Key Insights

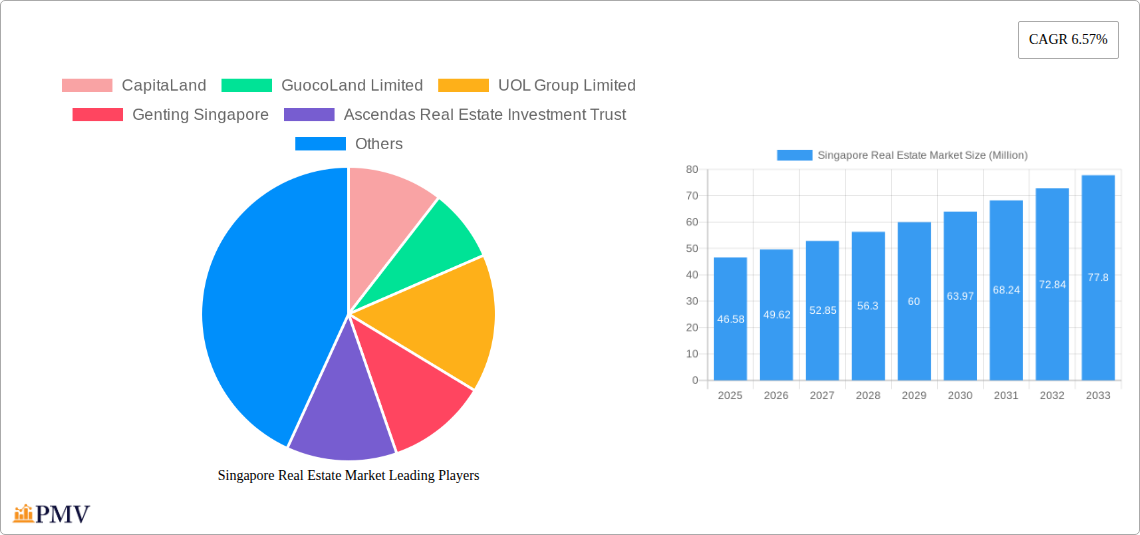

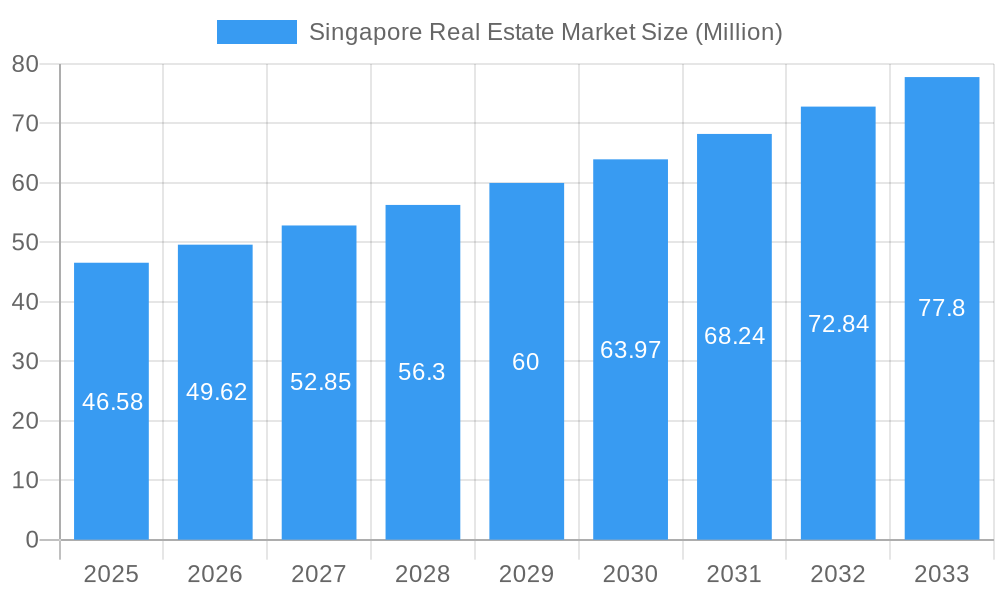

The Singapore Real Estate Market is projected to reach a significant valuation of $46.58 million by 2025, demonstrating robust growth with a compound annual growth rate (CAGR) of 6.57% over the forecast period from 2025 to 2033. This upward trajectory is driven by a confluence of factors including strong government initiatives aimed at enhancing urban living and sustainability, sustained demand from both local and international investors attracted to Singapore's stable economic environment, and a burgeoning population that fuels the need for diverse housing solutions. The market is segmented into various property types, including apartments, condominiums, and villas, catering to a wide spectrum of buyers. Furthermore, the value proposition spans across premium, luxury, and affordable segments, reflecting the diverse purchasing power and preferences within the nation. Key players like CapitaLand, GuocoLand Limited, and UOL Group Limited are at the forefront, actively shaping the market landscape through strategic developments and investments.

Singapore Real Estate Market Market Size (In Million)

The market's dynamism is further amplified by emerging trends such as the increasing focus on smart home technologies and sustainable building practices, aligning with Singapore's vision of a "City in a Garden." The government's continuous efforts to streamline property regulations and introduce policies that encourage homeownership, particularly for first-time buyers, are also contributing to market resilience. While the market benefits from strong economic fundamentals and government support, potential restraints might include evolving interest rate environments and global economic uncertainties, which could influence buyer sentiment and investment decisions. Nevertheless, the underlying demand, coupled with ongoing infrastructure development and the city-state's appeal as a global hub, positions the Singapore Real Estate Market for continued expansion and evolution throughout the forecast period.

Singapore Real Estate Market Company Market Share

This in-depth report provides a detailed examination of the Singapore real estate market, offering critical insights into its structure, trends, dominant segments, and future outlook. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this analysis is essential for investors, developers, policymakers, and industry professionals seeking to understand the dynamics of one of Asia's most vibrant property markets. We meticulously analyze key segments including Apartments, Condominiums, Villas, and Other Types, across the Value spectrum of Premium, Luxury, and Affordable housing.

Singapore Real Estate Market Market Structure & Competitive Dynamics

The Singapore real estate market exhibits a moderately concentrated structure, dominated by a few large developers and investment trusts. Key players like CapitaLand, GuocoLand Limited, UOL Group Limited, Genting Singapore, Ascendas Real Estate Investment Trust, City Developments Limited, Global Logistics Properties, EL Development Pte Limited, Frasers Property, and Far East Organization hold significant market share, though a healthy competitive landscape fosters innovation. The regulatory framework, overseen by authorities like the Urban Redevelopment Authority (URA) and Housing & Development Board (HDB), is robust, influencing land sales, development controls, and property cooling measures. Product substitutes, while limited in the residential sector due to land scarcity, exist in commercial and industrial spaces. End-user trends are increasingly shifting towards smart homes, sustainable living, and mixed-use developments, driven by evolving lifestyle preferences and government initiatives. Merger and acquisition (M&A) activities, while sometimes strategic, are carefully scrutinized to maintain market stability, with significant deal values, though specific figures vary. The market's innovation ecosystem is driven by technology adoption in construction and property management, alongside a focus on integrated urban planning.

Singapore Real Estate Market Industry Trends & Insights

The Singapore real estate market is poised for sustained growth, fueled by a confluence of economic stability, strategic government planning, and evolving lifestyle demands. The Compound Annual Growth Rate (CAGR) for the overall market is projected to be strong, driven by factors such as a consistently high population density, a growing affluent segment, and a stable political environment that attracts foreign investment. Technological disruptions are increasingly shaping the industry, with PropTech solutions enhancing property management, sales processes, and construction efficiency. The adoption of artificial intelligence for market analysis and virtual reality for property viewing are becoming mainstream. Consumer preferences are leaning towards flexible living arrangements, eco-friendly designs, and integrated community spaces. Demand for smart homes, energy-efficient buildings, and amenities that support a healthy lifestyle is on the rise. Competitive dynamics are characterized by intense competition among established developers, with a growing focus on niche markets and differentiated offerings. Market penetration of integrated developments and serviced residences is expected to increase, catering to both local and international buyers. The government's proactive approach to urban planning and land reclamation ensures a steady supply of diverse housing options, further stimulating market activity and contributing to its resilience.

Dominant Markets & Segments in Singapore Real Estate Market

Within the Singapore real estate market, Condominiums emerge as a dominant segment, accounting for a significant portion of new developments and resale transactions. This dominance is driven by factors such as their appeal to both first-time homebuyers and investors, offering a blend of private amenities and convenient locations. The Premium and Luxury value segments within condominiums are particularly strong, reflecting Singapore's status as a global financial hub and its attractiveness to high-net-worth individuals.

- Economic Policies: Pro-growth economic policies, coupled with attractive investment incentives for foreign buyers, have consistently bolstered the premium and luxury segments.

- Infrastructure Development: The continuous expansion and upgrading of public transportation networks, including new MRT lines, enhance the accessibility and desirability of condominium developments in various neighborhoods.

- Urban Planning: Strategic urban planning by government bodies, focusing on creating vibrant, well-connected residential enclaves, directly supports the demand for well-appointed condominiums.

The Apartment segment, particularly public housing (HDB flats), remains the bedrock of Singapore's housing landscape, catering to a broader demographic and ensuring affordability. While not always driving headline-grabbing value, its sheer volume and consistent demand make it a critical and stable component of the market.

- Government Housing Initiatives: The government's commitment to providing affordable and quality public housing through programs like Build-to-Order (BTO) schemes ensures sustained demand and market stability for apartments.

- High Population Density: The inherent land scarcity and high population density necessitate efficient and accessible housing solutions, where apartments play a crucial role.

The Villas segment, though niche due to land constraints and high entry costs, continues to attract a discerning clientele seeking exclusivity and bespoke living experiences, often found in prime districts. Other Types, encompassing commercial, industrial, and mixed-use properties, also represent significant investment opportunities, driven by Singapore's role as a regional business hub.

Singapore Real Estate Market Product Innovations

Product innovations in the Singapore real estate market are increasingly focused on sustainability and smart living. Developers are incorporating eco-friendly materials, energy-efficient designs, and advanced building management systems to reduce environmental impact and operational costs. The integration of smart home technology, offering enhanced convenience and security through connected devices and AI-powered solutions, is a key differentiator. These innovations cater to a growing demand for technologically advanced and environmentally conscious living spaces, providing competitive advantages to developers who can effectively deliver these features.

Report Segmentation & Scope

This report segments the Singapore real estate market by property Type: Apartments, Condominiums, Villas, and Other Types (including commercial and industrial properties). It further segments by Value: Premium, Luxury, and Affordable housing.

- Apartments: This segment primarily encompasses public housing (HDB flats) and executive condominiums. The Affordable segment within Apartments is projected to maintain steady demand, driven by government housing policies and the needs of the majority of the population. Market size is substantial, with significant growth in the forecast period due to ongoing HDB development projects.

- Condominiums: Covering a wide range of price points from mid-range to high-end, Condominiums are analyzed across Premium and Luxury Value segments. Forecasts indicate strong growth, particularly in the Premium and Luxury segments, driven by urban influx and investment appetite. Competitive dynamics are intense among developers offering diverse unit configurations and lifestyle amenities.

- Villas: This niche segment, characterized by exclusive landed properties, is analyzed within the Luxury Value segment. While its market size is smaller, it commands high transaction values. Growth is expected to be steady, driven by demand from ultra-high-net-worth individuals seeking bespoke residences.

- Other Types: This broad category includes commercial, industrial, and retail spaces. The analysis will delve into their market sizes and growth projections, considering Singapore's role as a global business hub. Competitive dynamics will be influenced by economic growth, e-commerce trends, and industrial diversification.

Key Drivers of Singapore Real Estate Market Growth

Singapore's real estate market growth is propelled by a robust economy with high per capita income, attracting significant foreign direct investment. A stable political climate and transparent legal framework foster investor confidence. Proactive government policies, including urban planning initiatives and infrastructure development, create an environment conducive to sustainable growth. Technological advancements in construction and property management are enhancing efficiency and creating new development possibilities. The demand for quality housing, driven by a growing population and lifestyle aspirations, remains a fundamental growth driver.

Challenges in the Singapore Real Estate Market Sector

Despite its strengths, the Singapore real estate market faces challenges. Land scarcity is an inherent constraint, leading to high property prices and intense competition for development sites. Stringent regulations and cooling measures, while aimed at market stability, can sometimes impact transaction volumes and developer margins. Global economic uncertainties and interest rate fluctuations can influence buyer sentiment and investment flows. Furthermore, evolving sustainability mandates require significant investment in green building technologies.

Leading Players in the Singapore Real Estate Market Market

- CapitaLand

- GuocoLand Limited

- UOL Group Limited

- Genting Singapore

- Ascendas Real Estate Investment Trust

- City Developments Limited

- Global Logistics Properties

- EL Development Pte Limited

- Frasers Property

- Far East Organization

Key Developments in Singapore Real Estate Market Sector

- April 2024: Two historical buildings in the Pearl’s Hill vicinity are set for demolition to make way for new housing developments. The government plans to build 6,000 new homes in the area over the next decade. A key housing site is located at the intersection of Chin Swee and Outram roads, while a white site sits primarily atop the underground Outram Park MRT station. This 2.9 ha white site, with a plot ratio of 6.3, is planned to include condominium units and long-term serviced apartments, addressing diverse housing needs and enhancing urban living.

- March 2024: To meet the escalating demand for homes, the government decided to launch a new housing area in Yishun, with potential for a new residential neighborhood at Gillman Barracks. Approximately 10,000 homes will be constructed in the new Yishun estate of Chencharu, situated near Khatib MRT station. At least 80% of these homes will be public housing, with the first Build-to-Order (BTO) project, comprising 1,200 units of two-room Flexi to five-room flats, slated for launch in 2024, significantly boosting the affordable housing supply.

Strategic Singapore Real Estate Market Market Outlook

The strategic outlook for the Singapore real estate market remains exceptionally strong, driven by its role as a global financial and business hub. Continuous government investment in infrastructure and urban rejuvenation, coupled with a commitment to sustainability and smart city initiatives, will continue to attract both domestic and international investors. The market is expected to benefit from ongoing demand for quality residential properties, driven by population growth and an increasing number of expatriates. Opportunities exist in the development of integrated mixed-use projects, serviced residences, and niche luxury segments. Embracing technological advancements and sustainable practices will be crucial for long-term success and value creation in this dynamic market.

Singapore Real Estate Market Segmentation

-

1. Type

- 1.1. Apartment

- 1.2. Condominiums

- 1.3. Villas

- 1.4. Other Types

-

2. Value

- 2.1. Premium

- 2.2. Luxury

- 2.3. Affordable

Singapore Real Estate Market Segmentation By Geography

- 1. Singapore

Singapore Real Estate Market Regional Market Share

Geographic Coverage of Singapore Real Estate Market

Singapore Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Economic Growth; High Demand for Property Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Rise in the Residential Segment of the Singapore Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartment

- 5.1.2. Condominiums

- 5.1.3. Villas

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Value

- 5.2.1. Premium

- 5.2.2. Luxury

- 5.2.3. Affordable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CapitaLand

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GuocoLand Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UOL Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genting Singapore

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascendas Real Estate Investment Trust

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 City Developments Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Logistics Properties

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EL Development Pte Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Frasers Property**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Far East Organization

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CapitaLand

List of Figures

- Figure 1: Singapore Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Singapore Real Estate Market Revenue Million Forecast, by Value 2020 & 2033

- Table 3: Singapore Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Singapore Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Singapore Real Estate Market Revenue Million Forecast, by Value 2020 & 2033

- Table 6: Singapore Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Real Estate Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Singapore Real Estate Market?

Key companies in the market include CapitaLand, GuocoLand Limited, UOL Group Limited, Genting Singapore, Ascendas Real Estate Investment Trust, City Developments Limited, Global Logistics Properties, EL Development Pte Limited, Frasers Property**List Not Exhaustive, Far East Organization.

3. What are the main segments of the Singapore Real Estate Market?

The market segments include Type, Value.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Economic Growth; High Demand for Property Boosting the Market.

6. What are the notable trends driving market growth?

Rise in the Residential Segment of the Singapore Real Estate Market.

7. Are there any restraints impacting market growth?

Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

April 2024: Two historical buildings in the Pearl’s Hill vicinity are set to be demolished to make way for new housing developments. The government plans to build 6,000 new homes in the area over the next decade. The third housing site is located at the intersection of Chin Swee and Outram roads, while the white site sits primarily atop the underground Outram Park MRT station. The 2.9 ha white site, with a plot ratio of 6.3, has condominium units and long-term serviced apartments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Real Estate Market?

To stay informed about further developments, trends, and reports in the Singapore Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence