Key Insights

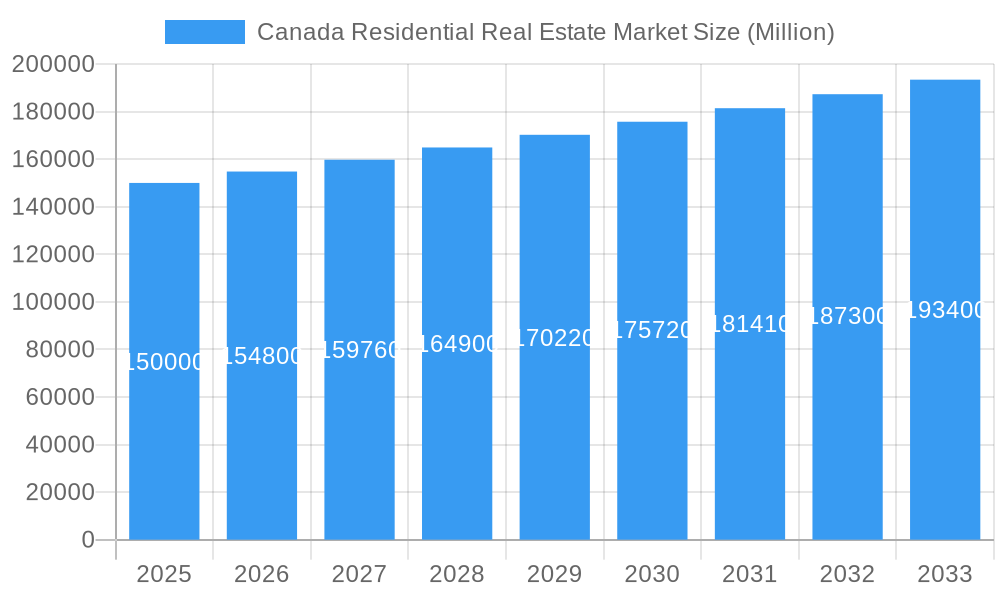

The Canadian residential real estate market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size data), is projected to experience steady growth with a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is driven by several key factors, including a growing population, particularly in major urban centers like Toronto, Vancouver, and Montreal, increasing urbanization, and strong economic fundamentals in certain regions. Demand for various property types, including apartments and condominiums, as well as villas and landed houses, contributes to the market's dynamism. However, factors such as interest rate fluctuations, affordability concerns in major metropolitan areas, and potential regulatory changes pose challenges to sustained market expansion. The market is segmented geographically, with Eastern, Western, and Central Canada exhibiting varying growth trajectories influenced by regional economic conditions and government policies. Leading developers and real estate firms, including Aquilini Development, Century 21 Canada, and Bosa Properties, actively shape the market landscape through new construction projects and investment activities.

Canada Residential Real Estate Market Market Size (In Billion)

The forecast period (2025-2033) will likely see a continued albeit moderated growth trajectory, as affordability challenges and potential economic shifts could influence buyer behavior. While the Western and Central Canadian markets may experience more pronounced fluctuations due to resource sector performance, the Eastern Canadian market, particularly in Toronto and Montreal, is expected to maintain relatively consistent growth due to robust population growth and ongoing infrastructure development. The market's performance will depend significantly on economic stability, government policies impacting mortgage rates and housing construction, and evolving consumer preferences within the diverse residential property segments. Data analysis suggests ongoing investment in both the construction and sales sectors, ensuring continued activity throughout the forecast period.

Canada Residential Real Estate Market Company Market Share

Canada Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Canadian residential real estate market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, and future growth potential, empowering stakeholders to make informed decisions. The report features detailed segmentations by property type (Apartments and Condominiums, Villas and Landed Houses) and city (Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and Other Cities), incorporating data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Key players such as Aquilini Development, Century 21 Canada, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Living Realty, Amacon, Polygon Realty Limited, CAPREIT, and Slavens & Associates are analyzed, alongside significant industry developments. The report's focus on high-ranking keywords like "Canada residential real estate," "Canadian housing market," "real estate investment Canada," and "Toronto real estate market" ensures maximum search engine visibility.

Canada Residential Real Estate Market Structure & Competitive Dynamics

The Canadian residential real estate market exhibits a moderately concentrated structure, with a few large players holding significant market share, while numerous smaller firms operate regionally. The market share of the top five players is estimated at xx% in 2025, reflecting ongoing consolidation. Innovation is driven by technological advancements in property management software, online platforms, and data analytics. Regulatory frameworks, including building codes and zoning regulations, significantly influence market dynamics, especially in high-demand areas. Substitute products, such as rental housing, compete with homeownership, influencing demand fluctuations. End-user preferences are shifting towards sustainable and technologically advanced homes, impacting new construction trends. M&A activity has been robust, with deals totaling an estimated $xx Million in 2024. Notable transactions include:

- [Transaction 1 details, if available, including company names and deal value]

- [Transaction 2 details, if available, including company names and deal value]

- [Transaction 3 details, if available, including company names and deal value]

Canada Residential Real Estate Market Industry Trends & Insights

The Canadian residential real estate market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Population growth, particularly in major urban centers, is a significant driver, increasing demand for housing. Low interest rates historically fueled market growth but recent increases have dampened this to some degree. Technological disruptions, such as the rise of proptech companies and online real estate platforms, are transforming market operations, increasing efficiency and transparency. Consumer preferences are increasingly influenced by sustainability concerns, leading to a growing demand for energy-efficient homes. The market penetration of smart home technologies is also on the rise, reaching xx% in 2025. Intense competition among developers and real estate agents is pushing for innovation and improved customer service, while evolving government policies continue to play a role in shaping market dynamics.

Dominant Markets & Segments in Canada Residential Real Estate Market

The Greater Toronto Area (GTA) remains the dominant market, representing approximately xx% of the total market value in 2025. Vancouver and Montreal also hold significant shares. Within the segments, apartments and condominiums dominate due to affordability and urban lifestyle preferences. Key drivers of dominance include:

- Toronto: Strong economic growth, high population density, and robust infrastructure investments.

- Montreal: Affordable housing options, vibrant cultural scene, and government incentives.

- Vancouver: Stunning natural environment, high-income population, and limited land availability driving prices up.

Villas and landed houses have their own unique appeal, especially amongst growing families outside of dense urban areas and are experiencing increased demand in suburban and rural regions of Canada, fueled by changing lifestyle preferences and remote work opportunities.

Canada Residential Real Estate Market Product Innovations

Significant product innovations include the integration of smart home technology, sustainable building materials, and improved energy efficiency features. These innovations are enhancing the appeal of new constructions and renovations, offering enhanced convenience, security, and reduced environmental impact. The increasing use of Virtual Reality (VR) and Augmented Reality (AR) technologies in property marketing and design is streamlining the process while enhancing potential customer experience.

Report Segmentation & Scope

The report segments the market by property type:

Apartments and Condominiums: This segment is projected to grow at a CAGR of xx% from 2025 to 2033, driven by high demand in urban centers. Market size in 2025 is estimated at $xx Million. Competition is intense, with numerous developers vying for market share.

Villas and Landed Houses: This segment is expected to experience a CAGR of xx% during the forecast period, propelled by demand in suburban and rural areas. Market size in 2025 is estimated at $xx Million. Competitive dynamics are influenced by land availability and construction costs.

The market is further segmented by city, with detailed analysis of Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and other cities. Each city's growth projection, market size, and competitive dynamics are explored individually.

Key Drivers of Canada Residential Real Estate Market Growth

Key growth drivers include:

- Population Growth: Continued population growth, especially in major urban centers, fuels demand for housing.

- Economic Growth: Strong economic conditions contribute to increased disposable income and consumer confidence, driving real estate investment.

- Government Policies: Government policies, such as mortgage rates and tax incentives, influence market affordability and activity.

- Technological Advancements: Proptech solutions are improving market efficiency and customer experience.

Challenges in the Canada Residential Real Estate Market Sector

The Canadian residential real estate market faces several challenges, including:

- Affordability: Rising house prices and interest rates make homeownership increasingly unaffordable for many.

- Supply Chain Disruptions: Supply chain issues impacting construction materials lead to delays and increased costs.

- Regulatory Hurdles: Complex regulations and bureaucratic processes can hinder development projects.

- Interest Rate Volatility: Fluctuations in interest rates impact borrowing costs and overall market sentiment.

Leading Players in the Canada Residential Real Estate Market Market

- Aquilini Development

- Century 21 Canada

- Shato Holdings Ltd

- B C Investment Management Corp

- Bosa Properties

- Brookfield Asset Management

- Concert Properties Ltd

- Living Realty

- Amacon

- Polygon Realty Limited

- CAPREIT

- Slavens & Associates

Key Developments in Canada Residential Real Estate Market Sector

- October 2022: Dye & Durham and Lone Wolf Technologies announced a new integration for CREA WEBForms, improving legal services access.

- September 2022: ApartmentLove Inc. acquired OwnerDirect.com and secured a U.S. rental listing agreement, expanding its reach.

Strategic Canada Residential Real Estate Market Outlook

The Canadian residential real estate market presents significant long-term growth opportunities. Strategic investments in sustainable and technologically advanced housing, coupled with adapting to evolving consumer preferences and addressing affordability concerns will be critical for success. The market is expected to evolve dynamically, reflecting shifts in demographics, technology, and government policies. Focusing on key growth areas and navigating challenges strategically will be crucial for players to thrive in this dynamic market.

Canada Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Toronto

- 2.2. Montreal

- 2.3. Vancouver

- 2.4. Ottawa

- 2.5. Cagalry

- 2.6. Hamilton

- 2.7. Other Cities

Canada Residential Real Estate Market Segmentation By Geography

- 1. Canada

Canada Residential Real Estate Market Regional Market Share

Geographic Coverage of Canada Residential Real Estate Market

Canada Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth is the main driving factor; Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Housing Supply Shortage; Interest rates and Financing

- 3.4. Market Trends

- 3.4.1. Immigration Policies are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Toronto

- 5.2.2. Montreal

- 5.2.3. Vancouver

- 5.2.4. Ottawa

- 5.2.5. Cagalry

- 5.2.6. Hamilton

- 5.2.7. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aquilini Development

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Century 21 Canada**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shato Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 B C Investment Management Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosa Properties

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brookfield Asset Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Concert Properties Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Living Realty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amacon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Polygon Realty Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAPREIT

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Slavens & Associates

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Aquilini Development

List of Figures

- Figure 1: Canada Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Canada Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Canada Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Residential Real Estate Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Canada Residential Real Estate Market?

Key companies in the market include Aquilini Development, Century 21 Canada**List Not Exhaustive, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Living Realty, Amacon, Polygon Realty Limited, CAPREIT, Slavens & Associates.

3. What are the main segments of the Canada Residential Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth is the main driving factor; Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector.

6. What are the notable trends driving market growth?

Immigration Policies are Driving the Market.

7. Are there any restraints impacting market growth?

Housing Supply Shortage; Interest rates and Financing.

8. Can you provide examples of recent developments in the market?

October 2022: Dye & Durham Limited ("Dye & Durham") and Lone Wolf Technologies ("Lone Wolf") have announced a brand-new integration that was created specifically for CREA WEBForms powered by Transactions (TransactionDesk Edition) to enable access to and communication with legal services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence