Key Insights

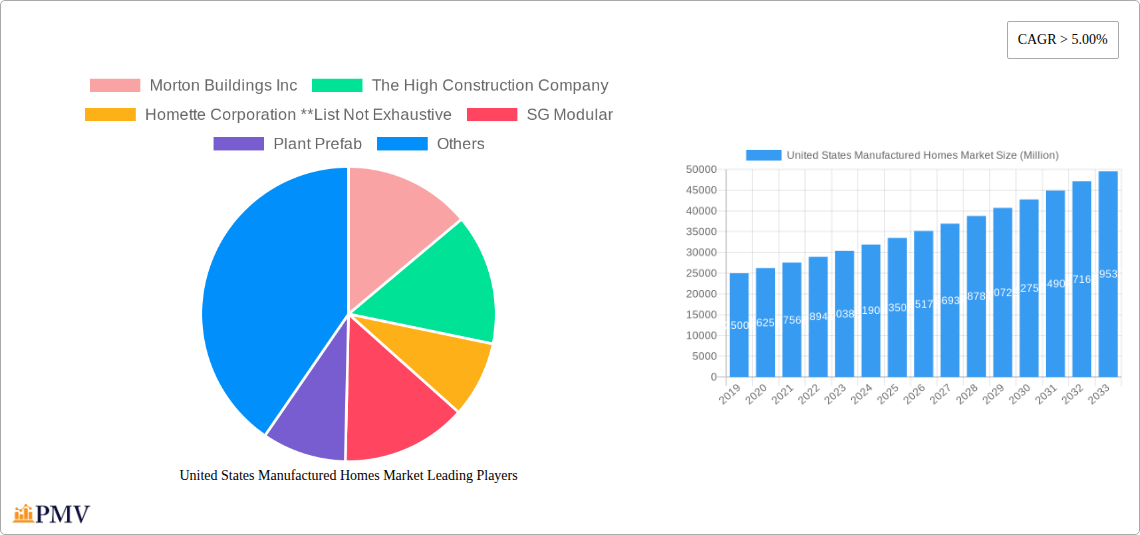

The United States manufactured homes market is projected for substantial growth, with an estimated market size of $27.28 billion in the base year 2025 and a Compound Annual Growth Rate (CAGR) of 5.3%. This expansion is driven by the nation's escalating housing affordability crisis, positioning manufactured homes as a highly accessible and attractive housing solution for a broad demographic. The inherent cost-efficiency and accelerated construction timelines of factory-built homes directly address the increasing demand for budget-friendly housing options. Moreover, continuous advancements in design, materials, and customization are significantly enhancing the appeal and perception of manufactured homes, attracting a wider buyer base seeking modern and comfortable living spaces.

United States Manufactured Homes Market Market Size (In Billion)

Key market drivers include the persistent shortage of affordable housing, particularly in urban and suburban regions, alongside supportive government initiatives promoting accessible housing. Innovations in construction methodologies, such as modular and prefabricated building, are improving efficiency and quality, thereby increasing consumer confidence. The market is segmented into single-family and multi-family units, with single-family homes currently leading the segment, driven by robust demand from individuals and families seeking independent residences. Leading industry players, including Morton Buildings Inc., Skyline Champion Corporation, and Varco Pruden, are at the forefront of this market evolution, investing in technology and expanding production capacities to meet growing demand. Emerging trends also highlight a stronger focus on sustainable building practices and energy-efficient designs within the manufactured housing sector.

United States Manufactured Homes Market Company Market Share

United States Manufactured Homes Market Analysis & Forecast: 2019-2033

This comprehensive report offers in-depth insights into the United States manufactured homes market. Analyzing the historical period (2019-2024), the base year 2025, and an extensive forecast period (2025-2033), this study examines market structure, competitive landscapes, industry trends, dominant segments, product innovations, growth drivers, and key challenges. Understand the strategic initiatives of key players such as Morton Buildings Inc., The High Construction Company, Homette Corporation, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc., Varco Pruden, Affinity Building Systems, and Z Modular. Identify the impact of recent industry developments and actionable strategies for navigating this dynamic sector.

United States Manufactured Homes Market Market Structure & Competitive Dynamics

The United States manufactured homes market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Innovation is driven by advancements in modular construction techniques, energy efficiency, and customizable designs, fostering a competitive ecosystem. Regulatory frameworks, including zoning laws and building codes, play a crucial role in shaping market accessibility and growth, often presenting both opportunities and challenges for manufacturers. Product substitutes, such as site-built homes and other prefabricated housing solutions, exert continuous pressure, necessitating constant product differentiation and value proposition enhancement. End-user trends are increasingly leaning towards affordability, speed of construction, and sustainable living, influencing product development and marketing strategies. Merger and acquisition (M&A) activities are a significant aspect of the market's competitive dynamics. For instance, the acquisition of Manis Custom Builders Inc. by Champion Home Builders for approximately $10 million in May 2022 highlights strategic consolidation efforts aimed at expanding manufacturing capacity and market reach. These M&A activities are crucial for companies seeking to enhance their product portfolios, gain economies of scale, and strengthen their competitive positioning within the evolving US manufactured housing landscape.

United States Manufactured Homes Market Industry Trends & Insights

The United States manufactured homes market is experiencing robust growth, propelled by a confluence of economic, demographic, and technological factors. The increasing demand for affordable housing solutions, particularly in regions with high housing costs and limited land availability, serves as a primary market growth driver. A significant contributing factor is the ongoing housing affordability crisis, which makes manufactured homes an attractive alternative to traditional site-built housing for a wide demographic, from first-time homebuyers to retirees seeking cost-effective living solutions. The market penetration of manufactured homes is steadily increasing as perceptions shift from the older, less sophisticated models to modern, high-quality, and aesthetically pleasing residences. Technological disruptions are playing a pivotal role, with advancements in prefabrication and modular construction enabling faster build times, enhanced quality control, and greater design flexibility. This leads to improved construction efficiency and reduced waste, aligning with growing consumer demand for sustainable building practices. The integration of smart home technologies and energy-efficient features is further enhancing the appeal and value proposition of manufactured homes.

Consumer preferences are evolving, with a greater emphasis on customization, modern design aesthetics, and energy efficiency. Manufacturers are responding by offering a wider array of floor plans, interior finishes, and sustainable material options, moving away from a one-size-fits-all approach. The competitive dynamics are characterized by both established players and emerging innovators focusing on niche markets and specialized products. The ongoing industry developments, such as strategic acquisitions and the expansion of retail footprints, underscore the sector's dynamism. For example, the acquisition of Factory Expo Home Centers by Champion Retail Housing in July 2022 indicates a strategic move to bolster retail presence and direct-to-consumer channels, further driving market penetration. The compound annual growth rate (CAGR) for the United States manufactured homes market is projected to be significant, reflecting sustained demand and increasing adoption. The industry is witnessing a broader acceptance of manufactured homes as a viable and desirable housing option, driven by their inherent cost-effectiveness, rapid deployment capabilities, and increasingly sophisticated designs. This trend is expected to continue, making manufactured homes a critical component of the broader US housing market solution.

Dominant Markets & Segments in United States Manufactured Homes Market

The United States manufactured homes market is characterized by a strong dominance of the Single-Family segment, which consistently represents the largest share of the market. This preference is driven by a multitude of factors, including the enduring American dream of homeownership and the increasing need for individual dwelling units that offer both affordability and privacy. Economic policies that support homeownership, such as accessible mortgage lending and down payment assistance programs, disproportionately benefit the single-family housing sector, including manufactured homes. Furthermore, the adaptability of manufactured homes to diverse geographical locations and land types makes them a versatile solution for individual households across the country.

Key Drivers for Single-Family Dominance:

- Affordability: Single-family manufactured homes offer a significantly lower cost per square foot compared to traditional site-built single-family homes, making homeownership accessible to a broader income bracket.

- Demand for Personal Space: The inherent desire for private living spaces, yards, and individual property remains a powerful driver for single-family housing solutions.

- Favorable Zoning and Land Use: While challenges persist, many communities are increasingly amending zoning regulations to permit the placement of modern manufactured homes in designated areas, further supporting single-family development.

- Economic Policies: Government incentives and housing programs aimed at increasing homeownership often have a direct or indirect positive impact on the demand for single-family manufactured homes.

While the Multi-Family segment is growing, particularly in areas with high population density and a critical need for rental housing, it currently lags behind the single-family segment in overall market share. The growth in the multi-family sector is often spurred by urban development projects, student housing initiatives, and workforce housing solutions where manufactured and modular construction can offer speed and cost efficiencies. However, the established preference for individual homes and the existing infrastructure favoring single-family residences continue to position the Single-Family segment as the dominant force in the United States manufactured homes market. The detailed analysis within this report will further explore the specific market sizes, growth trajectories, and competitive nuances within both these critical segments, providing a granular view of their current standing and future potential.

United States Manufactured Homes Market Product Innovations

Product innovations in the United States manufactured homes market are increasingly focused on enhancing energy efficiency, aesthetic appeal, and smart home integration. Manufacturers are adopting advanced insulation techniques, energy-efficient windows, and solar panel options to reduce operational costs for homeowners and align with sustainability trends. Modern designs feature more customizable floor plans, attractive exterior finishes, and higher-quality interior materials, blurring the lines between manufactured and traditional site-built homes. The integration of smart home technology, including connected appliances, smart thermostats, and enhanced security systems, is also becoming a standard offering, appealing to tech-savvy consumers. These innovations provide a significant competitive advantage by meeting evolving consumer demands for modern, comfortable, and sustainable living spaces, thereby expanding the market appeal of manufactured housing.

Report Segmentation & Scope

This comprehensive report segments the United States manufactured homes market primarily by Type: Single Family and Multi Family. The Single Family segment encompasses detached manufactured homes designed for individual households, catering to a broad range of demographic needs from first-time buyers to retirees. This segment is projected to maintain its leading market position due to its inherent affordability and widespread consumer preference for private residences. The Multi Family segment includes manufactured housing designed for shared living spaces, such as apartment complexes or townhouses. While currently smaller in market share, this segment is expected to witness significant growth, driven by the increasing demand for affordable rental housing solutions in urban and suburban areas, and the cost-effectiveness of modular construction for multi-unit developments. The report provides detailed market sizes, growth projections, and competitive dynamics for each of these key segments.

Key Drivers of United States Manufactured Homes Market Growth

The United States manufactured homes market growth is propelled by several key drivers. The persistent housing affordability crisis across the nation is a primary catalyst, making manufactured homes an accessible alternative to traditional housing. Technological advancements in modular construction and prefabrication enable faster production times, reduced costs, and improved quality control, enhancing the appeal of manufactured homes. Furthermore, evolving consumer preferences for modern designs, energy efficiency, and customizable living spaces are being met by innovative manufacturers. Favorable government policies, including incentives for affordable housing development and updated zoning regulations that permit manufactured homes, also contribute significantly. The increasing acceptance of manufactured homes as a legitimate and high-quality housing option, shedding outdated stigmas, is a crucial driver for sustained market expansion.

Challenges in the United States Manufactured Homes Market Sector

Despite robust growth, the United States manufactured homes market faces several challenges. Persistent negative perceptions and outdated stereotypes associated with older manufactured housing models can hinder broader market acceptance. Stringent and varied zoning regulations across different municipalities often create barriers to placement and development, limiting where manufactured homes can be legally installed. Supply chain disruptions and fluctuations in the cost of raw materials, such as lumber and steel, can impact production costs and timelines, affecting affordability and delivery schedules. Intense competition from the site-built housing sector and other prefabricated construction methods also exerts pressure on market share. Additionally, limited availability of suitable land for installation and the perceived challenges in securing financing for manufactured homes compared to traditional properties can also act as restraints.

Leading Players in the United States Manufactured Homes Market Market

- Morton Buildings Inc

- The High Construction Company

- Homette Corporation

- SG Modular

- Plant Prefab

- Skyline Champion Corporation

- Westchester Modular Homes Inc

- Varco Pruden

- Affinity Building Systems

- Z Modular

Key Developments in United States Manufactured Homes Market Sector

- July 2022: Champion Retail Housing, a subsidiary of Skyline Champion Corporation, acquired the assets and management of Factory Expo Home Centers, expanding their retail footprint with these centers situated at 12 Skyline Champion manufacturing plants across the United States.

- May 2022: Champion Home Builders significantly expanded its manufacturing capabilities by purchasing nearly all operating assets of Manis Custom Builders Inc. and related companies for approximately $10 million. This acquisition added a 250,000 square foot campus in Laurinburg, NC, and a Manis retail location to their existing North Carolina operations.

Strategic United States Manufactured Homes Market Market Outlook

The strategic outlook for the United States manufactured homes market is highly promising, driven by escalating demand for affordable and rapidly deployable housing solutions. Growth accelerators include continued innovation in design and technology, leading to more sustainable and aesthetically pleasing homes. The increasing acceptance of modular and off-site construction methods as efficient alternatives to traditional building practices will further propel the market. Government initiatives focused on addressing the housing shortage and promoting affordable homeownership are expected to provide significant tailwinds. Strategic opportunities lie in expanding into new geographical markets, developing specialized housing solutions for diverse demographic needs, and leveraging digital platforms for sales and customer engagement. The market is poised for sustained expansion as manufacturers continue to address cost, speed, and quality imperatives, solidifying the role of manufactured homes in the national housing landscape.

United States Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

United States Manufactured Homes Market Segmentation By Geography

- 1. United States

United States Manufactured Homes Market Regional Market Share

Geographic Coverage of United States Manufactured Homes Market

United States Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. States in the US Spending the Most on Manufactured Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Morton Buildings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The High Construction Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Homette Corporation **List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SG Modular

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plant Prefab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Skyline Champion Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Westchester Modular Homes Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Varco Pruden

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affinity Building Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Z Modular

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Morton Buildings Inc

List of Figures

- Figure 1: United States Manufactured Homes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: United States Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Manufactured Homes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: United States Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: United States Manufactured Homes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Manufactured Homes Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the United States Manufactured Homes Market?

Key companies in the market include Morton Buildings Inc, The High Construction Company, Homette Corporation **List Not Exhaustive, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, Z Modular.

3. What are the main segments of the United States Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

States in the US Spending the Most on Manufactured Housing.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

July 2022: The Factory Expo Home Centers are situated at 12 Skyline Champion manufacturing plants around the United States. Champion Retail Housing, a subsidiary of Skyline Champion Corporation, agreed with Alta Cima Corporation to purchase the assets and take over the management of the Factory Expo Home Centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the United States Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence