Key Insights

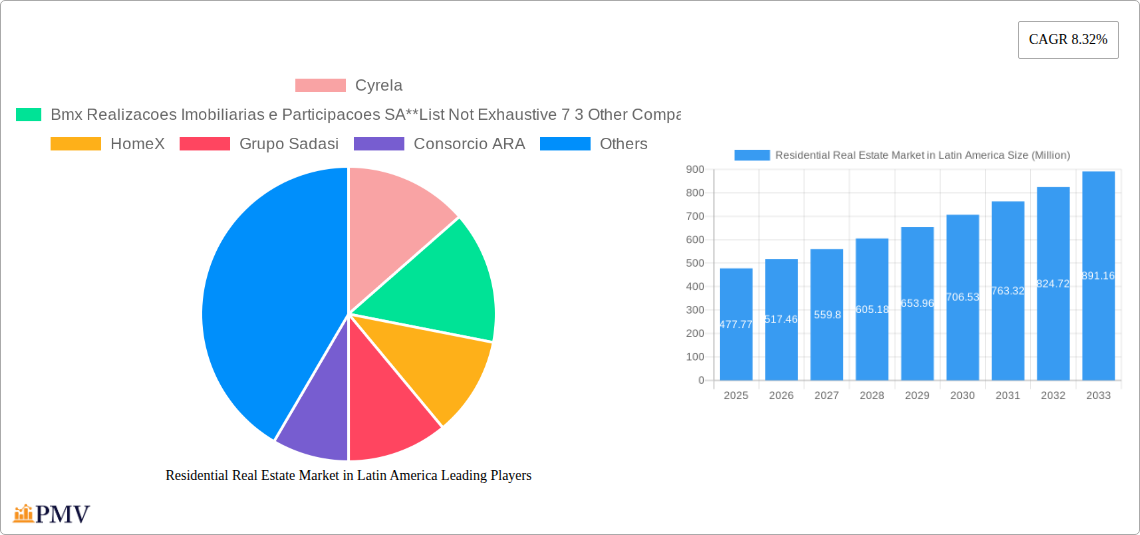

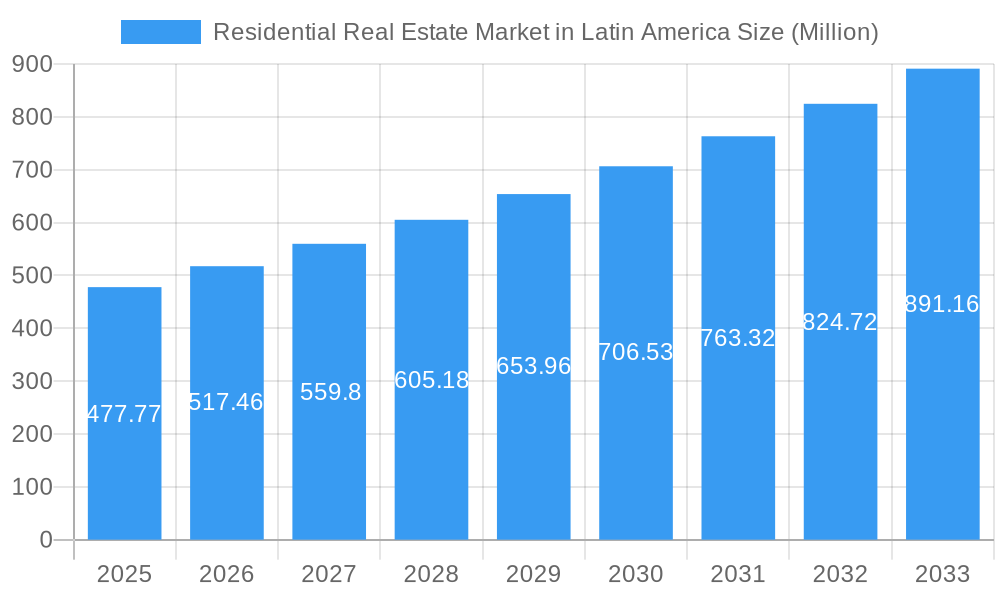

The Latin American Residential Real Estate Market is poised for robust expansion, with a current estimated market size of 477.77 Million and a projected Compound Annual Growth Rate (CAGR) of 8.32% during the forecast period of 2025-2033. This dynamic growth is propelled by a confluence of economic and demographic factors. Significant drivers include a burgeoning middle class across key economies like Mexico, Brazil, and Colombia, leading to increased demand for homeownership. Urbanization trends continue to fuel the need for housing solutions, particularly in major metropolitan areas. Government initiatives aimed at promoting affordable housing and stimulating construction are also playing a pivotal role in bolstering market activity. Furthermore, rising disposable incomes and a growing young population entering the home-buying demographic contribute substantially to market resilience and future potential. The market is characterized by a strong demand for both Apartments and Condominiums, catering to urban dwellers, and Landed Houses and Villas, appealing to families and those seeking more space. This dual demand highlights the diverse needs within the region.

Residential Real Estate Market in Latin America Market Size (In Million)

Several key trends are shaping the Latin American residential real estate landscape. The increasing adoption of sustainable building practices and green technologies is becoming a significant differentiator, attracting environmentally conscious buyers. Digitalization and PropTech are revolutionizing the way properties are bought, sold, and managed, enhancing transparency and efficiency. We are also observing a growing preference for mixed-use developments, integrating residential spaces with commercial and recreational facilities, thereby creating self-sufficient communities. While the market exhibits strong growth potential, certain restraints warrant attention. Economic volatility and currency fluctuations in some countries can impact investment sentiment and affordability. Regulatory hurdles and complexities in land acquisition and permitting processes can also pose challenges to developers. Nevertheless, the underlying demand, coupled with strategic investments and evolving consumer preferences, indicates a promising future for the Latin American residential real estate sector, with companies like Cyrela, Mrv Engenharia e Participacoes SA, and JLL actively participating in shaping its trajectory.

Residential Real Estate Market in Latin America Company Market Share

This comprehensive report offers an unparalleled deep dive into the dynamic Latin American residential real estate market. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study provides critical insights and actionable intelligence for stakeholders seeking to capitalize on burgeoning opportunities in the region. We analyze key segments like apartments and condominiums, landed houses and villas, across major geographies including Mexico, Brazil, and Colombia, alongside the Rest of Latin America. Understand market concentration, innovative real estate technology, evolving consumer preferences, and the impact of regulatory frameworks. With an estimated market size of USD X,XXX Million and a projected CAGR of XX.X%, this report is an essential resource for investors, developers, and industry professionals navigating the complex Latam real estate landscape.

Residential Real Estate Market in Latin America Market Structure & Competitive Dynamics

The Latin American residential real estate market exhibits a moderate to high market concentration, with a few dominant players vying for market share across key geographies. Companies like Cyrela, MRV Engenharia e Participacoes SA, and HomeX are significant contributors to this landscape, alongside other prominent developers such as Bmx Realizacoes Imobiliarias e Participacoes SA, Grupo Sadasi, Consorcio ARA, Groupe CARSO, and Multiplan Real Estate Asset Management. The innovation ecosystem is increasingly driven by PropTech solutions, aimed at enhancing customer experience and operational efficiency. Regulatory frameworks vary across countries, presenting both opportunities and challenges for real estate investment. The competitive landscape is characterized by continuous product differentiation and strategic partnerships.

- Market Share Analysis: Leading companies hold significant market share in their respective core markets, with top players in Brazil and Mexico accounting for an estimated XX% of the total market value.

- M&A Activities: While large-scale mergers and acquisitions are less frequent, strategic joint ventures and smaller acquisitions are observed, particularly for land acquisition and project development. M&A deal values in recent years are estimated to be in the range of USD XX Million to XXX Million.

- Product Substitutes: The primary substitutes for traditional homeownership include rental markets and alternative housing solutions, which are gaining traction in urban centers.

Residential Real Estate Market in Latin America Industry Trends & Insights

The Latin American residential real estate industry is poised for substantial growth, driven by a confluence of demographic shifts, economic recovery, and evolving consumer aspirations. A key trend is the increasing demand for modern, sustainable, and technology-integrated living spaces. Urbanization continues to be a significant catalyst, pushing demand for apartments and condominiums in major metropolitan areas like São Paulo, Mexico City, and Bogotá. Conversely, landed houses and villas are experiencing renewed interest in suburban and exurban regions, fueled by a desire for more space and privacy, a trend amplified by post-pandemic preferences. The market penetration of smart home technologies is steadily increasing, with an estimated XX% of new developments incorporating such features. Real estate technology (PropTech) is revolutionizing the sector, from online listing platforms and virtual tours to AI-driven property management and fractional ownership models. This technological disruption is enhancing accessibility and transparency for buyers and investors. The economic growth of countries like Brazil and Mexico, coupled with favorable interest rates for mortgages and government initiatives promoting homeownership, are significant market growth drivers. The rise of the middle class across the region is further fueling demand for quality housing.

- Market Growth Drivers: Robust population growth, a burgeoning middle class, increased urbanization, and supportive government housing policies are propelling the market forward.

- Technological Disruptions: The adoption of PropTech, including virtual reality tours, online sales platforms, and proptech-enabled construction, is reshaping the customer journey and operational efficiencies.

- Consumer Preferences: A shift towards larger living spaces, sustainability features, community amenities, and integrated technology is evident in buyer choices.

- Competitive Dynamics: Intense competition among developers is driving innovation in design, pricing, and customer service. Strategic alliances with financial institutions and technology providers are becoming more common.

- Market Penetration: The penetration of digital sales channels and construction technology is projected to reach XX% by 2030.

- CAGR: The residential real estate market in Latin America is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX.X% during the forecast period.

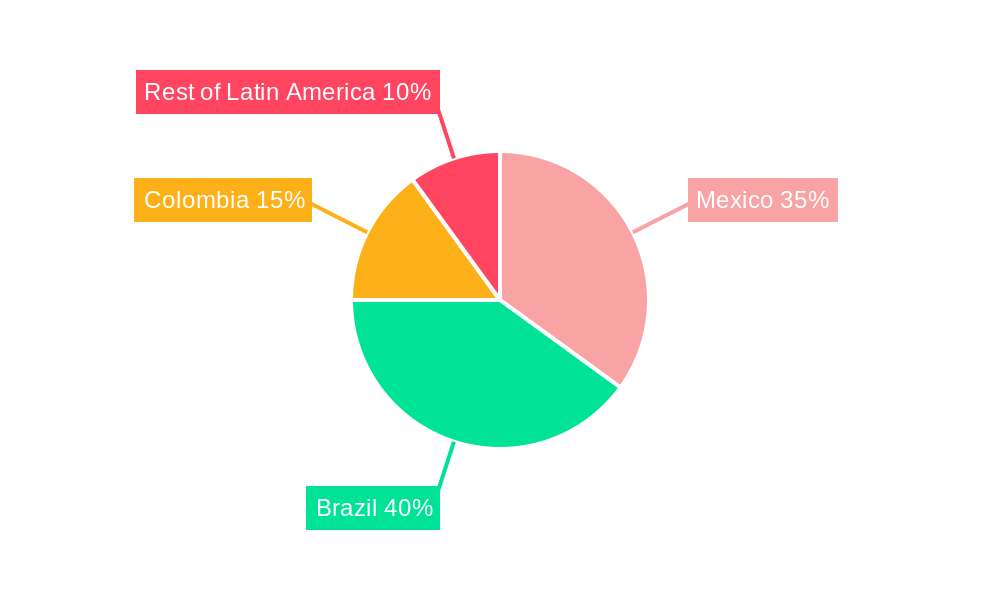

Dominant Markets & Segments in Residential Real Estate Market in Latin America

Brazil consistently emerges as the dominant market within the Latin American residential real estate sector, driven by its large population, diverse economy, and significant urbanization. The apartments and condominiums segment holds the largest market share, particularly in metropolitan hubs like São Paulo and Rio de Janeiro, accounting for an estimated XX% of the total market value. This dominance is attributed to increasing population density in urban centers and a growing demand for accessible and convenient living solutions. The landed houses and villas segment, while smaller in overall market share, is experiencing robust growth, especially in the outskirts of major cities and in more affluent suburban areas. This surge is fueled by evolving lifestyle preferences favoring space, privacy, and family-oriented living.

Mexico represents the second-largest market, with a strong demand for apartments and condominiums in cities like Mexico City and Guadalajara. Government initiatives aimed at affordable housing have also contributed to the growth of this segment. Colombia, particularly Bogotá, is another significant player, with a consistent demand for both apartments and condominiums and landed houses and villas. The Rest of Latin America, encompassing countries like Peru, Chile, and Argentina, showcases a more varied market landscape. While individual country contributions are smaller, the collective potential is substantial, with emerging opportunities in rapidly growing urban centers and the increasing interest in second-home ownership.

- Key Drivers of Dominance in Brazil:

- Large and growing urban populations.

- Significant disposable income among the middle and upper classes.

- Government housing programs and incentives.

- Extensive infrastructure development in key cities.

- Dominance Analysis in Mexico:

- High demand for urban housing due to continued migration to cities.

- Growth in the middle-income segment driving demand for affordable housing solutions.

- Foreign investment contributing to the development of luxury properties.

- Key Drivers in Colombia:

- Increasing foreign direct investment in real estate.

- Urbanization and a growing young population entering the housing market.

- Government focus on infrastructure projects.

- Market Size and Growth Projections: Brazil is projected to maintain its leading position, with an estimated market size of USD XXXX Million by 2033. Mexico follows closely, with projections of USD XXX Million by the same year.

Residential Real Estate Market in Latin America Product Innovations

Product innovation in the Latin American residential real estate market is increasingly focused on sustainability, technology integration, and enhanced lifestyle amenities. Developers are incorporating green building materials, energy-efficient designs, and smart home systems to appeal to environmentally conscious buyers. The rise of PropTech enables features like contactless entry, smart appliance integration, and remote property management, offering greater convenience and security. Community-centric developments, featuring shared co-working spaces, recreational facilities, and concierge services, are also gaining traction, catering to evolving social and professional needs. These innovations provide a competitive advantage by meeting the demand for modern, efficient, and desirable living environments.

Report Segmentation & Scope

This report segments the Latin American residential real estate market into key categories for granular analysis. The Type segmentation includes Apartments and Condominiums, and Landed Houses and Villas. The Geography segmentation encompasses Mexico, Brazil, Colombia, and the Rest of Latin America. The analysis provides detailed market sizes, growth projections, and competitive dynamics for each segment. For instance, the Apartments and Condominiums segment in Brazil is projected to reach USD XXX Million by 2033, driven by strong urbanization. Landed Houses and Villas in Mexico are expected to witness a CAGR of XX.X% during the forecast period.

Key Drivers of Residential Real Estate Market in Latin America Growth

Several factors are propelling the residential real estate market in Latin America. Technologically, the increasing adoption of PropTech solutions is enhancing sales processes and property management. Economically, a growing middle class, increasing disposable incomes, and favorable mortgage interest rates are boosting purchasing power. Furthermore, supportive government policies, including housing subsidies and incentives for developers, are creating a conducive environment for growth. Infrastructure development in key urban and suburban areas also plays a crucial role by improving accessibility and desirability.

Challenges in the Residential Real Estate Market in Latin America Sector

Despite robust growth, the residential real estate market in Latin America faces several challenges. Regulatory hurdles and complex bureaucratic processes in some countries can slow down project approvals and development. Supply chain disruptions and rising construction material costs can impact project timelines and profitability. Moreover, economic volatility and inflation can affect buyer affordability and investor confidence. Intense competition among developers, particularly in prime locations, also presents a significant pressure.

Leading Players in the Residential Real Estate Market in Latin America Market

- Cyrela

- Bmx Realizacoes Imobiliarias e Participacoes SA

- HomeX

- Grupo Sadasi

- Consorcio ARA

- MRV Engenharia e Participacoes SA

- Groupe CARSO

- Multiplan Real Estate Asset Management

- JLL

- CBRE

Key Developments in Residential Real Estate Market in Latin America Sector

- November 2023: CBRE, a prominent global consultancy and real estate services firm, unveiled its latest initiative, the Latam-Iberia platform. The platform's primary goal is to reinvigorate the real estate markets in Europe and Latin America while fostering investment ties between the two regions. By enhancing business collaborations and amplifying the visibility of real estate solutions, CBRE aims to catalyze growth in the sector.

- May 2023: CJ do Brasil, a subsidiary of multinational firm CJ Bio, completed its USD 57 million plant expansion in Piracicaba, 160 km from Brazil's capital. CJ Bio is renowned for its expertise in amino acid production. The expansion is projected to create 650 new job opportunities, and the investment also encompasses the establishment of residential, research, and development centers.

Strategic Residential Real Estate Market in Latin America Market Outlook

The strategic outlook for the residential real estate market in Latin America is highly promising, driven by sustained demographic expansion and increasing urbanization. Opportunities abound for developers and investors focusing on sustainable living, smart homes, and community-centric projects. The expansion of the middle class will continue to fuel demand for affordable yet quality housing. Strategic collaborations between real estate developers, PropTech firms, and financial institutions will be crucial for unlocking new market segments and driving innovation. The Latam-Iberia platform by CBRE signifies a strategic push to strengthen investment ties and amplify market visibility, indicating a positive trajectory for cross-regional real estate growth. Emerging economies within the Rest of Latin America also present significant untapped potential for market entry and expansion.

Residential Real Estate Market in Latin America Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Colombia

- 2.4. Rest of Latin America

Residential Real Estate Market in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Rest of Latin America

Residential Real Estate Market in Latin America Regional Market Share

Geographic Coverage of Residential Real Estate Market in Latin America

Residential Real Estate Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Accelerated Increase in Construction Costs

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Colombia

- 6.2.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Colombia

- 7.2.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Colombia

- 8.2.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Colombia

- 9.2.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cyrela

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HomeX

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Grupo Sadasi

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Consorcio ARA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mrv Engenharia e Participacoes SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Groupe CARSO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Multiplan Real Estate Asset Management

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 JLL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CBRE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cyrela

List of Figures

- Figure 1: Residential Real Estate Market in Latin America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Residential Real Estate Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in Latin America?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Residential Real Estate Market in Latin America?

Key companies in the market include Cyrela, Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie, HomeX, Grupo Sadasi, Consorcio ARA, Mrv Engenharia e Participacoes SA, Groupe CARSO, Multiplan Real Estate Asset Management, JLL, CBRE.

3. What are the main segments of the Residential Real Estate Market in Latin America?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 477.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Accelerated Increase in Construction Costs.

8. Can you provide examples of recent developments in the market?

November 2023: CBRE, a prominent global consultancy and real estate services firm, unveiled its latest initiative, the Latam-Iberia platform. The platform's primary goal is to reinvigorate the real estate markets in Europe and Latin America while fostering investment ties between the two regions. By enhancing business collaborations and amplifying the visibility of real estate solutions, CBRE aims to catalyze growth in the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in Latin America?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence