Key Insights

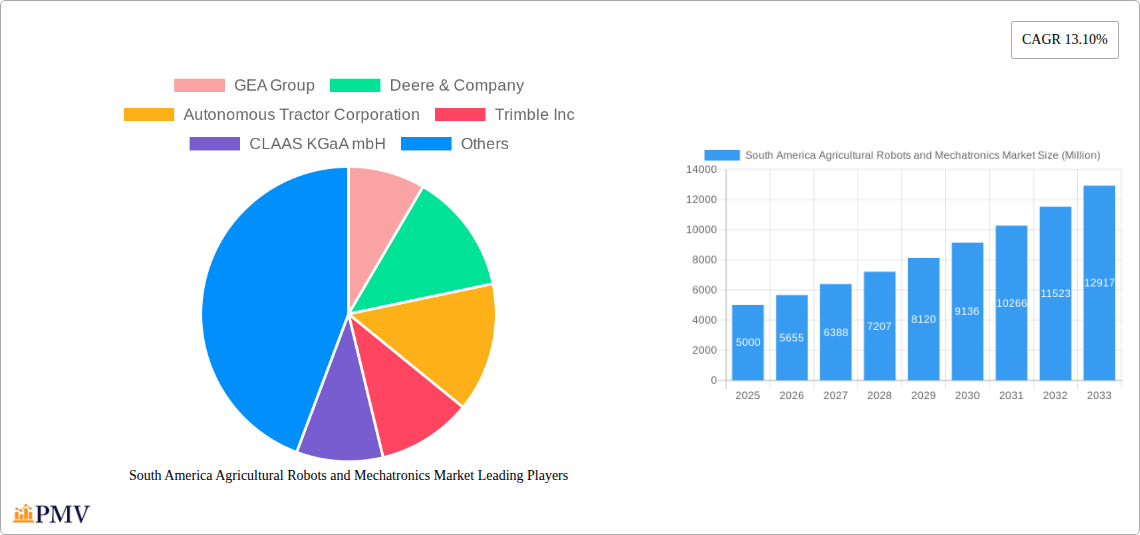

The South America Agricultural Robots and Mechatronics Market is poised for substantial growth, with an estimated market size of approximately $5,000 million in 2025, projected to expand at a robust Compound Annual Growth Rate (CAGR) of 13.10% through 2033. This expansion is primarily fueled by the increasing adoption of advanced technologies to enhance agricultural productivity, address labor shortages, and improve sustainability across the region. Key drivers include the urgent need for precision agriculture to optimize resource utilization, the growing demand for higher crop yields to feed a rising population, and government initiatives supporting the modernization of the agricultural sector. The rising adoption of autonomous tractors, unmanned aerial vehicles (UAVs) for crop monitoring and spraying, and automated milking robots in animal husbandry are at the forefront of this technological revolution. These solutions offer significant benefits, including reduced operational costs, minimized human error, and improved overall farm efficiency.

South America Agricultural Robots and Mechatronics Market Market Size (In Billion)

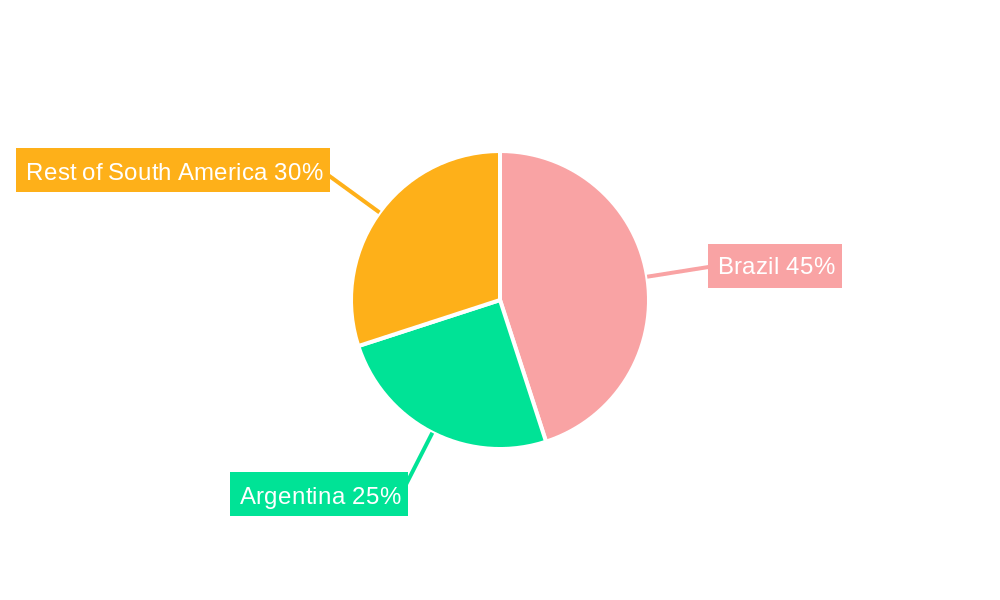

The market's trajectory is further shaped by prevailing trends such as the increasing integration of AI and IoT in agricultural machinery, enabling real-time data analysis for informed decision-making, and the growing focus on sustainable farming practices that minimize environmental impact. However, certain restraints may influence the pace of adoption, including the high initial investment costs associated with advanced agricultural robotics, the need for skilled labor to operate and maintain these sophisticated systems, and the varying levels of technological infrastructure across different South American countries. Despite these challenges, the persistent demand for enhanced food security and the continuous innovation in agricultural mechatronics are expected to drive sustained market expansion. Brazil, being the largest agricultural producer in South America, is anticipated to lead this growth, followed by Argentina, with the rest of South America also showing significant potential.

South America Agricultural Robots and Mechatronics Market Company Market Share

Here's the SEO-optimized, detailed report description for the South America Agricultural Robots and Mechatronics Market:

Unlock critical insights into the rapidly evolving South America Agricultural Robots and Mechatronics Market. This in-depth report, covering the study period of 2019–2033 with a base year of 2025, provides a granular view of market dynamics, segmentation, and future growth trajectories. Discover the impact of advanced robotics, AI, and automation on crop production, animal husbandry, and forest control across Brazil, Argentina, and the rest of South America. This report is essential for stakeholders seeking to capitalize on the burgeoning precision agriculture and smart farming landscape.

South America Agricultural Robots and Mechatronics Market Market Structure & Competitive Dynamics

The South America Agricultural Robots and Mechatronics Market is characterized by a moderately consolidated structure, driven by significant investments in R&D and strategic partnerships. Leading players are actively shaping the innovation ecosystem, with a strong focus on developing sophisticated autonomous tractors, advanced unmanned aerial vehicles (UAVs) for precision spraying and monitoring, and efficient milking robots. Regulatory frameworks are progressively adapting to accommodate these technological advancements, though regional variations present nuanced market entry strategies. Product substitutes are gradually being displaced by the superior efficiency and cost-effectiveness of robotic solutions. End-user trends indicate a strong preference for solutions that enhance yield, reduce labor costs, and promote sustainable agricultural practices. Mergers and acquisitions (M&A) are a key feature, with several notable transactions observed, aiming to expand market reach and technological capabilities. For instance, the GEA Group has been active in acquiring companies to bolster its dairy farm automation portfolio, and Deere & Company continues to invest heavily in autonomous farming solutions. The market share distribution is dynamic, with major players like Trimble Inc., CLAAS KGaA mbH, and AGCO Corporation holding significant positions, while emerging innovators like Autonomous Tractor Corporation and Harvest Automation are making their mark.

South America Agricultural Robots and Mechatronics Market Industry Trends & Insights

The South America Agricultural Robots and Mechatronics Market is experiencing robust growth, fueled by increasing adoption of precision farming technologies and the imperative to enhance agricultural productivity amidst a growing global demand for food. Technological disruptions are at the forefront, with advancements in AI-powered data analytics, sensor technology, and machine learning enabling more precise and efficient farming operations. The market penetration of agricultural robotics is steadily increasing, driven by the potential to automate labor-intensive tasks, thereby addressing rural labor shortages and improving working conditions for farmers. Consumer preferences are shifting towards sustainably produced food, pushing the demand for eco-friendly and resource-efficient farming methods facilitated by these advanced technologies. Competitive dynamics are intense, with established agricultural machinery manufacturers and specialized robotics firms vying for market dominance. The CAGR is projected to be approximately 15% over the forecast period, indicating a significant expansion. Key market drivers include government initiatives promoting agricultural modernization, rising investments in smart agriculture, and the increasing adoption of data-driven farming practices. The integration of IoT devices and cloud computing further enhances the capabilities of these robots, enabling real-time monitoring and control of agricultural operations. This technological convergence is creating new avenues for revenue generation and market expansion within the South American context, where the vast agricultural landholdings present immense opportunities for scalable automation solutions.

Dominant Markets & Segments in South America Agricultural Robots and Mechatronics Market

Brazil stands out as the dominant market within the South America Agricultural Robots and Mechatronics Market, driven by its status as a global agricultural powerhouse with vast arable land and significant government support for technological innovation. The Crop Production application segment is leading the charge, primarily due to the extensive cultivation of soybeans, corn, and sugarcane, where autonomous tractors and unmanned aerial vehicles (UAVs) are crucial for large-scale operations. Economic policies favoring agricultural modernization and substantial investments in infrastructure, such as improved connectivity for data transmission, further bolster Brazil's leadership.

- Key Drivers in Brazil:

- Government subsidies and incentives for adopting advanced farming equipment.

- The pressing need to increase yield and efficiency in large-scale commercial farming.

- High adoption rate of precision agriculture techniques.

- Availability of significant venture capital funding for agritech startups.

Argentina emerges as another significant player, with a strong focus on crop production, particularly in wheat and soybean farming. The adoption of precision spraying drones and automated harvesters is gaining momentum, contributing to its market share. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, presents emerging opportunities, with a growing interest in animal husbandry automation through milking robots and specialized robotic solutions for niche crops.

Dominance Analysis by Product Type:

- Autonomous Tractors: These command the largest market share due to their versatility in performing a wide range of field operations, from plowing to harvesting, significantly reducing manual labor and improving operational efficiency for large farms.

- Unmanned Aerial Vehicles (UAVs): Rapidly gaining traction for their applications in crop monitoring, soil analysis, and precision spraying, offering cost-effectiveness and enhanced safety over traditional methods.

- Milking Robots: Experiencing substantial growth in dairy-producing regions, driven by the need for improved animal welfare, reduced labor intensity in milking, and enhanced milk quality data.

- Other Types: This category includes specialized robots for weeding, planting, and fruit picking, which are gaining traction in specific agricultural niches and markets.

Dominance Analysis by Application:

- Crop Production: This is the largest application segment, encompassing a broad spectrum of robotic solutions for planting, cultivating, monitoring, and harvesting various crops.

- Animal Husbandry: This segment is growing rapidly with the adoption of automated feeding systems, robotic milking, and health monitoring solutions for livestock.

- Forest Control: While a smaller segment, it holds potential for robotic applications in reforestation, monitoring, and harvesting of timber.

South America Agricultural Robots and Mechatronics Market Product Innovations

Recent product innovations are significantly enhancing the capabilities of agricultural robots and mechatronic systems in South America. Leading companies are focusing on developing smarter, more autonomous, and data-driven solutions. Innovations include enhanced AI algorithms for real-time decision-making in autonomous tractors, advanced sensor payloads for UAVs enabling hyper-spectral imaging and disease detection, and more efficient and gentler robotic arms for harvesting delicate produce. Competitive advantages are being gained through improved battery life, enhanced navigation systems for challenging terrains, and seamless integration with farm management software. The market fit for these innovations is strong, addressing the critical needs for increased efficiency, reduced environmental impact, and improved profitability in the region's diverse agricultural landscape.

Report Segmentation & Scope

This comprehensive report segments the South America Agricultural Robots and Mechatronics Market by Product Type, Application, and Geography. The Product Type segmentation includes: Autonomous Tractors, Unmanned Aerial Vehicles (UAVs), Milking Robots, and Other Types (e.g., robotic weeders, harvesters). The Application segmentation covers Crop Production, Animal Husbandry, Forest Control, and Other Applications. Geographically, the market is analyzed across Brazil, Argentina, and the Rest of South America. Each segment offers detailed insights into market size, growth projections, and competitive dynamics, providing a granular view for strategic decision-making.

Key Drivers of South America Agricultural Robots and Mechatronics Market Growth

The growth of the South America Agricultural Robots and Mechatronics Market is propelled by several key drivers. A significant factor is the increasing demand for food security in a region with a growing population and substantial export potential, necessitating higher agricultural output. The rising labor costs and scarcity of skilled agricultural workers in many South American countries are compelling farmers to adopt automation solutions. Furthermore, government initiatives and subsidies aimed at modernizing the agricultural sector and promoting sustainable practices provide strong economic incentives for investment in agricultural robots and mechatronics. The continuous advancement in AI, IoT, and sensor technologies is making these solutions more sophisticated, efficient, and cost-effective, further accelerating their adoption.

Challenges in the South America Agricultural Robots and Mechatronics Market Sector

Despite the promising growth, the South America Agricultural Robots and Mechatronics Market faces several challenges. The high initial investment cost for advanced robotic systems remains a significant barrier for small and medium-sized farmers, impacting market penetration. Insufficient digital infrastructure, including reliable internet connectivity and data management capabilities in some rural areas, can hinder the effective deployment and operation of smart farming technologies. Regulatory hurdles and the lack of standardized guidelines for autonomous agricultural machinery in certain countries can also create complexities for manufacturers and users. Additionally, a shortage of skilled technicians for maintenance and repair of these sophisticated machines poses another challenge to widespread adoption.

Leading Players in the South America Agricultural Robots and Mechatronics Market Market

- GEA Group

- Deere & Company

- Autonomous Tractor Corporation

- Trimble Inc.

- CLAAS KGaA mbH

- Autonomous Solutions Inc.

- CNH Industrial

- Harvest Automation

- AGCO Corporation

Key Developments in South America Agricultural Robots and Mechatronics Market Sector

- 2023: Deere & Company launches its autonomous tractor, signaling a significant step towards full automation in large-scale farming.

- 2022: GEA Group enhances its robotic milking systems with AI-driven health monitoring capabilities for dairy herds.

- 2021: Trimble Inc. expands its precision agriculture portfolio with advanced drone-based soil mapping solutions.

- 2020: CLAAS KGaA mbH integrates advanced sensor technology into its combine harvesters for real-time yield optimization.

- 2019: Autonomous Solutions Inc. partners with agricultural cooperatives in Argentina to pilot large-scale autonomous farming operations.

Strategic South America Agricultural Robots and Mechatronics Market Market Outlook

The strategic outlook for the South America Agricultural Robots and Mechatronics Market is exceptionally bright, driven by the convergence of increasing food demand, technological innovation, and supportive government policies. Opportunities abound for companies to expand their offerings in autonomous farming, precision spraying drones, and robotic milking solutions. The market is poised for significant growth as more farmers recognize the long-term benefits of automation, including enhanced productivity, reduced operational costs, and improved sustainability. Strategic collaborations between technology providers, agricultural machinery manufacturers, and local distributors will be crucial for overcoming market entry barriers and driving widespread adoption. The increasing focus on data analytics and AI will unlock further potential for intelligent farming systems, shaping a more efficient and resilient agricultural future for South America.

South America Agricultural Robots and Mechatronics Market Segmentation

-

1. Product Type

- 1.1. Autonomous Tractors

- 1.2. Unmanned Aerial Vehicles

- 1.3. Milking Robots

- 1.4. Other Types

-

2. Application

- 2.1. Crop Production

- 2.2. Animal Husbandry

- 2.3. Forest Control

- 2.4. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

-

4. Product Type

- 4.1. Autonomous Tractors

- 4.2. Unmanned Aerial Vehicles

- 4.3. Milking Robots

- 4.4. Other Types

-

5. Application

- 5.1. Crop Production

- 5.2. Animal Husbandry

- 5.3. Forest Control

- 5.4. Other Applications

South America Agricultural Robots and Mechatronics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Agricultural Robots and Mechatronics Market Regional Market Share

Geographic Coverage of South America Agricultural Robots and Mechatronics Market

South America Agricultural Robots and Mechatronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Growth of Precision farming Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Autonomous Tractors

- 5.1.2. Unmanned Aerial Vehicles

- 5.1.3. Milking Robots

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Crop Production

- 5.2.2. Animal Husbandry

- 5.2.3. Forest Control

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Autonomous Tractors

- 5.4.2. Unmanned Aerial Vehicles

- 5.4.3. Milking Robots

- 5.4.4. Other Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Crop Production

- 5.5.2. Animal Husbandry

- 5.5.3. Forest Control

- 5.5.4. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Autonomous Tractors

- 6.1.2. Unmanned Aerial Vehicles

- 6.1.3. Milking Robots

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Crop Production

- 6.2.2. Animal Husbandry

- 6.2.3. Forest Control

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.4. Market Analysis, Insights and Forecast - by Product Type

- 6.4.1. Autonomous Tractors

- 6.4.2. Unmanned Aerial Vehicles

- 6.4.3. Milking Robots

- 6.4.4. Other Types

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Crop Production

- 6.5.2. Animal Husbandry

- 6.5.3. Forest Control

- 6.5.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Autonomous Tractors

- 7.1.2. Unmanned Aerial Vehicles

- 7.1.3. Milking Robots

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Crop Production

- 7.2.2. Animal Husbandry

- 7.2.3. Forest Control

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.4. Market Analysis, Insights and Forecast - by Product Type

- 7.4.1. Autonomous Tractors

- 7.4.2. Unmanned Aerial Vehicles

- 7.4.3. Milking Robots

- 7.4.4. Other Types

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Crop Production

- 7.5.2. Animal Husbandry

- 7.5.3. Forest Control

- 7.5.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Autonomous Tractors

- 8.1.2. Unmanned Aerial Vehicles

- 8.1.3. Milking Robots

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Crop Production

- 8.2.2. Animal Husbandry

- 8.2.3. Forest Control

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.4. Market Analysis, Insights and Forecast - by Product Type

- 8.4.1. Autonomous Tractors

- 8.4.2. Unmanned Aerial Vehicles

- 8.4.3. Milking Robots

- 8.4.4. Other Types

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Crop Production

- 8.5.2. Animal Husbandry

- 8.5.3. Forest Control

- 8.5.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GEA Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Deere & Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Autonomous Tractor Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Trimble Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 CLAAS KGaA mbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Autonomous Solutions Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 CNH Industrial

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Harvest Automatio

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 AGCO Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 GEA Group

List of Figures

- Figure 1: South America Agricultural Robots and Mechatronics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Robots and Mechatronics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Robots and Mechatronics Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the South America Agricultural Robots and Mechatronics Market?

Key companies in the market include GEA Group, Deere & Company, Autonomous Tractor Corporation, Trimble Inc, CLAAS KGaA mbH, Autonomous Solutions Inc, CNH Industrial, Harvest Automatio, AGCO Corporation.

3. What are the main segments of the South America Agricultural Robots and Mechatronics Market?

The market segments include Product Type, Application, Geography, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Growth of Precision farming Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Robots and Mechatronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Robots and Mechatronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Robots and Mechatronics Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Robots and Mechatronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence