Key Insights

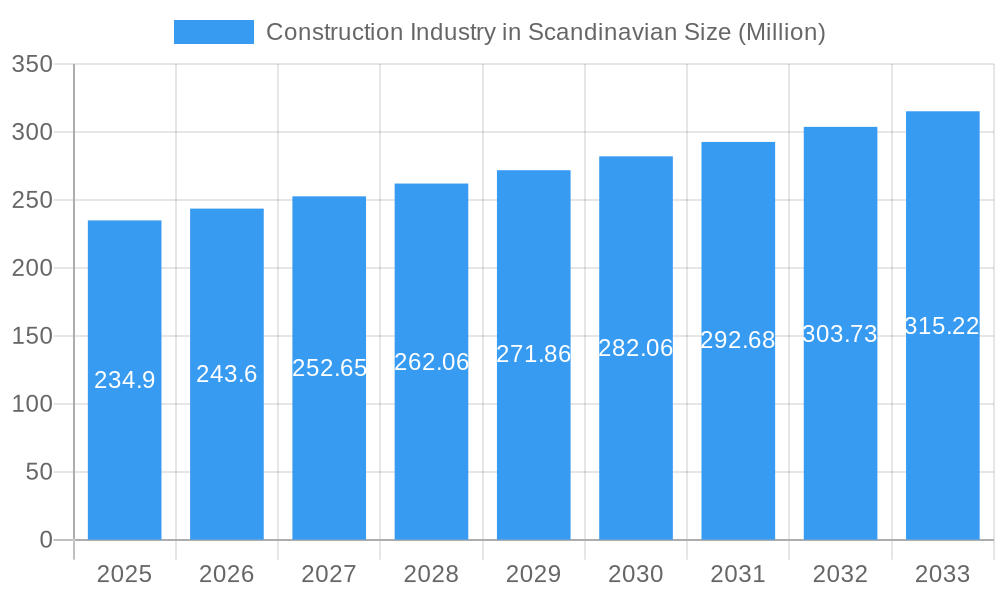

The Scandinavian construction industry is poised for steady growth, with a projected market size of $234.90 million and a Compound Annual Growth Rate (CAGR) of 3.75% from 2025 to 2033. This expansion is fueled by significant investments in infrastructure development, particularly in transportation networks and renewable energy projects across Sweden, Norway, Denmark, and Finland. The residential sector continues to be a strong contributor, driven by ongoing urbanization and a persistent demand for housing. Commercial construction is also seeing a resurgence, with companies expanding their footprints and embracing modern, sustainable building designs. Furthermore, the industrial segment benefits from advancements in automation and the need for upgraded manufacturing facilities. The region's commitment to sustainability and green building practices is a paramount driver, influencing material choices, construction methodologies, and energy efficiency standards across all segments.

Construction Industry in Scandinavian Market Size (In Million)

While the overall outlook is positive, the industry faces certain restraints that warrant strategic consideration. Rising material costs, coupled with supply chain volatilities, can impact project timelines and budgets. A shortage of skilled labor in specialized trades also presents a challenge, necessitating greater investment in training and development programs. Nevertheless, technological innovation, including the adoption of Building Information Modeling (BIM), prefabrication, and smart construction solutions, is actively mitigating these challenges and enhancing operational efficiency. Key players like Skanska, NCC, and Veidekke are at the forefront, leveraging their expertise to navigate these dynamics and capitalize on the burgeoning opportunities within the Scandinavian construction landscape. The focus on digital transformation and sustainable construction practices will continue to shape market trends and competitive strategies.

Construction Industry in Scandinavian Company Market Share

This comprehensive report provides an unparalleled deep dive into the Scandinavian construction industry, offering critical insights for stakeholders seeking to navigate this dynamic and evolving market. Spanning the historical period of 2019-2024, the base year of 2025, and projecting through to 2033, this study meticulously analyzes market structure, competitive dynamics, industry trends, product innovations, and strategic outlooks. Leveraging high-ranking keywords such as "Scandinavian construction market," "Nordic construction trends," "European construction outlook," and "infrastructure investment Scandinavia," this report is optimized for maximum search visibility and engagement with construction professionals, investors, and policymakers.

Construction Industry in Scandinavian Market Structure & Competitive Dynamics

The Scandinavian construction market exhibits a moderately concentrated structure, characterized by the presence of major international players and robust national construction companies. Market share is notably distributed among key firms. For instance, Skanska Sverige AB and PEAB Sverige AB command significant portions of the Swedish market. In Norway, Veidekke ASA and Skanska Norge AS are prominent. Finland sees strong competition from YIT Suomi Oy and SRV Yhtiot Oyj. Denmark, while not explicitly detailed in the provided company list, also contributes to the overall regional landscape. M&A activities in the region have been strategic, focusing on expanding capabilities and geographical reach. Recent deal values indicate consolidation efforts, with estimated transaction values reaching several hundred million Euros for significant acquisitions. Innovation ecosystems are thriving, driven by a strong emphasis on sustainability, digitalization, and green building technologies. Regulatory frameworks, while stringent, encourage innovation, particularly in areas like energy efficiency and circular economy principles. Product substitutes are increasingly emerging, especially in modular construction and prefabrication, offering faster build times and reduced waste. End-user trends are heavily influenced by growing demand for sustainable housing, smart infrastructure, and energy-efficient commercial spaces. This dynamic interplay of factors shapes the competitive landscape, favoring companies that can adapt to evolving demands and technological advancements.

Construction Industry in Scandinavian Industry Trends & Insights

The Scandinavian construction industry is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This robust expansion is primarily driven by substantial investments in sustainable infrastructure development, including renewable energy projects and upgrading existing transportation networks. Technological disruptions are profoundly reshaping the industry, with a rapid adoption of Building Information Modeling (BIM), artificial intelligence (AI) for project management, and advanced robotics in construction processes. This digitalization enhances efficiency, reduces costs, and improves project accuracy. Consumer preferences are shifting towards eco-friendly and energy-efficient buildings, driving demand for green construction materials and techniques. The focus on sustainable urban development and smart city initiatives is also a key trend. Competitive dynamics are intensifying, with companies vying for market share through innovation, strategic partnerships, and a commitment to sustainability. The market penetration of prefabricated and modular construction solutions is steadily increasing, offering viable alternatives to traditional building methods. Furthermore, government policies promoting energy efficiency and carbon neutrality are acting as powerful market growth drivers, encouraging the adoption of innovative building solutions and materials. The ongoing need for housing, coupled with significant public and private sector investment in infrastructure, underpins the optimistic forecast for the Nordic construction sector.

Dominant Markets & Segments in Construction Industry in Scandinavian

The Scandinavian construction market demonstrates a strong emphasis on the Infrastructure (Transportation) and Residential sectors, which are projected to experience the highest growth rates. Economic policies in Denmark, Norway, Sweden, and Finland consistently prioritize infrastructure upgrades, including high-speed rail, road networks, and port expansions, driving significant investment. For instance, ongoing projects related to the development of offshore wind farms in the North Sea are significantly boosting the Energy and Utilities segment, alongside infrastructure development.

- Infrastructure (Transportation): This segment is a dominant force, fueled by government commitments to enhance connectivity and facilitate trade. Major projects across the region are focusing on modernizing public transportation systems and expanding road networks. Increased funding for sustainable transportation solutions, such as electric vehicle charging infrastructure and bicycle paths, further propels this sector. The estimated market size for infrastructure development is projected to reach over 50 Billion Euros by 2030.

- Residential: The demand for high-quality, sustainable housing remains consistently high across Scandinavia. Factors such as population growth, urbanization, and a strong desire for energy-efficient homes contribute to the sustained strength of this segment. The implementation of stringent building codes promoting energy performance and the use of eco-friendly materials are key drivers. The market size for residential construction is estimated to be around 35 Billion Euros in 2025.

- Commercial: While experiencing steady growth, the commercial sector is increasingly influenced by the rise of remote work and evolving retail landscapes. Investments are focused on flexible office spaces, sustainable commercial buildings, and logistics facilities to support e-commerce growth.

- Industrial: The industrial segment is experiencing a resurgence, particularly driven by investments in advanced manufacturing, automation, and logistics hubs catering to the growing e-commerce sector.

- Energy and Utilities: This segment is witnessing substantial growth, propelled by the transition towards renewable energy sources, including wind, solar, and hydropower projects. Investments in grid modernization and energy storage solutions are also critical.

Construction Industry in Scandinavian Product Innovations

Product innovations in the Scandinavian construction industry are predominantly focused on sustainability, digitalization, and enhanced performance. Advances in green building materials, such as sustainable timber, recycled aggregates, and low-carbon concrete, are gaining traction, offering reduced environmental impact and improved thermal efficiency. Modular and prefabricated construction techniques are also a significant area of innovation, enabling faster project timelines, reduced waste, and improved quality control. The integration of smart technologies, including IoT sensors for building performance monitoring and AI-driven design tools, is becoming increasingly prevalent, offering competitive advantages through increased efficiency and predictive maintenance capabilities.

Report Segmentation & Scope

This report meticulously segments the Scandinavian construction market across key sectors, providing granular analysis and growth projections. The scope encompasses the Residential sector, driven by housing demand and sustainability mandates, with projected growth of 4% CAGR. The Commercial sector, adapting to hybrid work models and e-commerce, is expected to grow at 3.5% CAGR. The Industrial sector, bolstered by advanced manufacturing and logistics, anticipates a 4.2% CAGR. Crucially, the Infrastructure (Transportation) sector, a major focus for regional development, is forecast to expand at an impressive 5.5% CAGR. The Energy and Utilities sector, fueled by the green energy transition, is projected to see a robust 6% CAGR. Market sizes and competitive dynamics are detailed for each segment within the study period.

Key Drivers of Construction Industry in Scandinavian Growth

The Scandinavian construction industry is propelled by several interconnected growth drivers. Technological advancements, particularly the widespread adoption of BIM and digital construction tools, are enhancing efficiency and project management. Economic policies supporting sustainable development, renewable energy, and infrastructure upgrades are significantly boosting investment. For example, Norway's extensive investments in its offshore wind sector and Sweden's commitment to expanding its high-speed rail network are critical. Furthermore, stringent regulatory frameworks mandating energy efficiency and carbon neutrality are fostering innovation and demand for green building solutions. The increasing focus on climate change mitigation and the circular economy are also powerful accelerators.

Challenges in the Construction Industry in Scandinavian Sector

Despite robust growth, the Scandinavian construction sector faces several challenges. Regulatory hurdles, while promoting sustainability, can sometimes lead to complex permitting processes and increased compliance costs. Supply chain issues, including material shortages and rising costs for key resources like steel and timber, continue to pose a restraint. The competitive pressure from both established and emerging players necessitates constant innovation and cost management. Labor shortages in skilled trades also present a significant impediment to project execution. Environmental regulations, while beneficial, require continuous adaptation and investment in sustainable practices. The estimated impact of these challenges on project timelines can range from 5% to 15% delay.

Leading Players in the Construction Industry in Scandinavian Market

- PEAB Sverige AB

- Skanska Sverige AB

- SRV Yhtiot Oyj

- Skanska Talonrakennus Oy

- Veidekke ASA

- Icop Norway

- YIT Suomi Oy

- JM AB

- NCC Sverige AB

- Obos Bbl

- Skanska Oy

- Skanska Norge AS

- List Not Exhaustive 7 3 Other Companie

Key Developments in Construction Industry in Scandinavian Sector

- 2023/2024: Increased investment in sustainable infrastructure projects across Sweden and Norway, focusing on renewable energy and smart transportation.

- 2023: Several major Scandinavian construction firms announced ambitious targets for carbon neutrality in their operations and projects.

- 2024: Significant adoption of modular construction techniques in the residential and commercial sectors in Finland and Denmark, leading to faster project completions.

- 2023: Strategic partnerships formed to develop and implement advanced digital construction technologies, including AI-powered project management software.

- 2024: Launch of new initiatives promoting the use of recycled materials and circular economy principles in construction projects across all Scandinavian countries.

- 2023: Acquisitions focused on expanding capabilities in specialized construction areas such as offshore wind farm installation and energy-efficient building retrofits.

Strategic Construction Industry in Scandinavian Market Outlook

The strategic outlook for the Scandinavian construction industry is highly positive, driven by sustained government commitment to infrastructure development and ambitious sustainability targets. The ongoing green transition and the push for net-zero emissions are creating significant opportunities in renewable energy projects and energy-efficient building retrofits, representing an estimated market expansion of over 30 Billion Euros. Digitalization will continue to be a key growth accelerator, enabling greater efficiency and cost savings. Strategic opportunities lie in focusing on innovative, sustainable building solutions, leveraging advanced digital technologies, and forming collaborations to tackle labor shortages and supply chain complexities. The market is ripe for companies that can demonstrate a strong commitment to environmental, social, and governance (ESG) principles, aligning with the region's progressive values.

Construction Industry in Scandinavian Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

Construction Industry in Scandinavian Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Scandinavian Regional Market Share

Geographic Coverage of Construction Industry in Scandinavian

Construction Industry in Scandinavian REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Ongoing Demand For Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Scandinavian Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PEAB Sverige AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skanska Sverige AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SRV Yhtiot Oyj

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skanska Talonrakennus Oy**List Not Exhaustive 7 3 Other Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veidekke ASA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Icop Norway

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YIT Suomi Oy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JM AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NCC Sverige AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Obos Bbl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skanska Oy

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska Norge AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 PEAB Sverige AB

List of Figures

- Figure 1: Global Construction Industry in Scandinavian Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 7: South America Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Construction Industry in Scandinavian Revenue (Million), by Sector 2025 & 2033

- Figure 19: Asia Pacific Construction Industry in Scandinavian Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Construction Industry in Scandinavian Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Construction Industry in Scandinavian Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Industry in Scandinavian Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 9: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 14: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 25: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Construction Industry in Scandinavian Revenue Million Forecast, by Sector 2020 & 2033

- Table 33: Global Construction Industry in Scandinavian Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Construction Industry in Scandinavian Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Scandinavian?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Construction Industry in Scandinavian?

Key companies in the market include PEAB Sverige AB, Skanska Sverige AB, SRV Yhtiot Oyj, Skanska Talonrakennus Oy**List Not Exhaustive 7 3 Other Companie, Veidekke ASA, Icop Norway, YIT Suomi Oy, JM AB, NCC Sverige AB, Obos Bbl, Skanska Oy, Skanska Norge AS.

3. What are the main segments of the Construction Industry in Scandinavian?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 234.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Ongoing Demand For Infrastructure.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Scandinavian," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Scandinavian report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Scandinavian?

To stay informed about further developments, trends, and reports in the Construction Industry in Scandinavian, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence