robust growth, driven by a confluence of factors including escalating demand for sustainable agricultural practices, increasing consumer awareness regarding food safety and environmental impact, and supportive government policies promoting organic and integrated pest management (IPM) strategies. The market is projected to witness a significant CAGR of approximately 15-20% during the forecast period, reaching an estimated market value of over 10,000 Million by 2033. Technological disruptions are playing a pivotal role, with advancements in formulation technologies, delivery systems, and the identification of novel microbial and botanical agents enhancing the efficacy and application range of biocontrol products. Genetic improvements, such as those achieved by E-NEMA GmbH in optimizing nematode traits, are further optimizing application densities and reducing costs for end-users. Consumer preferences are clearly shifting away from synthetic pesticides towards biological solutions that offer a reduced environmental footprint and minimize residue levels in food products. This shift is not only influencing farmer adoption but also driving innovation across the value chain. Competitive dynamics are intensifying, with established players expanding their offerings and new entrants focusing on niche markets and specialized biological solutions. The rising adoption of precision agriculture techniques also creates new opportunities for targeted and efficient application of biocontrol agents. Furthermore, the growing concern over pesticide resistance in conventional pest management underscores the critical need for diverse and sustainable alternatives provided by the biocontrol sector. The expansion of greenhouse cultivation and the increasing focus on high-value crops in regions across Europe are also significant drivers for the adoption of high-efficacy biocontrol solutions.

Dominant Markets & Segments in Europe Biocontrol Agents Market

The Production Analysis of the Europe Biocontrol Agents Market is dominated by countries with strong agricultural sectors and a proactive stance on sustainable farming, notably Spain, Italy, and the Netherlands. Economic policies that incentivize organic farming and significant investments in agricultural research and development infrastructure are key drivers for production dominance. These nations benefit from favorable climatic conditions and a high concentration of agricultural cooperatives promoting the adoption of biological pest control.

In terms of Consumption Analysis, the demand for biocontrol agents is highest in countries with intensive horticultural and high-value crop production, such as the Netherlands, France, and the United Kingdom. The stringent regulatory environment, coupled with a strong consumer preference for pesticide-free produce, fuels this demand. Furthermore, the extensive adoption of IPM programs in these regions makes them prime markets for biocontrol solutions.

The Import Market Analysis (Value & Volume) is significantly led by countries like Germany and France, which have a substantial agricultural output but also a considerable reliance on imported biocontrol agents to meet their demand, especially for specialized products. Robust distribution networks and a well-established agricultural supply chain facilitate these import flows. The value of imports is often higher due to the premium associated with advanced formulations and proprietary biological strains.

Conversely, the Export Market Analysis (Value & Volume) highlights the Netherlands and Belgium as major exporters of biocontrol agents. These countries possess advanced manufacturing capabilities, strong R&D facilities, and efficient logistics, enabling them to supply a wide range of products to other European nations and beyond. Their expertise in mass production of beneficial insects and microorganisms gives them a competitive edge in the global market.

The Price Trend Analysis indicates a gradual upward trend in the average price of biocontrol agents across Europe. This is attributable to factors such as rising R&D costs, increasing production complexity, and the premium associated with highly effective and sustainable solutions. However, volume-driven production and technological advancements in application efficiency are also contributing to price stabilization and potential cost reductions for end-users over the long term.

Europe Biocontrol Agents Market Product Innovations

Product innovations in the Europe Biocontrol Agents Market are primarily focused on enhancing efficacy, expanding target pest ranges, and improving ease of application. Companies are developing advanced formulations of microbial pesticides (bacteria, fungi, viruses) and botanical extracts, offering targeted pest control with minimal environmental impact. Biological insecticides and fungicides are gaining traction, providing effective alternatives to chemical counterparts. Competitive advantages stem from patented strains, novel delivery systems that ensure better survival and colonization of beneficial organisms, and integrated solutions that combine multiple biocontrol agents for broader spectrum control. The trend is towards developing ready-to-use products and intelligent application systems that integrate with precision agriculture, further solidifying market fit and user adoption.

Report Segmentation & Scope

The Europe Biocontrol Agents Market is segmented based on Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Production analysis examines the geographical output of biocontrol agents across Europe, with projected growth driven by advancements in manufacturing technologies and supportive agricultural policies. Consumption analysis scrutinizes the demand for these agents across various crop types and farming practices, forecasting significant market penetration due to the increasing adoption of sustainable agriculture. Import market analysis (value & volume) assesses the trade flows into different European countries, highlighting growth opportunities in regions with high demand and limited domestic production. Export market analysis (value & volume) focuses on leading exporting nations and their market share, indicating strong growth potential through expanded international trade. Price trend analysis provides insights into the evolving cost dynamics of biocontrol agents, influenced by R&D investments, production efficiencies, and market competition, with projections indicating a stable to slightly increasing price trajectory.

Key Drivers of Europe Biocontrol Agents Market Growth

The Europe Biocontrol Agents Market is propelled by several key drivers. A primary accelerator is the increasing consumer demand for organic and pesticide-free food products, which directly translates into a higher adoption rate of biological pest control solutions by farmers. Supportive governmental regulations and subsidies promoting sustainable agriculture and reducing reliance on chemical pesticides play a crucial role. Technological advancements in research and development, leading to the discovery and effective formulation of novel biocontrol agents with enhanced efficacy, are also significant growth catalysts. Furthermore, the growing awareness of the environmental and health risks associated with conventional pesticides is pushing the agricultural industry towards safer and more sustainable alternatives. The increasing incidence of pest resistance to chemical treatments further amplifies the need for diverse and effective biocontrol strategies.

Challenges in the Europe Biocontrol Agents Market Sector

Despite the promising growth, the Europe Biocontrol Agents Market faces several challenges. Regulatory hurdles and lengthy approval processes for new biocontrol products can hinder market entry and slow down innovation adoption. The relatively higher initial cost compared to some conventional pesticides can be a barrier for price-sensitive farmers, although long-term cost-effectiveness is often demonstrated. Supply chain complexities, including ensuring the viability and timely delivery of live biological agents, require robust logistics and cold chain management. Furthermore, limited awareness and knowledge gaps among some farmers regarding the effective use and benefits of biocontrol agents can impede widespread adoption. Competitive pressures from established chemical pesticide manufacturers and the need for continuous R&D to keep pace with evolving pest resistance also present ongoing challenges.

Leading Players in the Europe Biocontrol Agents Market Market

- Koppert Biological Systems Inc

- Bioline AgroSciences Ltd

- If Tech

- Bioplanet France

- Dragonfli

- VIRIDAXIS S

- OpenNatur

- Biobest Group NV

- E-NEMA GmbH

- Andermatt Group AG

Key Developments in Europe Biocontrol Agents Market Sector

- August 2022: Biobest announced the acquisition of Agronologica. The acquisition will allow enhanced access to Biobest’s technical expertise, product portfolio, and optimized logistics in Portugal, strengthening its market presence in the Iberian Peninsula.

- November 2020: E-NEMA GmbH succeeded in optimizing the beneficial traits of the nematode Heterorhabditis bacteriophora. The genetic improvement and adapted application technology allowed the reduction of the application density from 2 to 1 billion nematodes/ha (ca. 1 kg/ha) with 200 ltr. of water/ha in the seeding machine, leading to more efficient and cost-effective nematode application.

Strategic Europe Biocontrol Agents Market Market Outlook

The strategic outlook for the Europe Biocontrol Agents Market is exceptionally positive, driven by an intensifying global push towards sustainable agriculture and food security. Market growth accelerators include continued investment in research and development for novel biological solutions, the expansion of integrated pest management (IPM) programs across more crop types, and increasing consumer preference for residue-free produce. Opportunities lie in developing more user-friendly and cost-effective biocontrol products, leveraging advancements in biotechnology and precision agriculture for targeted applications, and expanding into emerging markets within Europe. Strategic collaborations between research institutions, technology providers, and agricultural producers will be crucial for accelerating innovation and market adoption, ensuring a sustained trajectory of growth for the biocontrol sector in Europe.

Europe Biocontrol Agents Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Biocontrol Agents Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Biocontrol Agents Market Regional Market Share

Geographic Coverage of Europe Biocontrol Agents Market

Europe Biocontrol Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Biofungicides is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biocontrol Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bioline AgroSciences Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 If Tech

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bioplanet France

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dragonfli

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VIRIDAXIS S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OpenNatur

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biobest Group NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E-NEMA GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Andermatt Group AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Europe Biocontrol Agents Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Biocontrol Agents Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Biocontrol Agents Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Biocontrol Agents Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Biocontrol Agents Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Biocontrol Agents Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Biocontrol Agents Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Biocontrol Agents Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Biocontrol Agents Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Biocontrol Agents Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biocontrol Agents Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Europe Biocontrol Agents Market?

Key companies in the market include Koppert Biological Systems Inc, Bioline AgroSciences Ltd, If Tech, Bioplanet France, Dragonfli, VIRIDAXIS S, OpenNatur, Biobest Group NV, E-NEMA GmbH, Andermatt Group AG.

3. What are the main segments of the Europe Biocontrol Agents Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Biofungicides is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: Biobest announced the acquisition of Agronologica. The acquisition will allow enhanced access to Biobest’s technical expertise, product portfolio, and optimized logistics in Portugal.November 2020: E-NEMA GmbH succeeded in optimizing the beneficial traits of the nematode Heterorhabditis bacteriophora. The genetic improvement and adapted application technology allowed the reduction of the application density from 2 to 1 billion nematodes/ha (ca. 1 kg/ha) with 200 ltr. of water/ha in the seeding machine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biocontrol Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biocontrol Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biocontrol Agents Market?

To stay informed about further developments, trends, and reports in the Europe Biocontrol Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence