Key Insights

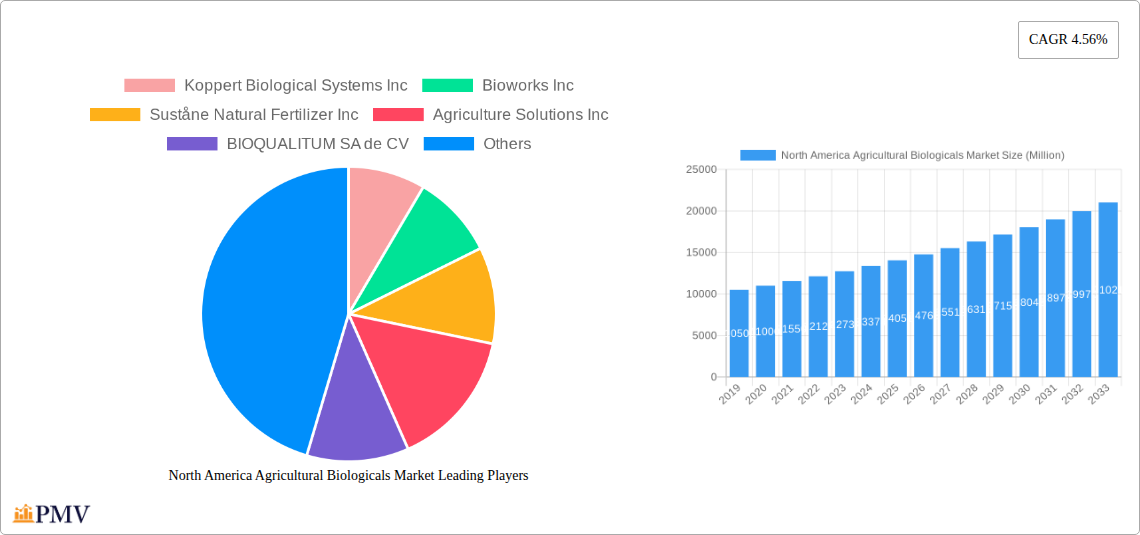

The North American agricultural biologicals market is poised for robust growth, projected to reach an estimated market size of $15,000 million by 2025, and expand at a Compound Annual Growth Rate (CAGR) of 4.56% through 2033. This upward trajectory is primarily fueled by the increasing global demand for sustainable and environmentally friendly agricultural practices. Farmers are increasingly adopting biological solutions, such as biopesticides, biofertilizers, and biostimulants, to enhance crop yields, improve soil health, and reduce reliance on synthetic chemicals. Stringent regulations aimed at limiting the use of conventional pesticides and fertilizers further bolster the adoption of biological alternatives. The growing consumer awareness regarding the health benefits of organic produce and the environmental impact of agricultural activities also plays a significant role in driving market expansion. Key players like Koppert Biological Systems Inc., Bioworks Inc., and Valagro US are at the forefront of innovation, introducing novel products and expanding their distribution networks to cater to the evolving needs of the North American agricultural sector. The market is also witnessing a surge in research and development activities, leading to the creation of more effective and targeted biological solutions.

North America Agricultural Biologicals Market Market Size (In Billion)

The market's growth drivers are multifaceted, encompassing the imperative for enhanced food security with a growing global population, the need to mitigate the environmental footprint of agriculture, and the rising awareness and demand for residue-free produce. Farmers in North America are actively seeking integrated pest management (IPM) strategies and nutrient management programs that incorporate biological inputs. The segmentation of the market reveals strong performance across production, consumption, and import/export analyses. While production is scaling up to meet domestic demand, imports of advanced biological formulations are also significant, reflecting the global nature of this industry. Price trends indicate a gradual but steady increase in the cost of biological inputs, driven by their efficacy and the R&D investments involved, though this is often offset by long-term benefits like improved soil fertility and reduced input costs for farmers. Restraints, such as the initial perception of higher costs compared to synthetic alternatives and the need for specialized knowledge in application, are gradually diminishing as the benefits of biologicals become more apparent and accessible. The competitive landscape is dynamic, with established companies and emerging innovators vying for market share, fostering continuous product development and market penetration across the United States, Canada, and Mexico.

North America Agricultural Biologicals Market Company Market Share

This detailed report provides an in-depth analysis of the North America agricultural biologicals market, offering critical insights into its structure, trends, dominant segments, product innovations, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the rapidly evolving landscape of sustainable agriculture.

North America Agricultural Biologicals Market Market Structure & Competitive Dynamics

The North America agricultural biologicals market is characterized by a moderately concentrated structure, with a mix of established multinational corporations and emerging regional players. Innovation ecosystems are thriving, driven by significant R&D investments in biological pest control, biofertilizers, and biostimulants. Regulatory frameworks, while evolving, generally favor the adoption of sustainable agricultural solutions, albeit with regional variations in approval processes. Product substitutes, primarily conventional synthetic inputs, are facing increasing scrutiny due to environmental concerns, driving demand for biological alternatives. End-user trends are heavily influenced by a growing demand for organic produce, reduced chemical residues, and improved soil health, directly impacting the adoption rate of agricultural biologicals. Mergers and acquisitions (M&A) activity is a significant driver of market consolidation and expansion, with companies leveraging strategic partnerships to enhance their product portfolios and geographical reach. For instance, recent M&A deals have seen market share shift as larger entities acquire innovative startups to integrate cutting-edge biological technologies. The competitive landscape is dynamic, with companies vying for market leadership through product differentiation, strategic collaborations, and robust distribution networks.

North America Agricultural Biologicals Market Industry Trends & Insights

The North America agricultural biologicals market is experiencing robust growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. This upward trajectory is fueled by a confluence of factors including escalating global food demand, increasing farmer awareness regarding the environmental and economic benefits of biological solutions, and a growing consumer preference for sustainably produced food. The market penetration of agricultural biologicals is steadily increasing as they offer a viable and eco-friendly alternative to synthetic agrochemicals. Technological disruptions are at the forefront of this expansion, with advancements in microbial fermentation, genetic engineering, and formulation technologies leading to the development of more effective and targeted biological products. These innovations are enabling farmers to achieve comparable or even superior crop yields and quality while minimizing their environmental footprint. Consumer preferences are shifting towards organic and residue-free produce, compelling agricultural producers to adopt sustainable practices and integrate biological inputs into their crop management programs. Competitive dynamics are intensifying, with key players investing heavily in research and development to introduce novel products and expand their market presence through strategic alliances and acquisitions. The market is also being shaped by favorable government policies and initiatives aimed at promoting sustainable agriculture and reducing the reliance on chemical inputs. For example, various subsidy programs and tax incentives are being introduced in countries like the United States and Canada to encourage the adoption of biological fertilizers and pesticides. Furthermore, the growing adoption of precision agriculture technologies is creating new opportunities for the application of targeted biological solutions, enhancing their efficacy and adoption rate. The integration of data analytics and artificial intelligence in agricultural practices also supports the optimized use of biological inputs, leading to improved farm management and increased profitability. The rising awareness of soil health and its critical role in long-term agricultural productivity is another significant driver for the agricultural biologicals market, as these products actively contribute to improving soil microbial diversity and nutrient cycling. The increasing incidence of pest resistance to conventional pesticides is also pushing farmers towards biological control agents, further bolstering market growth.

Dominant Markets & Segments in North America Agricultural Biologicals Market

The North America agricultural biologicals market exhibits significant dominance across various segments, with the United States emerging as the leading region due to its large agricultural base, advanced farming practices, and supportive regulatory environment for biological products.

Production Analysis:

- Key Drivers: High investment in R&D for novel biological formulations, presence of leading global agrochemical companies with dedicated biological divisions, and robust government funding for agricultural innovation.

- Dominance: The US leads in the production of biofertilizers and biopesticides, driven by extensive research facilities and a vast agricultural output requiring substantial input. Canada also shows a growing production capacity, focusing on specific biological solutions for its diverse climate.

Consumption Analysis:

- Key Drivers: Growing demand for organic produce, increasing adoption of integrated pest management (IPM) strategies, and heightened awareness among farmers about the benefits of soil health improvement.

- Dominance: The United States continues to be the largest consumer, with a strong market for biostimulants and biofertilizers in high-value crops like fruits, vegetables, and specialty grains. Mexico’s consumption is rapidly growing, especially in greenhouse agriculture and large-scale conventional farming seeking sustainable alternatives.

Import Market Analysis (Value & Volume):

- Key Drivers: Availability of specialized biological products not manufactured domestically, demand for advanced formulations, and competitive pricing from international suppliers.

- Dominance: The US imports a substantial volume of niche biofertilizers and biopesticides, particularly from European countries known for their advanced biological research. Mexico is increasingly importing biological inputs to supplement domestic production and meet specific crop needs. The total import value for the North American region is estimated to reach approximately $1,800 Million by 2025, with a volume of roughly 650,000 metric tons.

Export Market Analysis (Value & Volume):

- Key Drivers: High quality and efficacy of North American-developed biological products, strong brand reputation, and expansion into emerging agricultural markets.

- Dominance: The United States is a net exporter of agricultural biologicals, particularly to Latin America and Asia. Exports are driven by demand for established biofertilizer and biopesticide brands. The estimated export value is around $1,500 Million in 2025, with a volume of approximately 500,000 metric tons.

Price Trend Analysis:

- Key Drivers: Raw material costs, manufacturing complexity, R&D investments, and the competitive landscape.

- Dominance: Prices for biologicals are generally higher than conventional counterparts but are expected to see a gradual decline due to economies of scale and increased competition. The trend indicates a convergence in pricing as market penetration deepens.

North America Agricultural Biologicals Market Product Innovations

Product innovations in the North America agricultural biologicals market are rapidly advancing, focusing on enhanced efficacy, broader application spectra, and improved shelf-life. Key developments include the introduction of novel microbial inoculants for superior nutrient uptake and plant growth promotion, as well as next-generation biopesticides targeting specific pests with minimal impact on beneficial insects. Advancements in formulation technologies, such as microencapsulation and improved delivery systems, are ensuring better product stability and on-field performance, leading to increased farmer adoption. The competitive advantage lies in products that offer tangible improvements in yield, crop quality, and resistance to environmental stresses, coupled with ease of application and integration into existing farming practices.

Report Segmentation & Scope

The North America agricultural biologicals market is segmented based on Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The forecast period (2025–2033) anticipates significant growth across all these segments. Production is expected to increase by an estimated 15% annually, driven by increased investment in manufacturing facilities. Consumption is projected to grow at a CAGR of 12.5%, fueled by farmer adoption and consumer demand. The import market is estimated to reach $2,500 Million in value and 800,000 metric tons in volume by 2033, while the export market is projected to reach $2,200 Million in value and 750,000 metric tons in volume by the same year. Price trends indicate a gradual decrease in the average price of biologicals as production scales up and competition intensifies, fostering greater market accessibility.

Key Drivers of North America Agricultural Biologicals Market Growth

The North America agricultural biologicals market growth is propelled by several key drivers. Increasingly stringent environmental regulations globally and within North America are pushing for reduced use of synthetic pesticides and fertilizers. A rising consumer preference for organic and sustainably grown food products directly influences agricultural practices, creating demand for biological inputs. Technological advancements in microbial research and bioprocessing are leading to more effective and diverse biological solutions. Furthermore, growing farmer awareness of the long-term benefits of soil health and integrated pest management (IPM) strategies, coupled with the economic advantages of improved crop resilience and reduced input costs, are significant growth accelerators.

Challenges in the North America Agricultural Biologicals Market Sector

Despite its strong growth trajectory, the North America agricultural biologicals market faces certain challenges. Regulatory hurdles, although improving, can still be complex and time-consuming for new product approvals across different jurisdictions. The perception of higher upfront costs compared to conventional agrochemicals can be a barrier for some farmers, necessitating robust demonstration of return on investment. Supply chain complexities and the need for specific storage and handling conditions for some biological products can also pose logistical challenges. Additionally, the competitive pressure from well-established synthetic agrochemical companies requires continuous innovation and effective market education to highlight the distinct advantages of biological solutions.

Leading Players in the North America Agricultural Biologicals Market Market

- Koppert Biological Systems Inc

- Bioworks Inc

- Suståne Natural Fertilizer Inc

- Agriculture Solutions Inc

- BIOQUALITUM SA de CV

- Symborg Inc

- BioFert Manufacturing Inc

- Valagro US

- Andermatt Group AG

- Lallemand Inc

Key Developments in North America Agricultural Biologicals Market Sector

- September 2022: Andermatt Group AG opened its subsidiary in Mexico under the same segment with an aim to deliver Mexican farms with different biological solutions. This move helped the company strengthen its presence in Mexico.

- July 2022: A new granular inoculant called LALFIX® START SPHERICAL Granule was launched, which combines Bacillus velezensis, a plant growth-promoting microbe, with two distinct rhizobium strains. This powerful and well-tested PGPM boosts phosphorus solubilization and improves root mass.

- January 2022: In declaring the acquisition of Glen Biotech, Symborg strengthened its position as a global leader in sustainable agricultural biotechnology. Symborg expanded its product line with Glen Biotech's technology, which is based on the fungus Beauveria bassiana 203 that has a high potential for pest control.

Strategic North America Agricultural Biologicals Market Market Outlook

The strategic outlook for the North America agricultural biologicals market is exceptionally positive, driven by the undeniable shift towards sustainable agriculture. Future growth will be fueled by ongoing technological advancements in biopesticides, biofertilizers, and biostimulants, leading to more targeted and efficient solutions. Increased regulatory support for biological products, coupled with growing consumer demand for safe and environmentally friendly food, will further accelerate adoption. Strategic opportunities lie in expanding product portfolios, forging key partnerships with agricultural cooperatives and research institutions, and investing in market education to overcome residual skepticism among some farming communities. The market is poised for sustained expansion, presenting lucrative prospects for innovation and investment.

North America Agricultural Biologicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agricultural Biologicals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Biologicals Market Regional Market Share

Geographic Coverage of North America Agricultural Biologicals Market

North America Agricultural Biologicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Amino Acids is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Biologicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bioworks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suståne Natural Fertilizer Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Agriculture Solutions Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BIOQUALITUM SA de CV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Symborg Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BioFert Manufacturing Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valagro US

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Andermatt Group AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lallemand Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: North America Agricultural Biologicals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Biologicals Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Biologicals Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Agricultural Biologicals Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Agricultural Biologicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Agricultural Biologicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Biologicals Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Agricultural Biologicals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Agricultural Biologicals Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Agricultural Biologicals Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Agricultural Biologicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Agricultural Biologicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Agricultural Biologicals Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Agricultural Biologicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Agricultural Biologicals Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Agricultural Biologicals Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Agricultural Biologicals Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Biologicals Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the North America Agricultural Biologicals Market?

Key companies in the market include Koppert Biological Systems Inc, Bioworks Inc, Suståne Natural Fertilizer Inc, Agriculture Solutions Inc, BIOQUALITUM SA de CV, Symborg Inc, BioFert Manufacturing Inc, Valagro US, Andermatt Group AG, Lallemand Inc.

3. What are the main segments of the North America Agricultural Biologicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Amino Acids is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Andermatt Group AG opened its subsidiary in Mexico under the same segment with an aim to deliver Mexican farms with different biological solutions. This move helped the company strengthen its presence in Mexico.July 2022: A new granular inoculant called LALFIX® START SPHERICAL Granule was launched, which combines Bacillus velezensis, a plant growth-promoting microbe, with two distinct rhizobium strains. This powerful and well-tested PGPM boosts phosphorus solubilization and improves root mass.January 2022: In declaring the acquisition of Glen Biotech, Symborg strengthened its position as a global leader in sustainable agricultural biotechnology. Symborg expanded its product line with Glen Biotech's technology, which is based on the fungus Beauveria bassiana 203 that has a high potential for pest control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Biologicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Biologicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Biologicals Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Biologicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence