Key Insights

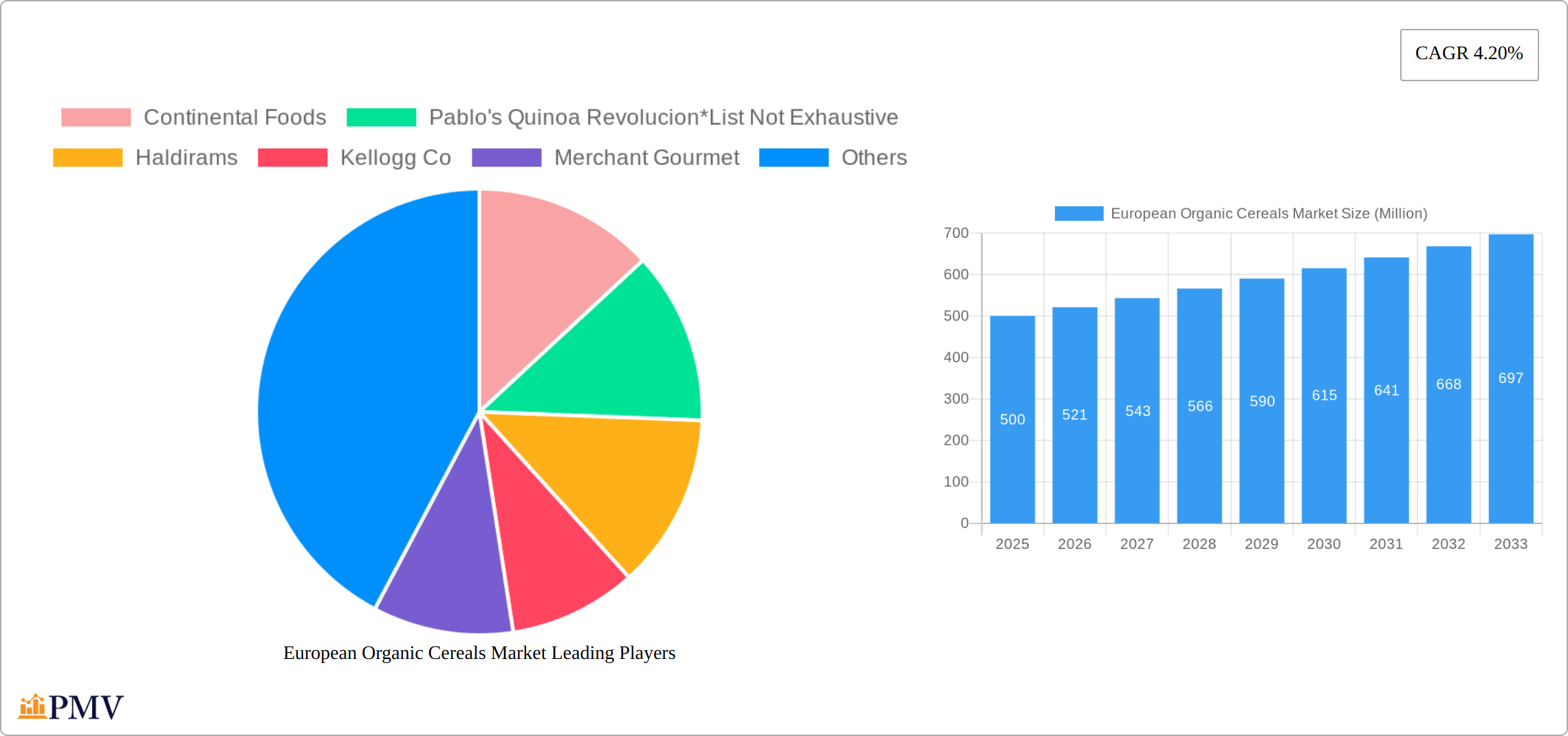

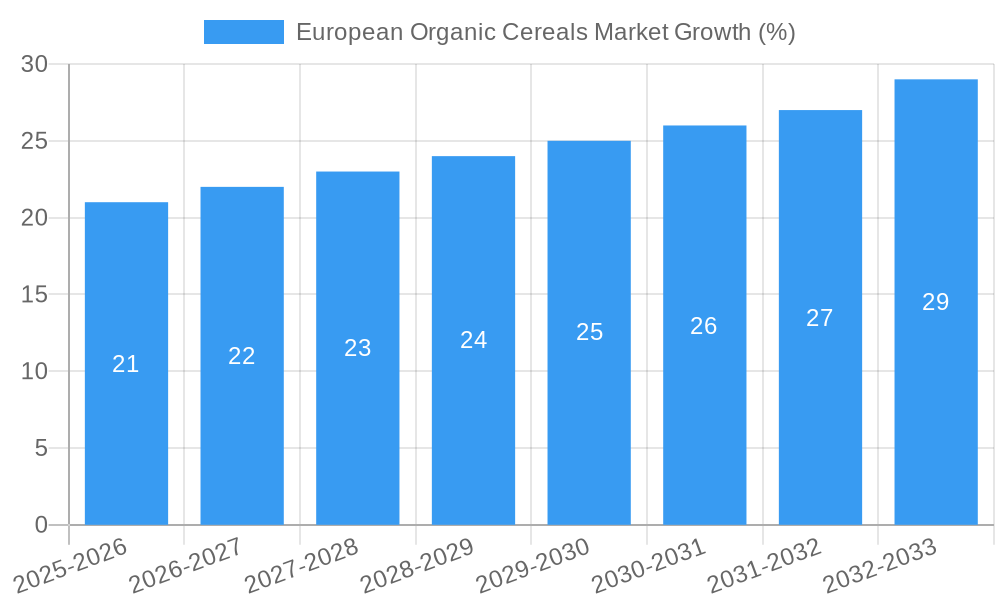

The European organic cereals market, valued at approximately €500 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.20% from 2025 to 2033. This expansion is fueled by several key drivers. The rising consumer awareness of health benefits associated with organic foods, coupled with a growing preference for convenient breakfast options, significantly boosts demand for organic ready-to-eat and ready-to-cook cereals. The increasing prevalence of health-conscious lifestyles, particularly among younger demographics, further contributes to this market's growth trajectory. Furthermore, the expanding distribution channels, including online retailers and specialty stores catering to health-conscious consumers, facilitate increased market accessibility and product reach. While the market faces challenges such as higher prices compared to conventional cereals and potential supply chain vulnerabilities, the overall market outlook remains positive, driven by sustained consumer demand for healthier and ethically sourced breakfast options.

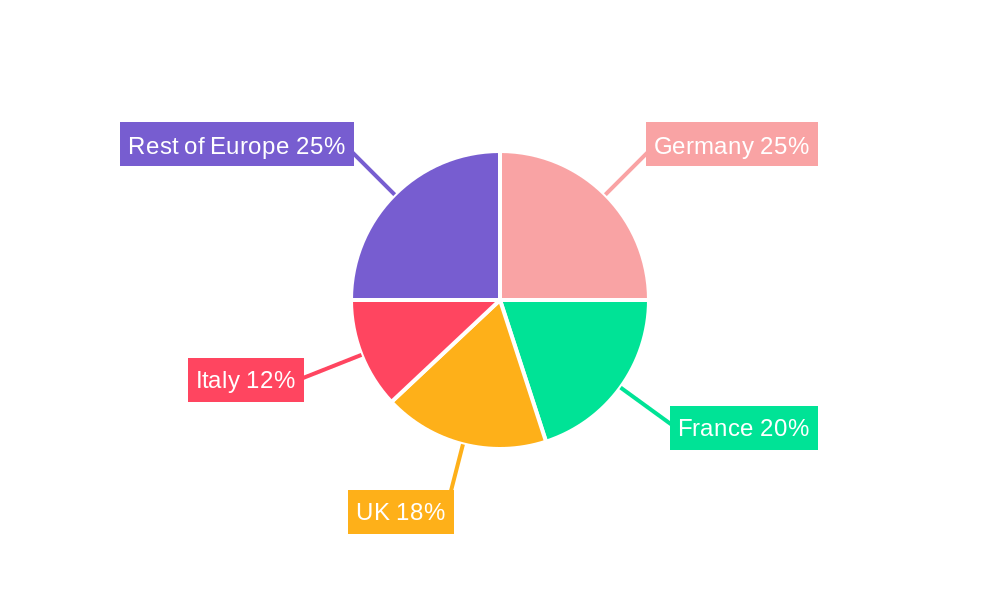

Specific segments within the European organic cereals market show varying growth potential. Ready-to-eat cereals are expected to maintain a larger market share due to their convenience, while the ready-to-cook segment will also see notable growth fueled by a renewed interest in home cooking and healthier breakfast options. Within product types, corn-based cereals are likely to retain a significant share, although blended and mixed cereals are anticipated to gain traction, capitalizing on the trend toward diverse and nutrient-rich breakfast choices. The leading market players, including Kellogg's, General Mills, and regional brands like Continental Foods and Haldirams, are actively innovating with new product offerings and marketing strategies to cater to the evolving consumer preferences and solidify their positions in this expanding market. Germany, France, and the UK are likely to be the leading markets within Europe, driven by high consumer awareness of organic products and strong purchasing power.

European Organic Cereals Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European organic cereals market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study period encompasses historical data (2019-2024) and projected figures (2025-2033), providing a complete overview of the market's trajectory. The report utilizes a combination of qualitative and quantitative analyses to provide a robust and actionable understanding of this dynamic market.

European Organic Cereals Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the European organic cereals market. We analyze market concentration, assessing the market share held by key players like Kellogg Co, General Mills, Continental Foods, and others, including emerging brands such as Pablo's Quinoa Revolucion. The report explores the innovation ecosystems driving new product development, regulatory frameworks impacting organic certification and labeling, and the presence of product substitutes (e.g., other breakfast foods). We also examine end-user trends, specifically focusing on shifting consumer preferences towards healthier and more sustainable food options, and analyze recent mergers and acquisitions (M&A) activities within the sector. The report provides estimations of M&A deal values (in Millions) where data is available and quantifies the market share of leading players. For example, Kellogg Co might hold a xx% market share, while smaller players collectively account for xx%. The impact of these dynamics on market structure and competition are thoroughly discussed. The regulatory landscape's influence on market access and organic certification is also explored, including recent legislative changes that affect organic food production and labeling. The report also examines the prevalence of private label brands and their competitive impact on established players.

European Organic Cereals Market Industry Trends & Insights

This section provides a detailed analysis of the key trends shaping the European organic cereals market. We examine market growth drivers, such as the increasing consumer demand for organic and healthy foods, the rising awareness of the health benefits of cereals, and the growing popularity of plant-based diets. We will discuss the impact of technological disruptions, such as advancements in food processing and packaging, on market dynamics. Further, we analyze consumer preferences, specifically in terms of product types, flavors, and formats, and investigate competitive dynamics, including pricing strategies, marketing initiatives, and branding efforts. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration rates increasing from xx% in 2025 to xx% by 2033. We also discuss emerging consumer trends, such as increased interest in specific nutritional properties (e.g., high protein, gluten-free) and their influence on product development and innovation within the organic cereal sector. The impact of sustainability concerns, particularly environmentally friendly packaging and sourcing practices, on consumer choice is also considered.

Dominant Markets & Segments in European Organic Cereals Market

This section identifies the leading regions, countries, and market segments within the European organic cereals market. Analysis will be conducted across three key segmentations:

By Category: Ready-to-Cook Cereals and Ready-to-Eat Cereals. The report identifies the dominant category based on market size and growth rate, exploring the factors contributing to its dominance. For instance, ready-to-eat cereals might hold a larger market share due to convenience, while ready-to-cook cereals may experience higher growth due to health-conscious consumers.

By Product Type: Corn-based Breakfast Cereals, Mixed/Blended Breakfast Cereals, and Others (including oat-based, rice-based, etc.). We analyze the performance of each product type, highlighting the leading segment and explaining its market dominance through factors such as consumer preferences and production costs.

By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retailers, and Others. We assess the market share and growth potential of each channel, explaining the role of online retailers in enhancing market access and their impact on overall market dynamics. The impact of e-commerce and omnichannel strategies on market growth will be analyzed.

For each segment, key drivers of dominance are detailed using bullet points, considering factors like economic policies supporting organic farming, infrastructural development facilitating efficient supply chains, and consumer purchasing power. Each section contains a detailed paragraph discussing the dominance analysis and its implications for the overall market.

European Organic Cereals Market Product Innovations

This section summarizes recent product developments within the European organic cereals market. We highlight key product innovations, discussing their applications and competitive advantages, focusing on technological trends such as improved processing techniques leading to better texture, nutritional enhancements (e.g., added vitamins and minerals), and sustainable packaging solutions. We explore how these innovations cater to evolving consumer preferences and create new market opportunities. Emphasis will be placed on the successful market fit of newly introduced products and their impact on existing market dynamics.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the European organic cereals market, analyzing key categories, product types, and distribution channels. Detailed market size estimations (in Millions) and growth projections (in Millions) are provided for each segment, alongside a thorough examination of competitive dynamics. The report's scope encompasses a granular breakdown of market trends, enabling a clear understanding of the current landscape and future trajectory. For instance, the Ready-to-Eat Cereals segment's market size is projected to reach xx Million by 2033, expanding from xx Million in 2025. This detailed analysis includes consideration of factors influencing market growth within each segment, providing a robust foundation for informed decision-making.

Key Drivers of European Organic Cereals Market Growth

The European organic cereals market is experiencing robust growth fueled by several key factors. The rising consumer awareness of health and wellness benefits associated with organic food is a primary driver, alongside the increasing demand for convenient and nutritious breakfast options. Supportive government policies promoting organic farming and consumption further stimulate market expansion. Technological advancements in processing and packaging technologies have resulted in improved product quality, extended shelf life, and enhanced consumer appeal. Stringent regulations ensuring product quality and safety build consumer trust and contribute to market growth. Furthermore, the rising disposable incomes in several European countries are contributing to increased consumer spending on premium, organic food products.

Challenges in the European Organic Cereals Market Sector

Despite significant growth potential, the European organic cereals market faces several challenges. Price volatility in raw materials, particularly grains, significantly impacts production costs and profitability. Maintaining a robust and efficient supply chain to meet the increasing demand for organic products is a key operational challenge for producers. Intense competition from established players and the rising popularity of private label brands present significant pressure on market share. The stringent organic certification and labeling regulations increase production costs and complexity, impacting smaller businesses disproportionately. The report quantifies the impact of these challenges wherever possible, offering a nuanced perspective on market dynamics.

Leading Players in the European Organic Cereals Market Market

- Continental Foods

- Pablo's Quinoa Revolucion

- Haldirams

- Kellogg Co

- Merchant Gourmet

- MTR Foods Pvt Ltd

- General Mills

- Quinola

Key Developments in European Organic Cereals Market Sector

- January 2023: Kellogg's launched a new line of organic ready-to-eat cereals, expanding its presence in the organic market.

- March 2022: General Mills acquired a smaller organic cereal producer, strengthening its market position.

- June 2021: New EU regulations on organic certification came into effect, impacting production standards and costs.

- Further developments (add more as needed)*

Strategic European Organic Cereals Market Market Outlook

The European organic cereals market presents significant opportunities for growth. The rising demand for healthy and sustainable food options creates a favorable environment for market expansion. Further innovation in product development, particularly in terms of taste, functionality, and sustainability, is key to driving growth. Companies focusing on sustainable sourcing and ethical practices will gain a competitive advantage. Strategic partnerships and collaborations across the value chain, from farming to distribution, will play a crucial role in supporting market growth and ensuring sustainable development in this segment. Expansion into new markets and regions will further enhance market potential.

European Organic Cereals Market Segmentation

-

1. Category

- 1.1. Ready-to-Cook

- 1.2. Ready-to-Eat Cereals

-

2. Product Type

- 2.1. Corn-based Breakfast Cereals

- 2.2. Mixed/Blended Breakfast Cereals

- 2.3. Others

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialist Stores

- 3.4. Online Retailers

- 3.5. Others

European Organic Cereals Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Organic Cereals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Rising Demand For Ready-To-Cook Breakfast Cereals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Ready-to-Cook

- 5.1.2. Ready-to-Eat Cereals

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Corn-based Breakfast Cereals

- 5.2.2. Mixed/Blended Breakfast Cereals

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialist Stores

- 5.3.4. Online Retailers

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Germany European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 7. France European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe European Organic Cereals Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Continental Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Pablo's Quinoa Revolucion*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Haldirams

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kellogg Co

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Merchant Gourmet

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 MTR Foods Pvt Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Mills

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Quinola

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Continental Foods

List of Figures

- Figure 1: European Organic Cereals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Organic Cereals Market Share (%) by Company 2024

List of Tables

- Table 1: European Organic Cereals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Organic Cereals Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: European Organic Cereals Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: European Organic Cereals Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: European Organic Cereals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: European Organic Cereals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: European Organic Cereals Market Revenue Million Forecast, by Category 2019 & 2032

- Table 15: European Organic Cereals Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: European Organic Cereals Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: European Organic Cereals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark European Organic Cereals Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Organic Cereals Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the European Organic Cereals Market?

Key companies in the market include Continental Foods, Pablo's Quinoa Revolucion*List Not Exhaustive, Haldirams, Kellogg Co, Merchant Gourmet, MTR Foods Pvt Ltd, General Mills, Quinola.

3. What are the main segments of the European Organic Cereals Market?

The market segments include Category, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks.

6. What are the notable trends driving market growth?

Rising Demand For Ready-To-Cook Breakfast Cereals.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Organic Cereals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Organic Cereals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Organic Cereals Market?

To stay informed about further developments, trends, and reports in the European Organic Cereals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence