Key Insights

The Denmark luxury residential real estate market is poised for significant expansion, propelled by a strong economy, a rising population of high-net-worth individuals, and a growing demand for premium properties. The market caters to varied preferences through its segmentation into villas and condominiums. Current market estimations indicate a substantial value, with a projected Compound Annual Growth Rate (CAGR) of 4.4%, reaching a market size of 81.6 million by 2023. Increased tourism and a favorable investment environment further stimulate this growth, attracting both domestic and international investors. However, constraints such as limited land availability in prime urban locations and stringent building regulations may temper expansion. Competition among leading developers like NRE Group and Rodgaard Ejendomme drives innovation in design and sustainability to attract discerning buyers.

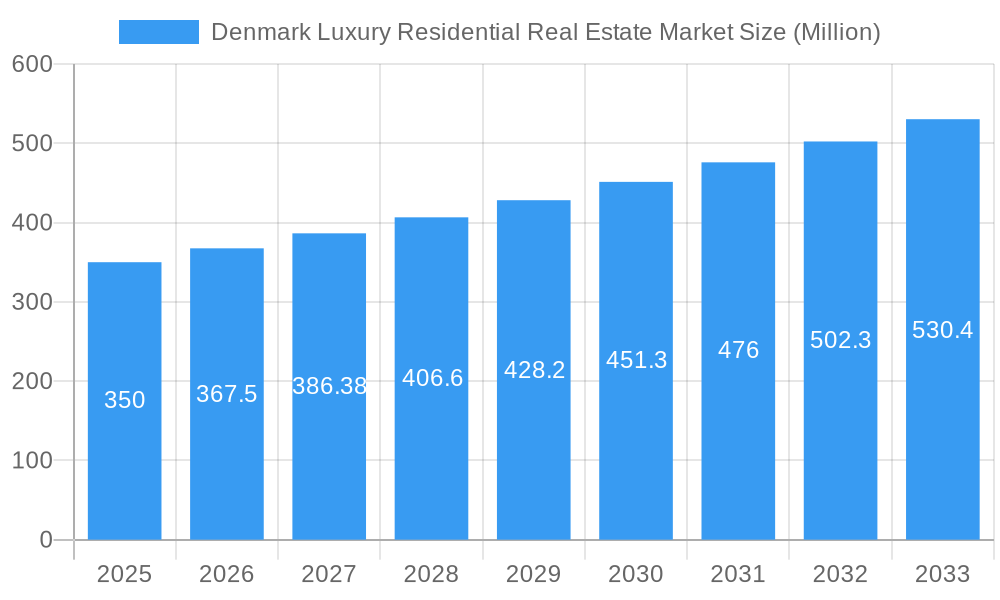

Denmark Luxury Residential Real Estate Market Market Size (In Million)

Projections for the next decade anticipate sustained market growth, supported by Denmark's robust economy and continued affluent resident inflow. Potential economic slowdowns or shifts in global investment trends represent key risks to monitor. High-end properties are expected to remain a preferred asset class, underpinned by investor confidence and Denmark's desirable lifestyle. Strategic focus on sustainability, technological integration, and distinctive property features will be crucial for success in this evolving market.

Denmark Luxury Residential Real Estate Market Company Market Share

Denmark Luxury Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Denmark luxury residential real estate market from 2019 to 2033, offering invaluable insights for investors, developers, and industry professionals. The study covers market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key growth drivers, along with challenges and a strategic outlook. With a base year of 2025 and a forecast period spanning 2025-2033, this report leverages historical data (2019-2024) to deliver accurate and actionable predictions for the future of luxury residential real estate in Denmark.

Keywords: Denmark luxury real estate, Danish real estate market, Copenhagen real estate, Aarhus real estate, luxury villas Denmark, luxury apartments Denmark, real estate investment Denmark, NRE Group, Rodgaard Ejendomme, Kaj Ove Madsen A/S, Zasa Ejendomme, 1927 Estate, Krobi, Juvel Ejendomme, Bruce Turner, Fink Ejendomme, Unika Ejendomme ApS, real estate market analysis, luxury property market trends, Danish luxury housing market, residential real estate forecast, real estate market size, CAGR, market share, M&A activity

Denmark Luxury Residential Real Estate Market Structure & Competitive Dynamics

The Denmark luxury residential real estate market exhibits a moderately concentrated structure, with a few large players and numerous smaller firms vying for market share. Key players such as NRE Group, Rodgaard Ejendomme, and Kaj Ove Madsen A/S hold significant positions, although precise market share data is proprietary. The market's competitive landscape is characterized by innovation in design and construction, driven by both established players and emerging firms. Regulatory frameworks, such as building codes and zoning regulations, significantly influence development and pricing. Product substitutes, such as high-end rental properties, exert some competitive pressure. End-user preferences, influenced by factors like lifestyle and location, shape demand. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million. Notable examples include Orange Capital Partners' June 2022 acquisition of a portfolio from NREP, demonstrating ongoing consolidation.

- Market Concentration: Moderately concentrated with leading players holding significant but not dominant shares.

- Innovation: Strong focus on sustainable and high-tech design, impacting new construction and renovations.

- Regulatory Framework: Influences development costs and project viability.

- Product Substitutes: High-end rental properties represent a competitive alternative to outright purchases.

- End-User Trends: Increasing demand for sustainable, eco-friendly, and smart homes, as well as properties in prime locations.

- M&A Activity: Moderate levels of activity with deal values varying significantly.

Denmark Luxury Residential Real Estate Market Industry Trends & Insights

The Denmark luxury residential real estate market is experiencing consistent growth, driven by several key factors. Strong economic performance and increasing disposable incomes among high-net-worth individuals fuel demand. The influx of foreign investment and the popularity of Denmark as a desirable location for expats also contribute to market growth. Technological advancements influence design, construction, and property management, improving efficiency and luxury features. Consumer preferences gravitate toward sustainable materials, smart home technology, and unique architectural designs. Competitive dynamics are shaped by innovation, location, and branding, with companies investing heavily in creating distinctive projects to stand out. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be approximately xx%. Market penetration of luxury properties is expected to increase by approximately xx% by 2033.

Dominant Markets & Segments in Denmark Luxury Residential Real Estate Market

Copenhagen and Aarhus remain the dominant markets for luxury residential properties, driven by strong economic activity, high concentrations of affluent residents, and superior infrastructure. Within segments, the luxury villa/landed house segment commands a higher average price point, although both segments exhibit growth potential.

Key Drivers for Dominance:

- Copenhagen: Strong economy, high concentration of high-net-worth individuals, excellent infrastructure, and desirable lifestyle.

- Aarhus: Growing economy, cultural attractions, relatively lower cost than Copenhagen, making it attractive to affluent buyers.

- Villas/Landed Houses: Appeals to buyers seeking larger spaces, privacy, and exclusive amenities.

- Condominiums/Apartments: Attractive for their central locations, amenities, and lower maintenance requirements.

The dominance analysis shows a clear preference for prime locations within Copenhagen and Aarhus, but increasing urbanization is pushing growth in other smaller Danish cities. Government policies supporting sustainable developments are boosting demand for eco-friendly luxury properties.

Denmark Luxury Residential Real Estate Market Product Innovations

Recent innovations include sustainable building materials, smart home technology integration (energy-efficient systems, automated lighting and security), and unique architectural designs. These innovations are driving enhanced luxury and appeal to environmentally conscious high-net-worth individuals, giving developers a competitive edge. The market is actively embracing technological advancements to improve the overall living experience and property value.

Report Segmentation & Scope

The report segments the market by property type:

Villas/Landed Houses: This segment comprises luxury detached houses and large plots of land with significant growth expected driven by continued demand for space and privacy among high-net-worth individuals. Market size is estimated at xx Million in 2025 and projected to grow to xx Million by 2033. Competition in this segment is characterized by differentiation through unique architectural designs and high-quality finishes.

Condominiums/Apartments: This segment includes luxury apartments and penthouses in high-rise buildings and exclusive developments, with significant growth driven by urban living preferences among younger, affluent buyers. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033. Competition is fierce, with developers focusing on amenity offerings and prime locations.

Key Drivers of Denmark Luxury Residential Real Estate Market Growth

Several factors contribute to the market's growth. Strong economic conditions and high disposable incomes fuel demand for luxury homes. Government policies promoting sustainable developments attract investment. A robust infrastructure ensures livability, and the increasing popularity of Denmark as a global destination attracts international buyers.

Challenges in the Denmark Luxury Residential Real Estate Market Sector

The market faces challenges, including limited land availability in prime areas, increasing construction costs, and stringent environmental regulations. These factors influence project feasibility and pricing, potentially affecting market growth trajectory. Furthermore, supply chain disruptions can impact construction timelines and budgets.

Leading Players in the Denmark Luxury Residential Real Estate Market Market

- NRE Group

- Rodgaard Ejendomme

- Kaj Ove Madsen A/S

- Zasa Ejendomme

- 1927 Estate

- Krobi

- Juvel Ejendomme

- Bruce Turner

- Fink Ejendomme

- Unika Ejendomme ApS

Key Developments in Denmark Luxury Residential Real Estate Market Sector

- June 2022: Orange Capital Partners acquired a portfolio of seven residential blocks (1,220 apartments) from NREP in Copenhagen and Aarhus for an undisclosed sum. This signifies significant investment in the rental market segment.

- November 2022: AkademikerPension announced plans to significantly expand its real estate allocation, shifting towards a 50% residential focus by 2026, indicating increased institutional investment in the residential sector, particularly in Copenhagen and Aarhus, with 25% allocated to smaller Danish cities.

Strategic Denmark Luxury Residential Real Estate Market Outlook

The Denmark luxury residential real estate market presents significant growth opportunities. Continued economic strength, increased high-net-worth individuals, and ongoing investment in sustainable and innovative developments will drive future growth. Strategic opportunities exist in catering to specific niche demands, like eco-friendly construction and smart home technology integration. Developers focusing on sustainable and design-forward projects in prime locations are well-positioned to capture market share.

Denmark Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Geography

- 2.1. Copenhagen

- 2.2. Aarhus

- 2.3. Odense

- 2.4. Aalborg

- 2.5. Rest of Denmark

Denmark Luxury Residential Real Estate Market Segmentation By Geography

- 1. Copenhagen

- 2. Aarhus

- 3. Odense

- 4. Aalborg

- 5. Rest of Denmark

Denmark Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Denmark Luxury Residential Real Estate Market

Denmark Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Increasing demand for luxury residences driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Copenhagen

- 5.2.2. Aarhus

- 5.2.3. Odense

- 5.2.4. Aalborg

- 5.2.5. Rest of Denmark

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Copenhagen

- 5.3.2. Aarhus

- 5.3.3. Odense

- 5.3.4. Aalborg

- 5.3.5. Rest of Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Copenhagen Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Copenhagen

- 6.2.2. Aarhus

- 6.2.3. Odense

- 6.2.4. Aalborg

- 6.2.5. Rest of Denmark

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Aarhus Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Copenhagen

- 7.2.2. Aarhus

- 7.2.3. Odense

- 7.2.4. Aalborg

- 7.2.5. Rest of Denmark

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Odense Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Copenhagen

- 8.2.2. Aarhus

- 8.2.3. Odense

- 8.2.4. Aalborg

- 8.2.5. Rest of Denmark

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Aalborg Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Copenhagen

- 9.2.2. Aarhus

- 9.2.3. Odense

- 9.2.4. Aalborg

- 9.2.5. Rest of Denmark

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Denmark Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Copenhagen

- 10.2.2. Aarhus

- 10.2.3. Odense

- 10.2.4. Aalborg

- 10.2.5. Rest of Denmark

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NRE Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rodgaard Ejendomme

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaj Ove Madsen A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zasa Ejendomme

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1927 Estate

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Krobi**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Juvel Ejendomme

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bruce Turner

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fink Ejendomme

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unika Ejendomme ApS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NRE Group

List of Figures

- Figure 1: Denmark Luxury Residential Real Estate Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Denmark Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 3: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 9: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: Denmark Luxury Residential Real Estate Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Luxury Residential Real Estate Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Denmark Luxury Residential Real Estate Market?

Key companies in the market include NRE Group, Rodgaard Ejendomme, Kaj Ove Madsen A/S, Zasa Ejendomme, 1927 Estate, Krobi**List Not Exhaustive, Juvel Ejendomme, Bruce Turner, Fink Ejendomme, Unika Ejendomme ApS.

3. What are the main segments of the Denmark Luxury Residential Real Estate Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.6 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Increasing demand for luxury residences driving the market.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

November 2022: The AkademikerPension expands real estate allocation. Whereas the portfolio currently consists primarily of offices in Copenhagen, the distribution in 2026 should be 50% residential, 30% offices, and various construction projects. Most investments will be made in Copenhagen and Aarhus, but approximately 25% of the real estate investments will be made in smaller Danish cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Denmark Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence