Key Insights

The European specialty fertilizer market is projected to experience significant growth, reaching an estimated 7.25 billion by 2025 and maintaining a Compound Annual Growth Rate (CAGR) of 5.9% through 2033. This expansion is driven by the increasing global focus on sustainable agriculture, the necessity to improve crop yields and quality, and growing farmer awareness of precision nutrient management benefits. Advancements in agricultural technologies, such as precision farming and controlled-release formulations, enhance nutrient utilization and minimize environmental impact, further bolstering demand. Stringent European environmental regulations, aimed at reducing nutrient runoff, also promote the adoption of advanced fertilizer solutions.

Europe Specialty Fertilizer Market Market Size (In Billion)

The market segmentation highlights key growth areas. Controlled-Release Fertilizers (CRF), including polymer-coated and polymer-sulfur coated types, are expected to dominate due to their gradual nutrient release, aligning with plant needs and reducing application frequency. Liquid fertilizers are gaining popularity for their ease of application and rapid nutrient delivery, especially in fertigation and foliar applications. The rising demand for water-soluble fertilizers, crucial for hydroponic and soilless cultivation, is another significant growth driver. Europe, with its advanced agricultural practices and robust regulatory environment, represents a key market. Fertigation and foliar application modes are anticipated to see substantial growth, meeting the precise nutritional demands of horticultural crops, turf, ornamentals, and field crops.

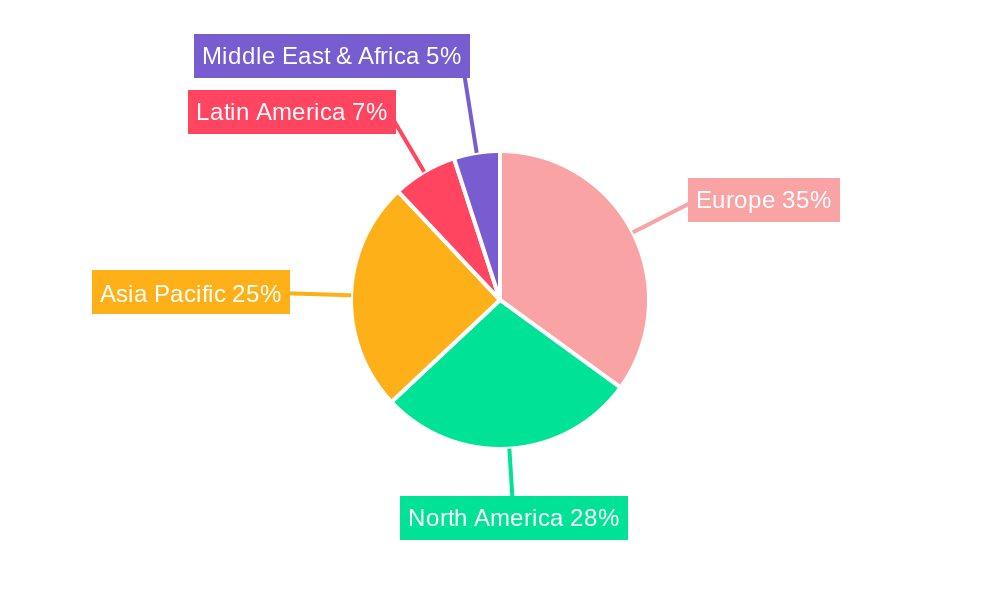

Europe Specialty Fertilizer Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Specialty Fertilizer Market, detailing its structure, trends, and future outlook. Covering the period from 2019 to 2033, with a focus on the base year of 2025 and a forecast from 2025 to 2033, this report is essential for stakeholders navigating this dynamic sector. We analyze key segments including Speciality Type (CRF – Polymer Coated, Polymer-Sulfur Coated, Others; Liquid Fertilizer; SRF; Water Soluble) and Application Mode (Fertigation, Foliar, Soil), alongside Crop Type (Field Crops, Horticultural Crops, Turf & Ornamental). Understanding these elements is critical for success in the European fertilizer industry.

Europe Specialty Fertilizer Market Market Structure & Competitive Dynamics

The Europe Specialty Fertilizer Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation ecosystems are robust, driven by increasing demand for high-efficiency fertilizers and sustainable agricultural practices. Regulatory frameworks, particularly those focused on environmental protection and nutrient management, play a pivotal role in shaping market entry and product development. Product substitutes, such as conventional fertilizers and organic amendments, pose a competitive challenge, but the superior performance and targeted application of specialty fertilizers continue to drive their adoption. End-user trends are shifting towards precision agriculture, demanding customized solutions that optimize nutrient uptake and minimize environmental impact. Mergers and acquisitions (M&A) activities are moderate, focusing on consolidating market presence and acquiring novel technologies. For instance, strategic partnerships and technology acquisitions are common tactics to enhance competitive advantage.

- Market Concentration: Moderate, with key players like Yara International AS and ICL Group Ltd leading.

- Innovation Ecosystems: Driven by R&D in controlled-release technologies and nutrient-use efficiency.

- Regulatory Frameworks: EU Green Deal and Farm to Fork strategy influence product development and application.

- Product Substitutes: Conventional fertilizers, organic manure, and biostimulants.

- End-User Trends: Precision agriculture, integrated nutrient management, and sustainable farming.

- M&A Activities: Focus on acquiring specialized technologies and expanding market reach.

Europe Specialty Fertilizer Market Industry Trends & Insights

The Europe Specialty Fertilizer Market is experiencing robust growth, propelled by a confluence of factors. A significant driver is the increasing awareness among farmers regarding the benefits of specialty fertilizers, such as enhanced crop yields, improved nutrient use efficiency, and reduced environmental impact. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be substantial, reflecting this rising demand. Technological disruptions, including advancements in Controlled-Release Fertilizer (CRF) coatings and the development of highly soluble formulations, are revolutionizing nutrient delivery. Consumer preferences are increasingly leaning towards sustainably produced food, indirectly boosting the demand for specialty fertilizers that support eco-friendly agricultural practices. Competitive dynamics are intensifying, with companies focusing on product differentiation, strategic partnerships, and geographical expansion to capture market share. The adoption of digital farming tools and data analytics is further enabling precision application, maximizing the efficacy of specialty fertilizers. Market penetration of specialty fertilizers is steadily increasing across diverse crop segments, indicating a fundamental shift in agricultural input management. The rising cost of conventional fertilizers and the need to maximize arable land productivity are also critical contributors to this upward trend.

Dominant Markets & Segments in Europe Specialty Fertilizer Market

The Europe Specialty Fertilizer Market is segmented across various product types, application modes, and crop categories, each exhibiting distinct growth patterns and dominance.

Speciality Type Dominance:

- CRF (Controlled-Release Fertilizer): This segment, particularly Polymer Coated variants, is a dominant force. The controlled release mechanism significantly reduces nutrient loss, making it highly attractive for efficient agriculture.

- Key Drivers: Environmental regulations, demand for reduced application frequency, enhanced crop quality.

- Liquid Fertilizers: These offer ease of application and rapid nutrient uptake, making them a prominent segment, especially in horticultural and high-value crop cultivation.

- Key Drivers: Precision application through fertigation and foliar spray, faster nutrient availability.

- Water Soluble Fertilizers: Essential for fertigation systems, this segment is crucial for greenhouse cultivation and intensive farming.

- Key Drivers: High solubility, compatibility with fertigation systems, efficient nutrient delivery.

- CRF (Controlled-Release Fertilizer): This segment, particularly Polymer Coated variants, is a dominant force. The controlled release mechanism significantly reduces nutrient loss, making it highly attractive for efficient agriculture.

Application Mode Dominance:

- Fertigation: This method, which integrates fertilizer application with irrigation, is a leading application mode. It ensures precise nutrient delivery directly to the root zone.

- Key Drivers: Water scarcity management, optimized nutrient uptake, reduced labor costs.

- Foliar Application: Increasingly adopted for micronutrient delivery and quick correction of nutrient deficiencies, foliar application is a significant growth area.

- Key Drivers: Rapid nutrient absorption, targeted deficiency correction, suitability for specific crop stages.

- Fertigation: This method, which integrates fertilizer application with irrigation, is a leading application mode. It ensures precise nutrient delivery directly to the root zone.

Crop Type Dominance:

- Horticultural Crops: This segment represents a significant market share due to the high value of produce and the need for precise nutrient management to ensure quality and yield.

- Key Drivers: Demand for premium quality fruits and vegetables, intensive cultivation practices, higher disposable income.

- Field Crops: While traditionally dominated by bulk fertilizers, specialty fertilizers are gaining traction for enhanced yields and improved soil health.

- Key Drivers: Need for increased food production, adoption of modern farming techniques, government subsidies.

- Horticultural Crops: This segment represents a significant market share due to the high value of produce and the need for precise nutrient management to ensure quality and yield.

Geographically, Western European countries like Germany, France, and the Netherlands are leading the market due to advanced agricultural infrastructure, high adoption rates of modern farming technologies, and stringent environmental regulations favoring specialty products.

Europe Specialty Fertilizer Market Product Innovations

Product innovations in the Europe Specialty Fertilizer Market are centered on enhancing nutrient efficiency and environmental sustainability. The development of advanced polymer coatings for Controlled-Release Fertilizers (CRF) allows for precise nutrient release tailored to crop needs throughout their growth cycle, minimizing losses to the environment. Innovations in liquid fertilizer formulations are enabling the integration of micronutrients and biostimulants, offering a multi-functional approach to plant nutrition. Water-soluble fertilizers are being optimized for higher purity and solubility, ensuring compatibility with sophisticated fertigation systems. These advancements provide competitive advantages by offering farmers more effective, targeted, and environmentally responsible solutions, aligning with the growing demand for sustainable agriculture and improved crop yields.

Report Segmentation & Scope

This report meticulously segments the Europe Specialty Fertilizer Market based on critical parameters to offer granular insights. The Speciality Type segmentation includes CRF (Polymer Coated, Polymer-Sulfur Coated, Others), Liquid Fertilizer, SRF (Slow-Release Fertilizer), and Water Soluble Fertilizers. Each of these segments is analyzed for its market size, growth projections, and competitive dynamics. The Application Mode is segmented into Fertigation, Foliar, and Soil application, detailing the adoption rates and benefits of each. Furthermore, the Crop Type segmentation covers Field Crops, Horticultural Crops, and Turf & Ornamental, providing an understanding of specialty fertilizer usage across diverse agricultural landscapes. The report's scope encompasses detailed market share analysis, key growth drivers, and challenges within each segment for the forecast period of 2025–2033.

Key Drivers of Europe Specialty Fertilizer Market Growth

The growth of the Europe Specialty Fertilizer Market is propelled by several key factors. Increasing global food demand necessitates enhanced agricultural productivity, which specialty fertilizers help achieve through improved nutrient-use efficiency. Stringent environmental regulations, such as those under the EU Green Deal, favor the adoption of products that minimize nutrient runoff and greenhouse gas emissions. Technological advancements in fertilizer coatings and formulations are leading to more effective and targeted nutrient delivery. A growing emphasis on sustainable agriculture and precision farming practices encourages farmers to invest in specialty inputs that optimize resource utilization and crop quality. Furthermore, rising awareness among growers about the long-term benefits of specialty fertilizers on soil health and crop resilience is a significant growth catalyst.

Challenges in the Europe Specialty Fertilizer Market Sector

Despite the promising growth, the Europe Specialty Fertilizer Market faces several challenges. Higher initial costs compared to conventional fertilizers can be a barrier for some farmers, particularly in price-sensitive markets. Complex regulatory approval processes for new formulations can slow down market entry. Supply chain disruptions, as witnessed in recent global events, can impact the availability and pricing of raw materials. Intense competition from established players and the introduction of innovative generic products also pose competitive pressures. Educating farmers about the diverse benefits and proper application techniques for various specialty fertilizers remains an ongoing challenge.

Leading Players in the Europe Specialty Fertilizer Market Market

- Achema

- Grupa Azoty S A (Compo Expert)

- EuroChem Group

- Fertiberia

- ICL Group Ltd

- AGLUKON Spezialduenger GmbH & Co

- Sociedad Quimica y Minera de Chile SA

- Kingenta Ecological Engineering Group Co Ltd

- Petrokemija DD Fertilizer Factory

- Yara International AS

Key Developments in Europe Specialty Fertilizer Market Sector

- January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion, enhancing ICL's market presence in specialty nutrient solutions.

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields, further strengthening its portfolio of high-performance fertilizers.

- May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton, demonstrating significant strategic supply agreements and market influence.

Strategic Europe Specialty Fertilizer Market Market Outlook

The strategic outlook for the Europe Specialty Fertilizer Market is exceptionally positive, driven by an unwavering commitment to sustainable agriculture and the relentless pursuit of enhanced crop productivity. Opportunities lie in the further development of bio-based specialty fertilizers and integrated nutrient management systems that combine chemical and biological inputs for superior results. The increasing adoption of digital agriculture and IoT solutions will enable more precise and data-driven application of specialty fertilizers, unlocking significant efficiency gains. Expansion into emerging European agricultural regions and strategic collaborations with agri-tech companies will be crucial for market players to capitalize on this dynamic and growing sector.

Europe Specialty Fertilizer Market Segmentation

-

1. Speciality Type

-

1.1. CRF

- 1.1.1. Polymer Coated

- 1.1.2. Polymer-Sulfur Coated

- 1.1.3. Others

- 1.2. Liquid Fertilizer

- 1.3. SRF

- 1.4. Water Soluble

-

1.1. CRF

-

2. Application Mode

- 2.1. Fertigation

- 2.2. Foliar

- 2.3. Soil

-

3. Crop Type

- 3.1. Field Crops

- 3.2. Horticultural Crops

- 3.3. Turf & Ornamental

-

4. Speciality Type

-

4.1. CRF

- 4.1.1. Polymer Coated

- 4.1.2. Polymer-Sulfur Coated

- 4.1.3. Others

- 4.2. Liquid Fertilizer

- 4.3. SRF

- 4.4. Water Soluble

-

4.1. CRF

-

5. Application Mode

- 5.1. Fertigation

- 5.2. Foliar

- 5.3. Soil

-

6. Crop Type

- 6.1. Field Crops

- 6.2. Horticultural Crops

- 6.3. Turf & Ornamental

Europe Specialty Fertilizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Specialty Fertilizer Market Regional Market Share

Geographic Coverage of Europe Specialty Fertilizer Market

Europe Specialty Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Specialty Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Speciality Type

- 5.1.1. CRF

- 5.1.1.1. Polymer Coated

- 5.1.1.2. Polymer-Sulfur Coated

- 5.1.1.3. Others

- 5.1.2. Liquid Fertilizer

- 5.1.3. SRF

- 5.1.4. Water Soluble

- 5.1.1. CRF

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Fertigation

- 5.2.2. Foliar

- 5.2.3. Soil

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Field Crops

- 5.3.2. Horticultural Crops

- 5.3.3. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Speciality Type

- 5.4.1. CRF

- 5.4.1.1. Polymer Coated

- 5.4.1.2. Polymer-Sulfur Coated

- 5.4.1.3. Others

- 5.4.2. Liquid Fertilizer

- 5.4.3. SRF

- 5.4.4. Water Soluble

- 5.4.1. CRF

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Fertigation

- 5.5.2. Foliar

- 5.5.3. Soil

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Field Crops

- 5.6.2. Horticultural Crops

- 5.6.3. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Speciality Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Achema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupa Azoty S A (Compo Expert)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EuroChem Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fertiberia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICL Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGLUKON Spezialduenger GmbH & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sociedad Quimica y Minera de Chile SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kingenta Ecological Engineering Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petrokemija DD Fertilizer Factory

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yara International AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Achema

List of Figures

- Figure 1: Europe Specialty Fertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Specialty Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 2: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 3: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 5: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 6: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 7: Europe Specialty Fertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 9: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 10: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 11: Europe Specialty Fertilizer Market Revenue billion Forecast, by Speciality Type 2020 & 2033

- Table 12: Europe Specialty Fertilizer Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 13: Europe Specialty Fertilizer Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: Europe Specialty Fertilizer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Sweden Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Norway Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Poland Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Denmark Europe Specialty Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Specialty Fertilizer Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Europe Specialty Fertilizer Market?

Key companies in the market include Achema, Grupa Azoty S A (Compo Expert), EuroChem Group, Fertiberia, ICL Group Ltd, AGLUKON Spezialduenger GmbH & Co, Sociedad Quimica y Minera de Chile SA, Kingenta Ecological Engineering Group Co Ltd, Petrokemija DD Fertilizer Factory, Yara International AS.

3. What are the main segments of the Europe Specialty Fertilizer Market?

The market segments include Speciality Type, Application Mode, Crop Type, Speciality Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Specialty Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Specialty Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Specialty Fertilizer Market?

To stay informed about further developments, trends, and reports in the Europe Specialty Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence