Key Insights

The Benelux foodservice market is projected for substantial growth, estimated to reach 41.74 billion by 2024 and expand at a Compound Annual Growth Rate (CAGR) of 3.06% through 2033. This expansion is driven by evolving consumer preferences for convenience and diverse dining experiences, supported by increasing disposable incomes. Key growth catalysts include the rising popularity of quick-service restaurants (QSRs) and the robust expansion of the 100% home delivery segment, indicating a significant shift towards off-premise dining. The influx of international fast-food brands and the development of local chained outlets are fostering heightened competition and innovation. The market's appeal is further diversified by the emergence of niche concepts like specialized cafes and bars, alongside the continued presence of traditional street food vendors.

Benelux Foodservice Market Market Size (In Billion)

Market dynamics are also influenced by trends such as the increasing demand for health-conscious food options, sustainable sourcing practices, and the integration of digital technologies for ordering and delivery services. Mobile ordering applications and loyalty programs are vital for customer engagement and retention for both large enterprises and independent establishments. Potential market restraints include rising operational costs, labor shortages, and the impact of economic volatility on consumer expenditure. Nevertheless, the strategic positioning within Belgium, the Netherlands, and Luxembourg, each with distinct consumer behaviors and regulatory environments, offers significant opportunities for market diversification and targeted penetration. The competitive arena features a blend of global industry leaders and agile local businesses competing for market share.

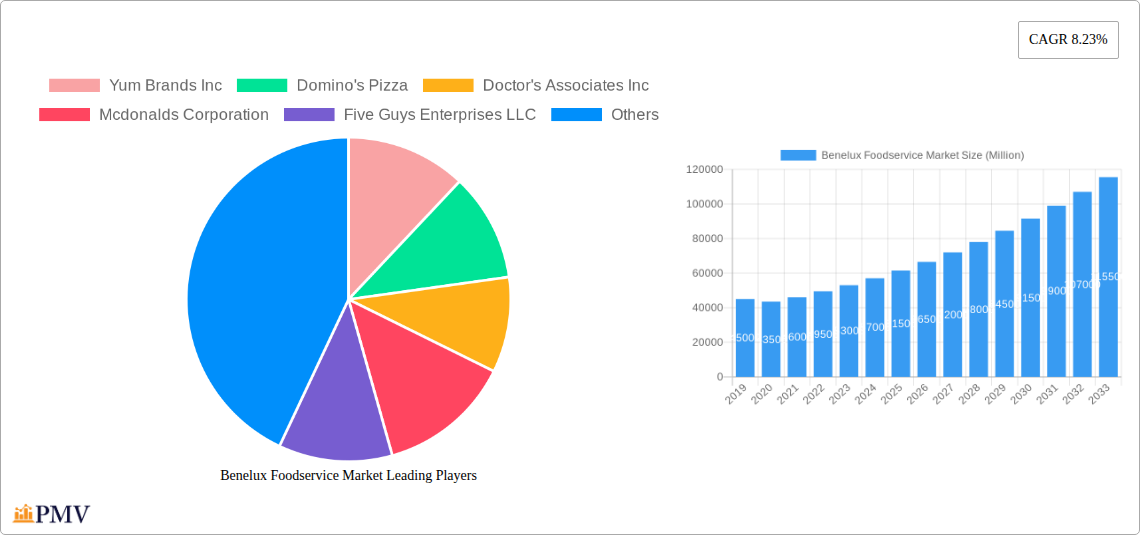

Benelux Foodservice Market Company Market Share

This comprehensive report offers an in-depth analysis of the Benelux foodservice market, covering Belgium, the Netherlands, and Luxembourg. It examines the historical period (2019-2024), the base year (2024), and the forecast period (2024-2033), providing critical insights into market structure, industry trends, dominant segments, product innovations, and key market participants. This report is essential for stakeholders aiming to understand the dynamics of this key European market and seeking strategic guidance for growth and investment.

Benelux Foodservice Market Market Structure & Competitive Dynamics

The Benelux foodservice market exhibits a dynamic competitive landscape characterized by a moderate level of concentration. Leading players, including global giants like McDonald's Corporation and Yum Brands Inc., alongside prominent regional operators such as BC FOODS BV, vie for market share. Innovation ecosystems are flourishing, driven by a demand for diverse culinary experiences and technological advancements in delivery and operational efficiency. Regulatory frameworks, while generally supportive, present varying compliance requirements across the region. Product substitutes are abundant, ranging from home-cooked meals to emerging food tech solutions, necessitating continuous adaptation by foodservice providers. End-user trends lean towards convenience, health-consciousness, and unique dining experiences. Merger and acquisition (M&A) activities, although not always publicly disclosed in detail, play a significant role in market consolidation and expansion. For instance, M&A deals are estimated to be in the tens of millions of Euros annually, impacting market share distribution among key companies. Market share for top players can range from 5% to 15% depending on the specific segment and country.

Benelux Foodservice Market Industry Trends & Insights

The Benelux foodservice market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This expansion is primarily fueled by several key industry trends. Firstly, evolving consumer preferences are driving demand for a wider array of cuisines, healthier options, and plant-based alternatives. The increasing adoption of digital platforms for ordering and delivery has significantly boosted the 100% home delivery segment, contributing to an estimated market penetration of over 70% for online food ordering services in urban areas. Technological disruptions are revolutionizing operations, with investments in AI-powered inventory management, automated kitchen equipment, and sophisticated customer relationship management (CRM) systems becoming crucial for maintaining a competitive edge. The rise of ghost kitchens and virtual brands is also reshaping the market, offering greater flexibility and lower overhead costs for new entrants. Furthermore, a growing emphasis on sustainability and ethical sourcing is influencing consumer choices, pushing brands to adopt eco-friendly practices. The economic stability of the Benelux region, coupled with a high disposable income, underpins consistent consumer spending on dining out and food delivery services. Competitive dynamics are intensified by aggressive pricing strategies, loyalty programs, and a focus on customer experience differentiation. Market penetration for Quick Service Restaurants (QSRs) remains high, while Full-Service Restaurants (FSRs) are adapting by offering enhanced experiential dining.

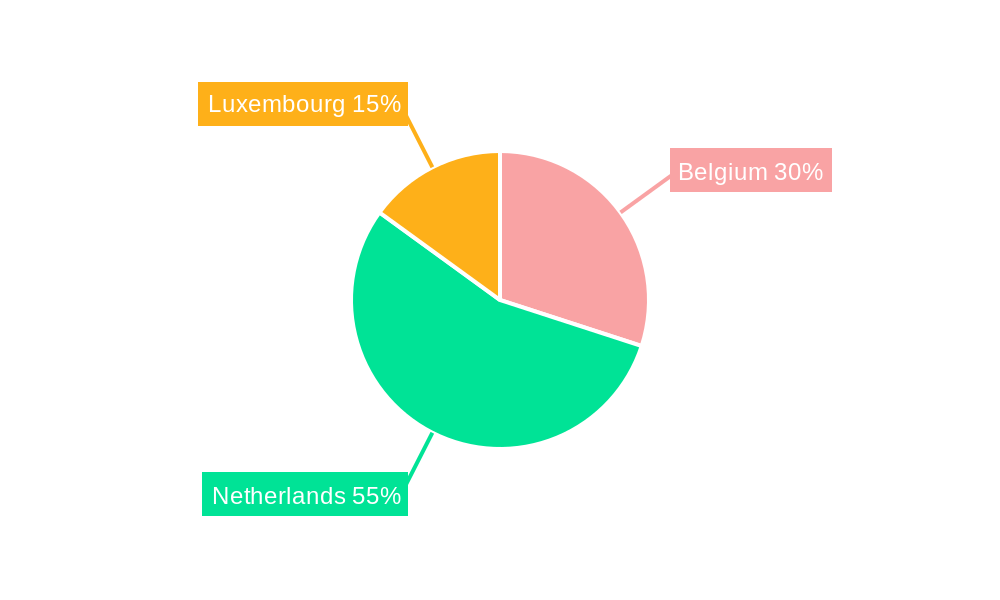

Dominant Markets & Segments in Benelux Foodservice Market

Within the Benelux foodservice market, the Netherlands consistently emerges as the dominant country, accounting for approximately 60% of the total market value, followed by Belgium (35%) and Luxembourg (5%). This dominance is attributed to its larger population, robust economic infrastructure, and a more mature and diversified foodservice landscape. The Quick Service Restaurant (QSR) segment reigns supreme, representing a significant portion of the market due to its widespread appeal for convenience and affordability, with an estimated market share exceeding 40%. Chained outlets also hold a commanding position, benefiting from brand recognition, standardized operations, and economies of scale, capturing over 65% of the market.

- Netherlands:

- Key Drivers: High population density, advanced logistics and delivery networks, significant tourist influx, and a strong culture of dining out.

- Dominance: Leads in QSR, FSR, and home delivery segments due to a higher concentration of global and national chains, as well as a well-developed online food ordering ecosystem.

- Belgium:

- Key Drivers: Rich culinary heritage, diverse tourism, and a strong presence of independent eateries alongside international brands.

- Dominance: Holds a strong position in the FSR and Cafes & Bars segments, catering to a more experiential dining culture.

- Luxembourg:

- Key Drivers: High per capita income, a significant expatriate population, and a demand for premium and international dining options.

- Dominance: Shows strong performance in niche FSRs and premium QSRs, driven by its affluent consumer base.

- Quick Service Restaurants (QSRs):

- Key Drivers: Convenience, speed of service, affordability, and the ubiquity of global brands.

- Dominance: Benefits from widespread accessibility and consistent demand for fast meals, especially in urban centers and transportation hubs.

- Chained Outlets:

- Key Drivers: Brand consistency, efficient supply chains, effective marketing, and strong financial backing.

- Dominance: Their standardized offerings and widespread presence allow them to capture a larger share of the market across various segments.

Benelux Foodservice Market Product Innovations

Product innovation in the Benelux foodservice market is increasingly focused on health, sustainability, and customization. Companies are actively developing plant-based alternatives, such as McDonald's Netherlands' yam-based Yamburger, appealing to environmentally conscious and health-aware consumers. The rise of meal kits and personalized dining experiences, facilitated by advanced ordering platforms, allows for greater menu flexibility and caters to individual dietary needs and preferences.

Report Segmentation & Scope

This comprehensive report segments the Benelux foodservice market across several key dimensions. The Type segmentation includes Full-Service Restaurants (FSRs), Cafes and Bars, Street Stalls and Kiosks, Quick Service Restaurants (QSRs), and 100% Home Delivery Restaurants. The Structure segmentation analyzes Chained Outlets and Independent Outlets. Geographically, the market is divided into Belgium, the Netherlands, and Luxembourg. Each segment's growth projections and market sizes are meticulously analyzed, providing a granular view of the competitive dynamics within each category.

Key Drivers of Benelux Foodservice Market Growth

The Benelux foodservice market's growth is propelled by a confluence of factors. Technologically, the widespread adoption of online ordering and delivery platforms, alongside advancements in kitchen automation, enhances operational efficiency and customer reach. Economically, the region's stable economies and high disposable incomes foster consistent consumer spending on dining out and takeaway. Regulatory factors, while requiring compliance, also shape opportunities, particularly concerning food safety and sustainability standards. The increasing demand for diverse and convenient food options continues to be a primary market accelerator.

Challenges in the Benelux Foodservice Market Sector

Despite robust growth, the Benelux foodservice market faces several challenges. Evolving regulatory landscapes, particularly around labor laws and food safety standards, require constant adaptation and can increase operational costs. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, pose a threat to ingredient availability and pricing stability. Intense competitive pressures from both established brands and emerging players necessitate continuous innovation and cost management. Labor shortages and the rising cost of raw materials further add to the operational complexities within the sector, potentially impacting profit margins by up to 5-10%.

Leading Players in the Benelux Foodservice Market Market

- Yum Brands Inc

- Domino's Pizza

- Doctor's Associates Inc

- Mcdonalds Corporation

- Five Guys Enterprises LLC

- Dea's Pizza

- BC FOODS BV

- Starbucks Corporation

- Papa John's International Inc

- Restaurant Brands International Inc

Key Developments in Benelux Foodservice Market Sector

- 2022: HMSHost International launched a new hot beverage subscription through its Broodzaak cafe chain at 18 railway station locations across the Netherlands, enabling customers to purchase up to five hot beverages daily via QR code.

- 2022: McDonald's Netherlands and organic food enterprise Eosta developed the yam-based burger, "Yamburger," driven by low production costs and interest in plant-based options.

- 2020: Burger King Europe announced a franchise agreement with BKNL BV to expand the Burger King brand's presence in the Netherlands.

Strategic Benelux Foodservice Market Market Outlook

The strategic outlook for the Benelux foodservice market remains highly positive, driven by sustained consumer demand for convenience, diverse culinary experiences, and health-conscious options. The continued expansion of home delivery services and the increasing adoption of technology by both large chains and independent operators are key growth accelerators. Opportunities lie in further leveraging digital platforms for personalized marketing, exploring sustainable sourcing and packaging, and catering to niche dietary requirements. The market is poised for continued expansion, with a focus on innovative business models and enhanced customer engagement to capture future market potential.

Benelux Foodservice Market Segmentation

-

1. Type

- 1.1. Full-Service Restaurant (FSRs)

- 1.2. Cafes and Bars

- 1.3. Street Stalls and Kiosks

- 1.4. Quick Service Restaurants

- 1.5. 100% Home Delivery Restaurant

-

2. Structure

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Geography

- 3.1. Belgium

- 3.2. Netherlands

- 3.3. Luxembourg

Benelux Foodservice Market Segmentation By Geography

- 1. Belgium

- 2. Netherlands

- 3. Luxembourg

Benelux Foodservice Market Regional Market Share

Geographic Coverage of Benelux Foodservice Market

Benelux Foodservice Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Benelux region attracts a significant number of tourists each year

- 3.2.2 particularly to cities like Amsterdam

- 3.2.3 Brussels

- 3.2.4 and Bruges. Tourism contributes significantly to the foodservice market

- 3.2.5 with visitors seeking both local cuisine and international dining options.

- 3.3. Market Restrains

- 3.3.1 The foodservice industry in the Benelux region faces labor shortages

- 3.3.2 particularly in skilled positions such as chefs and waitstaff. This issue is exacerbated by the relatively high cost of labor in these countries

- 3.3.3 which can squeeze profit margins.

- 3.4. Market Trends

- 3.4.1 Consumers in the Benelux region are becoming more health-conscious

- 3.4.2 driving demand for healthier menu options

- 3.4.3 including vegetarian

- 3.4.4 vegan

- 3.4.5 and gluten-free dishes. This trend is influencing menu design across various foodservice segments

- 3.4.6 from fast food to fine dining.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Benelux Foodservice Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Full-Service Restaurant (FSRs)

- 5.1.2. Cafes and Bars

- 5.1.3. Street Stalls and Kiosks

- 5.1.4. Quick Service Restaurants

- 5.1.5. 100% Home Delivery Restaurant

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Belgium

- 5.3.2. Netherlands

- 5.3.3. Luxembourg

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Belgium

- 5.4.2. Netherlands

- 5.4.3. Luxembourg

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Belgium Benelux Foodservice Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Full-Service Restaurant (FSRs)

- 6.1.2. Cafes and Bars

- 6.1.3. Street Stalls and Kiosks

- 6.1.4. Quick Service Restaurants

- 6.1.5. 100% Home Delivery Restaurant

- 6.2. Market Analysis, Insights and Forecast - by Structure

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Belgium

- 6.3.2. Netherlands

- 6.3.3. Luxembourg

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Netherlands Benelux Foodservice Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Full-Service Restaurant (FSRs)

- 7.1.2. Cafes and Bars

- 7.1.3. Street Stalls and Kiosks

- 7.1.4. Quick Service Restaurants

- 7.1.5. 100% Home Delivery Restaurant

- 7.2. Market Analysis, Insights and Forecast - by Structure

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Belgium

- 7.3.2. Netherlands

- 7.3.3. Luxembourg

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Luxembourg Benelux Foodservice Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Full-Service Restaurant (FSRs)

- 8.1.2. Cafes and Bars

- 8.1.3. Street Stalls and Kiosks

- 8.1.4. Quick Service Restaurants

- 8.1.5. 100% Home Delivery Restaurant

- 8.2. Market Analysis, Insights and Forecast - by Structure

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Belgium

- 8.3.2. Netherlands

- 8.3.3. Luxembourg

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Yum Brands Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Domino's Pizza

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Doctor's Associates Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mcdonalds Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Five Guys Enterprises LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dea's Pizza

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 BC FOODS BV

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Starbucks Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Papa John's International Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Restaurant Brands International Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Yum Brands Inc

List of Figures

- Figure 1: Global Benelux Foodservice Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Belgium Benelux Foodservice Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Belgium Benelux Foodservice Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Belgium Benelux Foodservice Market Revenue (billion), by Structure 2025 & 2033

- Figure 5: Belgium Benelux Foodservice Market Revenue Share (%), by Structure 2025 & 2033

- Figure 6: Belgium Benelux Foodservice Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: Belgium Benelux Foodservice Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Belgium Benelux Foodservice Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Belgium Benelux Foodservice Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Netherlands Benelux Foodservice Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Netherlands Benelux Foodservice Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Netherlands Benelux Foodservice Market Revenue (billion), by Structure 2025 & 2033

- Figure 13: Netherlands Benelux Foodservice Market Revenue Share (%), by Structure 2025 & 2033

- Figure 14: Netherlands Benelux Foodservice Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Netherlands Benelux Foodservice Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Netherlands Benelux Foodservice Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Netherlands Benelux Foodservice Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Luxembourg Benelux Foodservice Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Luxembourg Benelux Foodservice Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Luxembourg Benelux Foodservice Market Revenue (billion), by Structure 2025 & 2033

- Figure 21: Luxembourg Benelux Foodservice Market Revenue Share (%), by Structure 2025 & 2033

- Figure 22: Luxembourg Benelux Foodservice Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Luxembourg Benelux Foodservice Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Luxembourg Benelux Foodservice Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Luxembourg Benelux Foodservice Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Benelux Foodservice Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Benelux Foodservice Market Revenue billion Forecast, by Structure 2020 & 2033

- Table 3: Global Benelux Foodservice Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Benelux Foodservice Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Benelux Foodservice Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Benelux Foodservice Market Revenue billion Forecast, by Structure 2020 & 2033

- Table 7: Global Benelux Foodservice Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Benelux Foodservice Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Benelux Foodservice Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Benelux Foodservice Market Revenue billion Forecast, by Structure 2020 & 2033

- Table 11: Global Benelux Foodservice Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Benelux Foodservice Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Benelux Foodservice Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Benelux Foodservice Market Revenue billion Forecast, by Structure 2020 & 2033

- Table 15: Global Benelux Foodservice Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Benelux Foodservice Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Benelux Foodservice Market?

The projected CAGR is approximately 3.06%.

2. Which companies are prominent players in the Benelux Foodservice Market?

Key companies in the market include Yum Brands Inc, Domino's Pizza, Doctor's Associates Inc, Mcdonalds Corporation, Five Guys Enterprises LLC, Dea's Pizza, BC FOODS BV, Starbucks Corporation, Papa John's International Inc, Restaurant Brands International Inc.

3. What are the main segments of the Benelux Foodservice Market?

The market segments include Type, Structure, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.74 billion as of 2022.

5. What are some drivers contributing to market growth?

The Benelux region attracts a significant number of tourists each year. particularly to cities like Amsterdam. Brussels. and Bruges. Tourism contributes significantly to the foodservice market. with visitors seeking both local cuisine and international dining options..

6. What are the notable trends driving market growth?

Consumers in the Benelux region are becoming more health-conscious. driving demand for healthier menu options. including vegetarian. vegan. and gluten-free dishes. This trend is influencing menu design across various foodservice segments. from fast food to fine dining..

7. Are there any restraints impacting market growth?

The foodservice industry in the Benelux region faces labor shortages. particularly in skilled positions such as chefs and waitstaff. This issue is exacerbated by the relatively high cost of labor in these countries. which can squeeze profit margins..

8. Can you provide examples of recent developments in the market?

In 2022, foodservice company HMSHost International launched a new hot beverage subscription through its Broodzaak cafe chain at 18 railway station locations across the Netherlands. Through the subscription, customers can purchase up to five hot beverages a day via a QR code at any of Broodzaak's 18 locations in the Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Benelux Foodservice Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Benelux Foodservice Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Benelux Foodservice Market?

To stay informed about further developments, trends, and reports in the Benelux Foodservice Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence